If you are interested in minimizing the risks that come hand in hand with investing, then spreading your resources among different assets sounds smart. Putting all your eggs in one basket has never been a good idea. If you invest in different options, you have a net to fall back on if one of the assets is not performing as well as expected.

Building a broader portfolio helps protect against such an occurrence, and the exchange-traded funds help investors do the same thing a bit more easily. The multi-asset allocation funds stand somewhere between and take things to the next level at a lower cost.

What are multi-asset funds?

Simply put, multi-asset funds and ETFs have a lot in common. Both make it easier to hedge against the volatility of a single asset by spreading your resources onto more options.

Multi-asset allocation funds go the extra mile and allow holders to accumulate assets of different classes, like stocks, real estate, commodities, bonds, or cash, making the diversification even greater in extent.

This way, you gain broader exposure and lower the risk of one of the underperforming assets you invested in raining on your parade, so to say. The weight and the number of asset classes will depend on the investor’s personal preferences.

Not all the funds were created equal, and there are different kinds, including:

- Income funds

- Target-risk funds

- Target-date funds

- So-called balanced funds

The categories go on and on and explain which one would call for an article of its own, so let’s dive right in and see what multi-asset funds you might find interesting.

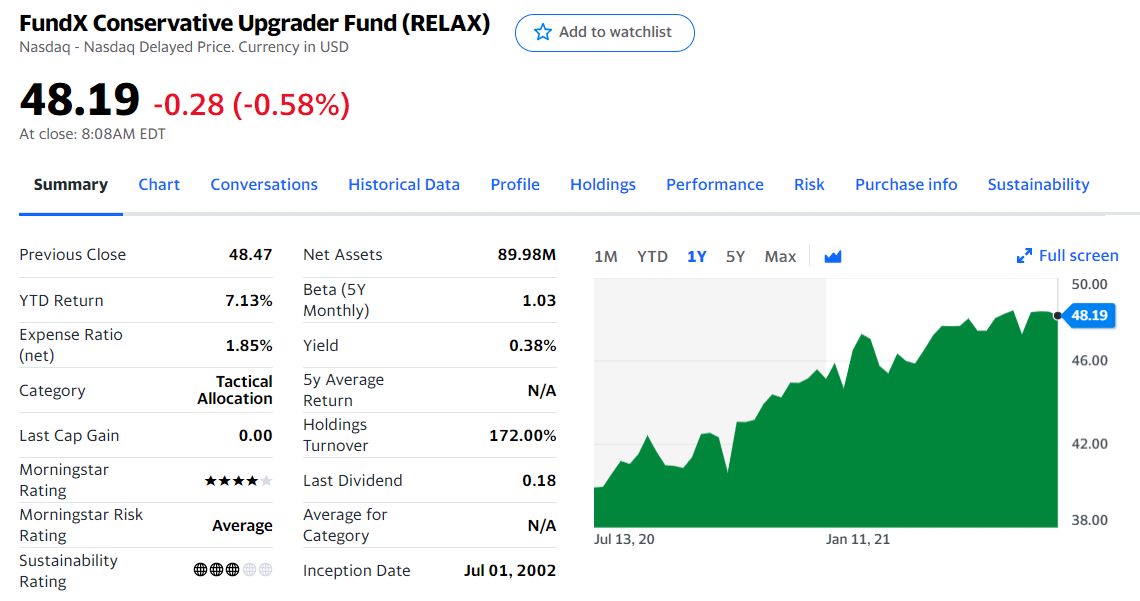

№ 1. FundX Conservative Upgrader Fund

This fund looks to reduce the portfolio volatility and obtain capital via an occasional lowering of current income.

It comprises stocks and bonds primarily with more than 53% and 21% shares, while the cash amounts to just under 6% of the fund’s holdings. It has returned 31.43% over the past year, 9.25% over the past three-year timeframe, and 9.45% over the past five.

To manage the holdings and accommodate for necessary strategy changes, the advisor uses upgrading.

