Cryptos have continued to uphold their reputation for volatility in recent months, but the frenzy over digital currencies doesn’t appear to be daunted. And crypto fans have more investment options than ever before as the list of Bitcoin and other crypto exchange-traded funds continues to swell.

What are crypto ETFs?

Crypto ETFs put a traditional spin on investing in crypto. The number of digital assets and crypto-related investments on the market is growing every day. Instead of taking a full risk by going “all in” with one individual crypto investment, investing in a crypto exchange-traded fund allows investors to easily access crypto assets while managing risk through the ETF’s diversified properties.

Each fund’s investments are linked to digital assets or blockchain technology to varying degrees, but crypto ETFs’ fortunes are pegged to the performance of major cryptos like Bitcoin and Ether. There are several crypto-themed ETFs out there, but keep in mind that they tend to charge high management fees.

Here are five of the best crypto ETFs that have exposure to crypto futures contracts.

How to buy crypto ETFs?

If you’re looking to invest in Bitcoin ETFs, you can purchase them through your broker or advisor if they offer them. If you decide to invest in a blockchain ETF rather than looking for a crypto ETF, you’re likely to have an easier time.

Step 1. Open a brokerage account

To buy shares of any ETF, you need to open a brokerage account. Several accounts are available, so figure out what’s likely to work for you. Then open an account where it makes sense for your portfolio.

Step 2. Decide how much you want to invest

Look at the rest of your investment portfolio and determine where a blockchain ETF fits your strategy and long-term goals.

Step 3. Search for the ticker

Look for the ticker symbol for your desired blockchain ETF.

Step 4. Place an order

Once you know how many shares you can buy, place a market order for the ETF.

Step 5. Set up an automatic investing plan

Set up an automatic investing plan with your broker if you want to regularly buy more shares of a blockchain ETF.

Top five crypto ETFs to buy in 2022

Here are five Bitcoin ETFs and other crypto funds available to investors today.

