Waiting Night is a robot that provides us with automatic orders execution on our demo or real accounts. There are various details and information about the system functionality and settings explained. So, let’s check the system out.

Waiting Night works with various cross pairs on the real account. The system focuses on performing orders in the night scalping period.

What is behind Waiting Night?

There are plenty of details explained about the system’s features. So, they were grouped up in the list below:

- There are live signals provided.

- The system works with a strategy of night scalping.

- There are GMT settings shared with proper explanations.

- There’s a price action strategy available as well.

- It’s possible to set proper risks that are acceptable for us.

- We can use the system with any broker house.

- There are five setting points.

- Trading is possible on USDCAD, USDCHF, USDJPY, EURCAD, EURCHF, EURUSD, EURGBP, EURAUD, GBPUSD, CHFJPY, AUDCAD, and AUDUSD.

- It places pending orders to decrease the slippage influence.

- The advisor doesn’t use strategies such as cost averaging, martingale, etc.

- It keeps orders on the market for 3-5 hours on average.

- We can expect that the system protects our orders with TP and SL levels.

- The system can’t filter news.

- It follows FIFO requirements.

- The system has to be used on an ECN account and on a VPS with low ping.

- The robot places a 0.01 lot for every $100 on the balance.

Key features

- Automatic trading.

- The robot works with various pairs that diversify risks.

- It is compatible with any broker.

Trading strategy

The robot scalps at night. So, it tries to work during the period of low slippages, spreads, and market volatility.

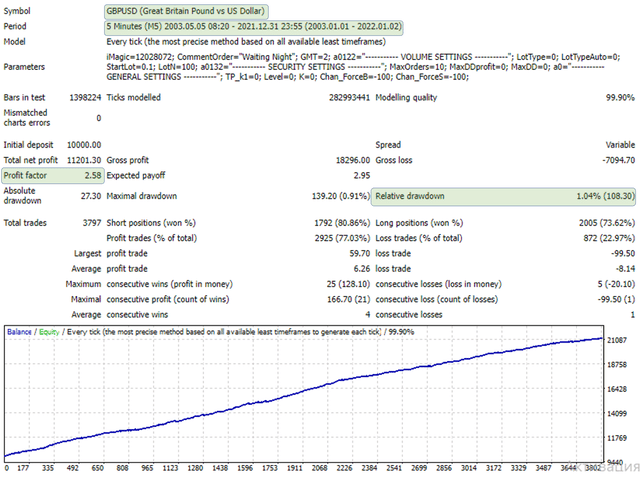

Waiting Night backtests

Waiting Night performed a backtest on GBPUSD. It uses 18-year tick data with modeling quality of 99.90%. An initial deposit of $10,000 turned into $11,201.30. The profit factor was acceptable as for a test‒2.58. The peak drawdown was 0.91%. It has executed 3797 deals with a win rate of 80.86% for shorts and 73.62% for longs.

Pricing

The current price is twice discounted: $199. The previous one was $399. There are no rental options at all.

