Happy Galaxy is a fully automated system that supports both ECN brokers and uses a news filter to detect market conditions with high volatility. The algorithm comes with multiple backtesting and live records that we will analyze in this Happy Galaxy review. At the end, traders will be able to make a right purchase decision.

The developers state that the robot uses an advanced method for determining the current trend of the market on multiple currencies. Developing a system that can work on various instruments with a single strategy is hard in the financial markets. To verify the authors’ claims, we had to review the product.

What is behind the Happy Galaxy?

Happy Forex is the company behind the robot. They do not provide information on their whereabouts or identities. Traders can only contact them through a form that is available on the website. The author is not clear about the customer support hours.

How it works

The robot works on both MT4 and MT5 platforms. To set up the system traders need to:

- Place the ex4 or ex 5 file within the MetaTrader experts’ folder after purchasing it from the developer

- Enable the auto trading option with the software

- Place it on the charts to start trading

Key features

The robot has the following key features:

- It can work on brokers of all types

- The system is fully automated

- Traders can use it on multiple currencies

- There is a built in news filter

- It comes with multiple backtesting records

Trading strategy

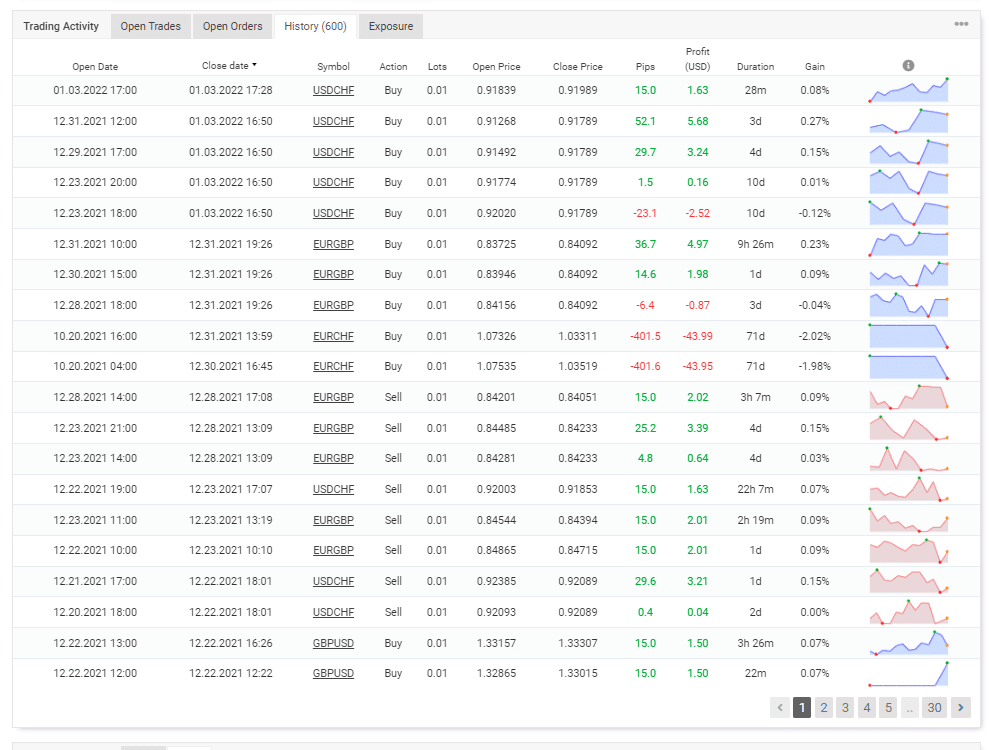

The developer states that the robot trades on EURUSD, GBPUSD, USDCHF, EURGBP and EURCHF and has a news filter to avoid volatile market conditions. It uses a new system for the detection of trends and small grids. From the live records on Myfxbook we can observe the use of averaging methodology with average trade holding duration of 4 days. The dev claims that the robot swings trades on multiple pairs and only closes orders when they are in profit.

