FxPro Dragon is introduced as an EA that is capable of working alone on the user’s account or jointly with other EAs. The developers imply that the robot features a money management functionality that helps traders not to lose their deposit. It is claimed that the robot’s algorithm is very distinctive hence allowing it to easily work with multiple currency pairs. However, the vendor has selected one best pair that enables the trader to attain stable profits.

Information about the company behind this EA is not provided. Therefore, we do not know the name of the company, year of foundation, physical address, their other robots or any other background information.

In this FXPro Dragon review, we will analyze this robot to establish if it is a good choice for traders to invest in. We will evaluate the different aspects of the bot putting key focus on backtest data and live trading results.

What is behind the FxPro Dragon EA?

FxPro Dragon EA trades automatically. After downloading the software, the vendor requires traders to provide parameters, scales, and limits to transactions. The EA then uses these data to execute trades.

Key Features

FxPro Dragon features are provided below:

- Trades on EURUSD, GBPUSD, USDCAD, USDCHF, and USDJPY currency pairs

- Is fully automated

- Works on the 4-hour time frame

- Has an easy to use installer that can start running in less than 5 minutes

- Adapts to 4 digit brokers

Trading Strategy

As per vendor claims, the robot does not open trades at all times. Rather, it scouts the market to ascertain the best periods to make entries. This enables the system to trade with several EAs on a sole account simultaneously thus preventing big drawdowns. However, it is important to note that this strategy explanation is inadequate. It is impossible to point out the indicators that the EA relies on. This reduces our confidence in the software’s ability to perform well in the live market.

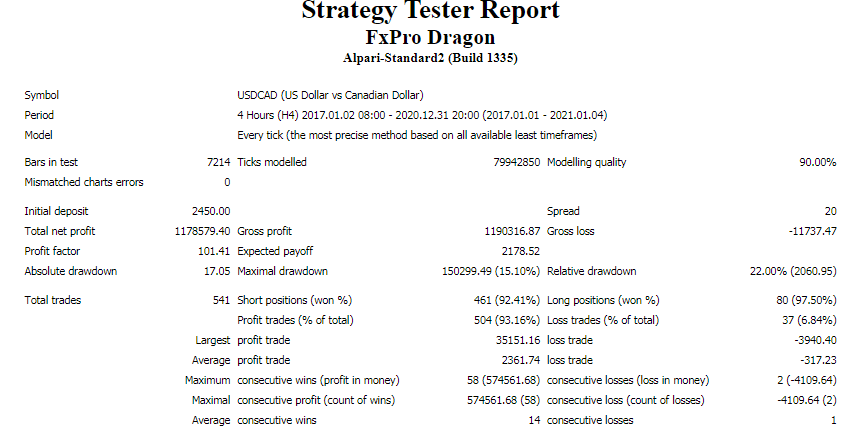

A screenshot of the backtest data is provided below:

The EA operated the account between January 2017 and December 2020. It traded with the USDCAD currency pair on the 4-hour time frame. An initial deposit of $2,450 was placed in the account, and out of it a total net profit of $1,178,579.40 was made. Our calculations indicate that, on average, the account made $32, 738. 32 profit per month. This figure is just absurd.

The win-rates were 92.41% for shorts and 97.50% for longs. The profit factor was 101.41. Again, this value is not feasible. The average profit trade was $2,361.74 whereas the average loss trade was -$317.23. The relative drawdown which was 22% is quite high. It highlights a high risk of loss.

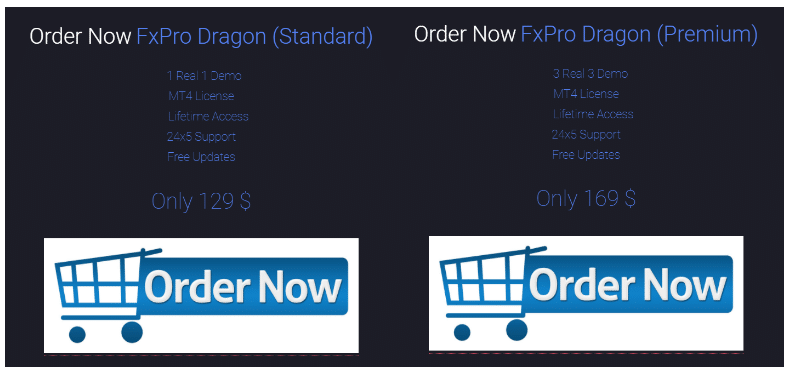

Pricing

The vendor sells FxPro Dragon in 2 packages. The standard plan costs $129 and features 1 real and 1 demo account. The premium package is $169 and includes 3 demo and 3 real accounts. Both pricing plans come with an MT4 license, lifetime access, 24×5 support, and free updates. The vendor does not mention any money-back guarantee. So, we assume that a trader cannot get their money back if they are unsatisfied by the EA’s performance. A refund offer usually demonstrates a vendor’s confidence in their product’s ability to meet user needs. Since it is missing, the EA is not worth the trader’s money as it is unreliable.

