Crypto has taken the world by storm, especially during the last few years. As cryptos such as Bitcoin and Ethereum have jumped in value, millions of investors have tried to profit off the rise of digital payment systems. The total value of all these digital currencies has swelled to about $2 trillion.

Some people have even stopped investing in traditional stocks altogether in hopes of scoring big by investing in crypto. Crypto’s rapid appreciation has many investors questioning the place of stocks in their portfolios. But there are numerous differences between stocks and cryptos. The most important is that a stock is an ownership interest in a business, whereas crypto is not backed by anything at all in most cases.

If you’re buying cryptos, it’s essential to understand what you’re purchasing and how they compare to traditional investments such as stocks, which have a solid long-term track record.

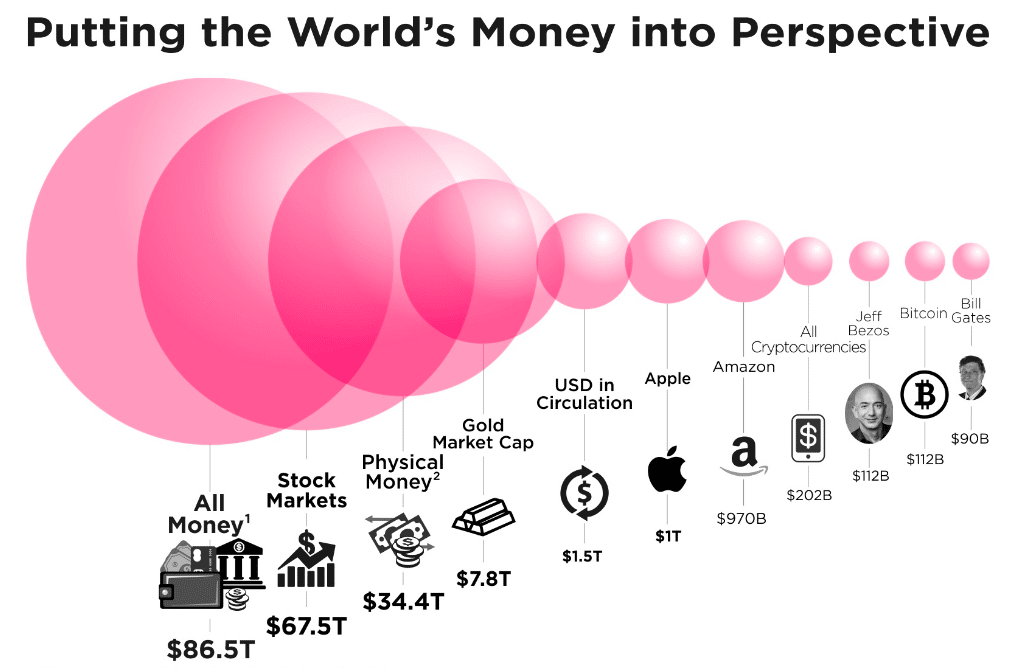

Crypto vs. entire world’s wealth

What is crypto?

It is a digital currency based on blockchain technology. The term “crypto” comes from the cryptographic techniques used to verify transactions. These techniques replace the need for one central intermediary, such as a bank, which proponents see as a significant benefit of crypto.

Crypto prices are also known for their volatility. If you’re interested in taking the plunge, you’ll benefit from learning the basics to make the most of your investment.

What is stock?

A stock, also known as a share, represents ownership of a fraction of a company. In many cases, the stockholder is often entitled to a corresponding share of the company’s profits in a dividend. Stocks are primarily bought and sold or “traded” on stock exchanges, such as the London Stock Exchange or the New York Stock Exchange.

For many investors, stocks have long been an attractive investment — when a given company does well, so do the people who have invested in it. If the value of their investment increases, they can sell it at a profit. Of course, companies don’t always do well, so investors run the risk that their investment can also go down in value.

Top 3 differences between crypto and stocks

So, what are the significant differences between cryptos and stocks?

