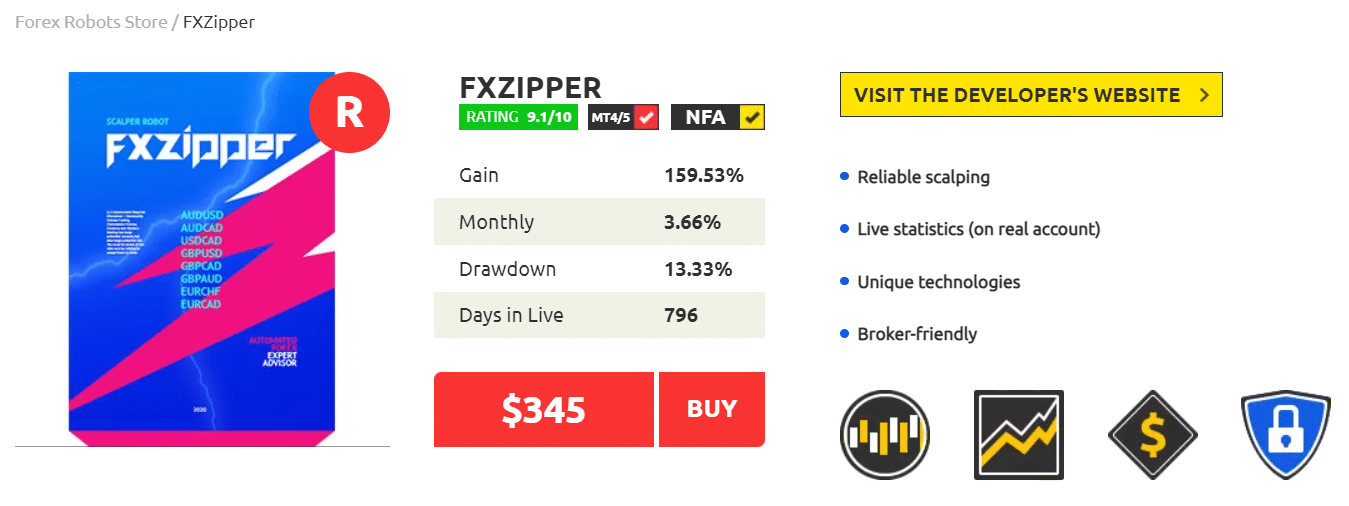

FXZipper is a trading advisor that has one of the shortest presentations. There’s a few details about the strategy and settings explained. The devs main claim that it is a reliable and broker-friendly scalper expert advisor.

Unfortunately, there is no information about the company or their headquarter location. To get in touch with support, traders need to fill in an online contact form. Neither phone number nor email address is provided.

The system scalps short profits on the market. It focuses only on the night hours to open an order. We decided to check it out from time to time. So, we saw the losses on the chart and figured out that it’s the right time to write a review.

What is behind FX Zipper?

The presentation is short but after a detailed analysis of the system we could gather some info that is not provided on the official dev’s website.

- FX Zipper can open and close orders for us on a terminal automatically.

- We can expect that the system places SL levels for every order.

- The robot closes orders asap if the market is against them.

- It works with a scalping strategy.

- We can expect to get 6-12 pips averagely.

- The robot cuts out money from the rough market moves.

- We can expect that an order will be on the market for seven hours.

- We have a feature “postpones the opening of a trade by signal if it has become unprofitable due to a sharp price increase, requotes, or a fleeting increase of spread.”

- We have to work with the system on the ECN account only.

- We may use the system on a VPS service.

- The advisor protects our orders from the fraudulent brokers.

Key features

- The advisor can trade automatically for us. So, we may do nothing in addition.

- It calculates lot sizes, SL and TP levels.

- The system has a broker protection feature.

- It works with GBP/CAD, GBP/AUD, EUR/CHF, AUD/USD, AUD/CAD, USD/CAD, GBP/USD, and EUR/CAD.

- We don’t know details about time frames.

- The devs didn’t provide us with intel about the deposit and leverage requirements.

- A broker should be ECN.

Trading strategy

The robot uses a scalping strategy on the platform. So, it probably doesn’t require much margin to function if it doesn’t use a Grid of orders or aggressive Martingale.