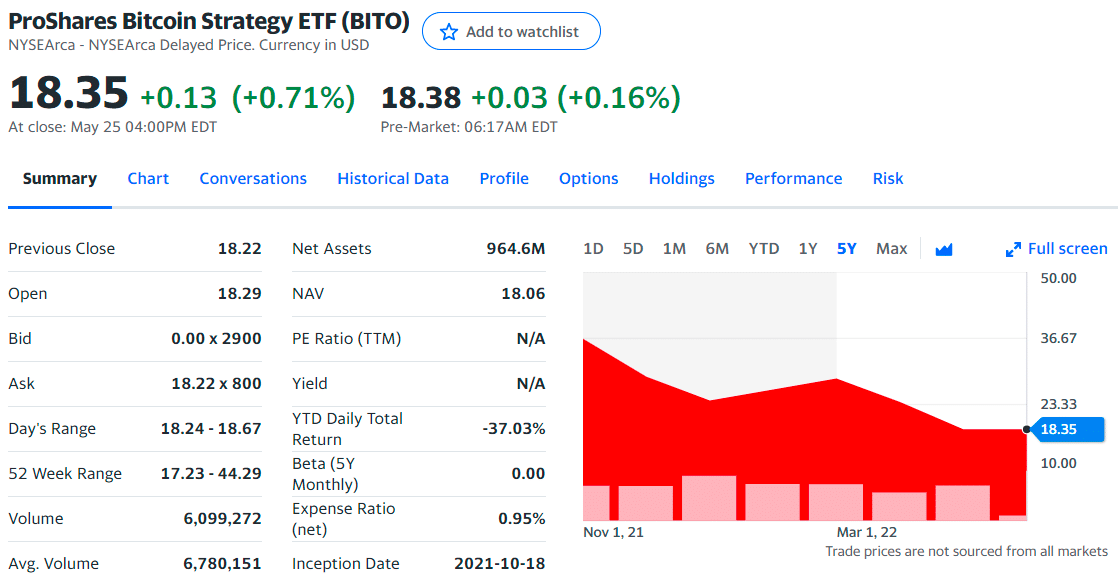

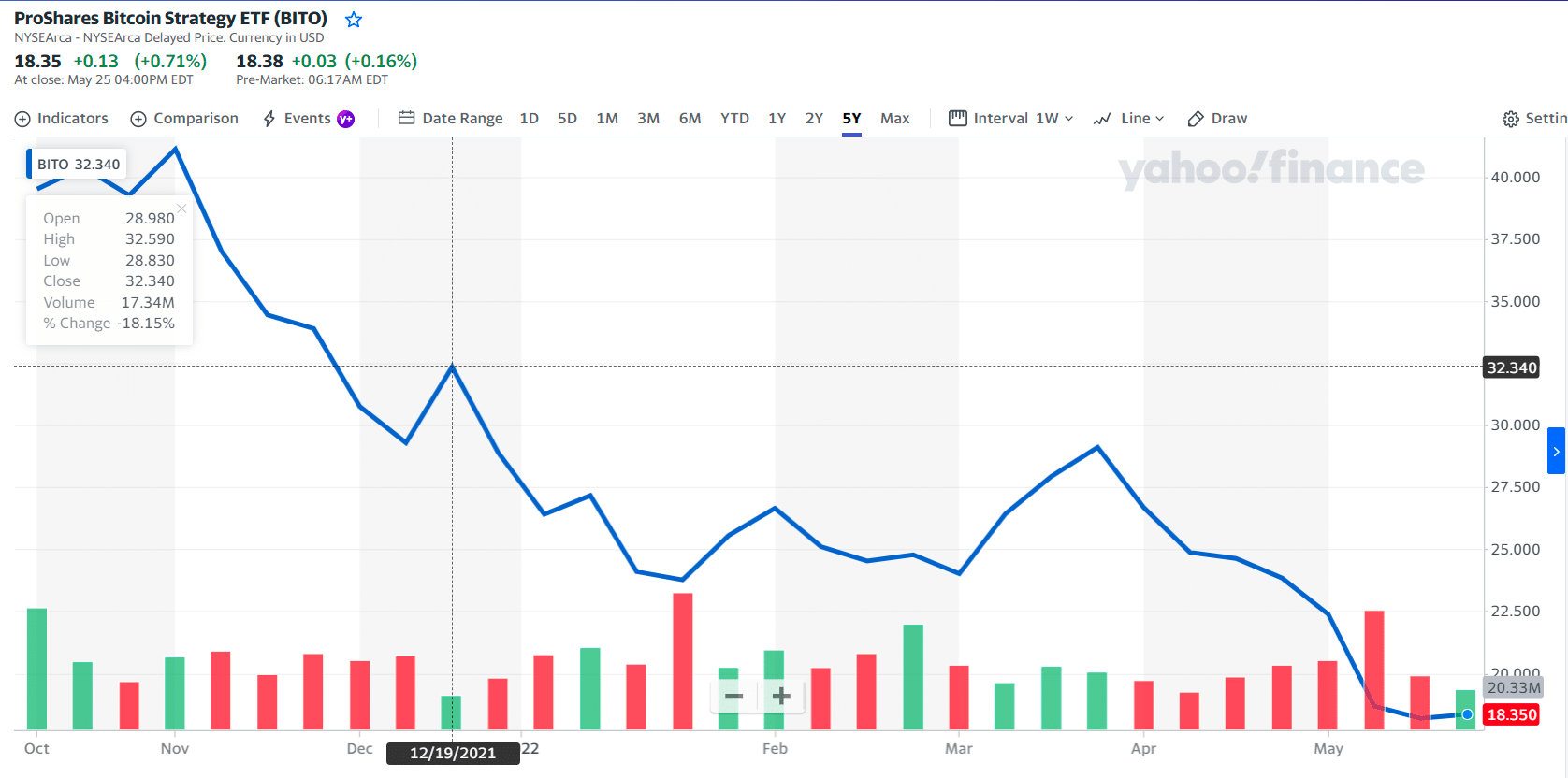

№ 1. ProShares Bitcoin Strategy ETF (BITO)

BITO ETF summary

It was launched in 2021 and managed by Alexander Ilyasov since October 18, 2021, at ProShares.

ProShares Bitcoin Strategy ETF was the first crypto-linked ETF available to investors to be approved by the SEC, and it began trading on the NYSE Arca exchange in October 2021. Before BITO, the SEC had consistently denied approval to crypto-linked ETFs. Still, it greenlit the fund because it allows individuals to invest in Bitcoin futures contracts rather than holding Bitcoin assets in the fund.

BITO price chart

BITO has an expense ratio of 0.95%, 34% lower than its category. Its expense ratio is high compared to funds in the Digital Assets category. In April 2022, BITO returned -16.6%.

Like other crypto ETFs holding Bitcoin futures contracts, BITO significantly underperformed the S&P 500 index year-to-date in 2022.