Trading performance of Waiting Night

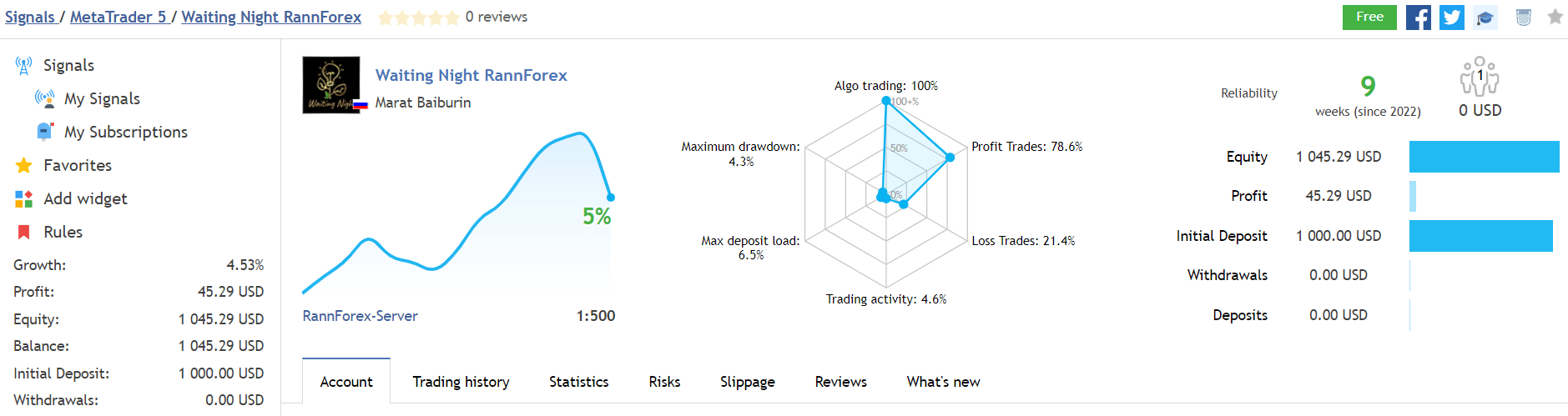

Waiting Night trading results on MQL5

This is the system running on IC Markets. The growth chart looks a bit dangerous. We don’t know if the system is able to recover after digging down. The leverage is common–1:500. It works with the maximum drawdown of 4.3% when the maximum deposit load is 6.5%. Its accuracy is 78.6%. The robot generated 4.53% of the growth.

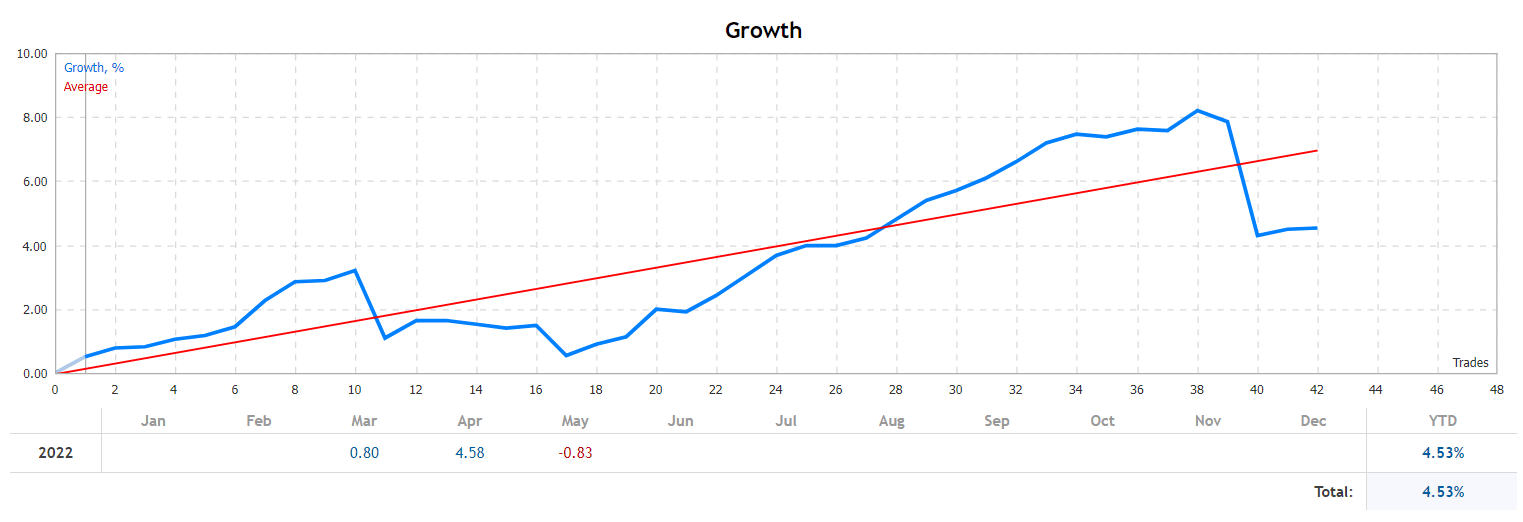

Waiting Night monthly profits

May wasn’t traded well, -0.83%.

