Should you have been fortunate enough to make money with penny stocks this year, you’re likely familiar with a trend. Whether it was stocked with high short interest or corporate developments like a merger, once fixated on a topic, waves of retail traders follow.

Some of the most popular platforms this group favors are ones offering a mobile-first experience. Robinhood is one of the most popular right now, but it comes with a catch. For the most part, and with only a few exceptions, it allows trading of only NASDAQ and NYSE stocks; that includes penny stocks.

So when it comes to finding these big stock breakouts, it’s wise to turn your attention to cheap stocks on major exchanges, and yes, penny stocks do exist outside of the OTC.

What are cheap stocks?

Millions of investors use apps like Robinhood to trade stocks but are in search of the real and cheapest penny stocks to buy by investing their money. Then if so, you are at the right place as one of the investors.

But first, let’s talk a little about cheap stocks. They are shares of small companies that typically trade for significantly less money than shares of larger companies. Despite the name, the term “penny” can be applied to any stocks under $5.

Characteristics of cheap stocks:

- Low liquidity

- Limited historical information

- Lack of public information

- No minimum listing requirements

- Potential for significant increases in value in a short period

How to buy cheap stocks on Robinhood?

Robinhood platform

- Browse the stocks you want to buy.

- Browse the available options on the Robinhood app.

- Tap the Trade button.

- Enter the amount you want to purchase.

- Review your order.

- Swipe to submit.

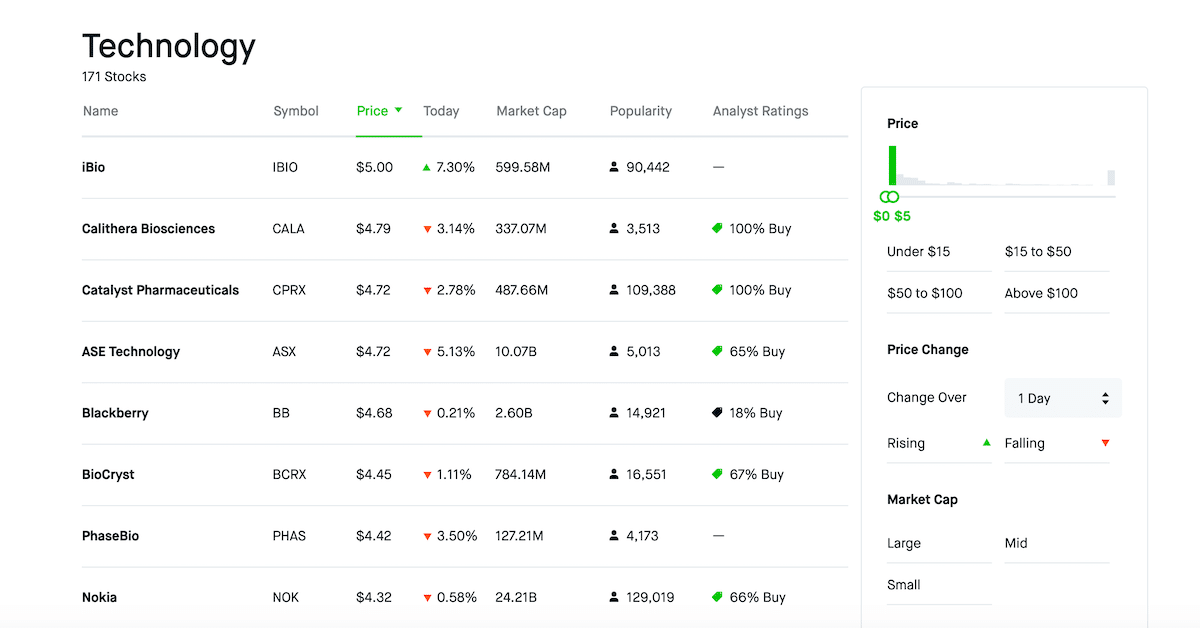

Top 3 cheap stocks to buy on Robinhood in 2022

Here are three stocks for investors to consider today.