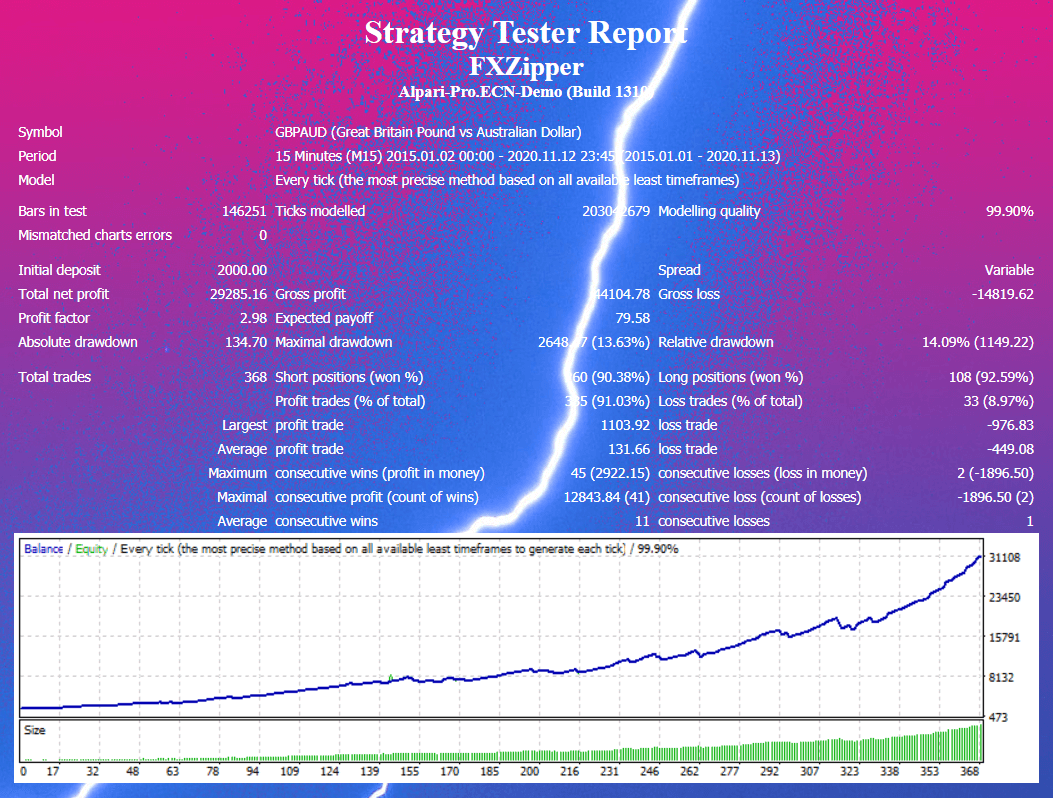

FX Zipper backtest report

We have a backtest report provided that was received after testing GBPAUD on the M15 time frame on the 5-year tick data. The modeling quality was 99.90%. The spreads matched the market conditions. An initial deposit was $2000. So, it turned into $29,285. The profit factor was 2.98. The maximum drawdown was 13.63%. It has closed 368 deals. The accuracy rate was 90% for shorts and 92% for longs.

Pricing

The offer is simple. We can purchase a copy of the robot for $345. The package includes: one real license, trading on 8 pairs, MT4/MT5 versions of the system, a user manual, free updates, and 24/7 friendly support. The developers provide us with a 30-day refund policy.

Trading performance of FX Zipper

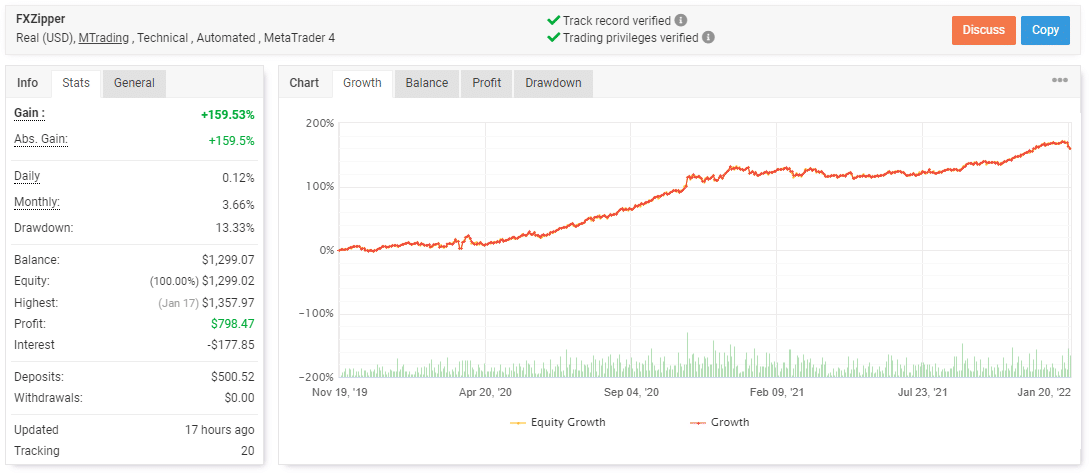

FX Zipper trading results on myfxbook

The advisor was set to work on a real MT4 account. The account has a verified track record and verified trading privileges. It was deployed on November 19, 2019, and deposited at $500.52 only. The total gain is 159.53%. The maximum drawdown is 13.33%.