-

Price volatility

The uncertainty about the future value of cryptos and the fact that they’re often not backed by physical assets means that they’re usually considered more volatile than stocks. Keep in mind that even investments considered less volatile, like stocks, can experience unexpected periods of volatility. And since the crypto market contains several crypto whales, people, or companies who hold a considerable amount of a particular coin, these become more vulnerable to investors’ actions.

-

Security risks

Crypto markets are evolving and growing at a rapid pace — and this, combined with their largely unregulated nature, means that they are a hotbed for scams of all kinds. These scams often revolve around attempts to obtain people’s data, such as the codes required to access an individual’s crypto holdings, or attempts to have investors transfer crypto to scam artists who might be impersonating legitimate entities.

There are all kinds of other stock scams, too. A stock’s price is artificially inflated by highly exaggerated statements encouraging investors to buy before the orchestrators of the scheme sell their holdings at a much higher price.

-

Diversification

If you choose to invest in stocks over crypto, you can select from companies in every sector and country. You can be a shareholder in the Japanese automobile industry or US-based tech companies and everything. This allows you to create a highly diverse portfolio that isn’t fully dependent on particular industries or geographical markets. In turn, this can help reduce your risk of losing everything.

While there are many different types of cryptos and crypto assets, such as NFTs, to choose from, there are fewer options to diversify with crypto than with stocks. While you can reduce risk by making sure you don’t buy just one type of crypto coin, there’s no easy way to diversify your investments fully.

| Differences | |

| Stocks | Cryptos |

| More volatile | Less volatile |

| High regulations | Low regulations |

| Centralized | Decentralized |

| Similarities | |

| Stocks | Cryptos |

| Prices fluctuate relative to supply & demand | |

| They can be viewed as investments/trades | |

| Similar trading instruments/options | |

Top 3 similarities between crypto and stocks

Most investors log on to a digital exchange, brokerage account, mobile application, or another online platform to engage with financial markets. Most stock and crypto platforms offer a similar user experience regarding layout, order-book-based liquidity mechanisms, and trading options. It’s easier now than ever to buy and sell stocks, and cryptocurrency exchanges have made investing in digital assets just as simple as investing in traditional markets.

-

Market order

It is an order to buy or sell an asset as soon as possible at the current bid or ask price. A market order guarantees that the order will be executed but does not guarantee the price.

-

Limit order

It is designed to buy or sell an asset at a specific price — or better if possible. A buy limit order can execute at the limit price or lower, and a sell limit order can execute at the limit price or higher.

-

Stop-loss order

It is used to mitigate excessive losses. It is an order to buy or sell a stock once the price of a security reaches a specified price, known as the stop price. When the stop price is reached, a stop order becomes a market order.

While buying and selling stocks and cryptos might appear very similar on platforms that have been designed for streamlined user experiences, there are many significant differences in engaging with these two very distinct asset classes.

How to invest in stocks?

There are many different ways to purchase stocks. Some people invest directly in individual companies and buy shares of those companies. Investors typically make these purchases through a discount or full-service broker who charges a fee to buy and sell shares for customers.

Other people invest in stocks through mutual funds, a pooled collection of assets that invests in stocks, bonds, or other securities.