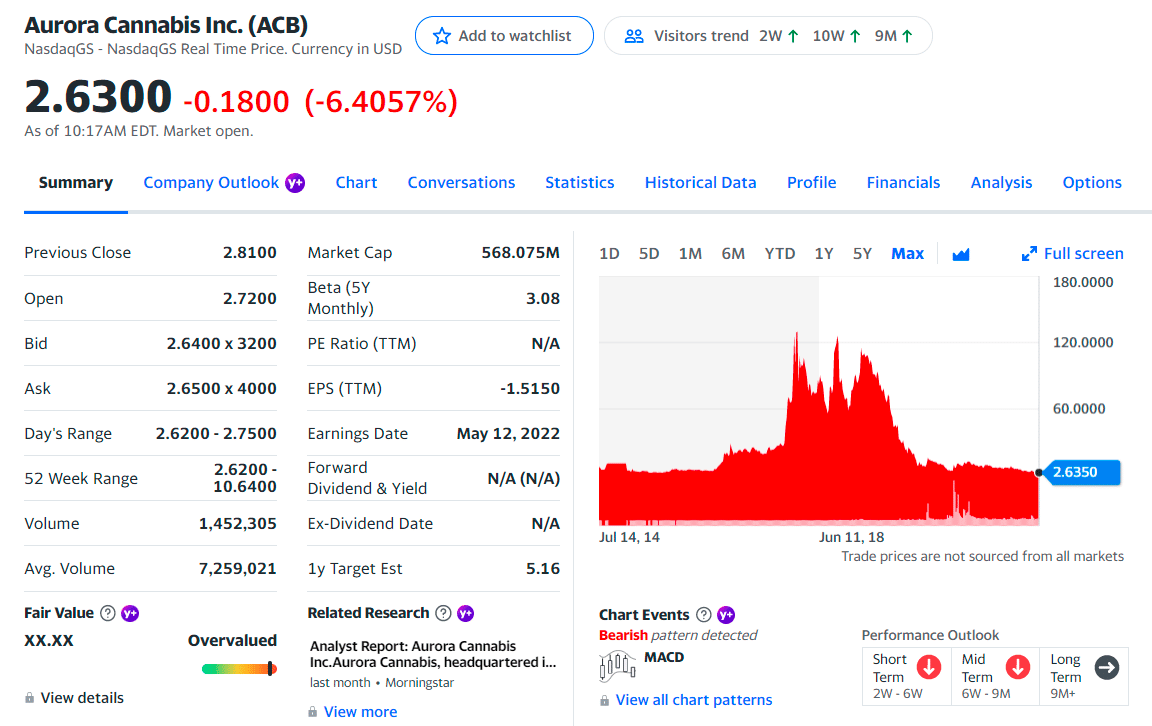

No. 1. Aurora Cannabis Inc. (ACB)

Price: $2.63

EPS: -1.5

Market cap: $568.07M

ACB summary

This is one of the cheapest and most popular penny stocks in Robinhood. This might not be the best penny stock to buy. Needless to say, where there’s attention, there is usually momentum. ACB is no stranger to volatility. It expects revenue to come in at the higher end of its previously issued guidance; $60-$64 million. Furthermore, the company’s anticipating adjusted gross margins to come in between 46% and 50% for the quarter.

