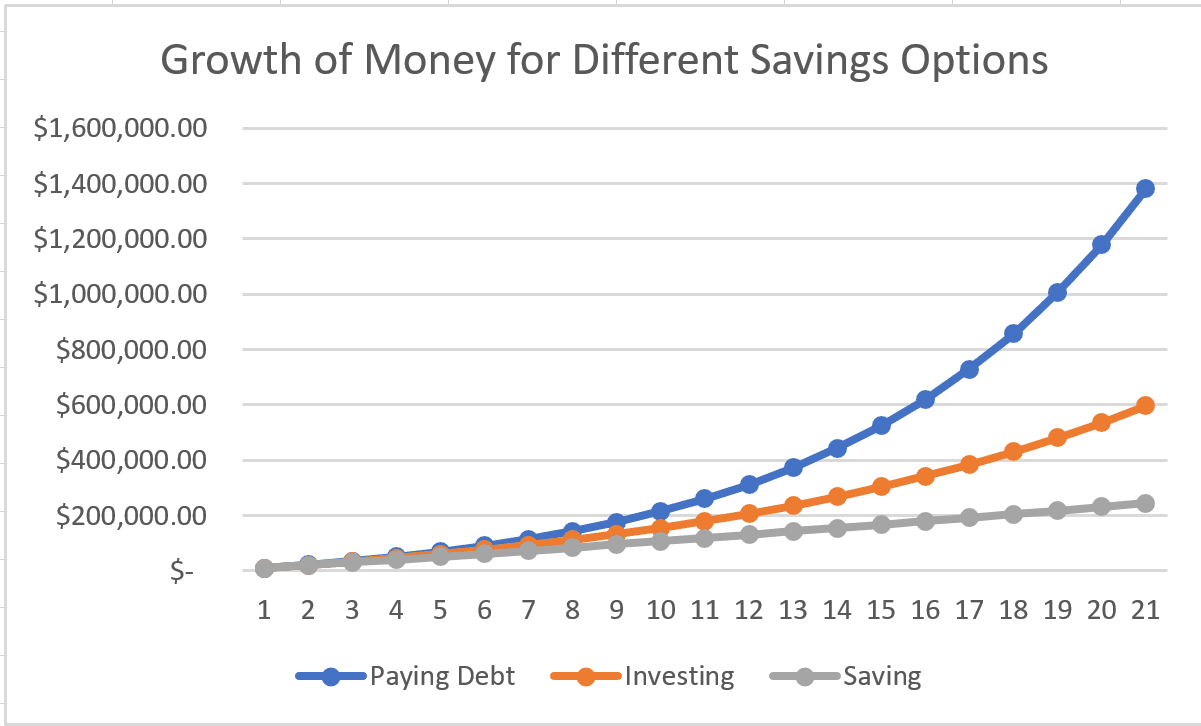

When you improve your financial stability, there are many savings categories to consider. Ideally, your emergency fund should be able to cover three to six months of living costs.

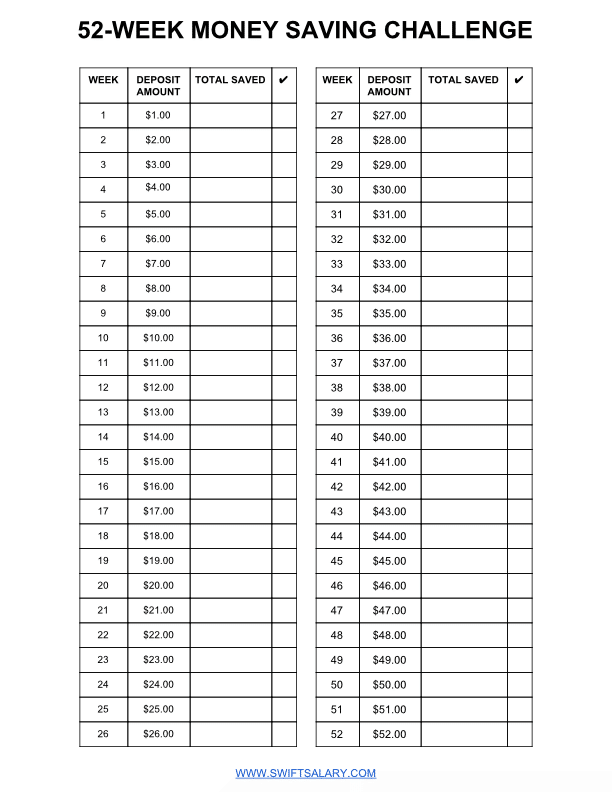

With the 52-week money challenge, you start off by saving $1 and work your way up to $52 by week 52, which leads to a total savings of $1,378. Unfortunately, many people have trouble starting to save. If you don’t know where to begin saving or have difficulty setting money aside, the 52-week savings chart can help you get started.

Decide what you want to save for now, and you’ll be highly motivated to stick with it throughout the whole year. Then, once you’ve determined your savings objectives, join it and save more with the 52-week money challenging task.

What exactly is a 52-week money challenge?

You should save an increasing number of dollars each week for one year using the 52-week money challenge.

Match the amount you save each week to the number of weeks in your challenge. In another sense, you’ll save $1 the first week, $2 the second week, $3 the third week, and so on until you’ve saved $52 at the end of week 52. Of course, you can be creative with the amount you save each week if you want to save more money over the year or do not have enough funds for the usual challenge. If you complete this challenge for the whole year, you will save a total of $1,378.

What is the 52-week money-saving goal chart?

Essentially, you save $1 for each week of the year:

- Week 1 — make a $1 savings

- Week 2 — make a $2 savings

- Week 3 — save $3, etc.