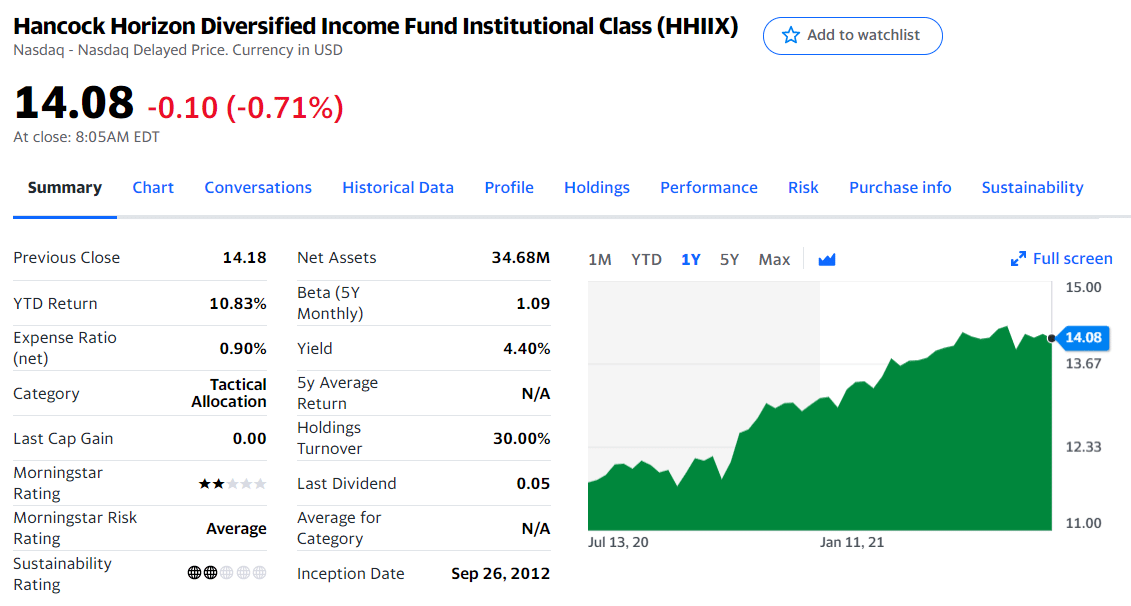

№ 2. Hancock Horizon Diversified Income Fund

Hancock Horizon Diversified Income Fund’s primary goal is to maximize the current income, as the name suggests. Its secondary aim is the long-term appreciation of capital. The fund comprises a wide range of securities, with stocks and bonds accounting for over 85% to fulfill the goal.

Apart from these two types of securities, it also holds municipal bonds, real estate investment trusts, master limited partnerships, etc. The fund’s annual return came in at 35.44%, while the figure stood at 6.63% and 5.7% in the past three-year period and the past five-year time frame, respectively.

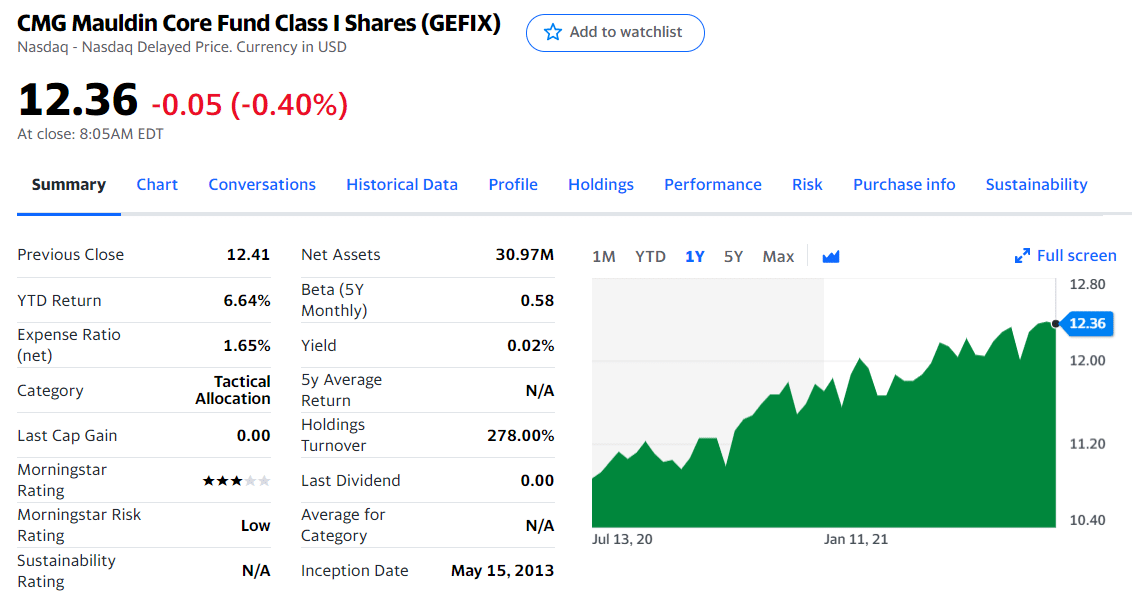

№ 3. CMG Mauldin Core Fund

With almost 20% in foreign stocks, the CMG Mauldin Core Fund stands out against others on the list. The fund’s primary goal is capital appreciation, which it seeks to secure through investing in emerging markets during rallies while also hedging against downturns by investing in US Treasury securities.