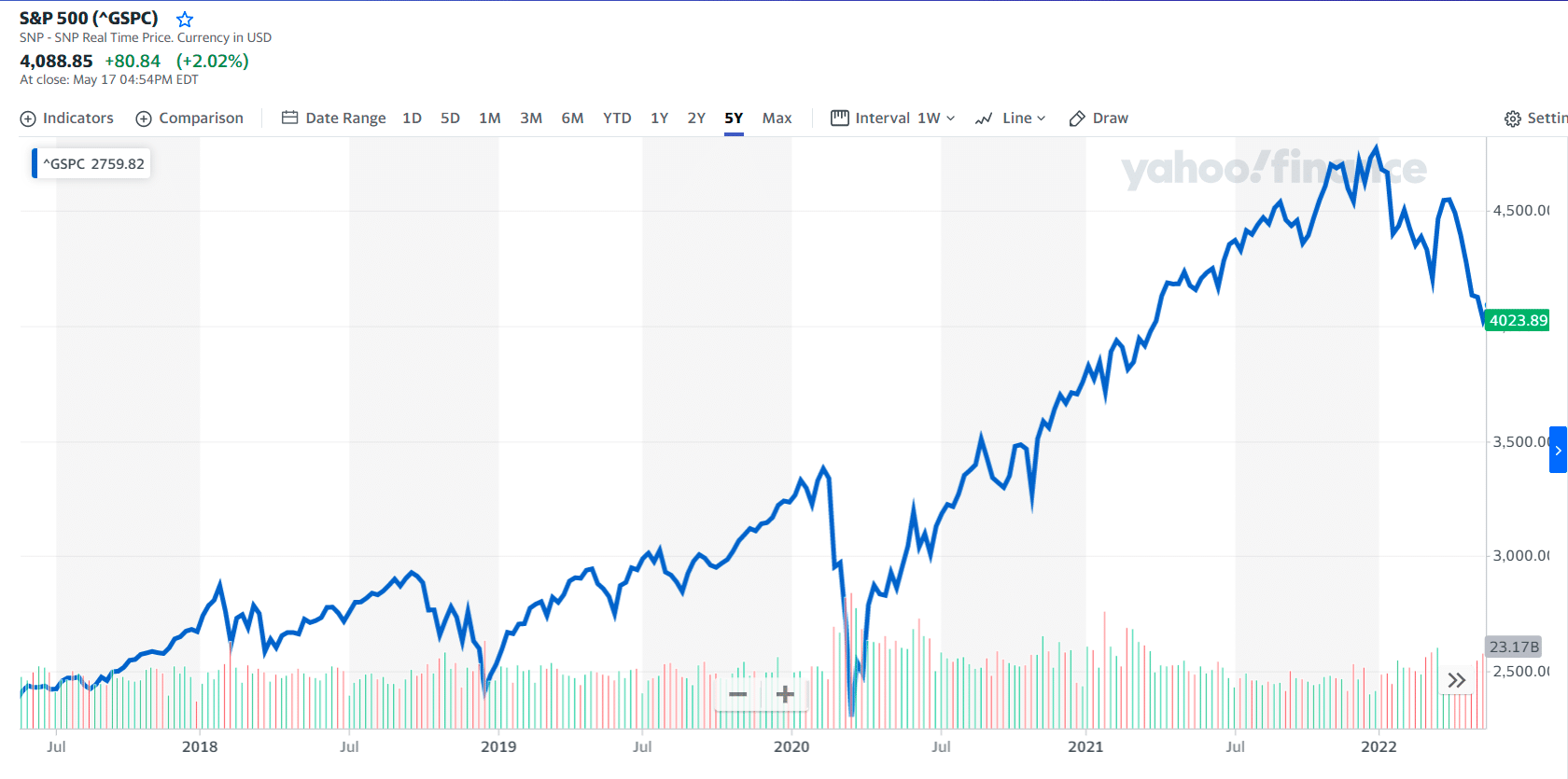

Some mutual funds are actively managed, meaning a fund manager decides how to invest the money in the hope of outperforming market benchmarks. Other mutual funds are passively managed index funds that track an index, such as the Standard & Poor’s 500.

S&P 500 5Y price chart

How to invest in crypto?

