The hottest investment today is a cryptocurrency, and it has overgrown to be adopted by the mainstream. Cryptos, including Bitcoin, were relatively unknown in 2012. This industry has since flourished to be worth more than $2 trillion. Cryptocurrency value surged suddenly and rapidly, creating considerable wealth for early investors. Because of this, there is an enduring interest in finding the next crypto unicorn and investing in it.

There are currently more than 11,000 cryptocurrencies available on the market. The world immersed in the digital realm as a result of Covid-19 has been investing in technologies that serve as a bridge between the blockchain universe. Our society is maybe even more profitable than trying to guess when Bitcoin or Ethereum will spike. Innovation companies are also working diligently to bridge the gap between both worlds.

So, let’s dive into the top three crypto stocks to watch in 2022.

What are cryptocurrency stocks?

Crypto is a form of electronic payment that does not require a bank to verify transactions. It is a peer-to-peer system that makes it possible for anyone to send and receive payments anywhere.

A cryptocurrency payment is merely an entry in an online database that describes the details of a specific transaction. Cryptos are not exchangeable and do not exist in physical form. Instead, transactions on crypto ledgers have records when transferring cryptocurrency funds. Digital wallets hold these funds.

As the name implies, cryptocurrencies use encryption to verify transactions. Cryptocurrency data must be stored and transmitted using advanced coding between wallets and the public ledger. The goal of encryption is to protect the data.

Today, BTC remains the most famous crypto, founded in 2009. The primary reason for cryptocurrencies’ interest is to trade for profit. As a result, speculators drive their prices to sky-high levels at times.

How to buy cryptocurrency stocks?

A great way to gain exposure to crypto is to own stock in companies with financial stakes in cryptocurrency or blockchain.

However, investments in individual stocks can carry the same risks as cryptocurrency investments. Therefore, investors should invest in diversified index funds or exchange-traded funds with a proven track record of long-term value growth rather than picking and investing in individual stocks.

As an example, Tesla, which holds over a billion dollars in Bitcoin and has previously accepted Bitcoin payments — is included in any tracker of the S&P 500 index. The company has become one of the most valuable and influential in the index since its inclusion in 2020. ARK Fintech Innovation ETF owns Coinbase, the only cryptocurrency exchange-traded on the open market.

Top three cryptocurrency stocks to buy in 2022

A crypto investor could certainly invest themselves, perhaps by buying a few different cryptocurrencies in small amounts. Following those guidelines, here are some of the leading cryptocurrency stocks to look at:

No. 1. Block Inc. (SQ)