Close to 89% of its holdings fall under categories of stocks and bonds. The fund also comprises a higher-than-usual share of cash investments, which amount to just under 3%.

Regarding returns, the fund has given back 16.94% in the last year, 4.06% in the previous three years, and 3.64% within the previous five-year period.

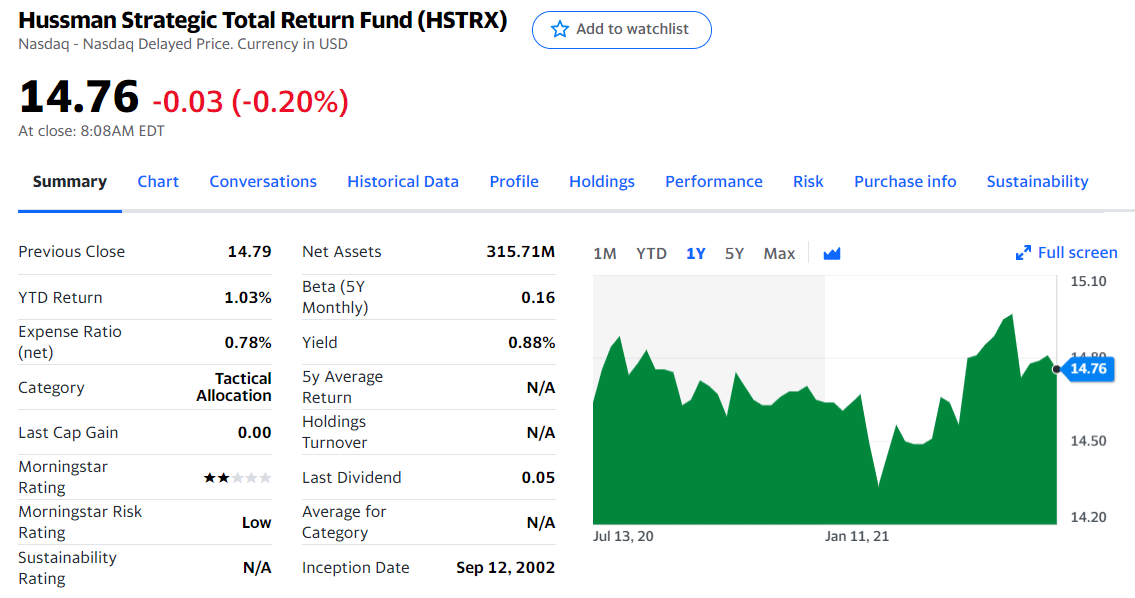

№ 4. Hussman Strategic Total Return Fund

If an unusually high stake of cash in a fund is what you like, this is the one you are going to want to watch. As the picture goes to prove, the Hussman Strategic Total Return Fund includes an even greater share of cash within its pull from others on the list.

The fund looks to secure the long-term return from income and capital appreciation. It does so by investing, for the most part, in US Treasury bonds and Treasury inflation-hedged securities.

The fund’s performance was fairly equal during the past year and the last three years, during which it returned 8.56% and 7.48%, respectively. During the past decade, the fund’s return amounted to 2.94%.

