No matter if you’ve filed your taxes or plan to file by the final deadline, you must know how to monitor them.

You should be aware that the IRS has a backlog of unprocessed individual returns, problems with 2020 returns, and modified returns that require repairs and special treatment. Furthermore, the IRS warns that disruptions might last as long as 12 weeks, even though payouts generally take 21 days to complete.

Are you looking for your tax refund for 2020? Indeed you are not alone. As of June 30, the IRS has not processed 35 million tax forms that require manual processing.

Despite making progress, the IRS still has to deal with a backlog of delayed tax returns. This is what you need to know and what you will do if you wait for a return.

Why is your refund waiting so long?

Refunds are generally processed, and refunds are issued within 21 days of receipt by the IRS. This tax season, though, is unique. Working under Covid-19 limitations reduced IRS production, resulting in a backup.

Simultaneously, substantial new demands have been placed on the organization, including three sessions of sign installments since the pandemic began. New monthly Child Tax Credit payments, a slew of tax rules, and Covid-related advantages have already complicated tax returns for the 2020 tax year.

When you consider the limits and age of many IRS systems, you get a potent mix of delays.

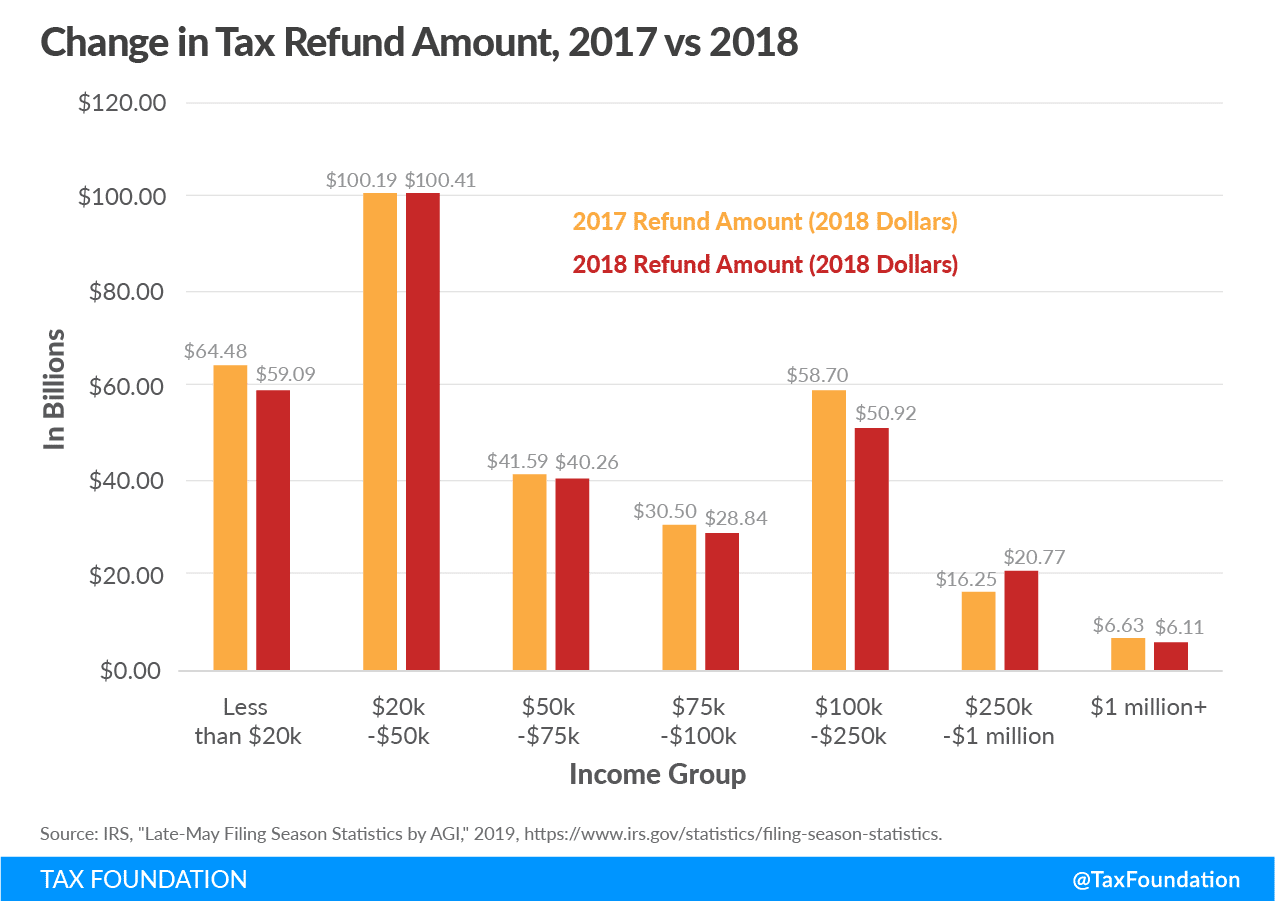

Change in a tax refund, 2017 vs. 2018

Your refund may indeed take a long time to complete if your tax return contains any of the following problems, as per IRS:

- Missteps.