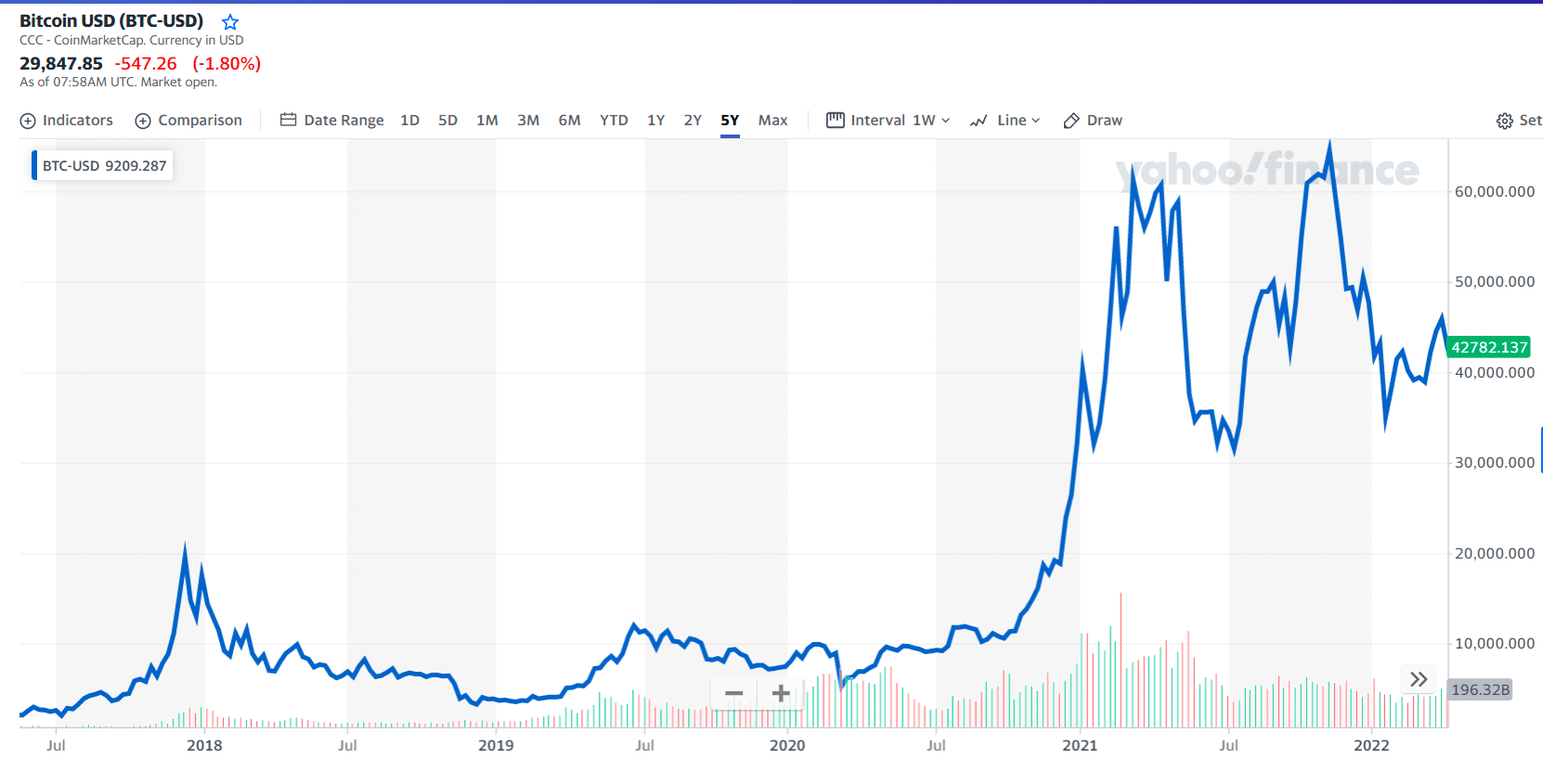

The most famous worldwide crypto is Bitcoin. To invest in crypto, you need to open an account on a crypto exchange. There are many different forms of cryptos, and a given exchange may not support the trading of all of those currencies. So, it is essential to do your research and know your goals before choosing an exchange.

BTC/USD 5Y price chart

Another option for storing your crypto is offline in what is known as a “cold wallet.” This is a device known as a “hardware wallet” that connects to your computer in most cases.

You can also store crypto in a hot wallet — a desktop, mobile, or web-based application that stores your crypto online — or actual physical wallet printouts of public and private keys. Usually, these are made up of a string of characters and scannable QR codes.

Final thoughts

So, crypto vs. stocks – which is the better investment option? It depends on your goals and preferences. If you’re looking for a stable, safe investment, then stocks are the way to go. But if you’re willing to take on more risk to earn higher returns potentially, crypto is a good option. Just remember that with higher risk comes the potential for higher losses. Ultimately, the best strategy may be to diversify your portfolio, investing in both.

Comments