Financial freedom is at the forefront of any person who wants to have a meaningful life, not just exist. However, it is such a hard nut to crack if you only rely on a salary. All the wealthy and super-rich people agree that financial freedom is only attainable with multiple income sources. As such, they have an income-generating investment portfolio, which is a prerequisite for financial freedom.

An investment portfolio that is income generating takes a plan and viable strategies tailor-made to fit your investment objective and current life circumstances. Otherwise, failure and losses await down the line. Investment strategies are the instructional manuals that ensure the investment options chosen to lead to financial freedom and not ruin. They provide wealth creation and growth and financial goals fulfillment, all at an acceptable risk level.

The most widely used investment strategies by the world’s wealthiest people are:

- Value investing

- Income investing

- Growth investing

- Dollar-cost averaging

- Buy and hold

Value investing

The proponent of value investing is Benjamin Graham, despite being now known as the Warren Buffett strategy. Value investing involves analyzing a company as a whole and identifying unjustifiably low valued stocks given a company’s “health,” intrinsic value. Stock undervaluation may result from a disconnect between the market forces of demand and supply or the low popularity of stocks. A dive into the fundamentals of an organization is the sure way of coming up with the intrinsic value of its stocks.

Graham and W. Buffet agrees that in the short term, a market is a voting machine that evolves into a weighing machine in the long-term. Thus, Layman’s tongue, value investing has no interest in the price of an investment asset due to market forces of demand and supply, but rather the value of the stocks due to the organization’s operation, top to bottom.

Therefore, value investing involves scouring organizational fundamentals and identifying undervalued stocks for purchase, not for capital gains but a controlling stake in earnings generating organization. According to W. Buffet, value investing is about holding stocks for the long haul in an organization that is business “sound” and profitable in the long run, year to year.

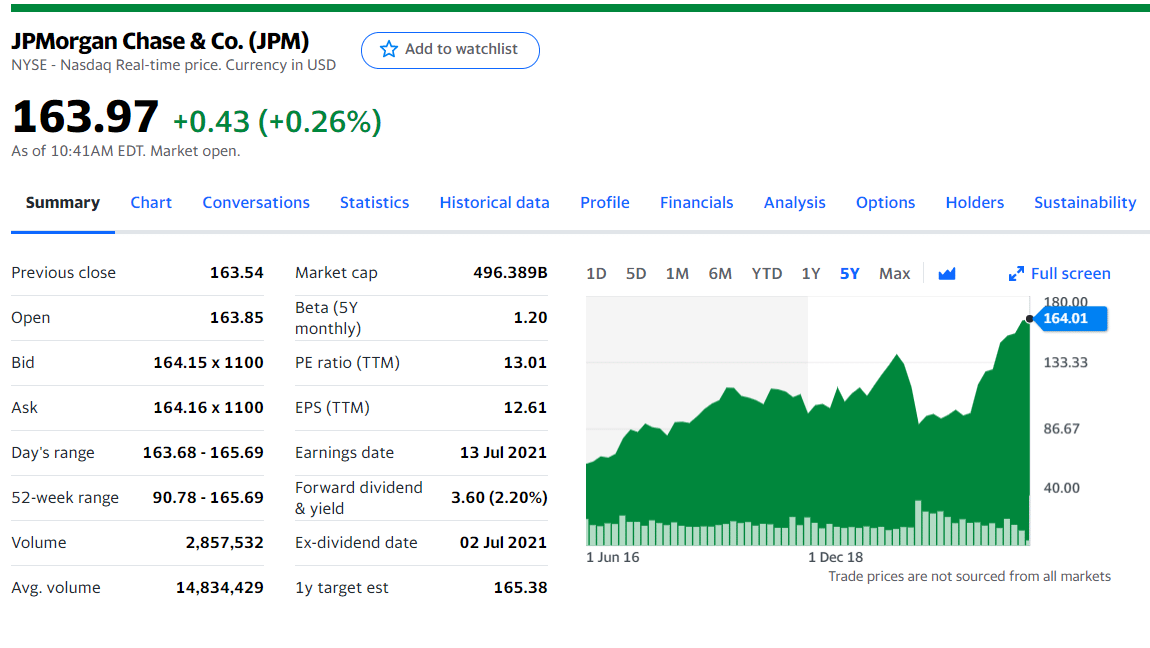

The chart above of JPMorgan and Chase, one of the oldest financial institutions globally, shows that proper analysis in 2017 would result in a 99.4% return on investment.