The top three holdings with their asset percentage are:

- US Dollar — 54.60%

- US Treasury bills — 44.55%

- US Treasury bills — 0.85%

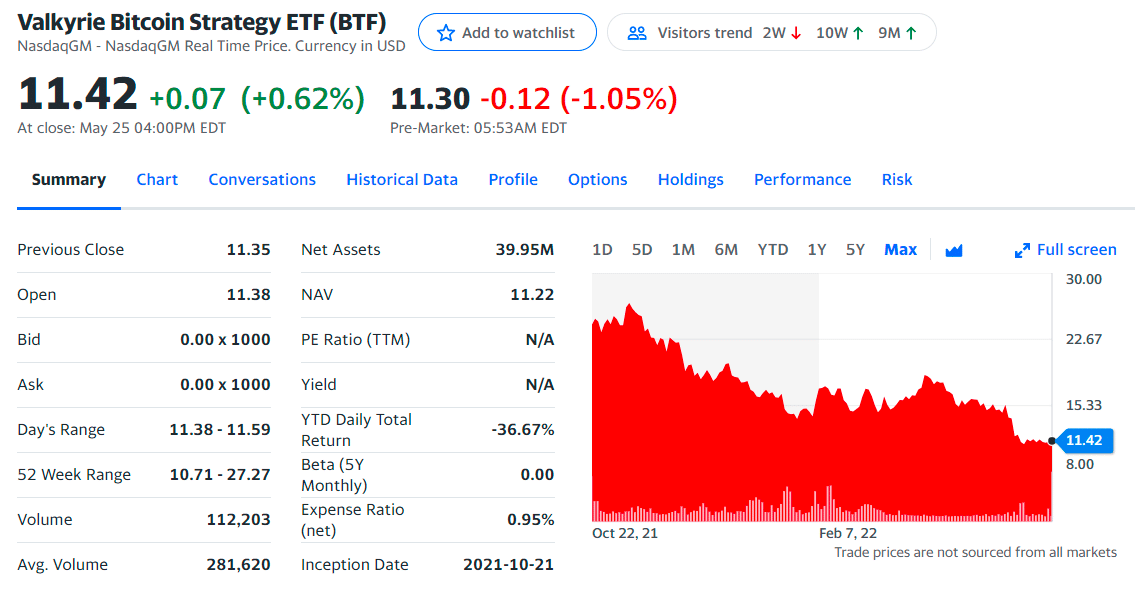

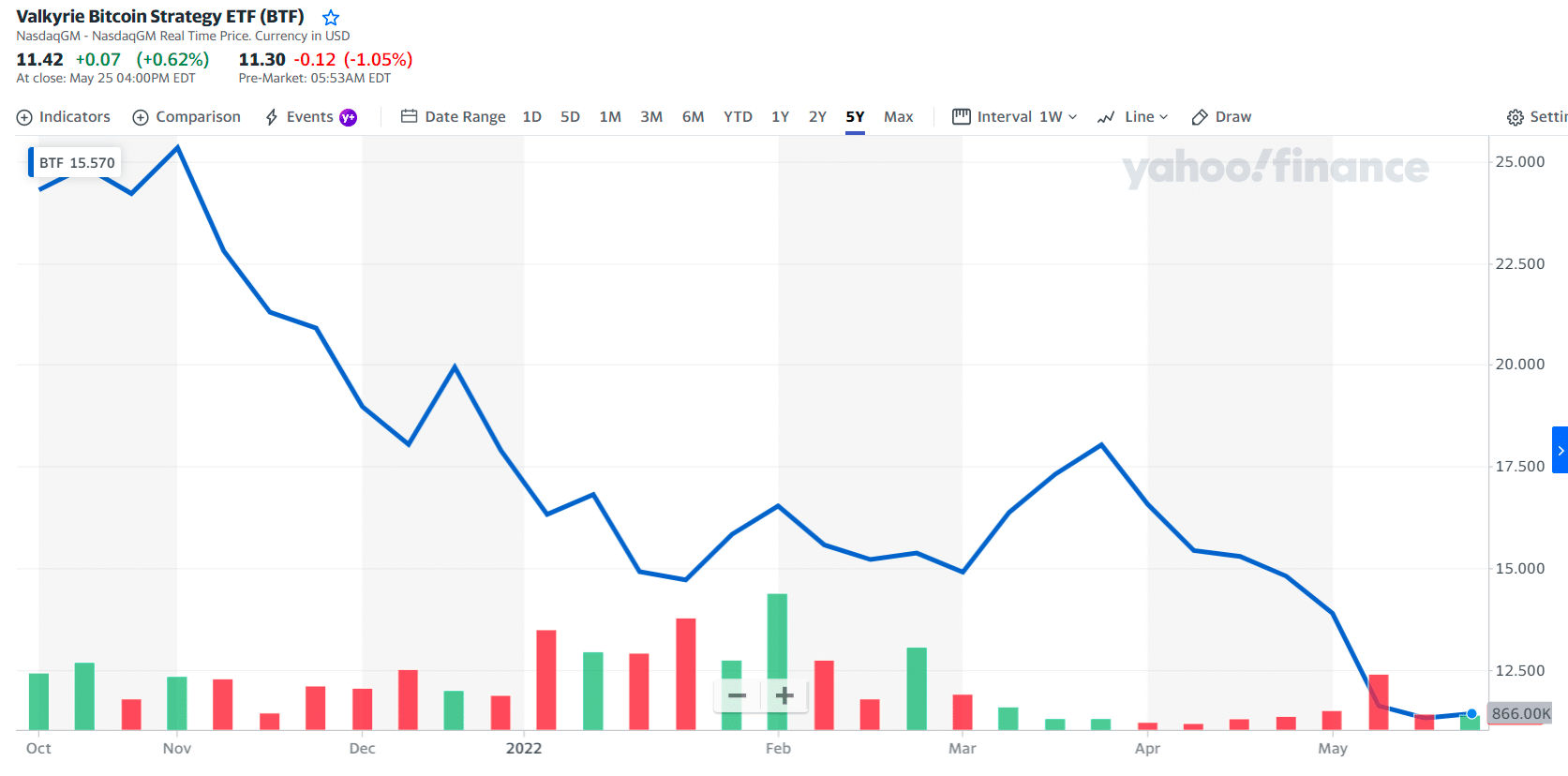

№ 2. Valkyrie Bitcoin Strategy ETF (BTF)

BFT ETF summary

It was launched in 2021 and has been managed by Rafael Zayas since October 21, 2021, at Valkyrie ETF Trust II.

It was the second crypto-linked ETF to be approved by the SEC, and it launched just a few days after BITO on the Nasdaq exchange. The two funds are very similar, allowing individuals to invest in Bitcoin futures. BTF’s portfolio consists of mostly Bitcoin futures with 26.2% US Treasury bills mixed in.