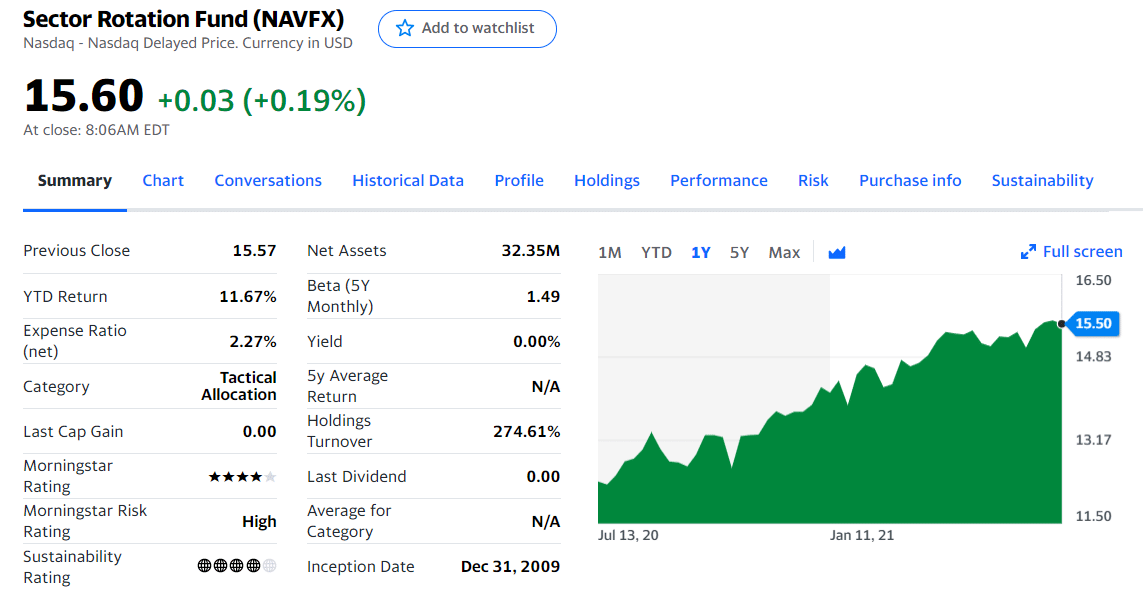

№ 5. Sector Rotation Fund

On the opposite note, here is one fund that focuses primarily on shares. The Sector Rotation Fund looks to achieve capital appreciation through buying stocks of exchange-traded funds.

Even though more than 93% of the fund’s holdings are stocks, it will not, under normal circumstances, invest in emerging markets.

The fund boasts a return of a whopping 49.67% during the past year. During the last three years, the investors in the fund saw a 10.64% return, along with a 12.27% return observed on a five-year basis.

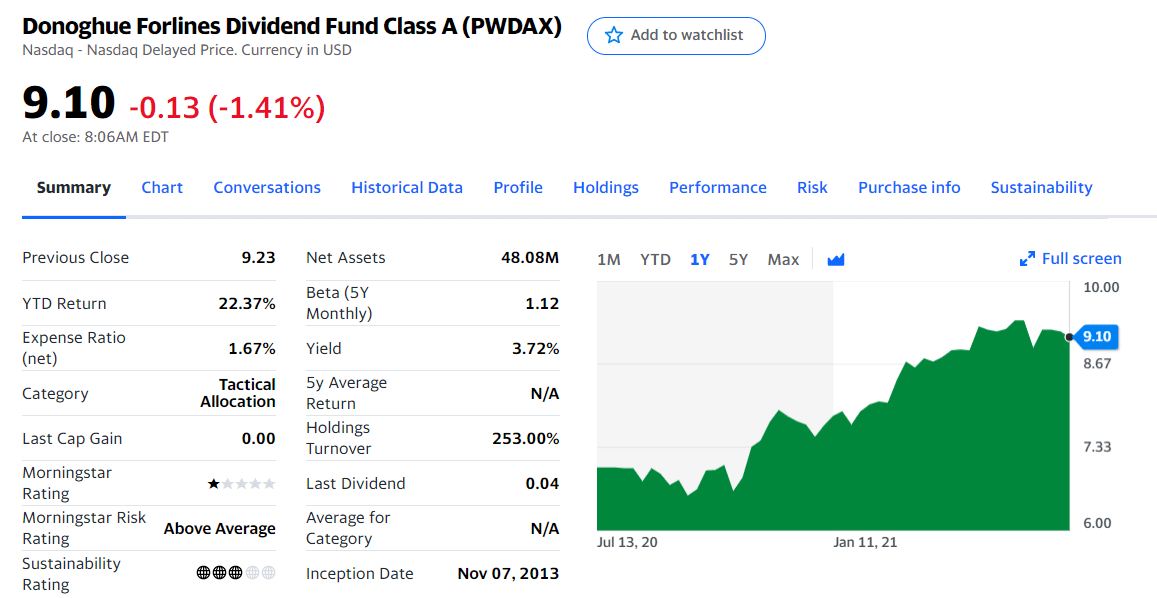

№ 6. Donoghue Forlines Dividend Fund

The Donoghue Forlines Dividend Fund has a two-fold objective: to pursue total return from either dividend or capital appreciation and capital preservation. It looks to mimic the movements of the TrimTabs Donoghue Forlines Risk Managed Free Cash Flow Dividend Sector Neutral 50 Index.