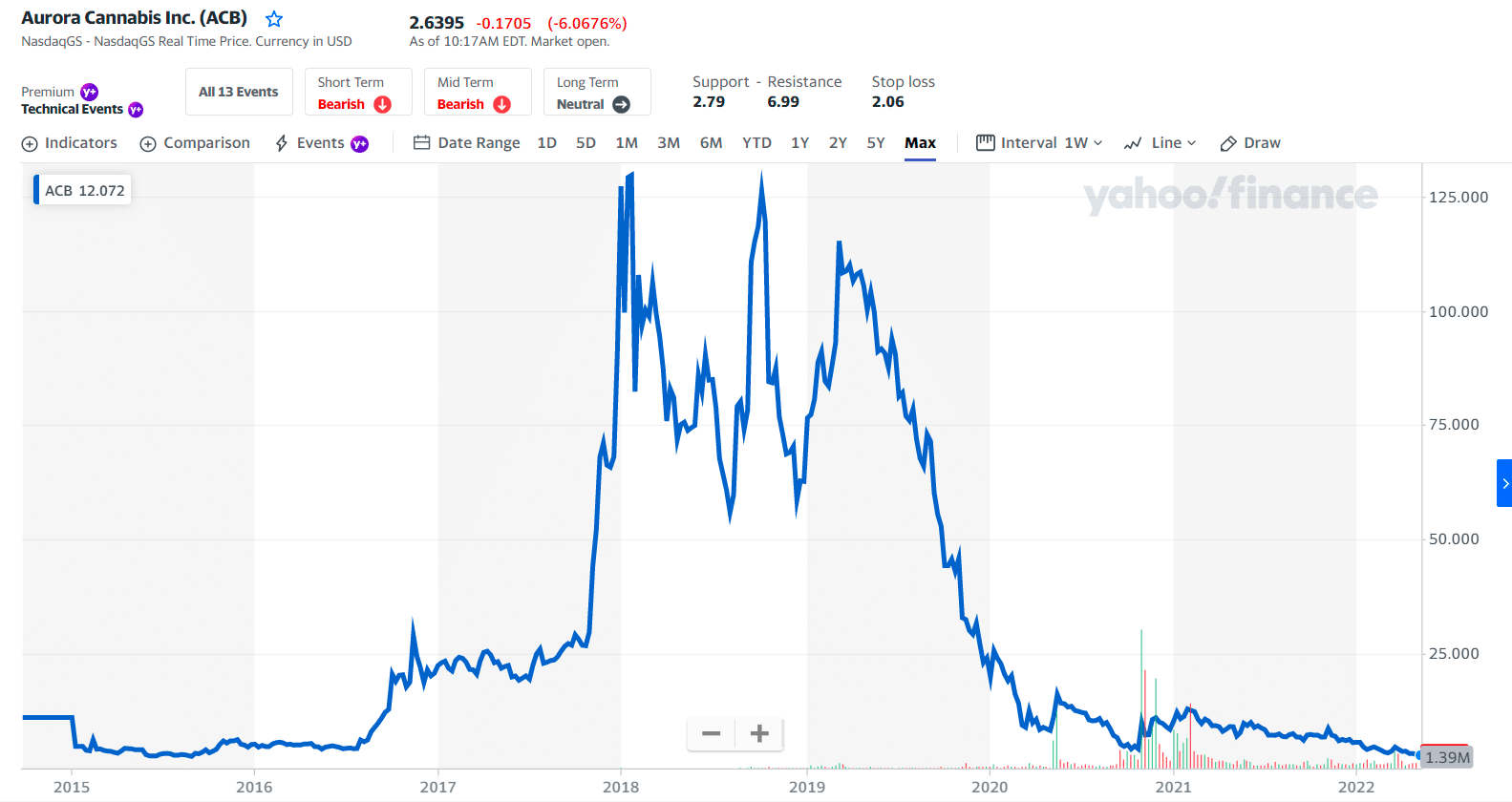

ACB price chart

This stock is one of the most overlooked assets on the market; it’s as simple as that. Many investors are discouraged by cannabis sector stocks after their abrupt drawdown during the past year.

Aurora is a “best-in-class” pick. First, the company exhibits the most extensive gross profit margins (53%) in the cannabis industry, suggesting that economics of scale is part of its furniture. Aurora achieved this feat by delivering a wide breadth of products spanning the medical and recreational markets.

Another aspect to consider is Aurora’s growth in the international markets. The company’s an upstream market leader in countries like Israel, Germany, France, Poland and the United Kingdom.

The first three holdings:

- ETF Managers Group, LLC — 5.10%

- Vanguard Group, Inc. — 2.70%

- Mirae Asset Global Investments Co., Ltd. — 0.70%

ACB price prediction

The ten analysts offering 12-month price forecasts for Aurora Cannabis Inc have a median target of $5.06, with a high estimate of $5.99 and a low estimate of $2.35. The median estimate represents a +80.46% increase from the last price of $2.81.