BFT price chart

Its expense ratio is high compared to funds in the Digital Assets category. It has an expense ratio of 0.95%, 34% lower than its category. In April 2022, BTF returned -16.5%.

Like other crypto ETFs holding Bitcoin futures contracts, BTF significantly underperformed the S&P 500 index year-to-date in 2022.

Top two holdings:

- United States Treasury Bills 0% — 2.52%

- Valkyrie ETF Cfc — 39.89%

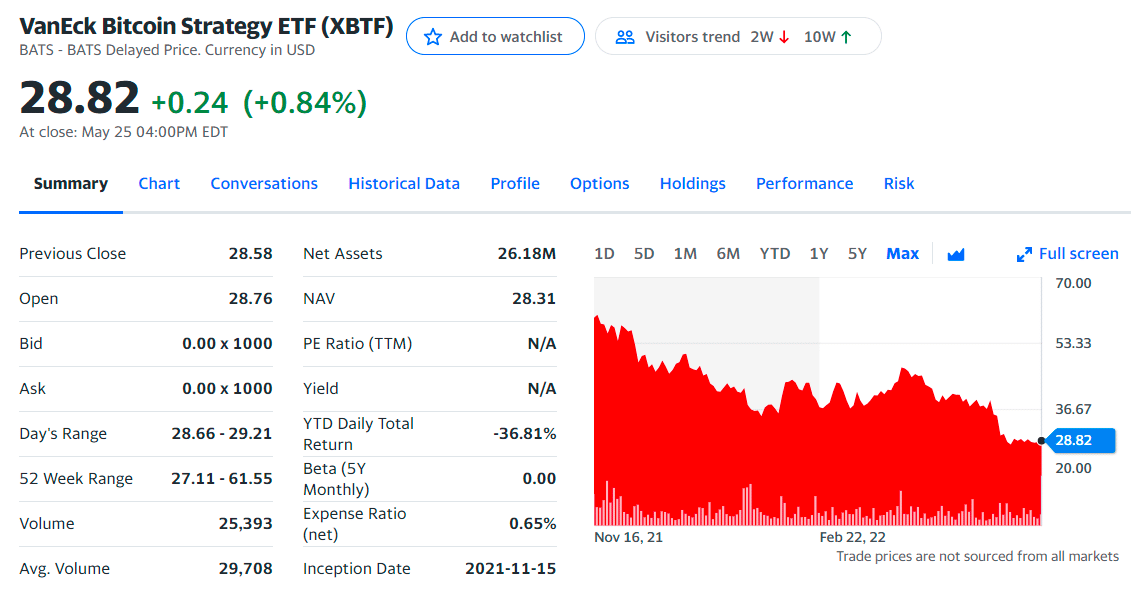

№ 3. VanEck Bitcoin Strategy ETF (XBTF)

XBTF ETF summary

It was launched in 2021 and managed by Gregory Krenzer since November 15, 2021, at VanEck.

