The Russian invasion of Ukraine on February 24 triggered unprecedented policy measures and market movements worldwide. The Russian currency is still at all-time lows, and the Russian equities market has been closed since February 25, while oil has risen beyond $130 a barrel for the first time since 2008, and gas prices have risen to all-time highs.

This guide will talk about the top five commodities you need to know about during the geopolitical crises.

What are commodities?

Raw resources or agricultural goods that may be purchased and traded are commodities. Therefore, they are one of the most important investing asset classes. Commodities are of two types: hard and soft.

- Hard commodities (gold, silver, platinum, copper) are mined.

- Soft commodities are used (wheat, corn, coffee beans, etc.)

Commodity prices often climb when inflation accelerates, so investors frequently turn to them for protection during periods of high inflation, particularly unanticipated inflation.

The demand for goods and services grows. So does the price of those goods and services, and commodities are needed to make those goods and services.

How to buy commodities?

There are three ways to buy commodities:

- Own the physical commodity itself

- Buy futures contracts

- Buy through a mutual fund or ETF

The commodities markets in the United States are located in Chicago, New York, and Atlanta. The Chicago Board of Trade specializes in grains, whereas the Chicago Mercantile Exchange centers on agricultural commodities. The New York Mercantile Exchange is primarily concerned with energy and metals.

Commodity ETFs are considered the best way to buy commodities.

Top five commodities to buy in 2022

Now that you know what commodities are and how to buy them let’s move on to the top five commodities you need to watch during the geopolitical turmoil.