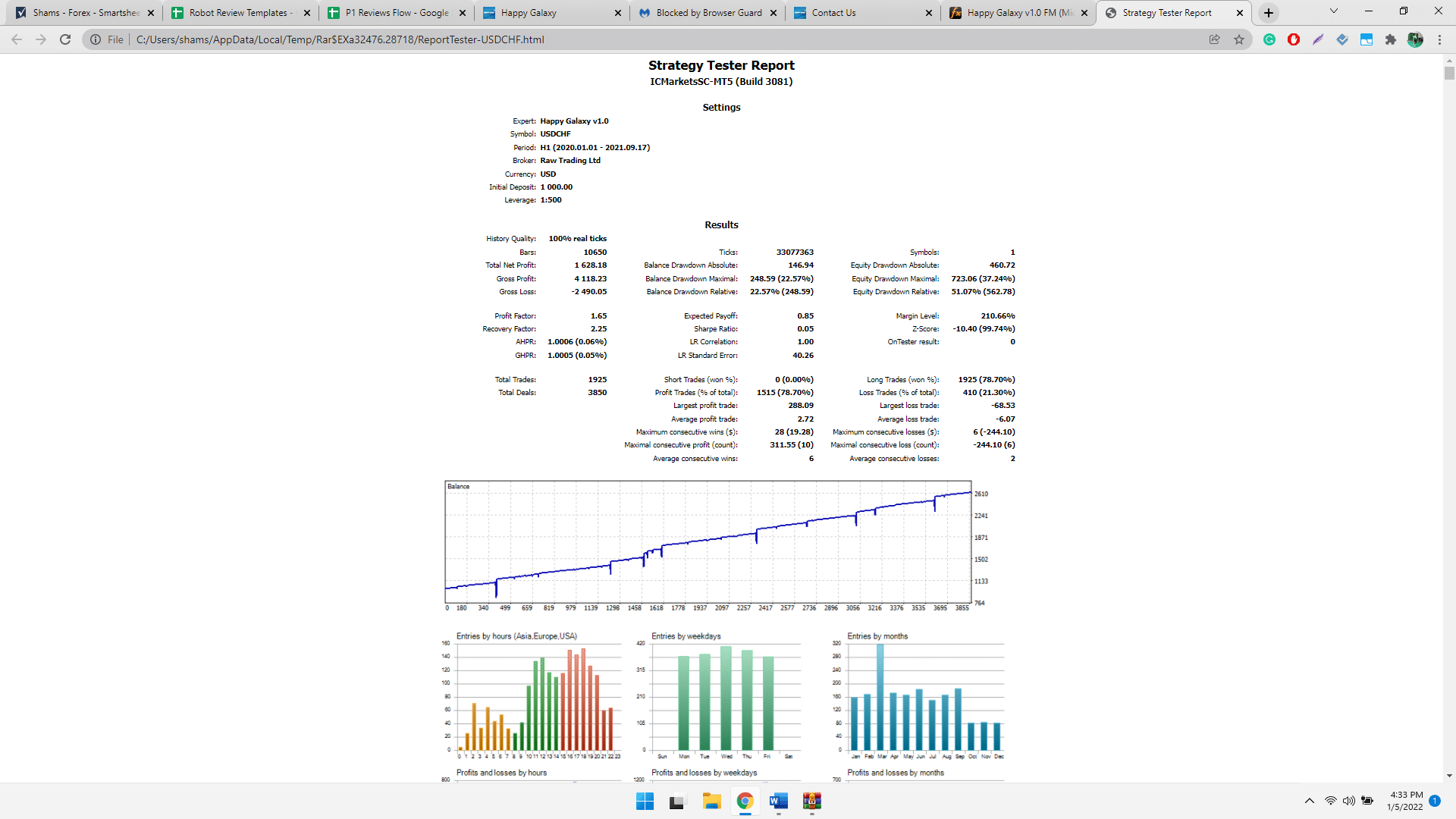

Trading history on MQL 5

Backtesting results are available for USD with 100% testing quality. The relative drawdown was around 51.07% which shows nearly half the loss of equity. The winning rate was 78.7%, with a profit factor of about 1.65.

All the tests were done on the 60 minutes chart with a starting balance of $1000. The robot tanked an average profit of $1628.18 for this period. There were 1925 trades in total, with 3850 deals.

Backtesting records

Pricing

The algorithm is only available for an asking price of €299 with a 30-day money-back guarantee. The developers provide traders with their 10 other systems with the purchase.

The pricing model of the robot

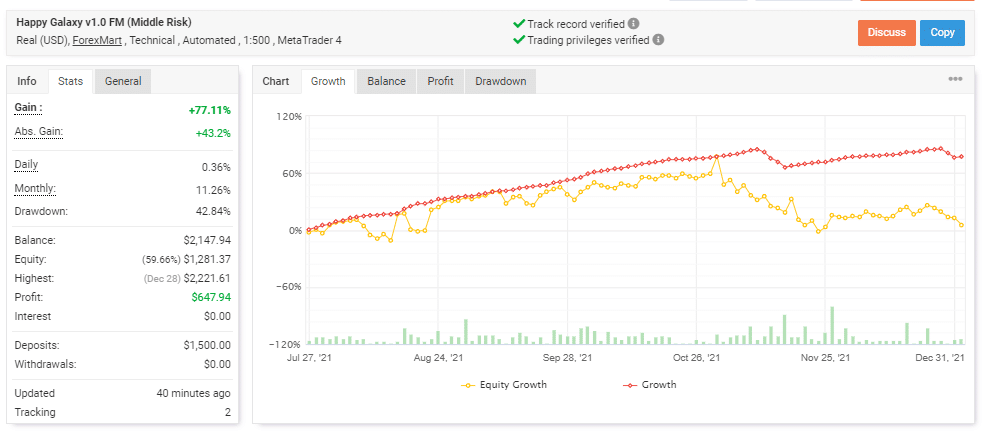

Trading performance of Happy Galaxy

Live trading results are available on Myfxbook. We have a performance from July 27, 2021, till the current date. The system made an average monthly gain of 11.26%, with a drawdown of 42.84%.

The winning rate stood at 81%, with a profit factor of 1.97. The best trade was $19.8, while the worst was -$45.21 within 597 trades. The developer trades with a real account with a deposit of $1500. The current balance of the system is $2147.94, with a total gain of 77.11%.

Live trading records on FXBlue

Customer support

Customer support is only available by filling out a form that is present on the website. Unfortunately, the developer is not clear on their support hours.

People feedback

The company has a total rating of 3.542 for 5 reviews on Forex Peace Army. One of the traders states that he has used one of the algorithms from Happy Forex, which has blown up his trading account.

The customer review at FPA

Comments