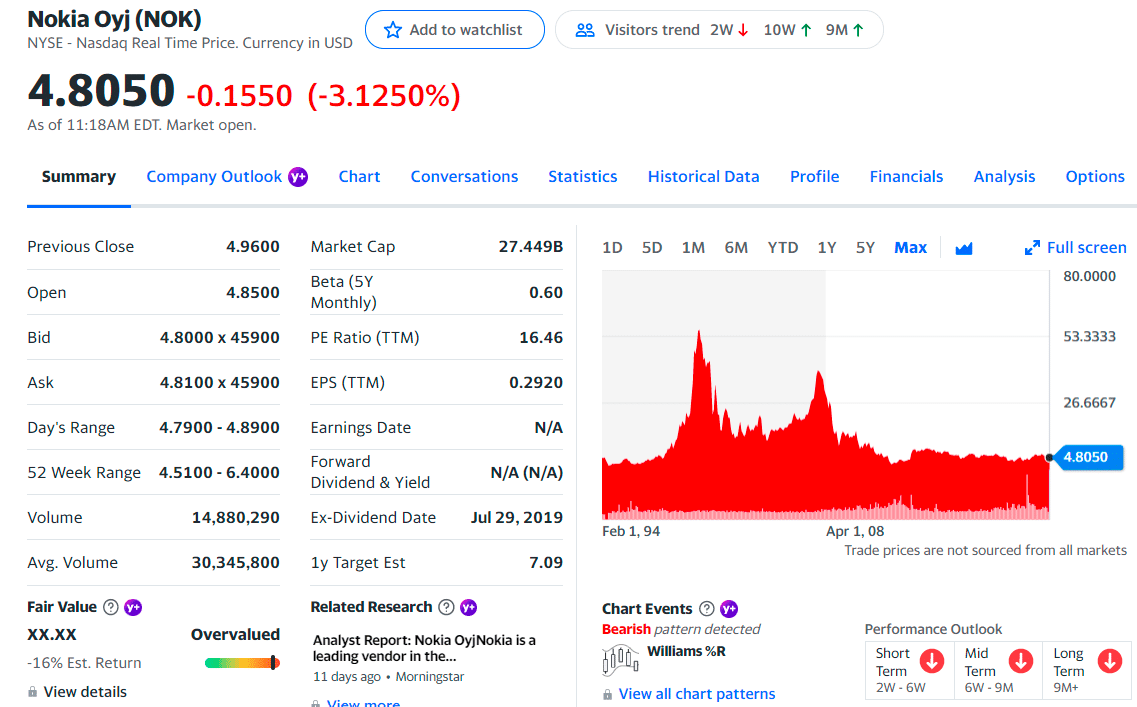

No. 2. Nokia Oyj (NOK)

Price: $4.80

EPS: $0.29

Market cap: 27.44B

NOK summary

Nokia Corporation is Finnish multinational telecommunication, information technology, and consumer electronics company. Also, this is one of the cheapest stocks in Robinhood.

NOK posted solid 5% year-over-year top-line growth in its first fiscal quarter of 2022, driven largely by Network Infrastructure growth of 14% and Cloud and Network Services sales increasing by 9%. Meanwhile, its Technologies business segment fell 16%, while its Mobile Networks business saw flat year-over-year performance.