Income investing

Investing doesn’t have to be long-term only. It is great to have money in the long-term, but meanwhile, bill settlement is a must-do, and there is a need for capital for more meaningful investments. Income investing strategy comes in to sort the day-to-day expenses and capital needs of other long-term investments.

Income investing strategy involves picking investment instruments that offer a consistent and regular return.

Thus, it is applicable for selecting:

- Bonds

- High-dividend paying equities/stocks

- High-dividend paying mutual funds and exchange-traded funds

- Interest-bearing certificates of deposits

- High-dividend spending real estate investment funds

- Rental income properties

The primary objective of income investing is consistent regular paychecks with meager associated costs and risks while preserving capital.

Growth investing

The growth investing strategy represents one of the oldest and most basic approaches to achieving financial freedom. At a glance, growth investing is very similar to value investing. However, it involves buying equities poised for significant growth in future-above average growth than the specific sector and broader economy.

Unlike value investing which looks at undervalued established, growth investing dives into the fundamentals and technicals of organizations to identify emerging, small-cap, and middle-cap entities poised for operational expansion and increased profitability in the future.

As such, most stocks in a growth investing strategy portfolio are high-risk, high-return assets-untried sufficiently in the market to ascertain volatility and liquidity accurately. Investors’ interests lie in an investment asset’s share price performance, growth earnings both historical and forecasted, return on equity, and profit margins.

This strategy is all about equity value appreciation hence the strategy skewness towards emerging markets and technologies sectors.

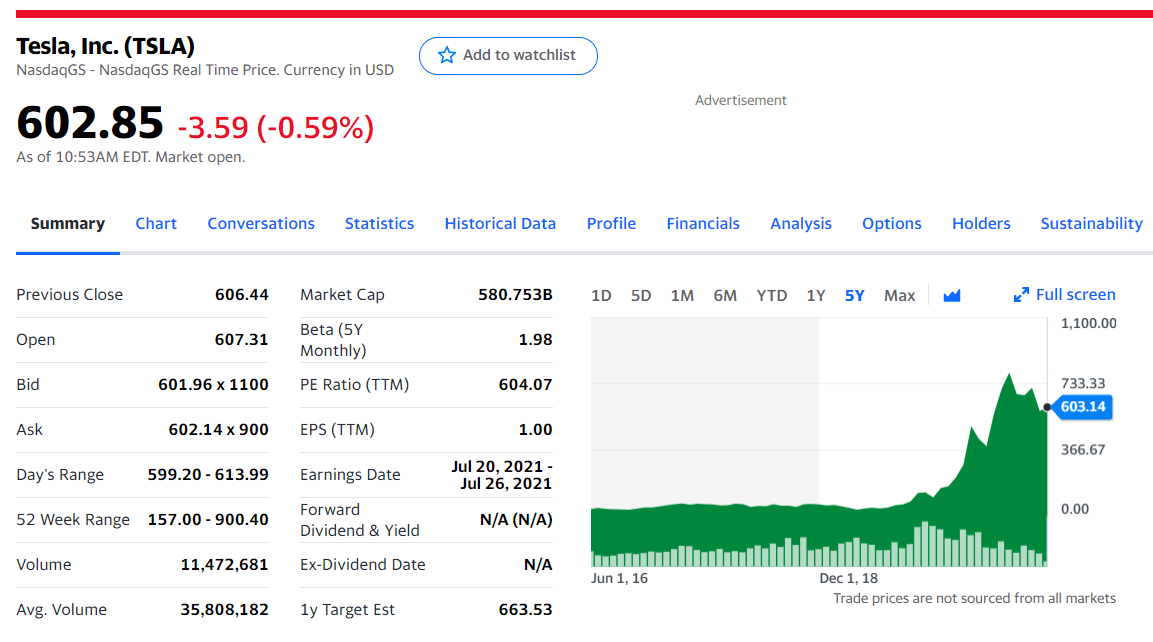

Any investor who bought Tesla shares in July 2017 at $45.16 now holds an investment that has grown approximately 1186% after four years.

