Working as an independent consultant in today’s economy is popular, but the additional income means there are tax implications to think about. Such consultants work for single and multi-level marketing companies, but they are not considered employees. They sell a product directly to customers through personal connections and host events. They can also recruit other consultants and earn a bonus or percentage for sales that happen down the line.

As a self-employed advisor, you are eligible for tax deductions related to the cost of doing work. However, to take these deductions, you need proof of your expenses. Develop a filing system to track all receipts for equipment, supplies, and services required to do your work. If your job requires traveling, keep track of your mileage and car expenses, as well as hotel and meal costs.

Self-employed or employee?

Whether full-time or part-time, you are considered self-employed if you carry on a trade or business or are in business for yourself. A self-employed person can be a sole proprietor or a freelancer. You are considered self-employed even if you are paid in cash and do not receive a 1099-MISC or 1099-NEC.

The IRS calls such consultants “direct sellers,” they have rules for filing taxes. Follow these tips and feel confident when tax season rolls around.

Tip 1. Report all your business income

As an advisor, you may receive different types of income:

- Income from sales when customers buy your products.

- Commissions, bonuses, or percentages when someone you sponsor made a sale.

- Prizes and awards.

- Products you receive for meeting a sales quota.

- Other gifts.

Most companies will send a Form 1099 to self-employed distributors who earned over $600 or purchased more than $5000 in inventory in the previous year. This is the form you will use to complete your tax return. It should account for all your income types.

How could you avoid tax underpayment penalties?

Tax underpayment penalties kick in when you owe more than $1,000 in unpaid taxes. You can avoid penalties when you pay the smaller amount of:

- 90% of this year’s tax liability

- 100% of last year’s tax liability

For example, you paid $10,000 in taxes last year. If you make four equal payments of $2,500 during the year, you should avoid underpayment penalties, regardless of this year’s income.

Tip 2. Know which expenses you can deduct

Business deductions are a way to lower your taxable income. This can reduce both your individual income tax and your self-employment tax. Direct sellers can generally deduct ordinary and necessary business expenses, including:

- Advertising and marketing

Deduct the cost of business cards, flyers, etc.

- Startup costs

Starter kits, training, and any fees you pay to become a consultant are deductible up to $5,000. You can choose to deduct or amortize these.

- Sample inventory

Products that you use for demonstration are deductible. They should be counted as inventory if you sell the samples instead of using them entirely for demonstration.

- Home office

If your space is exclusively used for business, you can deduct $5 per square foot using the simplified method.

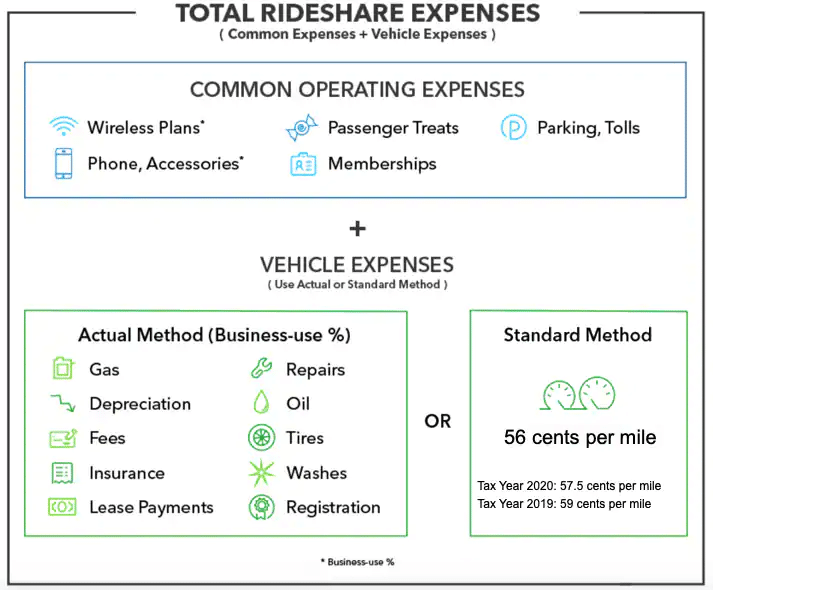

- Business miles and vehicle expenses

The miles you drive delivering products from one customer to another are deductible. You can’t deduct personal travel.

Total rideshare expenses

Inventory that you sell cannot be used as a tax deduction. The value of your inventory will be used to decrease your income before calculating taxes.

Tip 3. Pay self-employment tax

Since you are not an employee of your company, they do not withhold money from your pay for social security, medicare, or income tax. As a self-employed specialist, you are considered self-employed, so the IRS expects you to pay your tax if you earn more than $400 for the year.