The savings goal that you set for the year and all 52 weeks will be $1,378. We suggest that you look into adding this to your current savings strategy and goals. Saving that extra money would be a great idea.

Quick tips for finding the weekly savings to reach your weekly goal

So, now that you’ve downloaded the template or printed the chart, how can you begin saving money each week? Here are some tips to save money and to reach your weekly goal.

Statistics of 52-week savings

Tip 1. Prevent unneeded buying

Saving money requires you to follow one of the most important guidelines. Credit cards allow us to shop without paying in cash upfront, which is easier to do. Due to this, you may purchase items that are not necessary for your daily needs. It is easy to make purchases we regret, so being smarter about your purchases can sometimes make you feel better while preventing clutter and saving you money.

You may still treat yourself now and then. However, be mindful of your regular shopping habits to prevent squandering money in unnecessary locations. Make food lists to stick to, eliminate weekend mall visiting, and create a budget that allows no space for unnecessary expenditures. Making these tiny modifications can help you save a lot of money at the end of each week.

Tip 2. No extra dining out

We all like a nice meal, but eating well does not have to include dining out. It may seem like the simplest option to stop for fast food, but those inexpensive meals add up quickly. You can easily save hundreds of dollars each week by avoiding fast food and dining out. Instead, you can use the money you would have spent on eating out to pay for your groceries each month.

Become a couponer to save even more money on food. Take advantage of your local grocer’s weekly sales and download its app for exclusive digital coupons. The receipt showing your savings at the end of every grocery store trip can be rewarding and encourage you to start saving in other ways as well. You can do it for free, and it’s simple. Keeping money in your pocket instead of spending on things you normally buy helps you save more each month.

Tip 3. Avoid drinking more alcohol

Maybe you’ve heard of “Sober October,” “No Drink November,” or “Dry December.” The goal behind this fashionable task, which has gained popularity in recent years, is to abstain from consuming alcohol for the whole month.

Alcohol is costly, and giving it up for a while may help you save more than you expect. So whether it’s a glass of wine at night or a couple of beers with dinner on weekends, see how you feel and how much money you save by cutting out alcohol for a week. Then, take it a step further and give it a month’s worth of effort. This not only keeps costs down but also enhances your health in a variety of ways.

Tip 4. Hold the phone

Most of our everyday decisions are based on accessibility in today’s day and age. We have services that can provide you with everything we desire with the click of a mouse. While these services make our lives easier and more convenient, they come at a high cost. It could save you a lot of money if you stopped ordering meals from UberEats, using Favor to have your midnight snacks delivered, and having your groceries delivered.

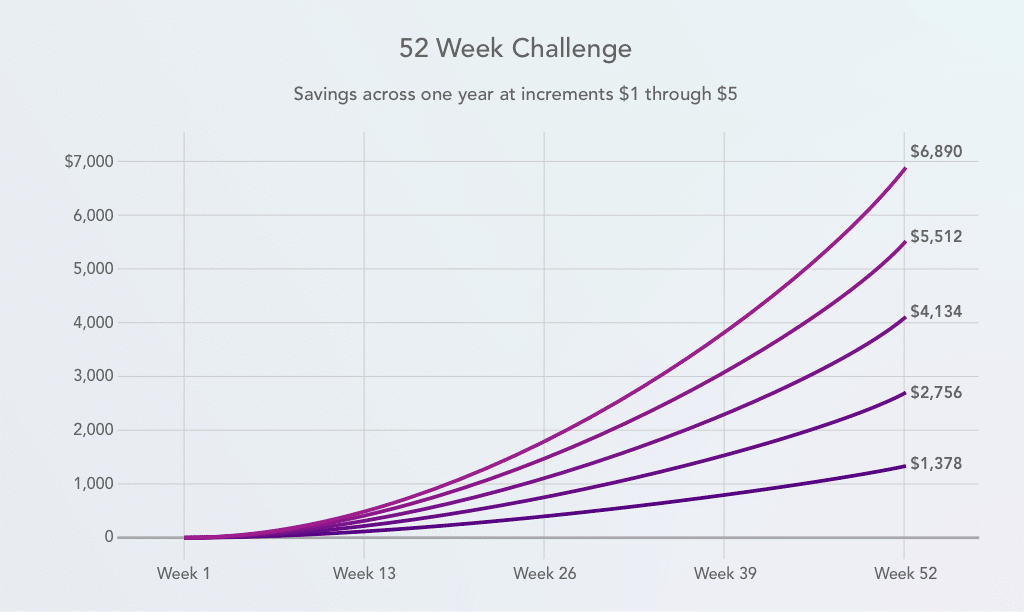

Different strategies of 52-week savings plan and their value

Using convenient mobile applications or purchasing online may seem like a good idea at the time but ultimately prove to be a waste of money. Our Gmail inboxes are flooded with emails, online discounts, and free two-day delivery offers from house brands like Amazon Prime. Purchasing online, on the other hand, might lead to liabilities that you would not otherwise acquire. So go a week without visiting your favorite online merchant and save the money for something more satisfying than a hasty, impulsive purchase.

Tip 5. Consider consigning your clothes or household items

Make some extra cash by clearing out your closet to get a head start on spring cleaning. You can sell your clothing right away to consignment shops.

Final thoughts

Many people have difficulty starting and sticking to a saving plan when it comes to saving. They aren’t sure how to manage their financial obligations while setting aside money for the future. Financial planning is a difficult task that may make you feel like a prisoner in your own house. Saving a lot, on the other hand, does not necessarily have to be a negative thing. Make saving one of your financial choices, and the 52-week savings challenge will help you get started.

After you’ve created a strategic budget for yourself and implemented small changes in your daily routine, promise yourself that you’ll reward yourself with some of the money you’ve saved at the end of it all.

Comments