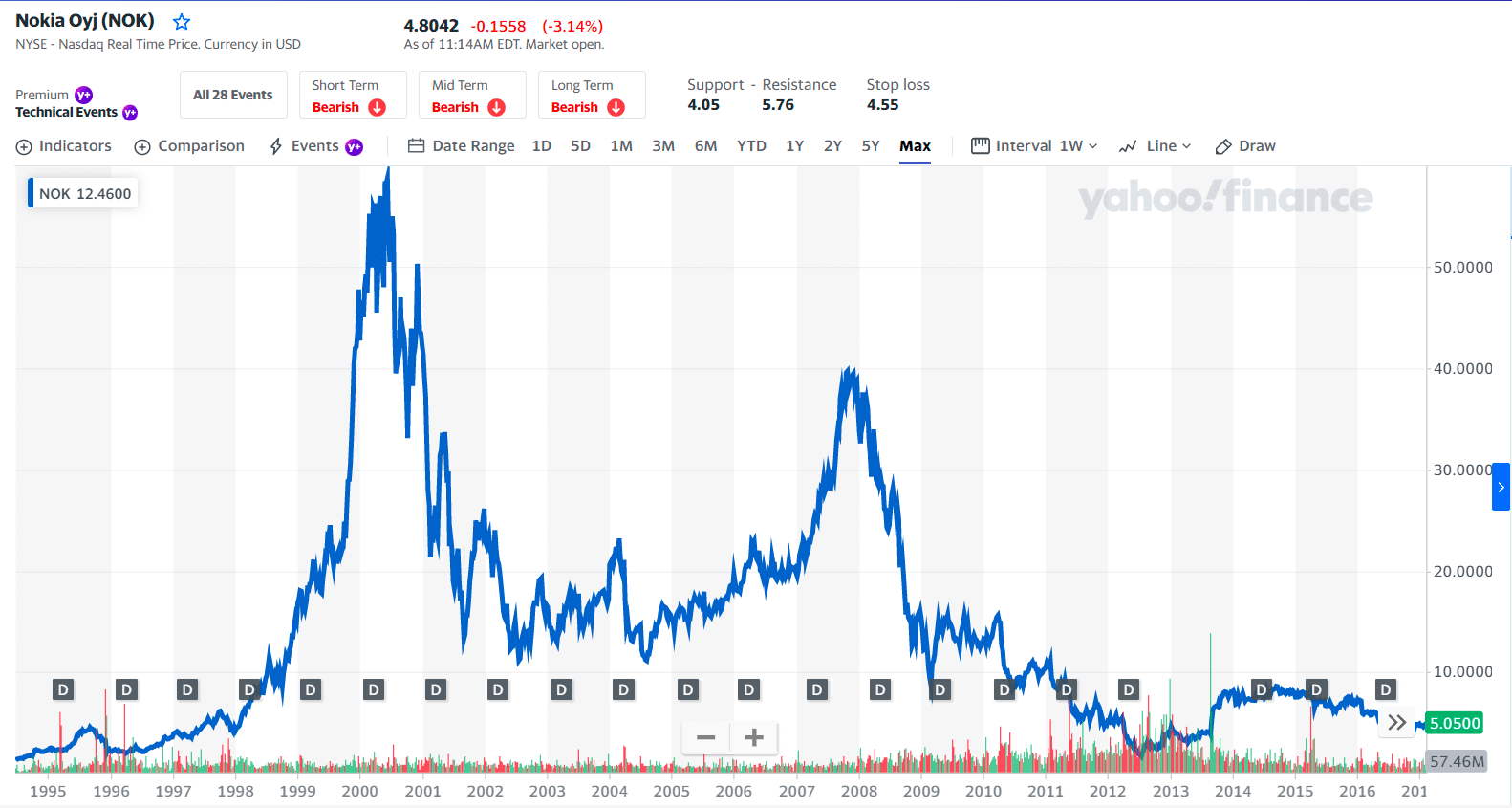

NOK price chart

However, the Mobile Networks business saw some encouraging developments as its gross and operating profit margins increased while revenue did not grow primarily due to short-term supply chain headwinds. As supply chain conditions normalize, we expect this segment to return to growth.

The first three holdings:

- Artisan Partners Limited Partnership — 1.19%

- Optiver Holding B.V — 1.13%

- Neuberger Berman Group, LLC — 0.77%

NOK price prediction

The 26 analysts offering 12-month price forecasts for Nokia Oyj have a median target of $6.49, with a high estimate of $8.41 and a low estimate of $5.52. The median estimate represents a +30.81% increase from the last price of $4.96.