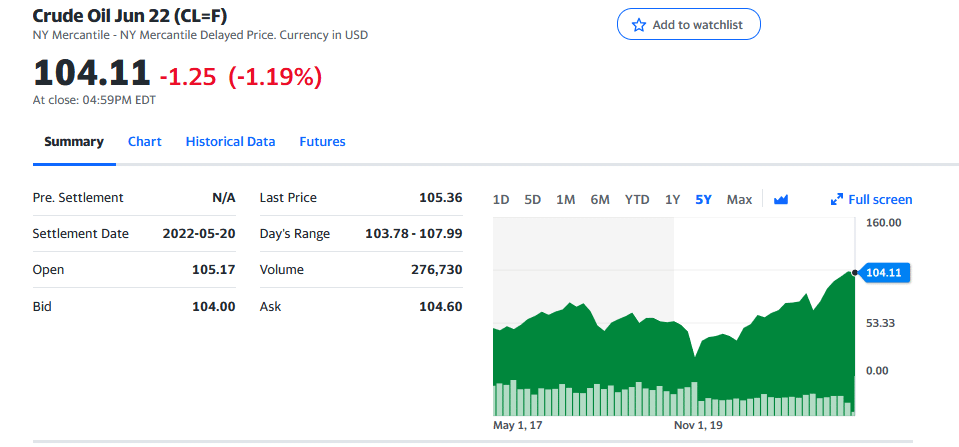

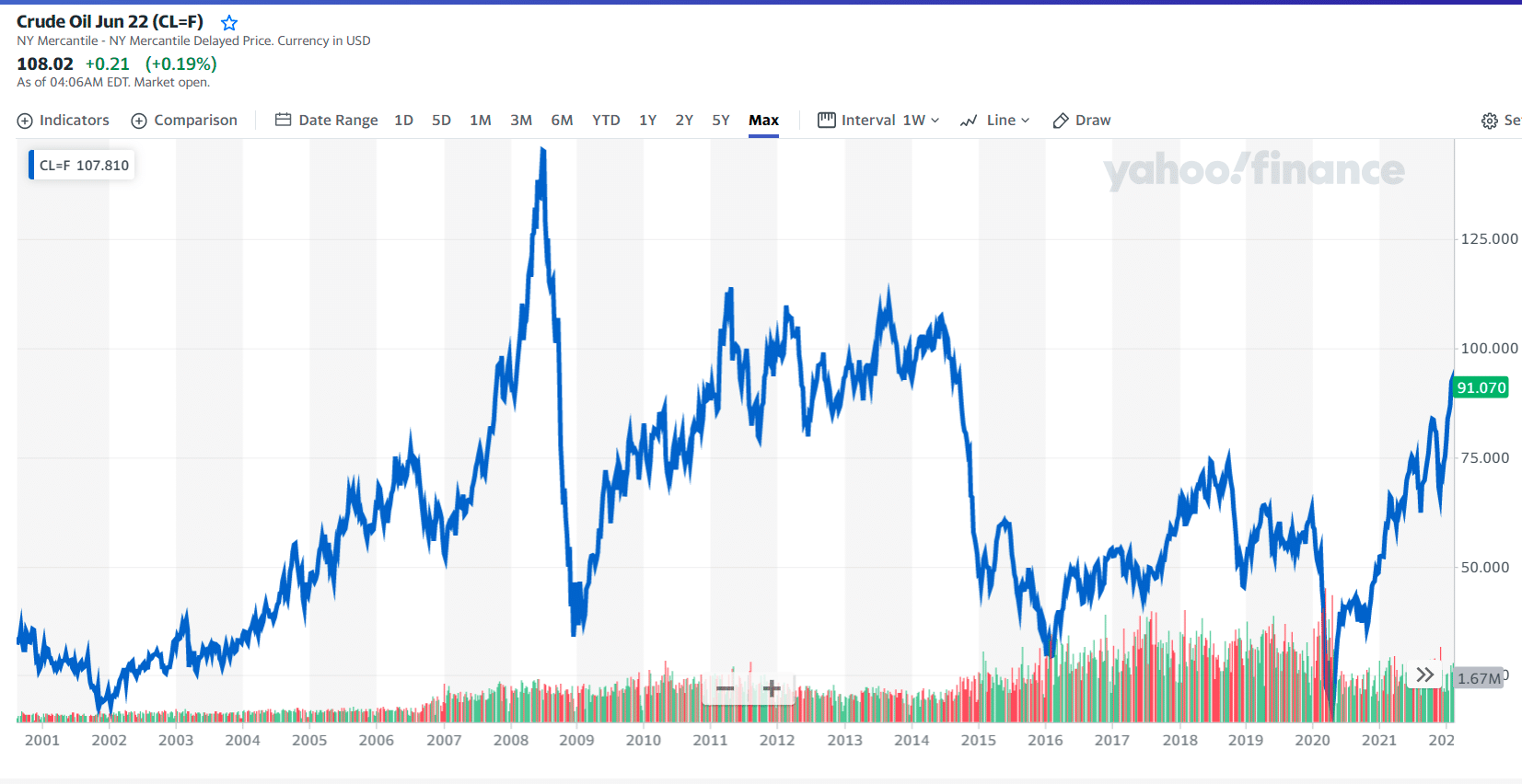

№ 1. Crude oil

Crude oil

Oil commodity markets have been optimistic since the outbreak of the crisis in Ukraine. With members of the Organization of Petroleum Exporting Countries (OPEC) continuing to curtail supply, global oil demand exceeds supply.

Furthermore, recent geopolitical turbulence in Eastern Europe boosted the speculative stance on oil, putting the black commodity near a ten-year high as worries of rising oil supply scarcity skyrocketed.

Crude oil price chart

The first three holdings with YTD performance are:

- Chevron Cooperation — 33.51%

- Conoco Phillips — 32.34%

- Exxon Mobil — 39.32%

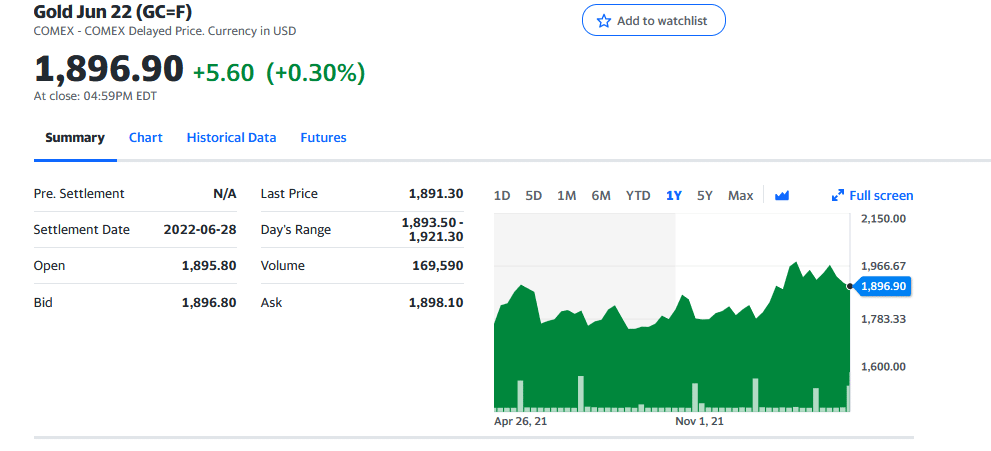

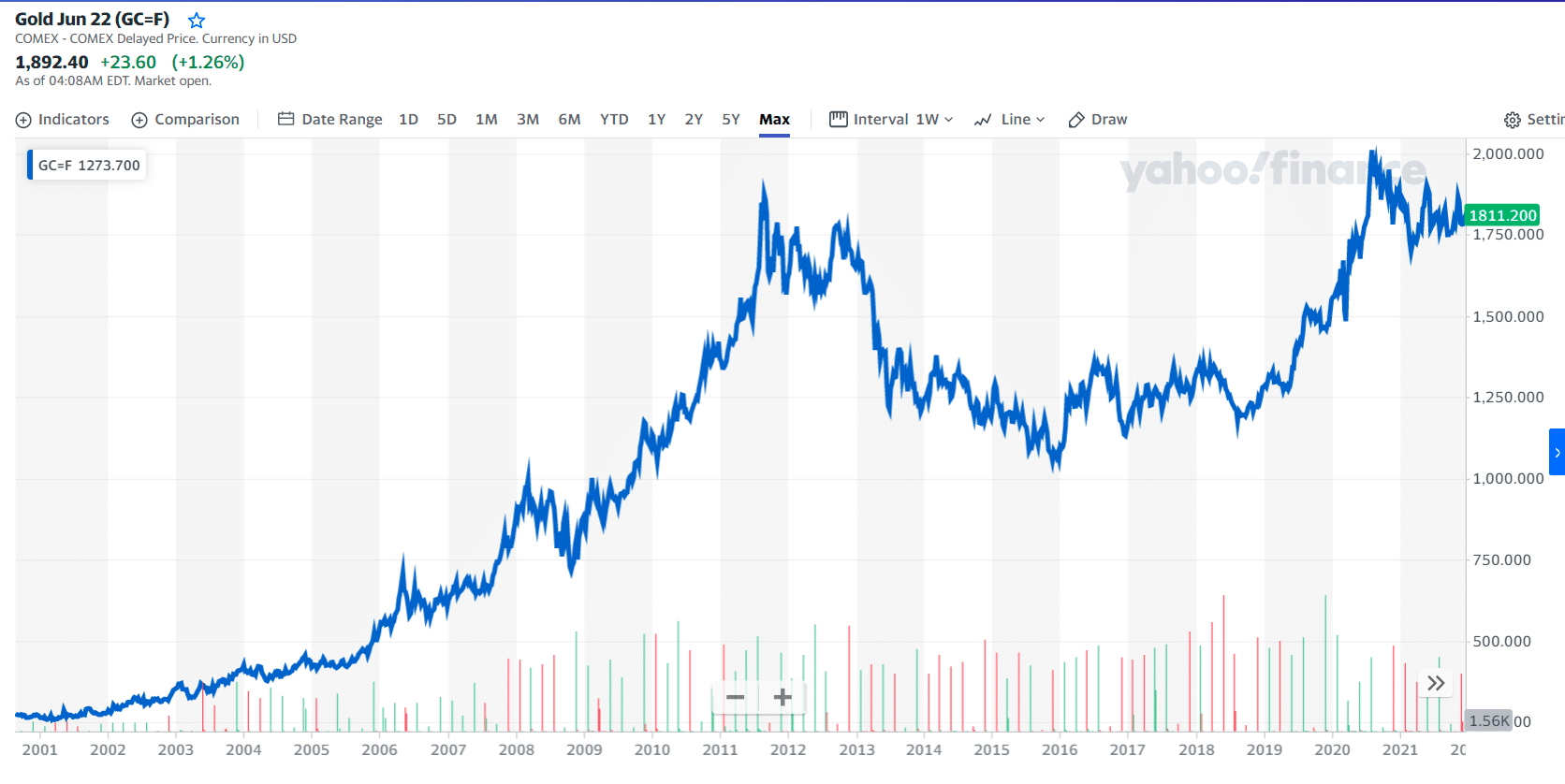

№ 2. Gold

Gold chart

Gold is another commodity that investors should keep an eye on. Since the start of the year, bullion prices have risen 5.43 % to $1,930.45 per ounce. It’s close to the previous high of $2,158.99 per ounce set in July 2020.

While recent geopolitical developments had no major influence on gold prices, rising economic pressures in Russia should give more upside. Historically, the yellow metal has served as a safe haven during significant equities market volatility moments.

Gold price chart

On the other hand, demand for gold is projected to be sluggish as central banks tighten monetary policies throughout the world and the dollar strengthens.

The first three holdings with their YTD performance are:

- Barrick Gold Corp. — 17.42%

- Newmont Corp. — 17.46%

- Wheaton Precious Metals Corp. — 4.5%

№ 3. Wheat

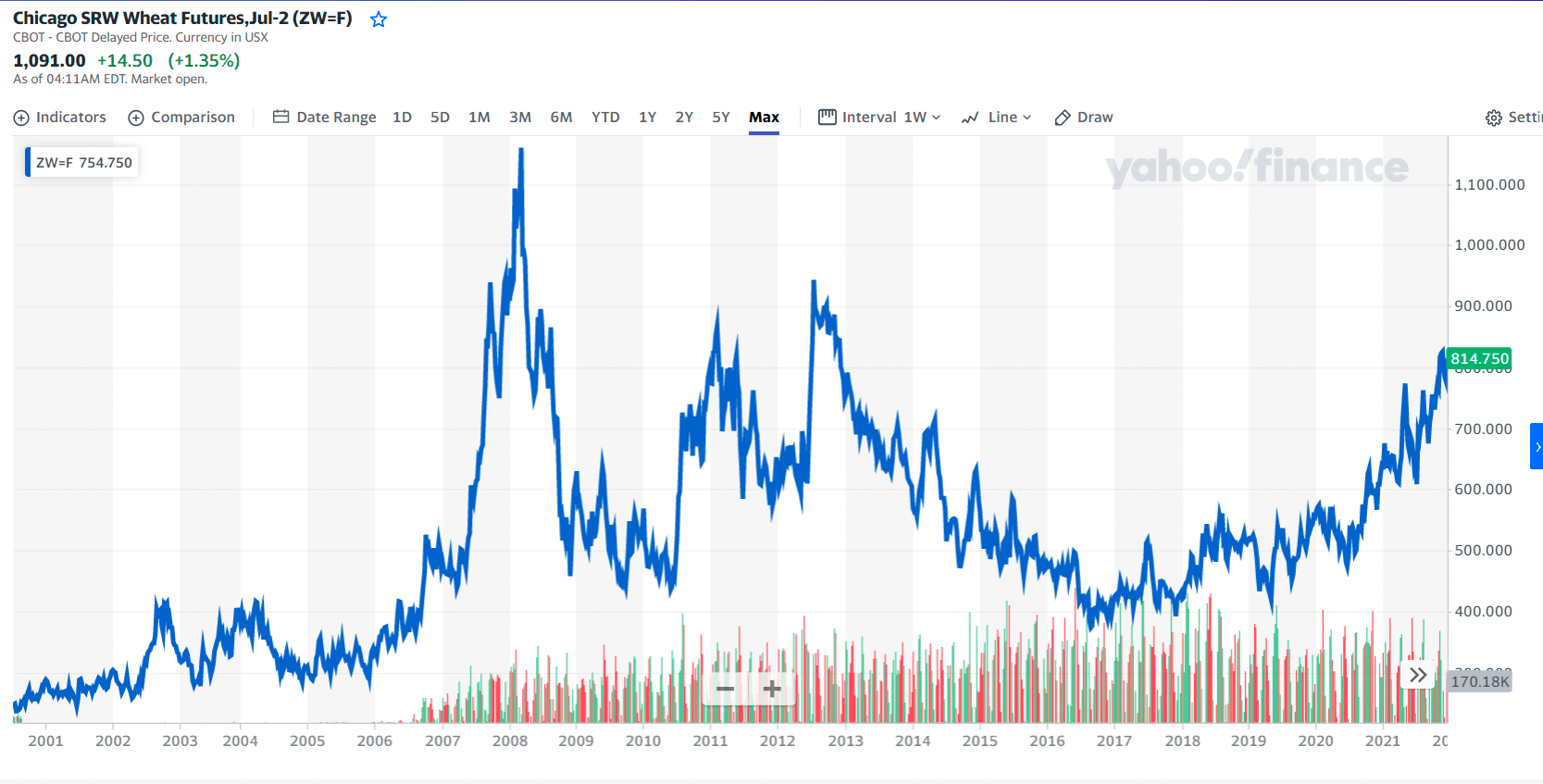

Wheat chart

Escalating geopolitical tensions are also influencing wheat prices. However, the current surge in wheat prices may last long since a quick settlement to the Ukrainian conflict appears unlikely.

Russia and Ukraine account for more than a quarter of global wheat exports. Russia is the world’s largest wheat exporter, with an annual production of 76 million tons, accounting for more than 18% of foreign exports in 2019. In contrast, Ukraine was the fifth largest exporter, with a market share of 7%.

Increased restrictions on Russian exports and the crisis in Ukraine will continue to impact wheat supplies, keeping wheat prices high.

Wheat price chart

The first three holdings with their YTD performance are:

- MGP Ingredients Inc. — 7.46%

- Archer-Daniels-Midland Co — 32.5%

- Bunge Ltd — 21.17%

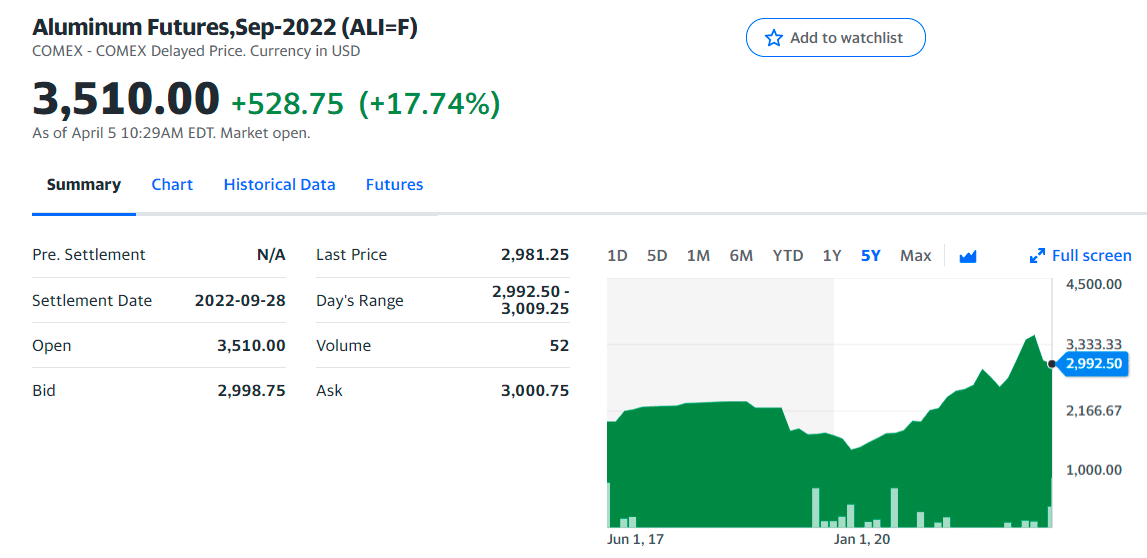

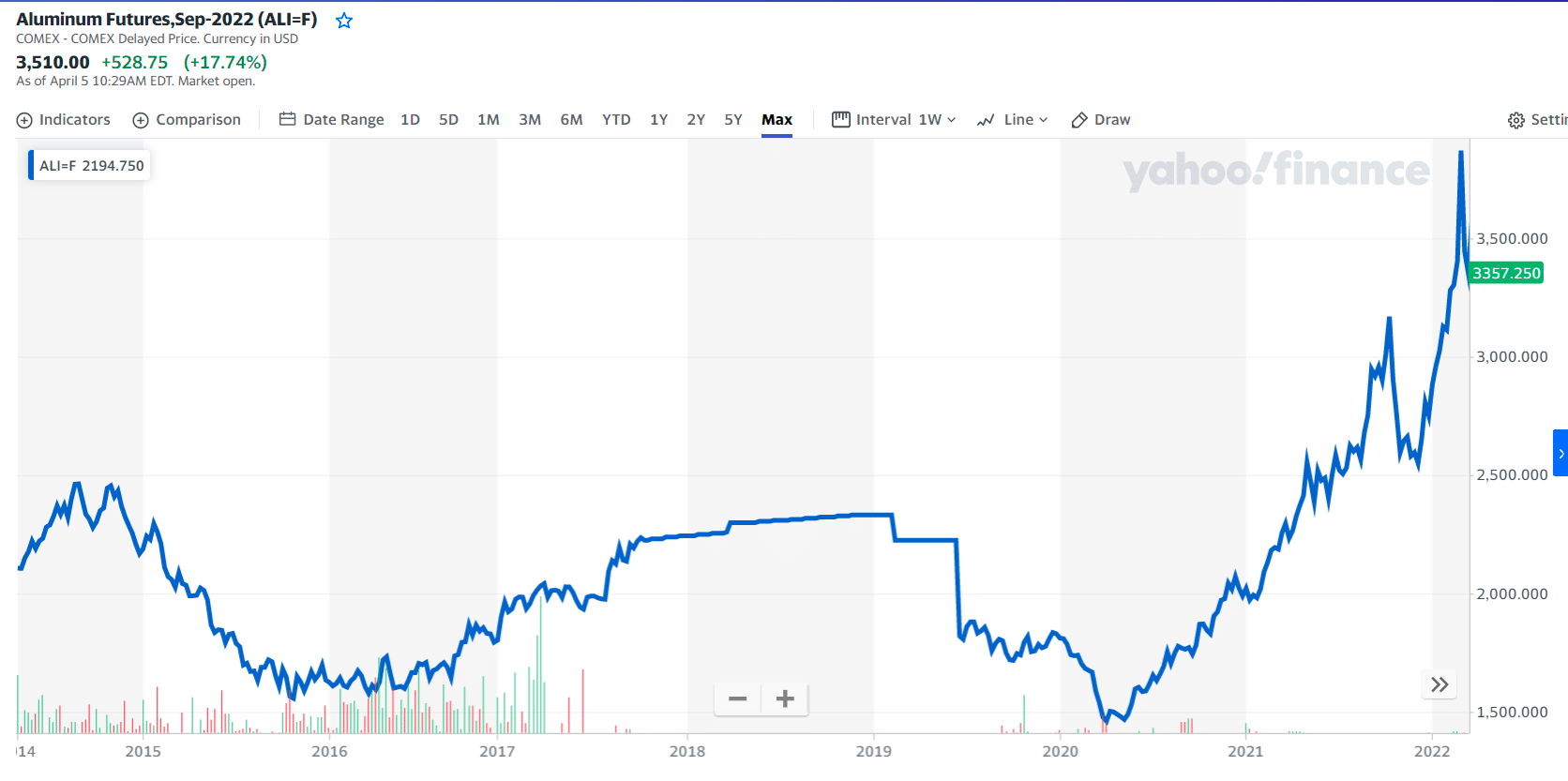

№ 4. Aluminum

Aluminum chart

Aluminum is another commodity likely to experience increased volatility as global tensions rise. It is rallying due to low stockpiles and mounting concerns about more supply-chain disruption. In addition, following the invasion of Ukraine, three of the world’s major container lines, MSC, Maersk, and CMA CGM, suspended cargo shipments to and from Russia, raising fears about further supply challenges.

Furthermore, China has been a net importer of Aluminum since earlier in the pandemic after being a net exporter. These variables indicate greater prices in the future, even if they are already at record highs.

Aluminum price chart

The first three holdings with their YTD performance are:

- Rio Tinto PLC — 6.24%

- Alcoa Corp. — 13.8%

- Century Aluminum Co. — 1.87%

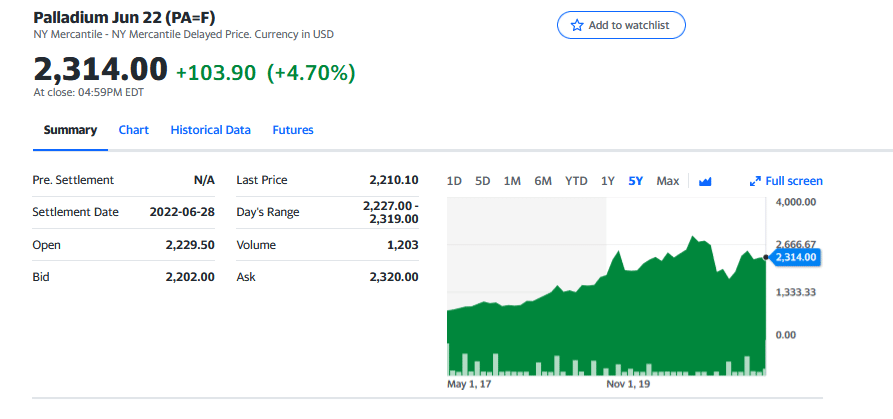

№ 5. Palladium

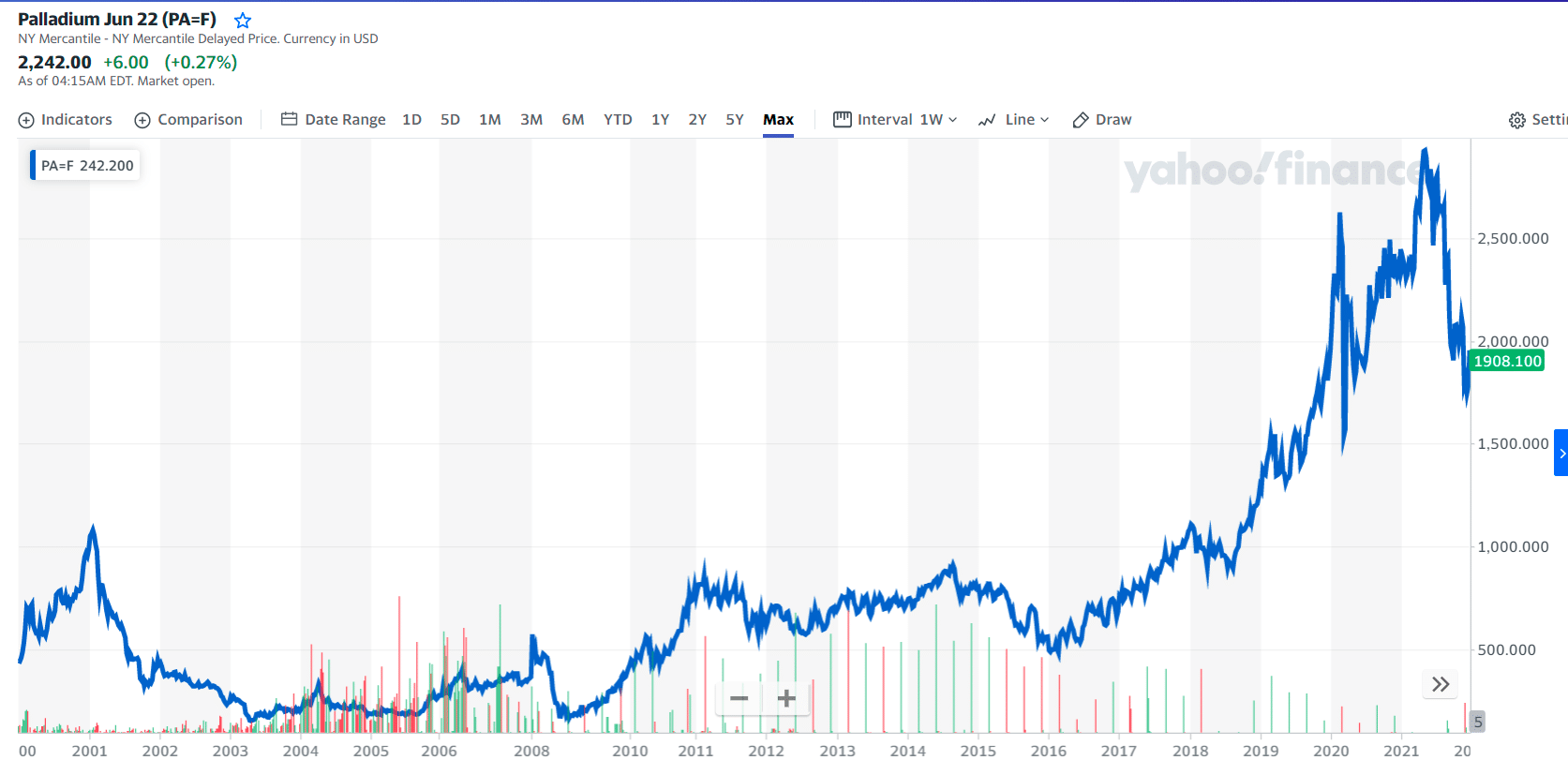

Palladium chart

Palladium is an essential component of gasoline engine auto-catalysts, allowing decreased automobile emissions. Russia is a significant palladium producer, with a yearly production of 74 metric tons in 2021, accounting for nearly 40% of world palladium production. Since the start of the year, palladium spot prices have risen considerably.

With a limited supply and high demand for gasoline engines, palladium’s bullish sentiment may not surprise investors, even though it reached $3,302 per ounce on March 8. Indeed, if the international response to Russia’s invasion of Ukraine continues, additional increases in palladium prices are still possible.

Palladium price chart

The first three holdings with their YTD performance are:

- Impala Platinum Holdings Ltd — 2.07%

- Sibanye Stillwater Ltd — 9.57%

- A-Mark Precious Metals Inc. — 28.97%

Final thoughts

With global inflation climbing at the fastest pace in 41 years and geopolitical crises happening in Eastern Europe, it’s no surprise that commodities have firmly positioned themselves as the best performing asset class of 2022. When geopolitical crises accelerate at a red-hot pace, so do the prices of commodities.

Comments