Dollar-cost averaging

Successful investors agree that the greatest misconception about the markets is that you can perfectly ‘time’ it. The dollar-cost averaging strategy, also referred to as the constant dollar strategy, seeks to minimize market volatility by spreading the investment over time in a scheduled approach. In effect, investment asset prices are bought at regular intervals regardless of the prevailing market prices.

For example, 401k plans invest in the chosen asset at regular intervals regardless of the prevailing prices. This investment strategy mitigates against high-value investment at the wrong time.

Buy and hold strategy

According to both W. Buffett and J. Bogle, healthy long-term returns are only achievable through buying and holding investing strategies. This strategy is a passive investing style that chooses stocks with potential long-term and holds them for as long as possible regardless of the short-term price fluctuation reason. It is also known as positional investing.

The buy & hold strategy has no set time limit regarding how long to hold a security. It is dependent on individual investment objectives. Among all the investment strategies, it is a relatively lower-risk, simple, and cost-efficient investment method.

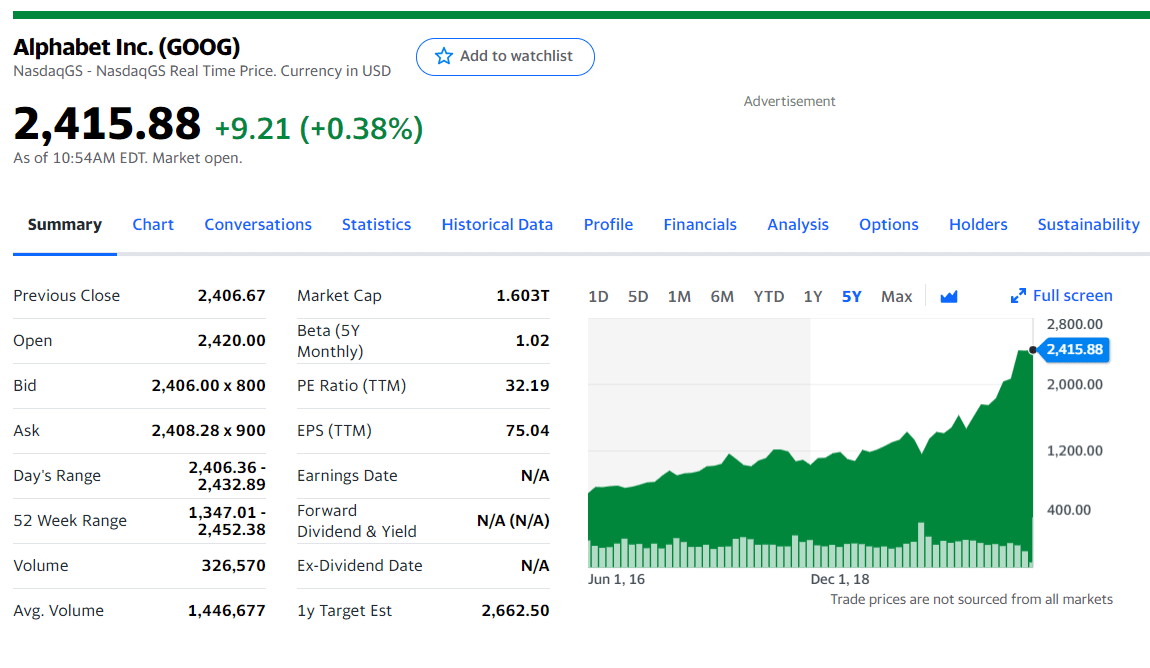

Any investor who bought Google Class A shares in August 2013 and held the stocks over the years despite the price fluctuations now has a 680.86% return on investment.

Bottom line

In investing, the adage doesn’t put all your eggs in one basket that holds water. None of the investment strategies discussed is a fit-all solution. Great investors advocate for portfolio diversification using different securities, which means different investment strategies. Individual investment goals and timelines for the achievement of these goals determine the mix of strategies to employ.

Comments