Lux Algo is a platform that claims to enhance your trading experience. It creates advanced visualization on Discord and TradingView to help you with your trading decisions. According to the vendor, this is the number one seller of advanced trading tools and is trusted by more than 35,000 traders.

Lux Algo was founded in April 2020 by Alexander Friend and Sean Mack, who wished to create indicator toolkits on the TradingView platform. Soon, they met Alex Pierrefeu, a prominent member of the TradingView community, and he became the lead developer of the company. We don’t know if this team has developed any other systems.

While there are hundreds of Forex trading platforms available today, not all of them are reliable. There are unscrupulous vendors who run scams that are designed to drain the customers’ money. This is why we should be very careful before investing in a system. In this review, we shall look into what the key features of this platform are, what trading schemes it uses, the pricing plans, trading performance, customer support, and user reviews.

What is behind the Lux Algo EA?

The premium suite on TradingView has three indicators that have features that traders can use for performing technical analysis. On Discord, users can get alerts for different markets and adjust their indicator settings with optimizer bots. Additionally, there is a vast community consisting of more than 50,000 members with whom you can interact.

The vendor claims that the indicators provide you with a 3D representation of the market. Thus, you can use the indicators individually or in tandem with others. After signing up on the official website and sharing your TradingView username through the Connect Accounts portal, you can utilize the indicators. You just need to open a TradingView chart, go to the Indicators menu, and select one of them from the invite-only scripts section.

Key features

You can use the indicators for trading in any pair of your choice. The vendor claims that they are compatible with all timeframes like M1, M5, M30, H1, H4, D1, W1, etc. Apart from long and short trading signals, you also get tools using which you can catch market patterns. They also let you monitor the activity of financial institutions.

Using the LuxBot system on Discord, you can display charts, monitor news updates, and backtest your automated strategies. There are seven channels where you can set up alerts for market scanners on different markets.

Trading strategy

Using the tools on this platform, you can trade in options, and engage in swing and scalp trading. There are different types of indicators available on this platform, namely Trend, Momentum, Volatility, and Volume. Trend indicators are usually lagging indicators that tell you about the nascent trend or the direction in which it is advancing.

Momentum indicators are leading indicators that can detect divergences in price. With volatility indicators, you can calculate the variations of the closing price, and volume indicators tell you about the liquidity of a pair. Since this is not an automated trading system, the vendor has not shared the backtesting results.

Pricing

There are three plans for Lux Algo, namely Monthly, Quarterly, and Yearly. The prices for these plans are $67.99, $143.97, and $489.99, respectively. You can cancel the plans anytime and there is a 30-day money-back guarantee for unsatisfied customers. The plans are quite expensive compared to others.

Trading performance of Lux Algo

Unfortunately, there are live trading accounts for Lux Algo. As such, we have no idea how the indicators would perform in the live Forex market.

Customer support

There is an official email address on the website where you can write a message if you face any issues. Alternatively, you can seek assistance from the Discord community members.

People feedback

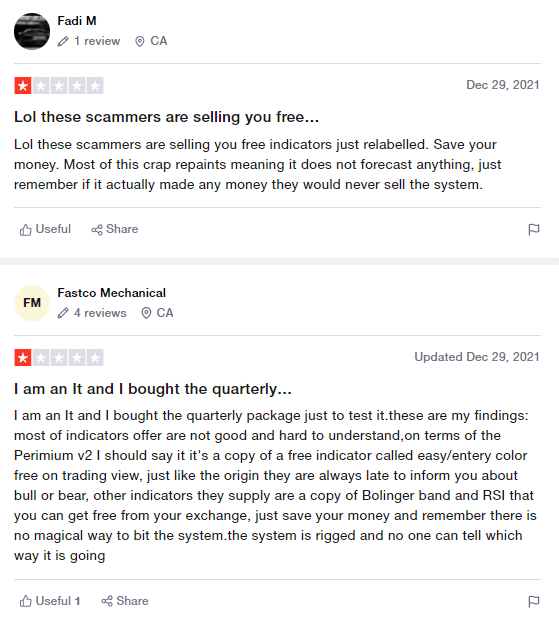

User reviews for Lux Algo on Trustpilot

On the Trustpilot website, there are several user reviews for this system. Some customers have labeled the service as a scam. They have said that the signals are repainted so they don’t actually forecast anything. Others have complained about the indicators being difficult to understand.

Comments