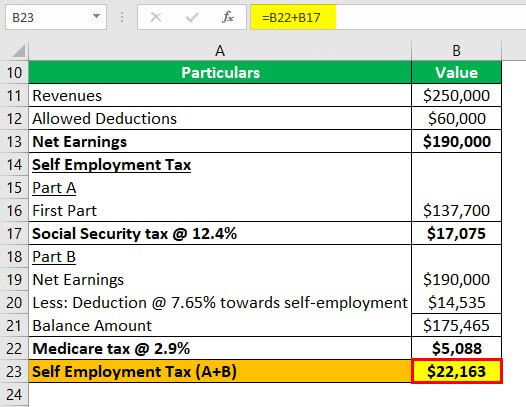

The self-employment tax rate in 2022 is 15.3% of your net earnings. It consists of the following:

- 12.4% for social security

- 2.9% for medicare

Tax calculation

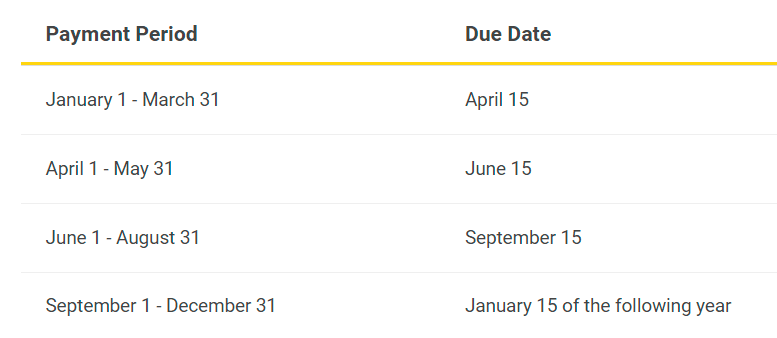

If you owe $1,000 or more in taxes when you file your tax return, you should pay the estimated tax. If you expect to owe less than $1,000 in taxes, you can pay it all at once when you file your tax return.

Tip 4. File your taxes

Most tax returns need to be submitted by the IRS deadline each year.

Estimated tax payments for the year

If you make an estimated tax payment by mail, your payment will be considered on time if it is postmarked on the due date. If the due date falls on a Saturday, Sunday, or legal holiday, you will be on time if your payment is made on the next business day. You must fill up the Form 1040 or 1040-SR as a self-employed consultant.

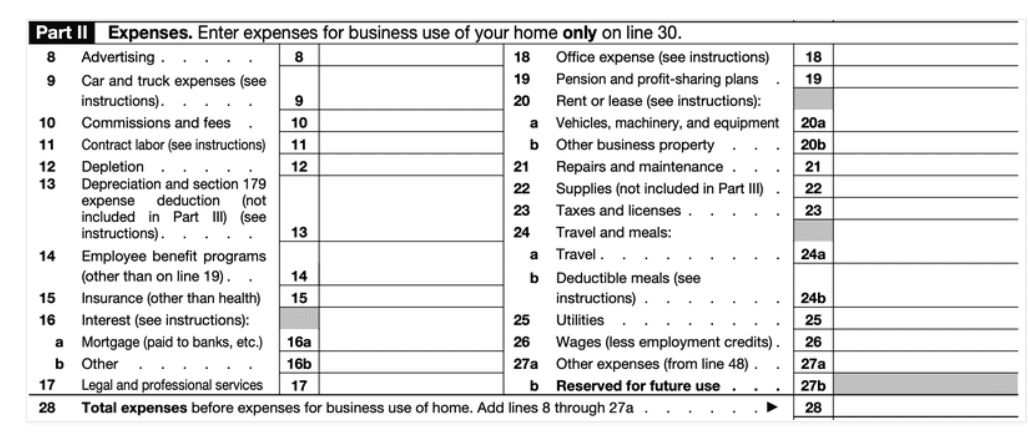

IRS form 1040

You must attach Schedule C on which you’ve figured your business’s net profit or loss after accounting for deductible expenses.

Tip 5. Separate business activity from hobbies

Maybe you became a consultant to get a reasonable price on the product, but you had no intention of turning it into an actual business. If you’re not really in direct sales for the money, you will still need to report any income you earn, but you won’t be able to deduct your expenses. Find out if the IRS considers you a hobbyist or self-employed.

Final thoughts

Always put aside enough money to pay your taxes. Don’t wait to make significant tax payments once a year — divide your estimated annual tax liability by four and make quarterly payments.

Comments