Darwin Evolution is a trading advisor that was designed to help people with automatic execution of orders on the terminal. We have an average presentation with details about how the system works and how it manages to survive on the real market.

Guillaume Duportal, the developer of Darwin Evolution, has three years of MQL5 experience. There are two products and 21 signals in his portfolio. Unfortunately, this information is everything we know about the developer.

The advisor runs charts without a clear strategy. It looks like the system has a price action strategy behind the system.

What is behind Darwin Evolution?

We have a presentation that explains to us what the system is going on in our terminal under real market conditions.

- We can expect automatic execution of our orders on a terminal if we purchase the system.

- The price stopped being discounted, $999.

- It keeps growing up to $1490.

- The system cannot be backtested.

- So, this sounds dangerous and unfriendly.

- We have to read the blog to better understand how the robot works.

- The robot can be used on a demo and real account.

- We will receive a user manual.

- The risks can be average.

- The system focuses on long term trading.

- It doesn’t open orders frequently.

- The open orders can be on the market for weeks.

- The dev provided us with a recovery system.

- It uses eight indicators data.

- There’s a news filter applied.

- We can customize our risks.

- The default risk level is set at 5%.

- The advisor can open orders in the sell and buy directions at once.

- The balance should be over $200.

- The leverage has to start from 1:30.

- There are two main strategies behind the system.

Key features

- The advisor works automatically.

- It can work with risks we set.

- The system calculates and places proper SL and TP levels.

- It closes orders for us.

- The recommended settings were delivered for EURUSD on M1.

- We can trade 28 cross pairs at once.

Trading strategy

We don’t know details about two strategies behind the system. So, this can be a con because many strategies simply can’t fit our trading style and we have to know about them right before purchasing the system.

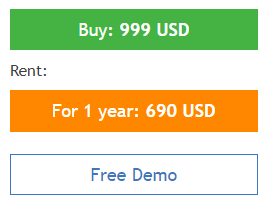

Pricing

Darwin Evolution pricing on MQL5

The pricing increased up to $999. A system like this should be that expensive. We can rent it out for $690 annually. The demo copy of the robot is ready to be downloaded.

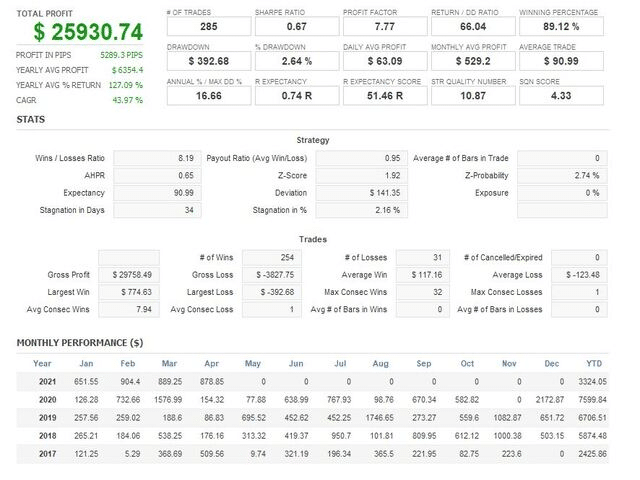

Trading performance of Darwin Evolution

Darwin Evolution backtest report

We have a backtest report that unites all cross pairs at once. The absolute profit was $25,930 when an annual profit was 127.09% ($6354.4). The system traded 185 deals. The profit factor was 7.77. The win rate was 89.12%. The maximum drawdown was 2.64%. It hasn’t lost any month.

