Saving money can be challenging, especially when the budget is tight, but it is always worth a while. You only have to plan wisely, creatively, and diligently. According to the report, approximately 40 million. Americans struggle to pay their living expenses or haven’t had anything in hand after spending their income. Saving comes to the rescue here.

This article will share a few surprising tips that you can follow to increase your savings in no time. However, before delving into the tips of saving money, its importance is also notable. So, let’s get started.

Why is saving money and having a budget important?

When it comes to financial security, people have to think about both the present and the future times. Most people willingly save money to fulfill their goals, dreams, or economic security. Yet, it seems impossible on low wages when paying bills is even challenging.

However, it is not the case. Everyone can save money even on low income and without cutting on to the goals or activities. Saving money doesn’t even call for payment at hold irrespective of the amount of income you earn.

Saving money and budgeting

Yet, without a proper budget plan, it seems impossible. As for saving some, you need an exact idea about where you are spending your income. It is the first and the foremost step towards saving. It also enables you to identify where to start. By separating the fixed payments from the income, you get an idea about the amount you will have in the end. Then, you can further divide it into other expenses or put it in the savings account.

What do you need to start saving fast with a low income?

Several reasons drive individuals to save money, and if you want to do it on a low income, it is worth appreciating. You can save for your retirement, investment, building a house, a car, or for your child’s educational finances, to name some.

You would probably be thinking about cutting off the money and saving it when you can hardly afford to live. In most cases, such people are either under high loans or have those emergency loans to fulfill their needs. So, preferably, everyone should have enough in their accounts to avoid killing debts. It requires clever management and evaluation of the income at first.

Tracking the expenses and daily activities make it easier to generate a budget plan. Therefore, it is an ideal time to start considering the tips that you can follow to save some money on a low income. Keep in mind that consistency and efforts are major steps towards saving money.

Basic tips to save money fast

As we said earlier, saving your money in low income doesn’t mean giving up on your goals. On the contrary, some creative ways can let you save your money on your low income without cutting fun parts of your life.

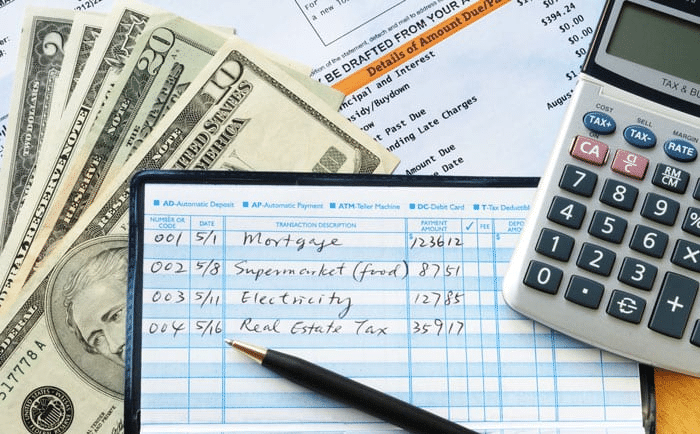

Tip 1. Calculate your expenses

Bookkeeping is the primary thing that comes to our mind when we think of saving money on a low income. It will help you in knowing where to spend less to save more. It will boost up your savings even at low income.

Tip 2. Track your goals

Saving money is not about letting your goals on hold. Instead, you should focus on your goal and leave all other expenses or entertainment besides a waste of money and your precious time. By focusing on your goals, you can convert your bank account from zero to a healthy one.