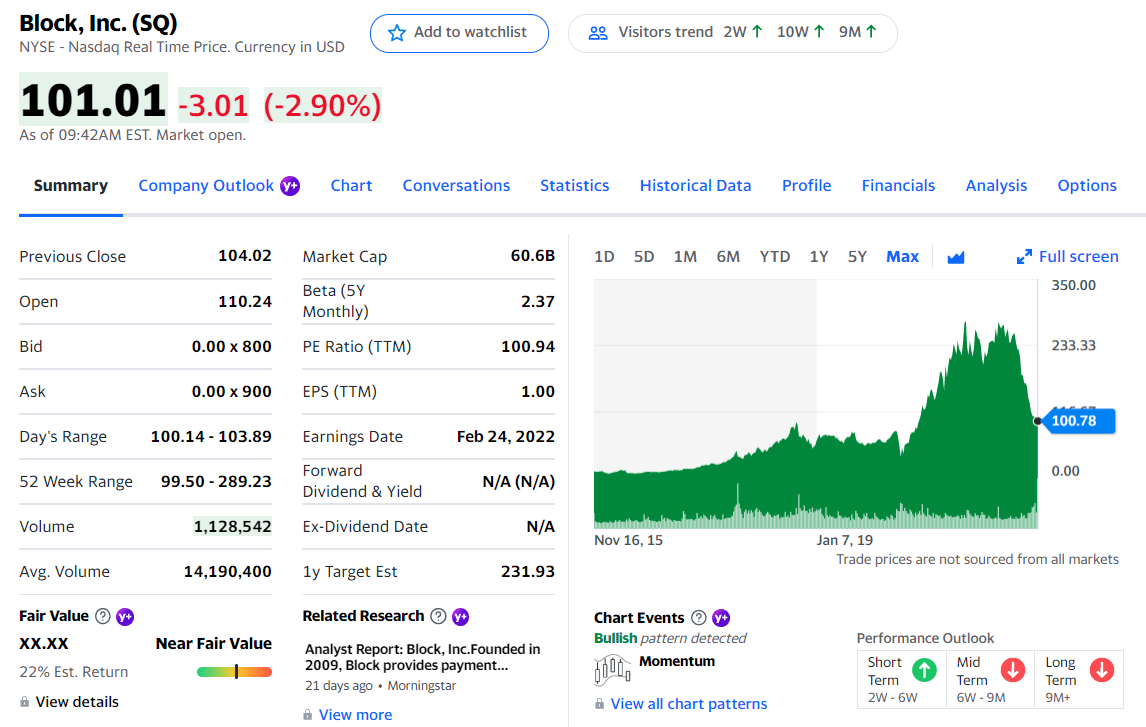

Price: $101.01

EPS: $1.00

Market cap: 64.155B

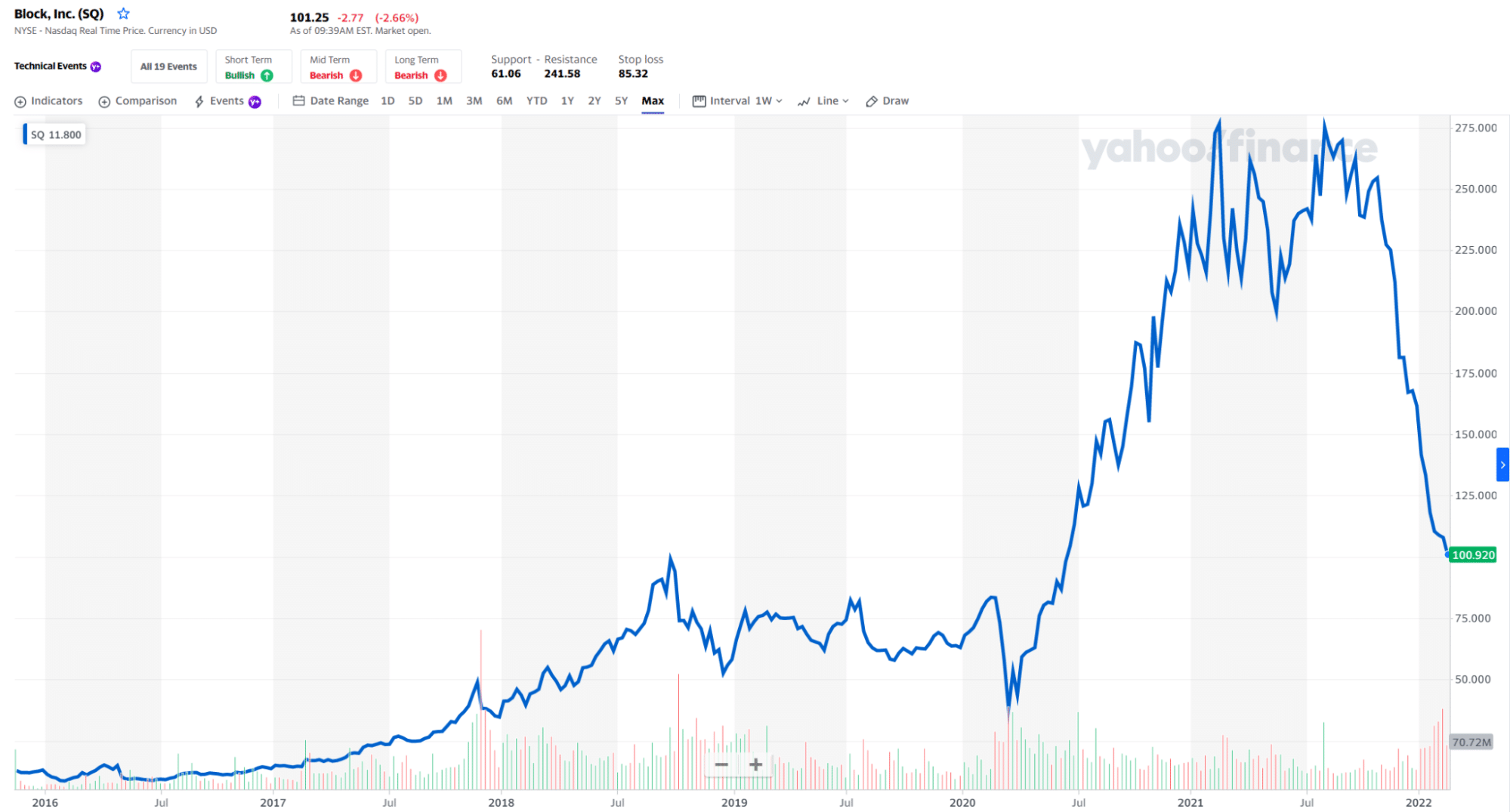

SQ price chart 2016-2022

Block Inc., formerly known as Square, offers a range of products and services designed to empower audiences economically. Block’s business includes Cash App, which is an app that makes it easy to accept payments for businesses. Another segment is Spiral, which provides open-source Bitcoin software. Then there’s Tidal, a global streaming music service. Lastly, TBD is a decentralized peer-to-peer crypto exchange.