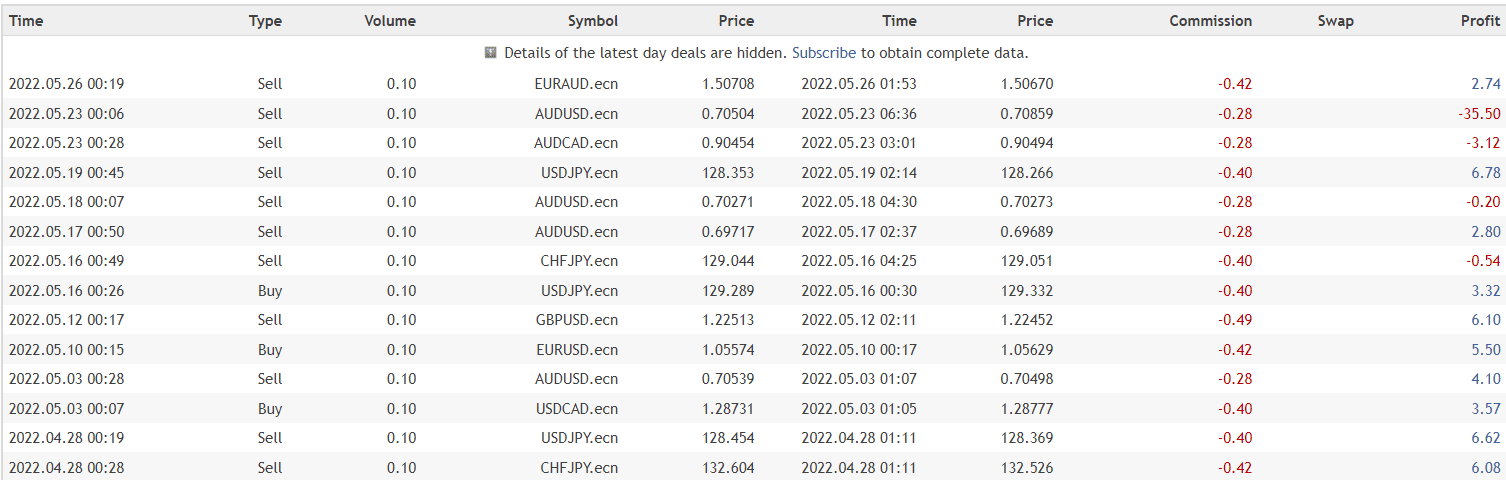

Waiting Night closed orders

We may note how deep the loss on AUDUSD was, -$35.50.

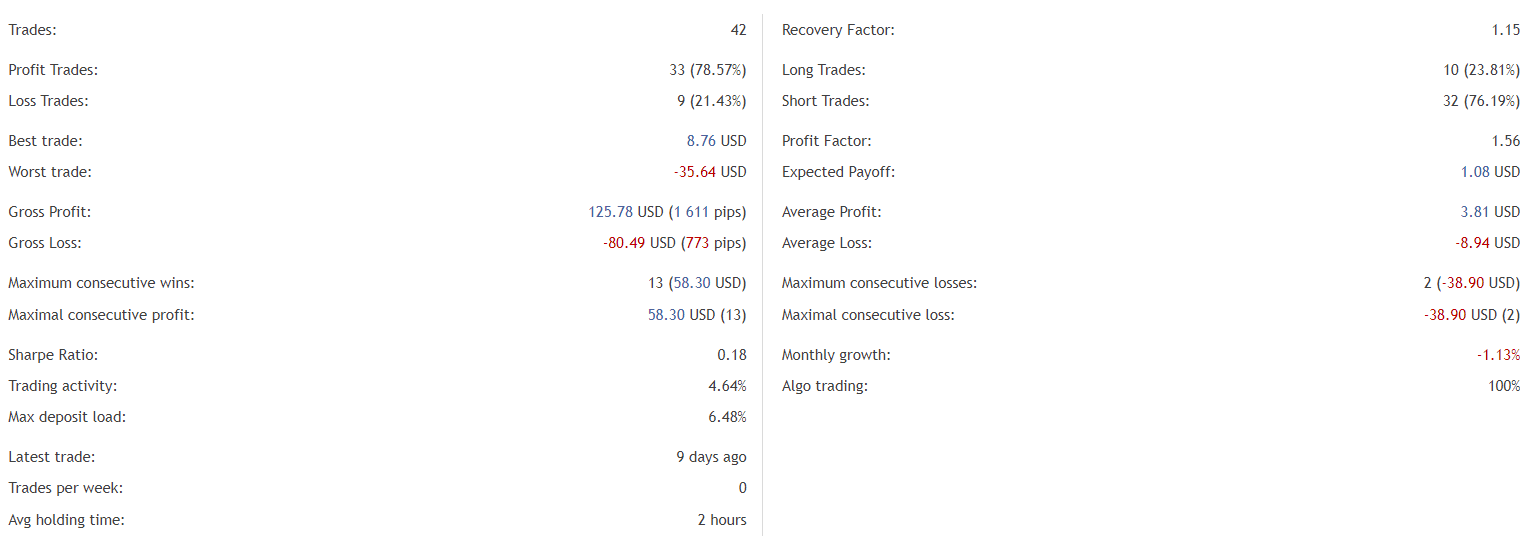

Waiting Night statistics

The robot closed 42 orders with the best trade of $8.76 and the worst trade of -$35.64. Its recovery factor is low, 1.15. The profit factor is still acceptable–1.56. An average monthly growth is -1.13%.