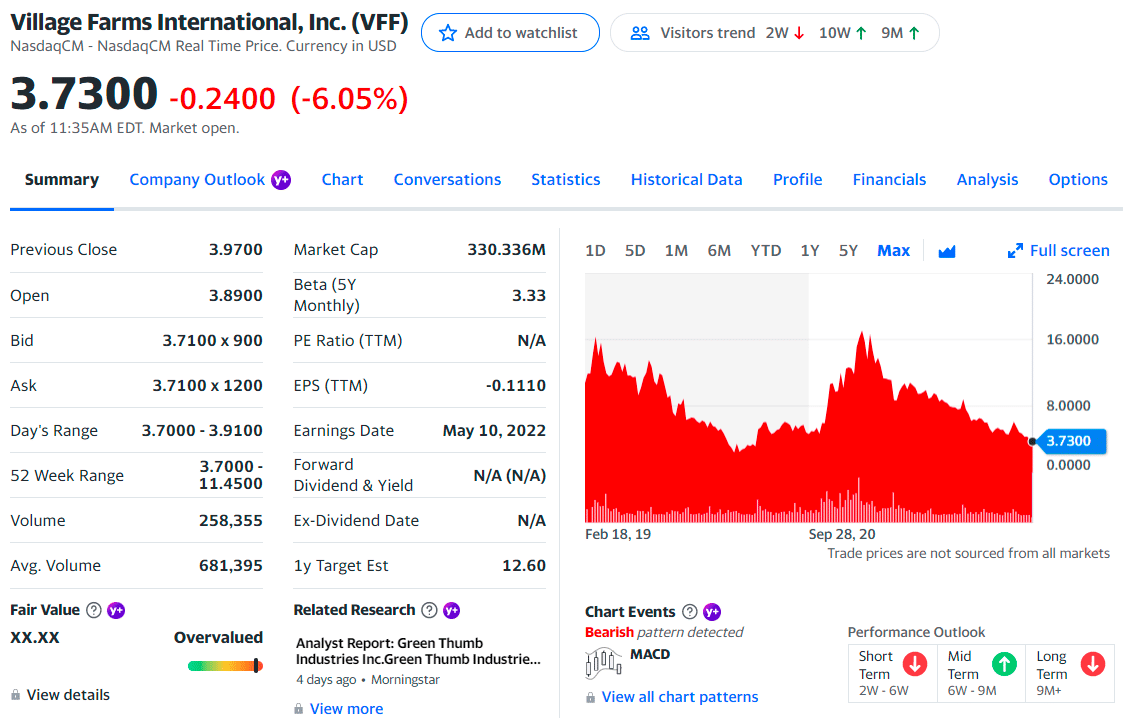

No. 3. Village Farms International Inc. (VFF)

Price: $3.73

EPS: $-0.11

Market cap: 330.33M

VFF summary

Village Farms International, Inc. manages and operates agricultural greenhouse facilities in the US and Canada. The company was founded by Michael A. DeGiglio and Albert W. Vanzeyst in 1987 and is headquartered in Delta, Canada.

It operates through the following segments: produce business, energy business, and cannabis.

- The produce segment focuses on the production, marketing, and selling of product groups which consist of tomatoes, bell peppers, and cucumbers.

- The energy segment offers power that it sells per a long-term contract to its one customer.

- The cannabis segment covers the production and supply of cannabis products sold to other licensed providers and provincial governments across Canada and internationally through Pure Sunfarms.