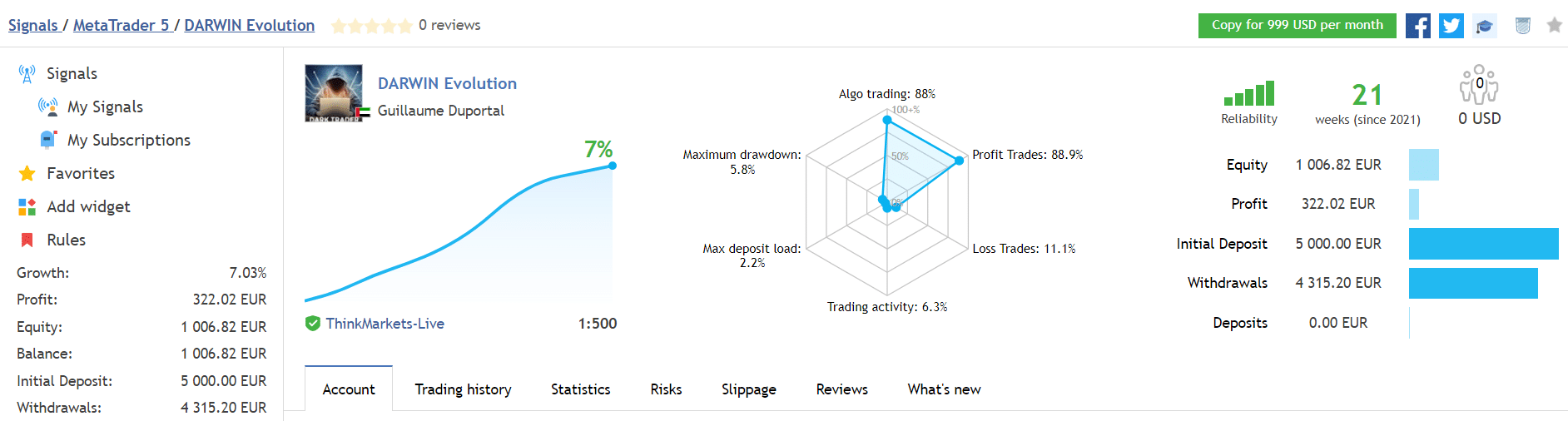

Darwin Evolution trading results on MQL5

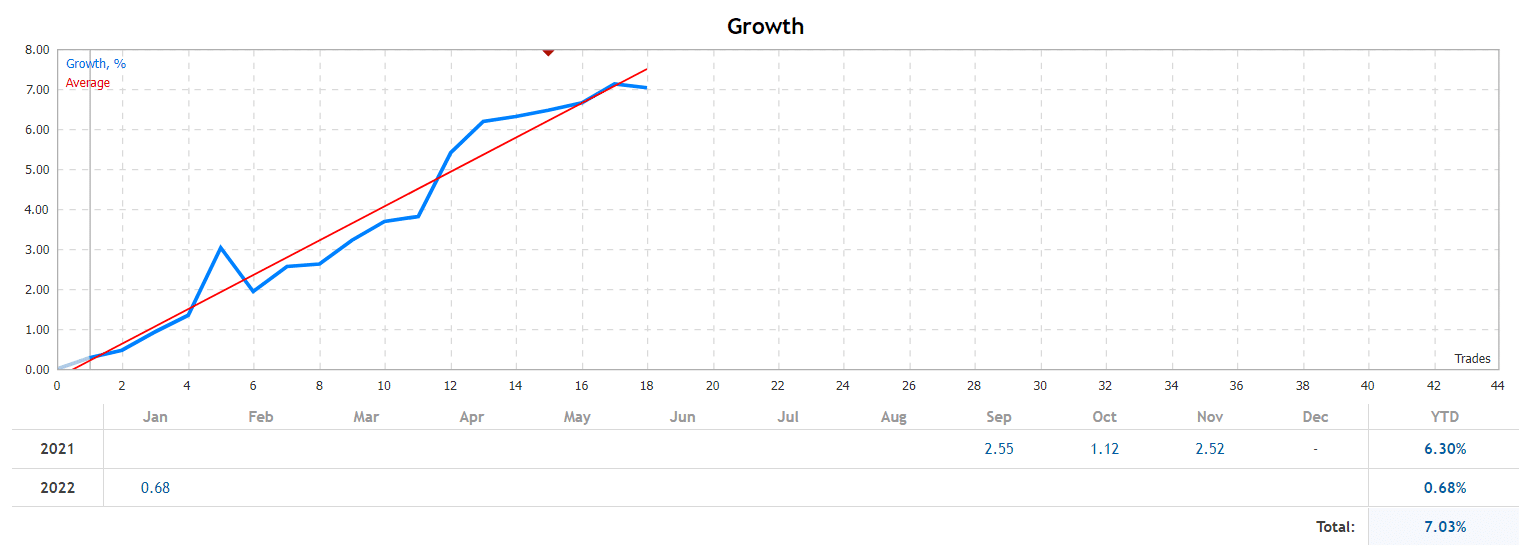

The advisor runs a real account with €5000 on the board on ThinkMarket. The leverage is 1:500. The maximum deposit load is 2.2%. The win rate is 93.3%. The maximum drawdown is 5.8%. The account works for 18 weeks. The absolute growth has amounted to 6.47%.

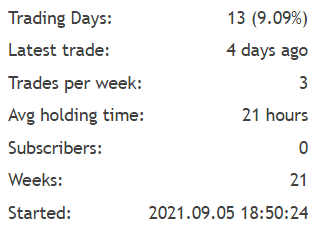

Darwin Evolution details

An average trading frequency is 3 trades a week. An average trade length is 21 hours. The account was created on September 5, 2021.

Darwin Evolution growth chart

The system avoided working during December 2021.