The ETF is the third crypto-linked ETF approved by the SEC to debut. It began trading on the Chicago Board Options Exchange in November 2021. The fund invests in Bitcoin futures and charges the lowest to maintain the three SEC-approved Bitcoin ETFs.

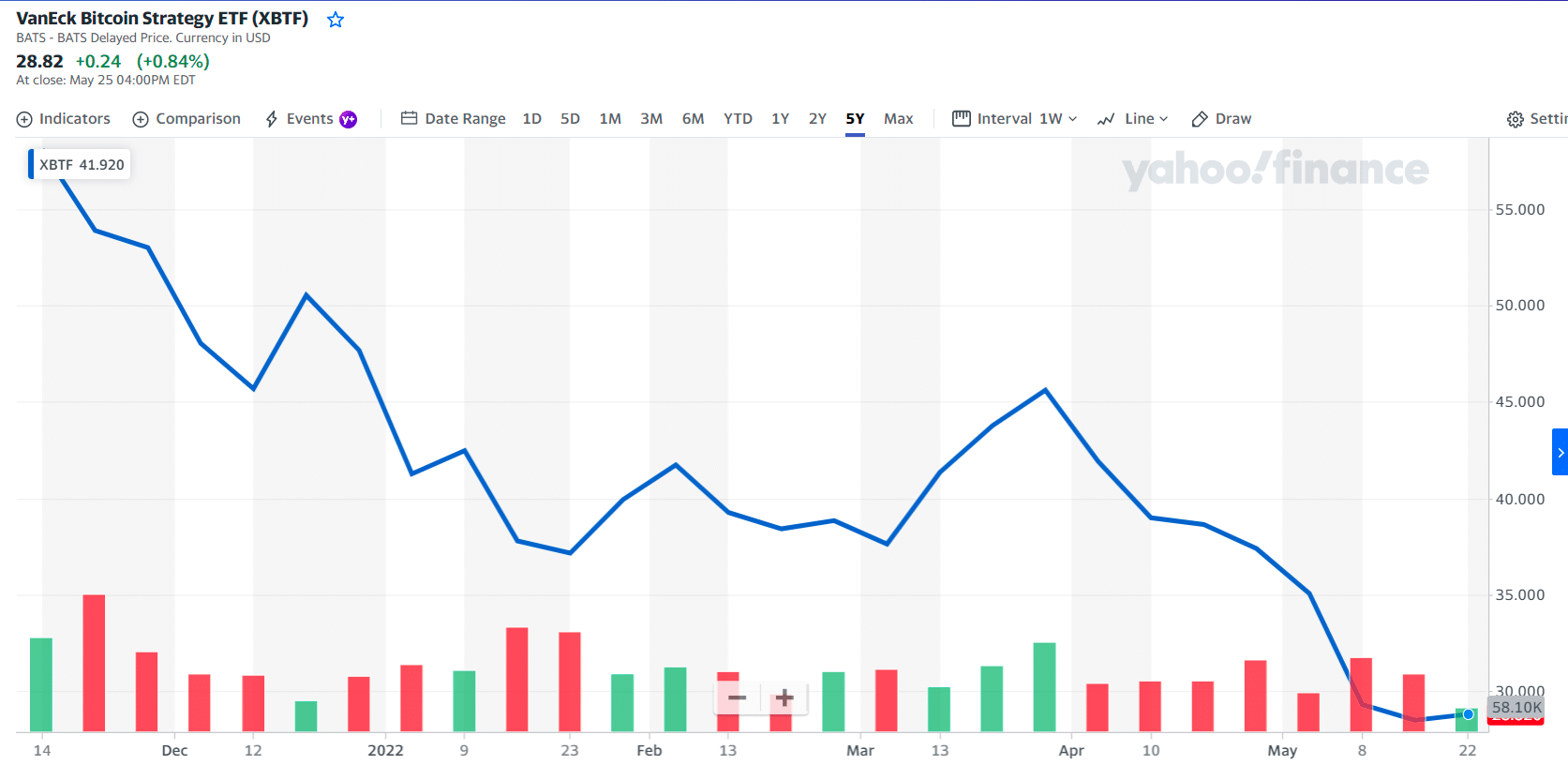

XBTF price chart

Its expense ratio is above average compared to funds in the Digital Assets category. It has an expense ratio of 0.65%, which is 55% lower than its category. In April 2022, XBTF returned -16.5%.