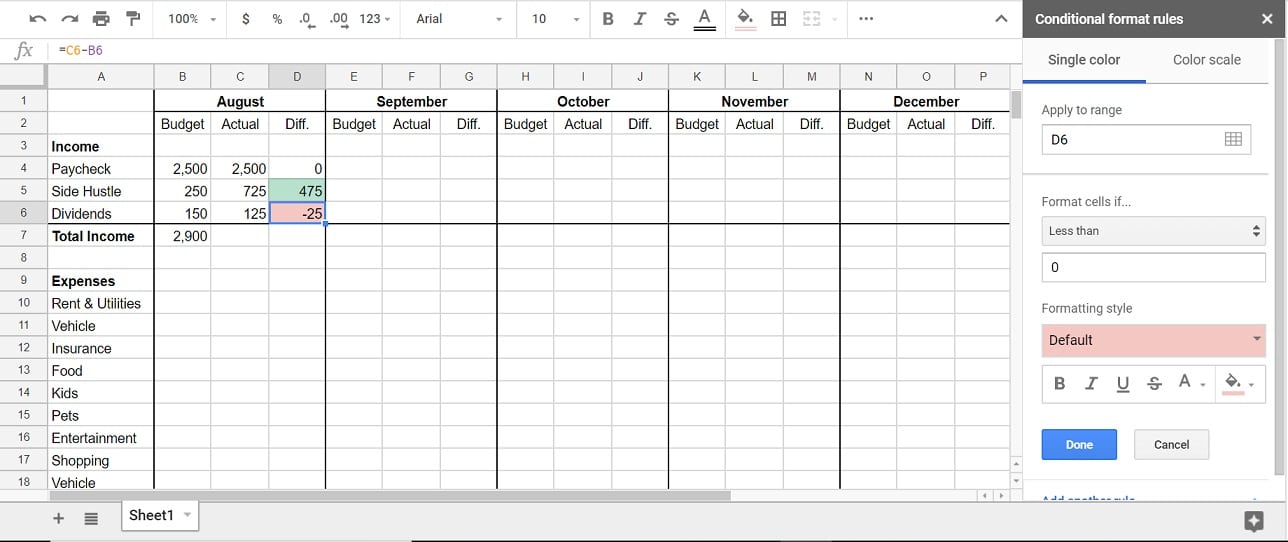

Tip 3. Make a budget plan

Saving money on a low income is not that difficult if you have a budget plan of how and where you are spending money according to your needs and expenses. Making a budget plan can help you in many ways. For example, it will help you in informing where you are spending your extra money.

Tip 4. Separate bank accounts

The initial step of saving your money in low income is to find a fee-free bank for your accounts. Banks charge extra taxes on your accounts which can harm you financially. However, there are lots of banks that advertise free accounts without charging any fee.

Tip 5. Reduce the number of bills

Reducing the number of bills plays a vital role in saving money. For example, using good appliances in your home which are cheaper in cost but are reliable can reduce half of your expenses on your house bills.

Tip 6. Avoid debts or bank loans

Debt and loans can hold you back from achieving new financial goals. Avoiding bank loans can save a lot of your amount. Bank gives loans or debts on interest which are cut from your bank accounts monthly or yearly. You can then use your savings instead of taking bank loans.

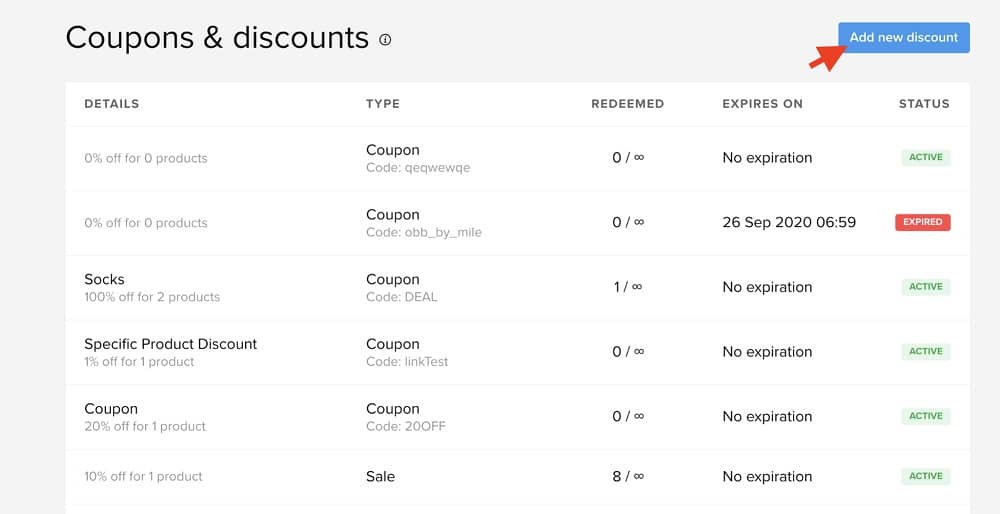

Tip 7. Use coupons or discount codes

Tip 8. Reduce spending on food and entertainment

Restricting yourself from wasting your money on unnecessary food or entertainment enables you to save your money faster than expected. Entertainment or food is one area of your budget that is entirely variable. Try to find entertainment places which are free of cost, like public parks or museums, etc.

Final thoughts

Planning and managing expenses is a crucial strategy of saving some money irrespective of the income. Yet, when it comes to low income, it becomes more critical. Saving is neither that difficult nor straightforward. Due diligence, consistency, and strategic planning skills can help you save more in less time, even on a tight budget. Everything becomes possible when you want to do it.

Comments