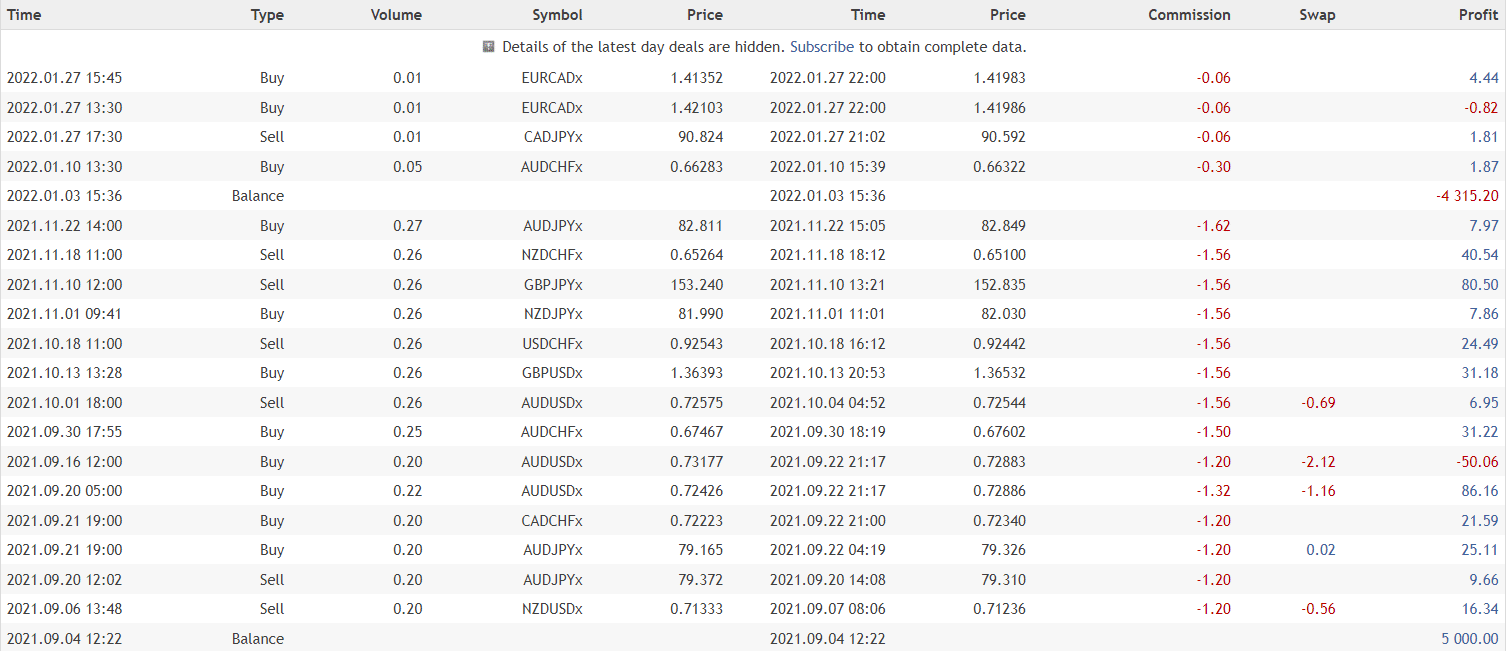

Darwin Evolution closed orders

The dev decided to withdraw the account – €4,315.20. It doesn’t increase the level of trust in this software.