The top three holdings with their asset percentage are:

- US Treasury Bills — 28.23%

- US Treasury Bills — 14.12%

- US Treasury Bills — 14.10%

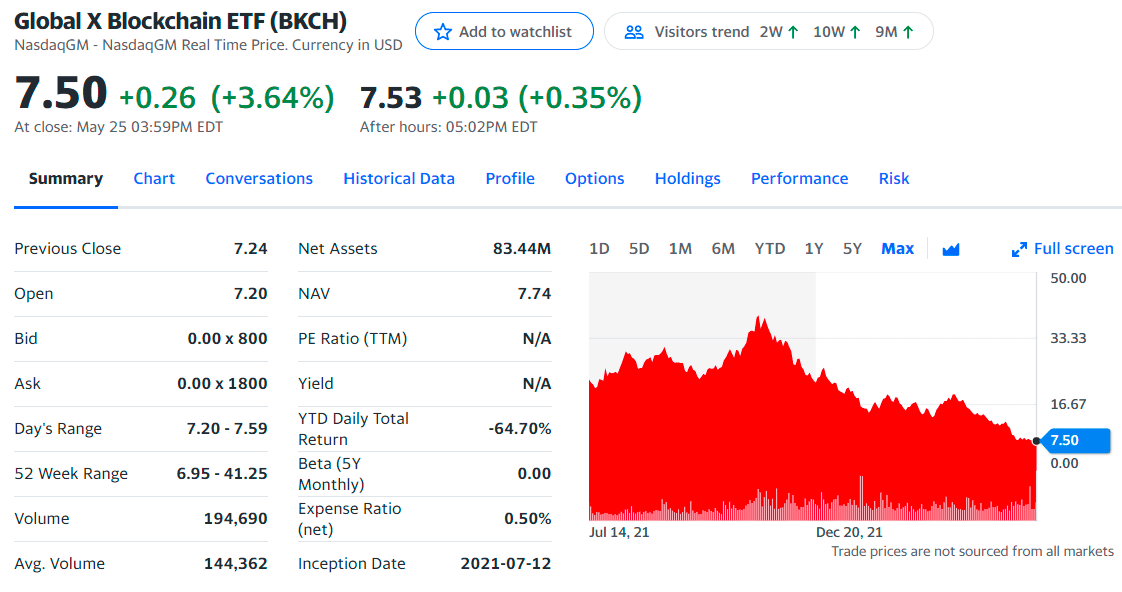

№ 4. Global X Blockchain ETF (BKCH)

BKCH ETF summary

It was launched in 2021 and managed by Nam To since July 12, 2021, at Global X Funds. It is invested in companies heavily involved in blockchain technologies and stands to benefit from the widespread adoption of blockchain technology.