Trading Performance of FxPro Dragon

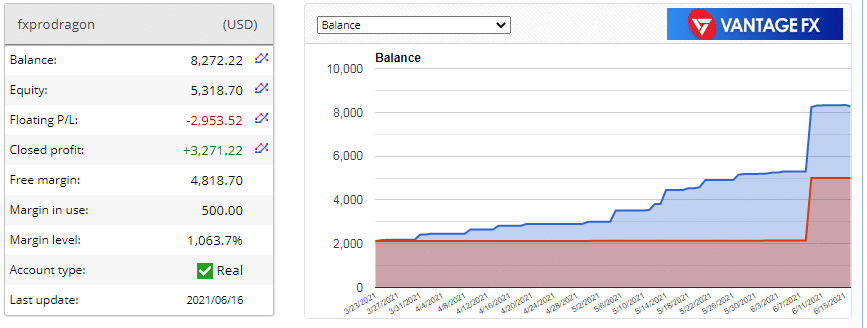

The account statement shows that the real account was activated on March 23, 2021 and last updated on June 16, 2021. It is evident that the account’s balance is $8,272.22. The profit made is $3,271.22. This amount is a far cry from the profit shown in the backtest report. The floating loss is $-2,953.52 whereas the free margin is 4,818.70.

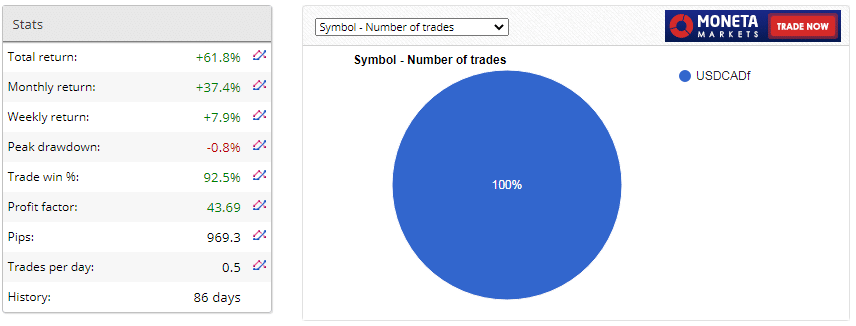

Evidently, the total return is 61.8% while the monthly return is 37.4%. The account has a trading history of 86 days, and executes 0.5 trades daily. The trade win is 92.5% and the profit factor is 43.69. The pip value (969.3) is relatively high, and therefore, the risk of loss is increased.

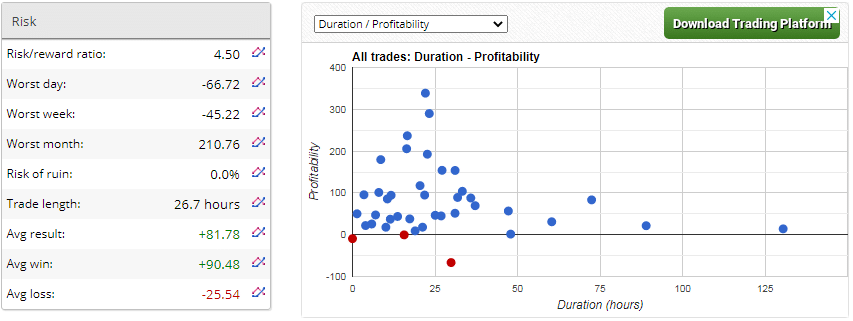

The risk/reward ratio is 4.50. This shows that the approach that the robot applies is inadequate to decrease the risk of losses. On its worst day, the account made -$66.72 in losses. The average win is $90.48 while the average loss is -$25.54.

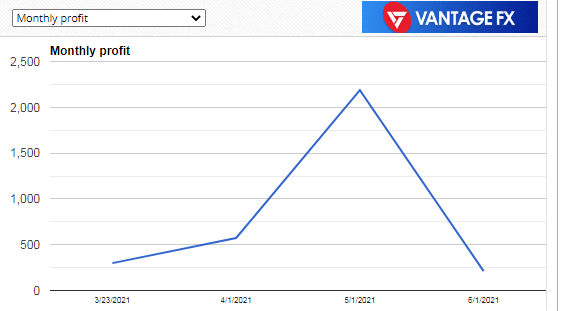

The highest monthly profit ($2,188) was made in May while June had the least amount of profit ($211).

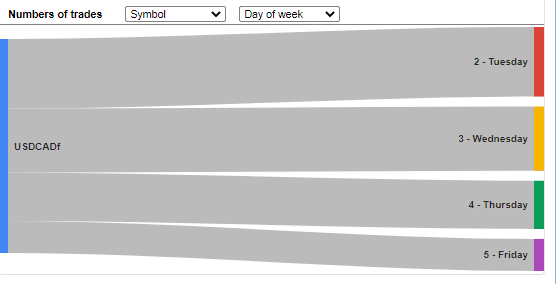

The account does not conduct trades on Monday. It makes most trades on Tuesdays.

Customer Support

The developers claim that they have a responsive support team that works 24 hours, 5 times a week. Traders having questions about the EA or the site are advised to contact support at [email protected]. However, we could not tell how long the team takes to respond to customer inquiries. So, we do not know if their claims of being responsive are true or not.

People Feedback

We were unable to find people’s feedback for this EA. Customer reviews were lacking in popular third-party sites like Forex Peace Army, Myfxbook, and Trustpilot. It is possible that traders are unfamiliar with this bot.

Comments