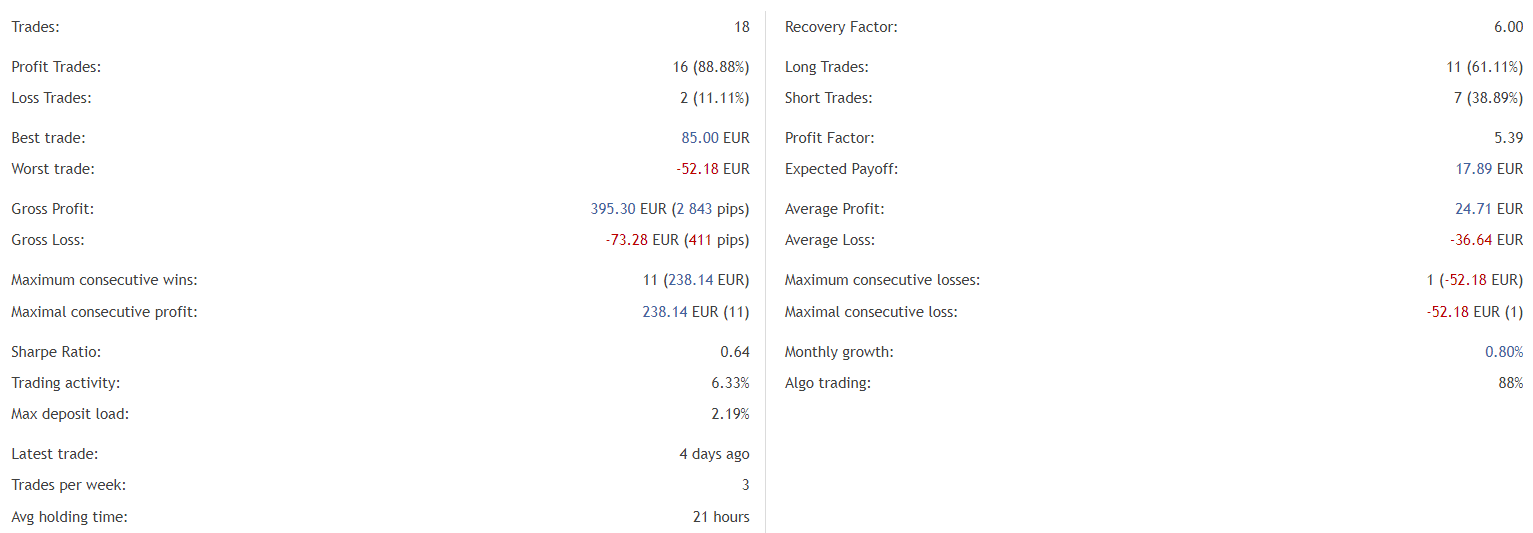

Darwin Evolution statistics

The robot tarded 18 orders. The best trade is €85 and the worst one is -€52.18. The recovery factor is 6.00 when the profit factor is 5.39. An average monthly profitability is 0.80%. It algo trades only in 88% cases.

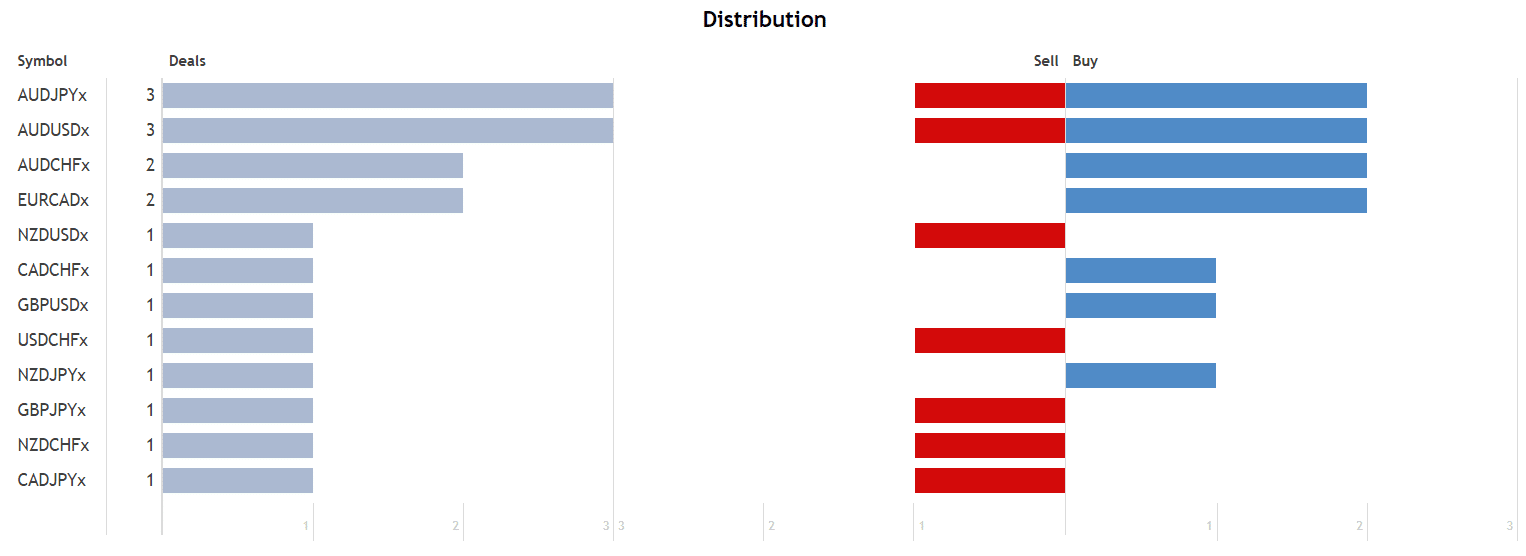

Darwin Evolution distribution

AUDJPY, AUDUSD and AUDCHF with 3 orders are the most traded cross pairs.

Customer support

We don’t know how good the developer’s support is. We should give it a try first.

People feedback

People testimonials on MQL5

The presentation includes only positive testimonials about how the system worked for people.

Comments