Almost all its holdings consist of stocks, with cash amounting to over half a percentage point.

Over the last year, the fund has returned 40.58% while also reporting a 3.28% return in the previous five years. In the past three-year period, the fund’s return came in at negative 0.08%.

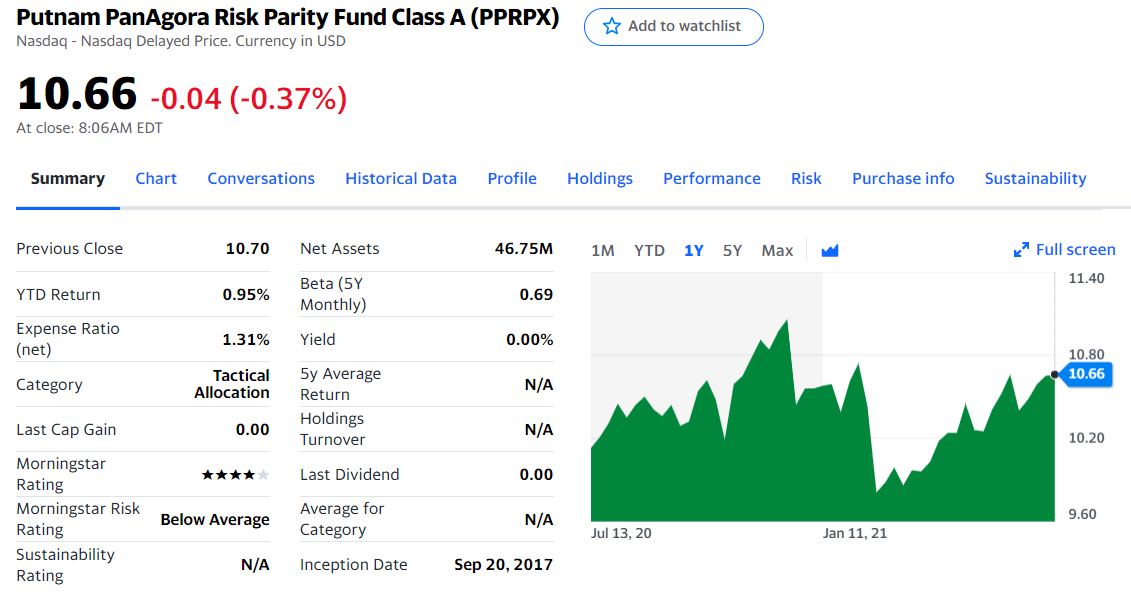

№ 7. Putnam PanAgora Risk Parity Fund

Putnam PanAgora, Risk Parity Fund, has an ambitious goal: to take advantage of periods of economic growth while also preserving capital during times of economic contraction.

It looks to do that by investing in asset classes with highly diversified risk characteristics. While this sounds like a win-win situation, it can come at an expense as both options can’t exist simultaneously.

Meanwhile, the fund’s yearly return of 13.71% and a 6.35% return registered during the past three years suggest that the fund’s strategy may be on point.

Pros & cons of multi-asset funds

While the multi-asset allocation funds may sound enticing, it is not an end all be all to investing and securing returns. Like with anything else, you have to figure out if the features of a phenomenon suit your particular interests, goals, and preferences.

- On the positive side, multi-asset funds are a great way to diversify your assets and cover a wide array of opportunities for investing. By doing so, you will also be able to hedge better against higher losses and extensive volatility.

- On the flip side, spreading your assets over too wide of a spectrum of securities and assets can lead to missing out on some gains you could have enjoyed with a narrower investment strategy.

Investing in multi-asset funds is usually followed by higher management fees.

Final thoughts

While it may not be the most exciting message to take home, it does boil down to: assess what works for you. Multi-asset allocation funds can be an excellent way for you to strategize and protect your assets by diversifying.

On the other hand, investing in ETFs can be more down the alley for investors looking to save on the management fees but still benefit from separating resources in different assets. The important thing is to be thorough, curious, and, above all, honest with yourself. If you decided that multi-asset funds are the way to go, well, now you know where to start.

Comments