Prop Firm EA is an FX robot that promises a low drawdown and high profits. It is a fully automated expert advisor that is capable of passing the Funding Firm challenges. The challenges are objectives fixed by companies to verify your trading capability wherein you maintain a consistent profit without having a high drawdown.

Once you pass the challenge, you are provided with an account capital of a maximum of $200,000. The profits you earn from the account are shared with the firm. Prop Firm EA is compatible with various funding firms like the FTMO. This FX EA is promoted by My EA Academy, which is part of Sinry Advice Worldwide. The company is based in Malaysia and provides a registration number and location address. Other products of the company include Red Fox EA and MT Forex Indicator.

This FX robot assures a low drawdown and verified results. Are the claims true? In this review, we have evaluated the features, functionality, trading approach, track record, and other aspects of this EA. The vendor does not provide info on how long the EA has been on the market. However, a few details of the features, approach, and results are present.

What is behind the Prop Firm EA?

As per the vendor, this EA is capable of limiting your drawdown to 4.20% and generating profit ranging from 10% up to 20%. Upon purchasing the FX EA, you get a complete setup guide in PDF format. The setup takes under 5 minutes and you will be ready to trade with the help of the EA.

Key Features

Features of Prop Firm EA

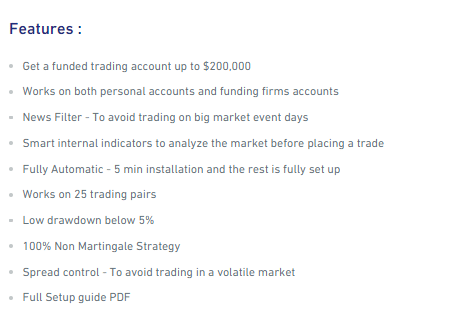

Some of the main features that the vendor highlights for this ATS are:

- The capability of working on personal accounts and with funding firm accounts.

- Smart integrated indicators help in assessing the market condition and the news filter feature helps to avoid the big market events.

- Spread control is present to avoid entering trades when the market is volatile.

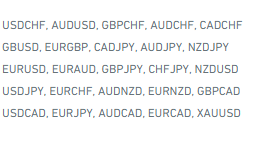

As per the vendor info, this FX robot can work on 25 currency pairs as shown below:

Currency pairs that Prop Firm EA works on

It can work on accounts starting from $10,000 up to $200,000. For money management, the EA uses automated lot management using your funds as the basis for choosing lot size.

Trading Strategy

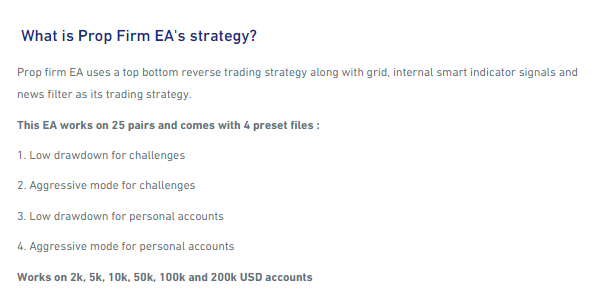

Strategy of Prop Firm EA

A top-bottom reverse trading approach is used by this EA. As per the vendor, indicator signals, grid method, and news filters are used for the approach. The vendor maintains that this EA does not use the Martingale approach. However, the grid method is also considered dangerous and most traders avoid it. With the vendor not elaborating on the strategy, we are suspicious of the reliability. Furthermore, there are no backtests to know about the efficacy of the approach.

Pricing

Pricing package of Prop Firm EA

To use this EA, you need to pay $588 which will give you a one-year license. A 6-month license key is also available for $388.00. A 14-day refund offer is present. When compared to the price of competitor EAs, we find this product is overpriced and not worth the money.