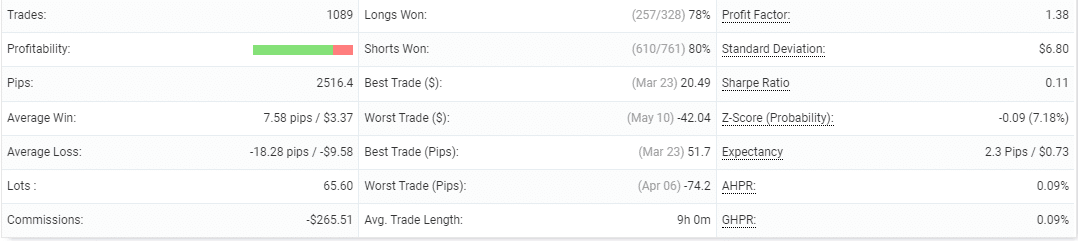

FX Zipper statistics on the myfxbook website

The advisor has closed 1089 orders with 2516.4 pips. An average win is 7.58 pips when an average loss is -18.28 pips. The accuracy is 78% for longs and 80% for shorts. An average trade length is 9 hours. The profit factor is 1.38.

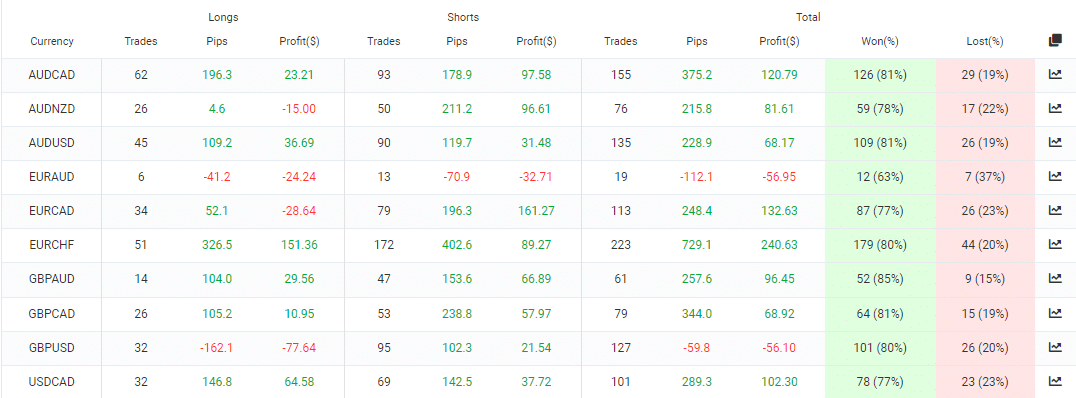

FX Zipper directions

The system opens orders on ten cross pairs instead of eight that were mentioned in the presentation. EURCHF is the most traded pair with 223 orders.

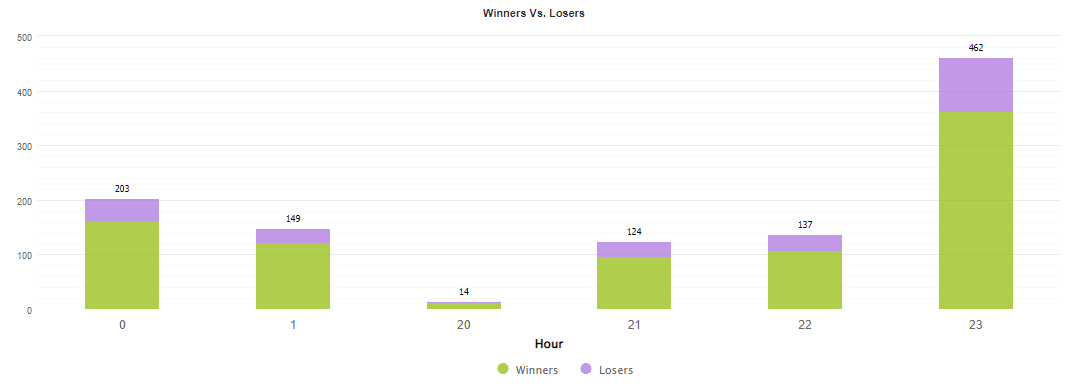

Screenshot of hourly activities from the myfxbook website

The most traded hours are the night one when the market is calm.