- A more evaluation is needed.

- Criminal activity is a possibility.

- A claim for the Estate Tax (EITC) or the Additional Child Tax Credit (ACTC).

- Referring to Form 8379, Damaged Partner Allocation, which might facilitate positive to 14 weeks to complete.

How can you check your refund status?

Any of these will indicate the status of your tax return 24 hours after it is processed. For example, your current state will be one of the following:

- Your return has been received and is being reviewed.

- Authorized means that your withdrawal has now been recognized and that your refund amount has been approved.

- Sent certifies that your refund will be immediate into your bank or delivered to you in the form of a cheque.

Since it has been over 21 days since you e-filed your refund or six weeks after you sent a paper return, one can contact the IRS at 800-829-1040 for a notification. Be notified: landlines are overloaded, and space is restricted. Just 3% of callers to the IRS “1040” hotline received live assistance during the normal tax season.

How and when to pay your bills while waiting for an IRS refund?

-

Put in a request for a hardship exemption to the IRS

Suppose your return is just being lifted up due to a temporary processing backlog. In that case, you can request that the IRS expedite all or parts of your return to pay hardship expenditures by dialing (800) 829-1040 and clarifying your circumstances.

This would be reserved for extreme circumstances, such as eviction notifications, electricity shut-offs, and the inability to pay for medication. You must only seek sufficient funds to make up for your unexpected hardship, and getting this means may cause the rest of your payment to be delayed.

-

Put your finances on standby

Reduce disposable incomes, required to minimize credit and debit cards, and put off large expenditures.

-

Take out a personal loan

Although it is prudent to avoid incurring debt while waiting for necessary finances, a personal loan may enable you to obtain cash now and repay them later. In addition, banks that finance business loans fast could be capable of offering you the emergency funds you require.

Make the most of your high credit score to obtain the lowest competitive APR.

Restrict your loan to the value of your refund minus tax so that when your refund comes, you may pay off another debt. Check to see if there are any charges for repaying off your loan early.

Avoid payday loan companies, title borrowers, and other increased forms of quick cash. Due to exorbitant lending rates, you may end up losing considerably far beyond your return total.

-

Check about quick opportunities to produce revenue

Look for ways to generate income streams as well. Employment and reselling your old content online are two obvious ways to get money.

-

Look for financing

Independent charitable organizations and government welfare initiatives might well be able to assist. Consider loan modification or comparable assistance with education loans or hospital bills.

-

Make any necessary changes to your reserve or estimations for 2021

For example, you have overpaid your taxes if you receive a tax refund. You will not receive a high amount of money, but in turn, pay may be increased. If such a scenario occurs in the 2021 tax term, you could be eligible to lower your withhold or anticipated tax payments for the rest of the year. Before making any changes, consult with your tax professional or use the IRS Tax Withholding Analyzer.

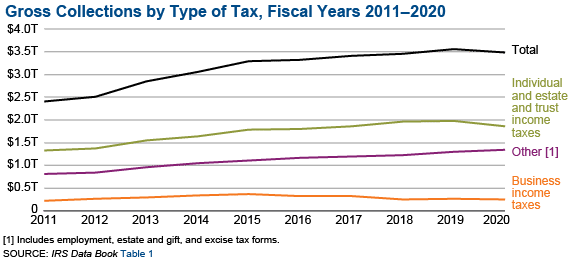

IRS data book 2011-2020 statistics

Final thoughts

A tax return takes extra treatment by an IRS specialist, and also any corresponding refund takes the IRS more than 21 days to release. If an appropriate action can be taken without engaging the customer, this one will do so, and a modification notification will just be delivered. A message will be addressed to the client if further information is required.

The time it takes to fix the problem is determined by how fast and precisely the taxpayer answers. However, where’s my refund? Neither IRS telephone personnel will give further details or a precise refund date while processing a refund.

Comments