Trading performance of Prop Firm EA

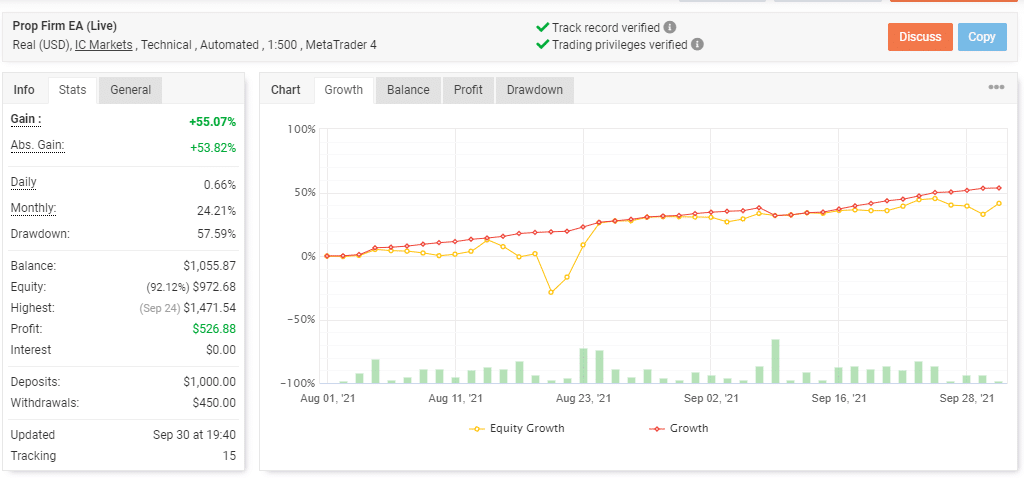

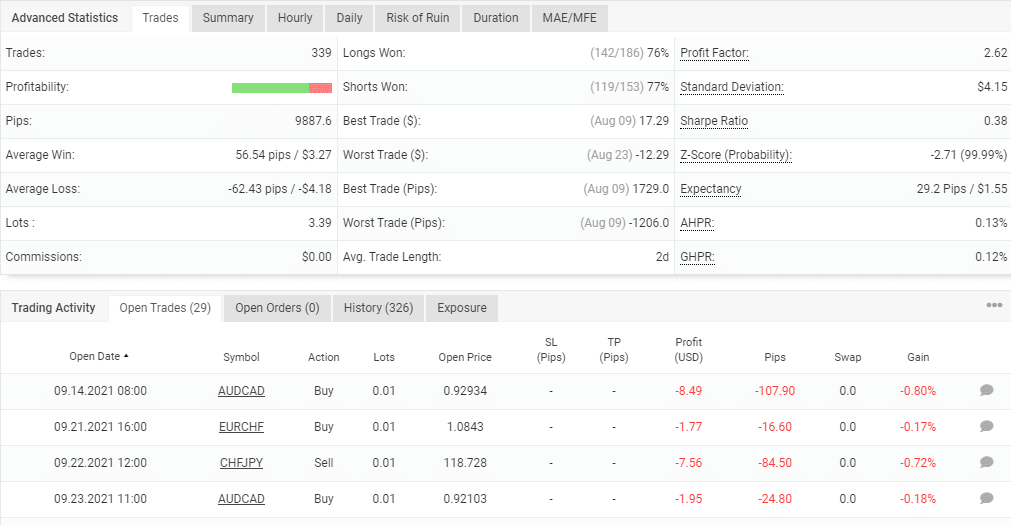

A real USD account verified by the myfxbook site is provided by the vendor. The automated account using 1:500 leverage on the MT4 platform is shown below:

Growth curve of Prop Firm EA

Advanced trading stats of Prop Firm EA

A total profit of 55.07% and an absolute profit of 53.82% are generated as per the trading stats. The daily and monthly profits for the account are 0.66% and 24.21% respectively. A drawdown of 57.59% is present for the account which shows the risky approach the EA uses. Nearly more than half of the capital has been wiped out with the drawdown which is not what traders would be comfortable with.

For a deposit of $1000, the account started in August 2021, and ending in September, reveals a total of 339 executed trades. A 77% profitability and a profit factor of 2.62 are present. A lot size of 0.01 is used. The small sample size makes it difficult to analyze the results properly.

Customer support

For support, an email address is present along with links to the social media profile of the company on Instagram, YouTube, and Facebook.

People feedback

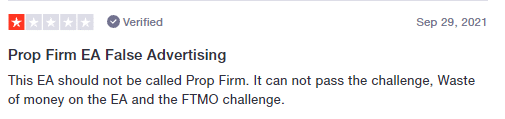

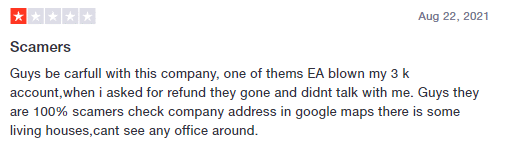

We found reviews for this EA on the Trustpilot site. Here are screenshots of a few of them.

User complaining of unreliable EA

User complaining that the company is a scam

From the feedback, we can see that the company is a scam producing huge losses and not refunding users’ money. The reviews corroborate our evaluation of the risky approach and poor performance of the FX robot.

Comments