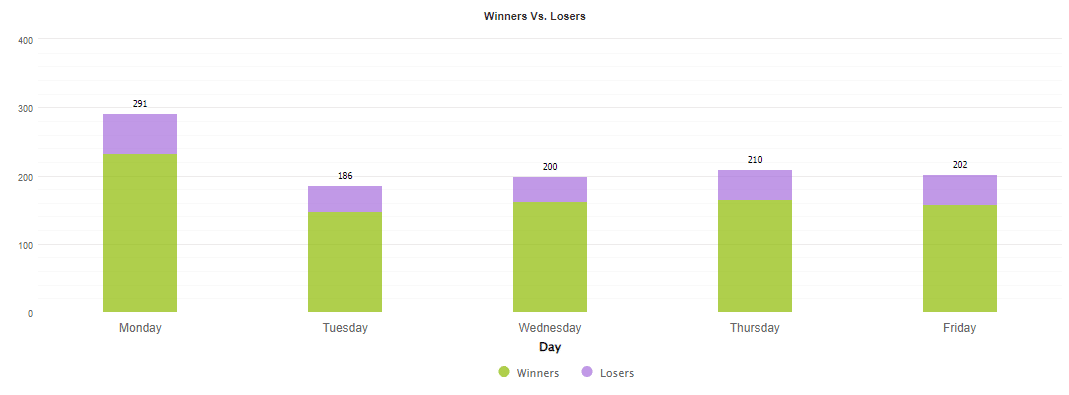

FX Zipper daily activities

Monday is ahead of trading activities during a week, 291 deals.

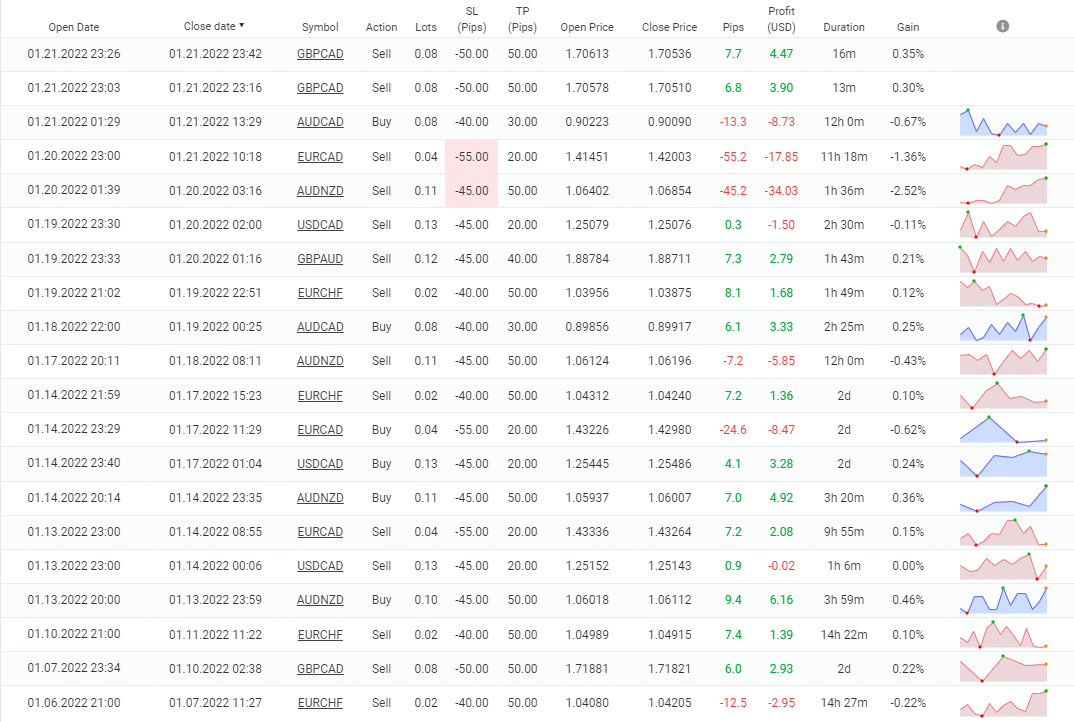

FX Zipper closed orders

The advisor works not only with deep SL levels but also with Martingale.

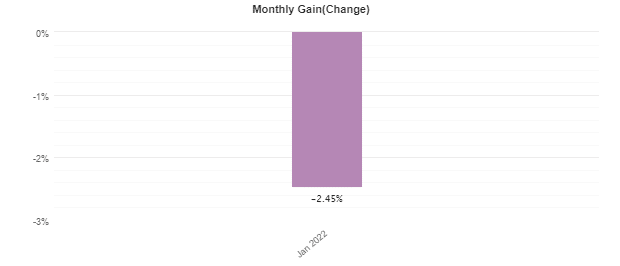

Trading results of January 2022

January 2022 has started with significant losses.

Customer support

The developers provide below average support. Sometimes it takes over a day to get feedback or help.

People feedback

FX Zipper page on Forex Store

We have FX Zipper released on the Forex Store also. It has a 9.1 rate out of 10 possible. It follows NFA rules. We have no testimonials provided to be sure that the system works well on clients’ accounts.

Comments