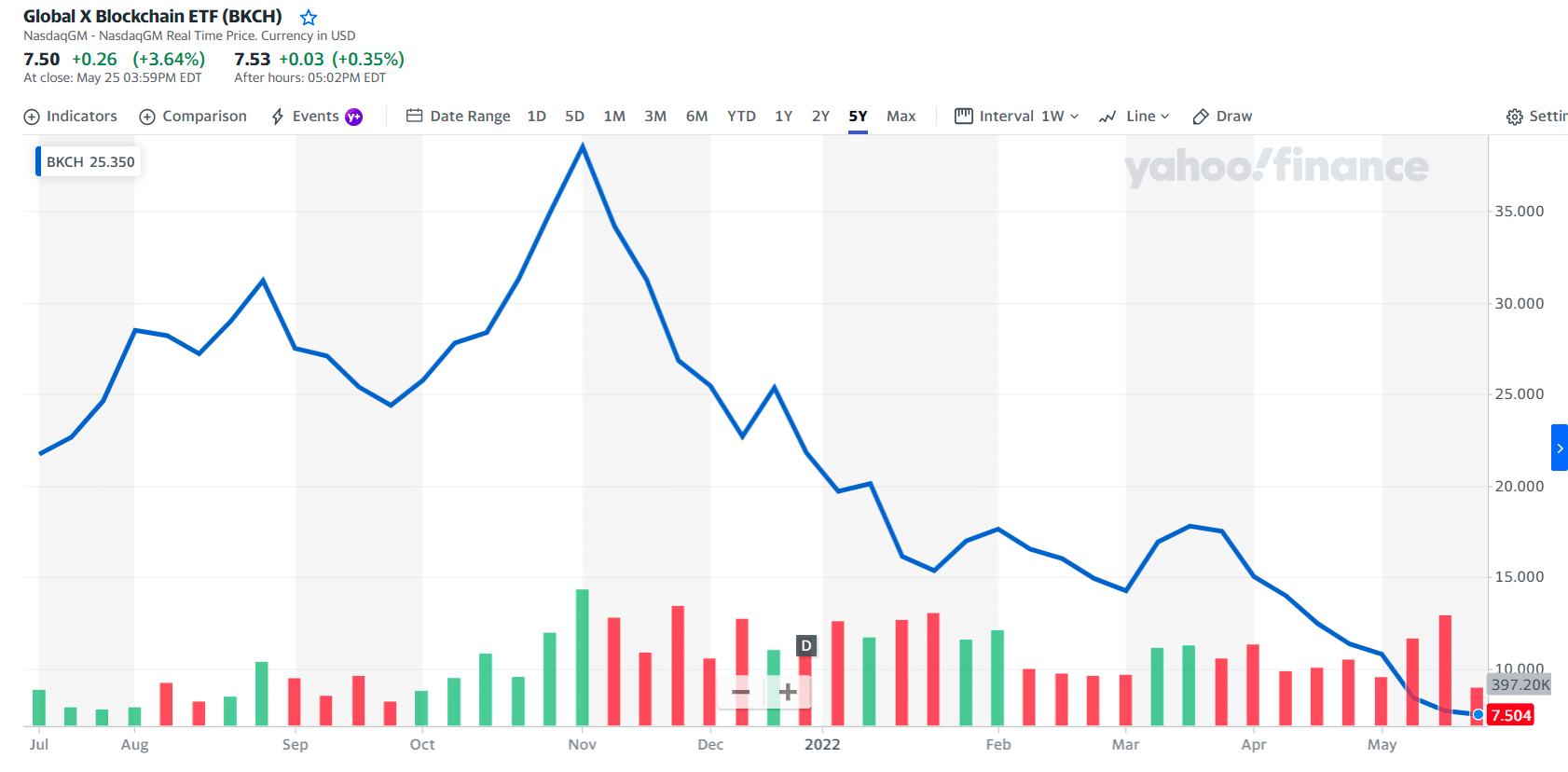

Like other crypto ETFs that hold Bitcoin futures contracts, XBTF significantly underperformed the S&P 500 index over the past month.

BKCH price chart

Its expense ratio is average compared to funds in the Digital Assets category. It has an expense ratio of 0.50%, which is 65% lower than its category. In April 2022 BKCH returned -34.7%.

The top three holdings with their asset percentage are:

- Marathon Digital Holdings — 9.89%

- Riot Blockchain Inc. — 9.77%

- Galaxy Digital Holdings Ltd. — 8.21%

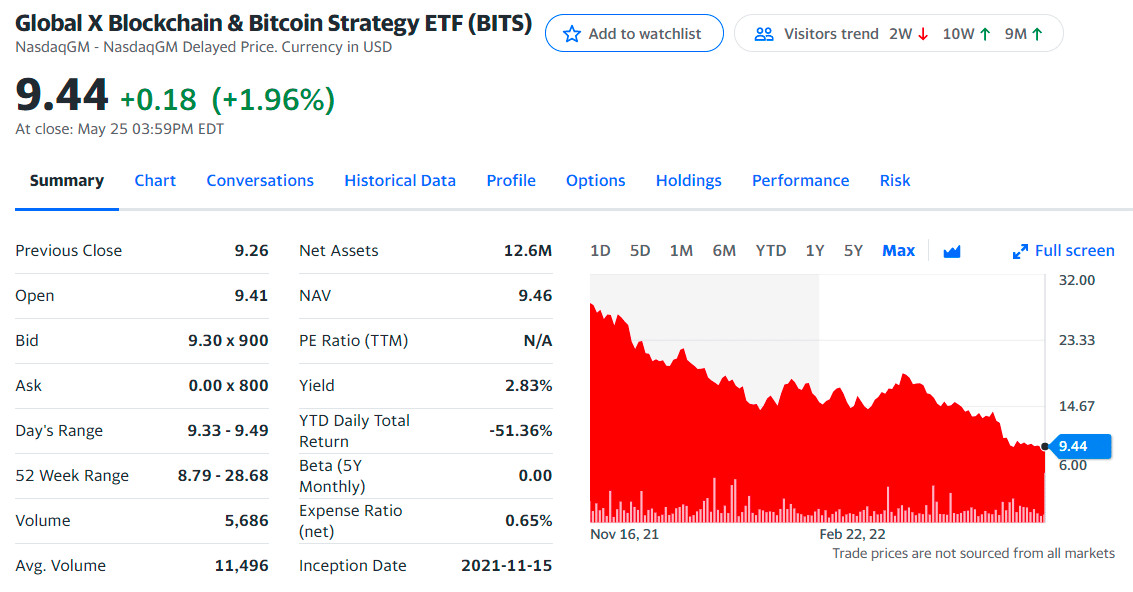

№ 5. Global X Blockchain & Bitcoin Strategy ETF (BITS)

BITS ETF summary

It was launched in 2021 and managed by Jay Jacobs on November 15, 2021, at Global X Funds.