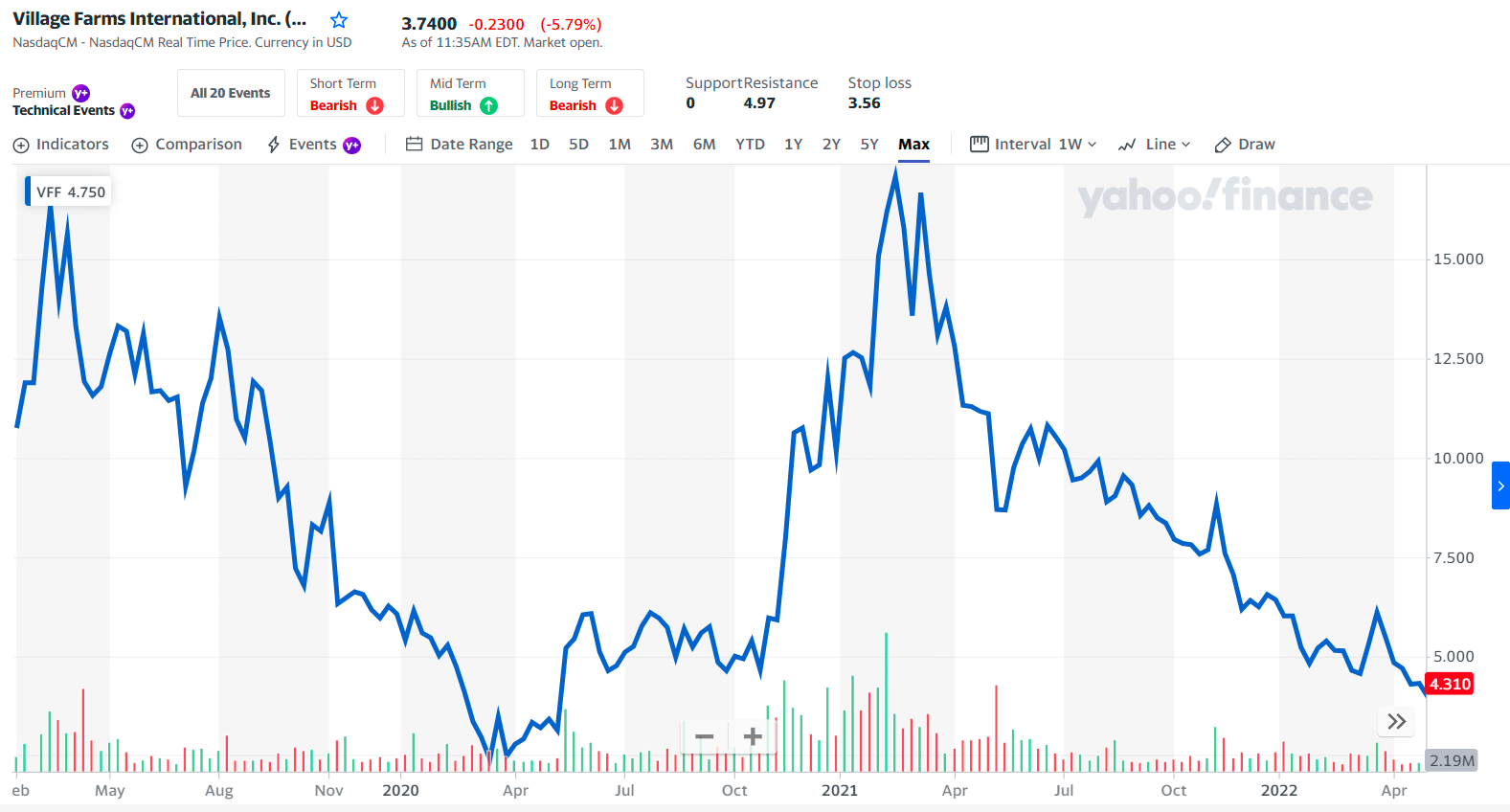

VFF price chart

The first three holdings:

- AdvisorShares Investments, LLC — 4.94%

- AdvisorShares Investments, LLC — 4.94%

- ETF Managers Group, LLC — 4.28%

VFF price prediction

The 8 analysts offering 12-month price forecasts for Village Farms International Inc have a median target of $13.25, with a high estimate of $17.00 and a low estimate of $5.00. The median estimate represents a +232.91% increase from the last price of $3.98.

Final thoughts

Such stocks can be highly volatile and come with more risk than you may imagine. However, the cost of entry and prospects of potential gains is why investors continue to bet big on cheaper stocks. The digital age of investing is here, and Robinhood is leading the charge.

Comments