Customer support

The developer provides average support for everyone who needs it.

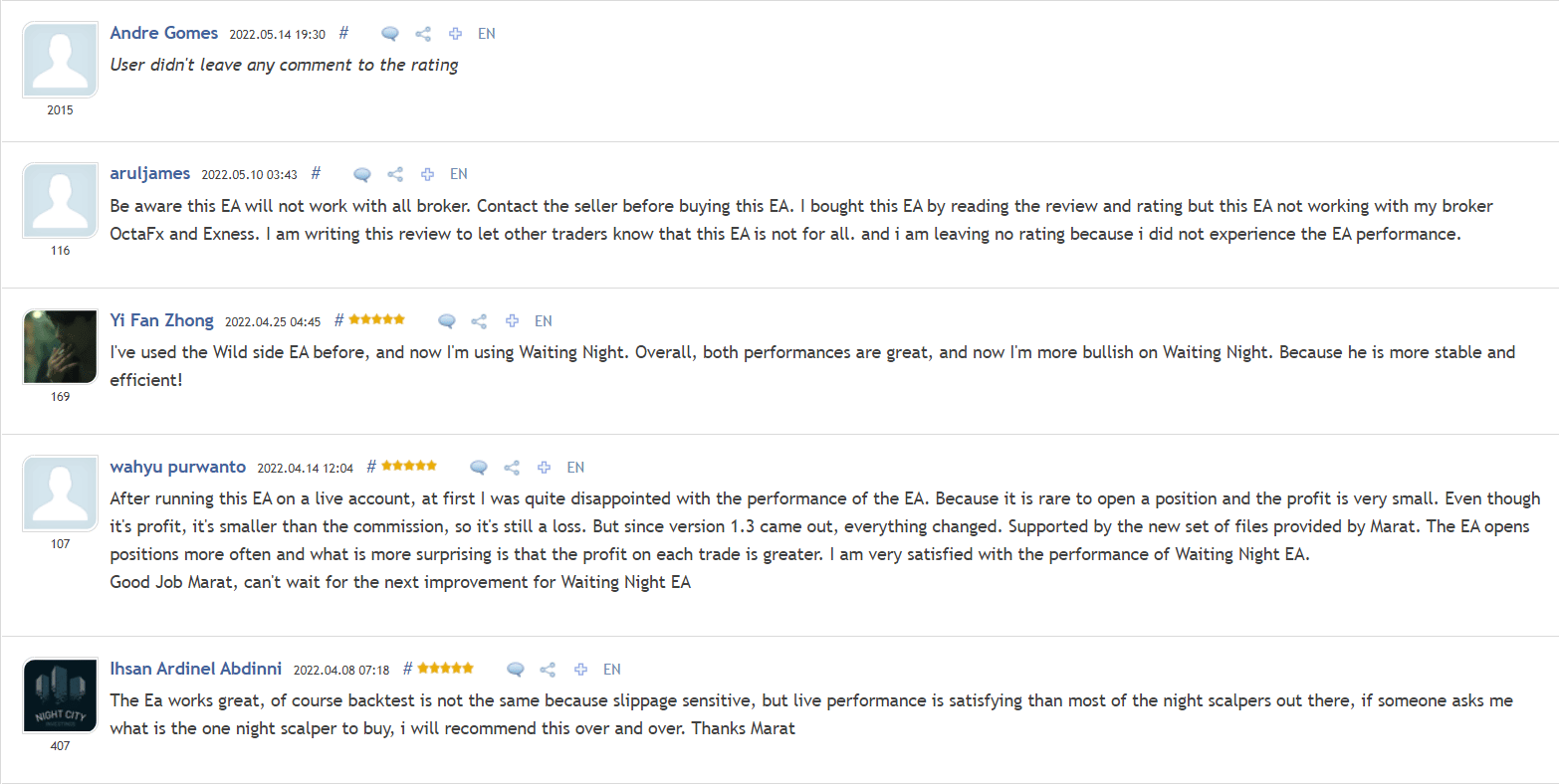

People feedback

Waiting Night testimonials

Clients mentioned that the system is good and profitable.

Waiting Night profile

Marat Baiburin is a Russian developer with a 4377 rate. The rate of his portfolio is 4.6 based on 23 testimonials.

Comments