This fund is also managed by Mirae Asset Financial Group and began trading on the Nasdaq exchange in November 2021. It combines cryptocurrency-linked assets, including Bitcoin futures and investments in blockchain technology-related companies through the Global X Blockchain ETF.

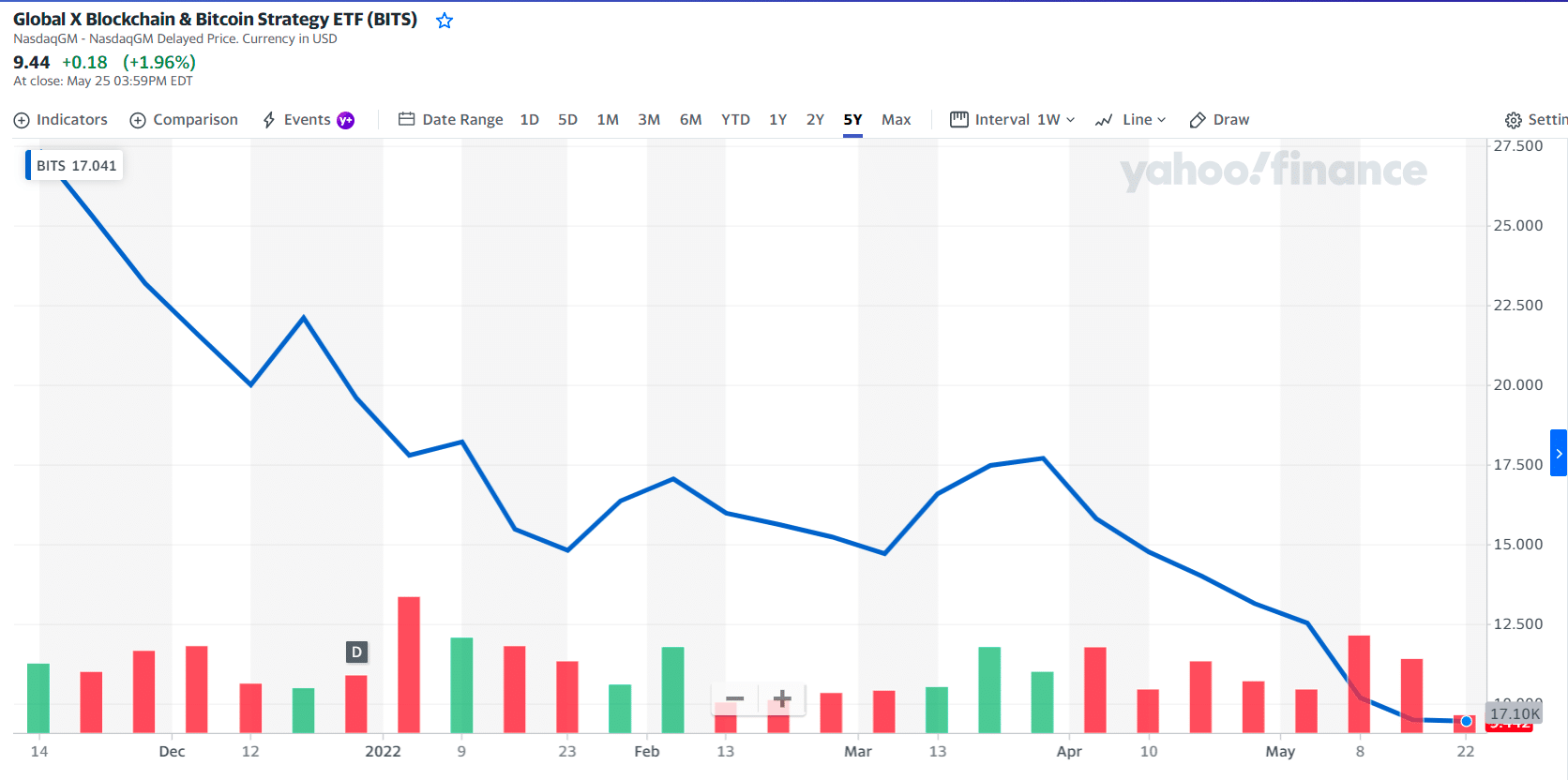

BITS price chart

Its expense ratio is above average compared to funds in the Digital Assets category. It has an expense ratio of 0.65%, which is 55% lower than its category. In April 2022, BITS returned -25.3%.

Like the other top crypto ETFs, it significantly underperformed the S&P 500 index over the past month.

Top 1 holdings (47.30% of total assets):

- Global X Blockchain ETF — 47.30%

Final thoughts

Investors should keep in mind that using futures tends to cause disconnects with the underlying value of the asset being tracked, which can cause the ETF’s performance to differ from that of its benchmark crypto.

Comments