In Jack Dorsey’s view, Bitcoin is the currency of the internet, and that’s why the CEO of Block wants to make the world’s most popular cryptocurrency his currency. Investing in Block allows investors to invest their dollars into a company whose executives strive to strengthen the crypto community. According to Block, Bitcoin revenue in the third quarter of 2021 reached $1.81 billion, up 11% from last year.

SQ stock summary

Top three holdings:

- BlackRock Inc.

- Price T Rowe Associations Inc.

- Sands Capital Management, LLC

No. 2. Canaan Inc. (CAN)

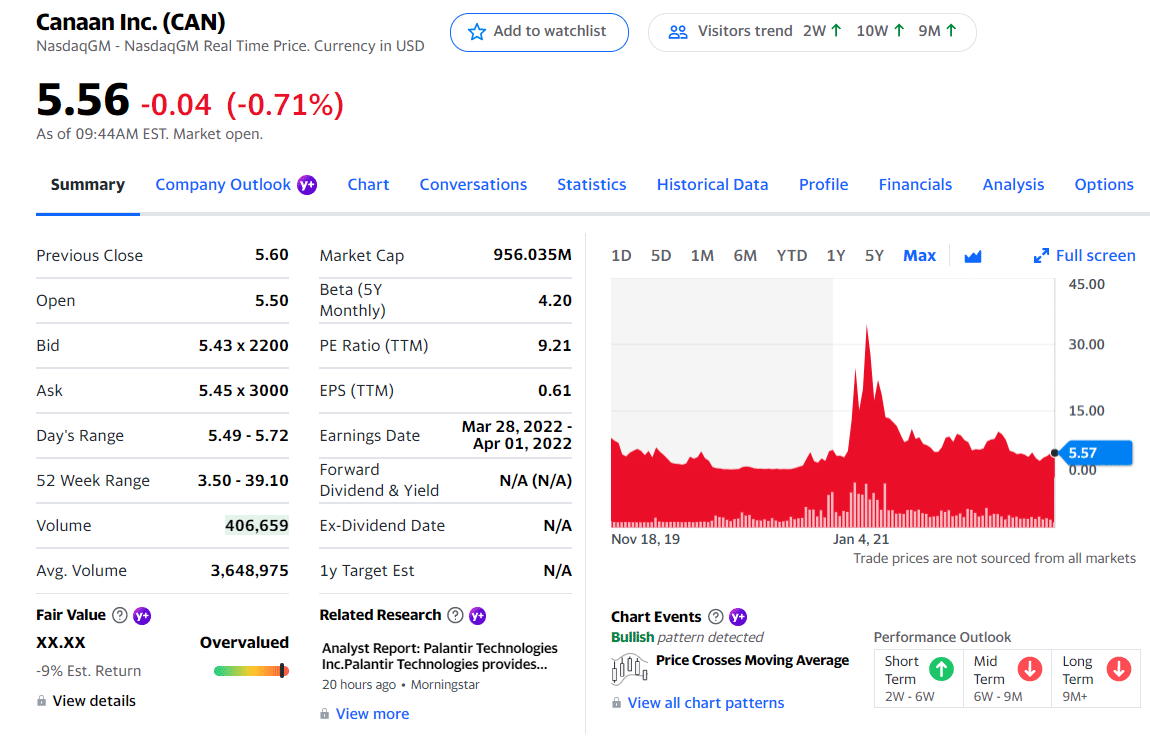

Price: $5.56

EPS: $0.61

Market cap: 923.738B

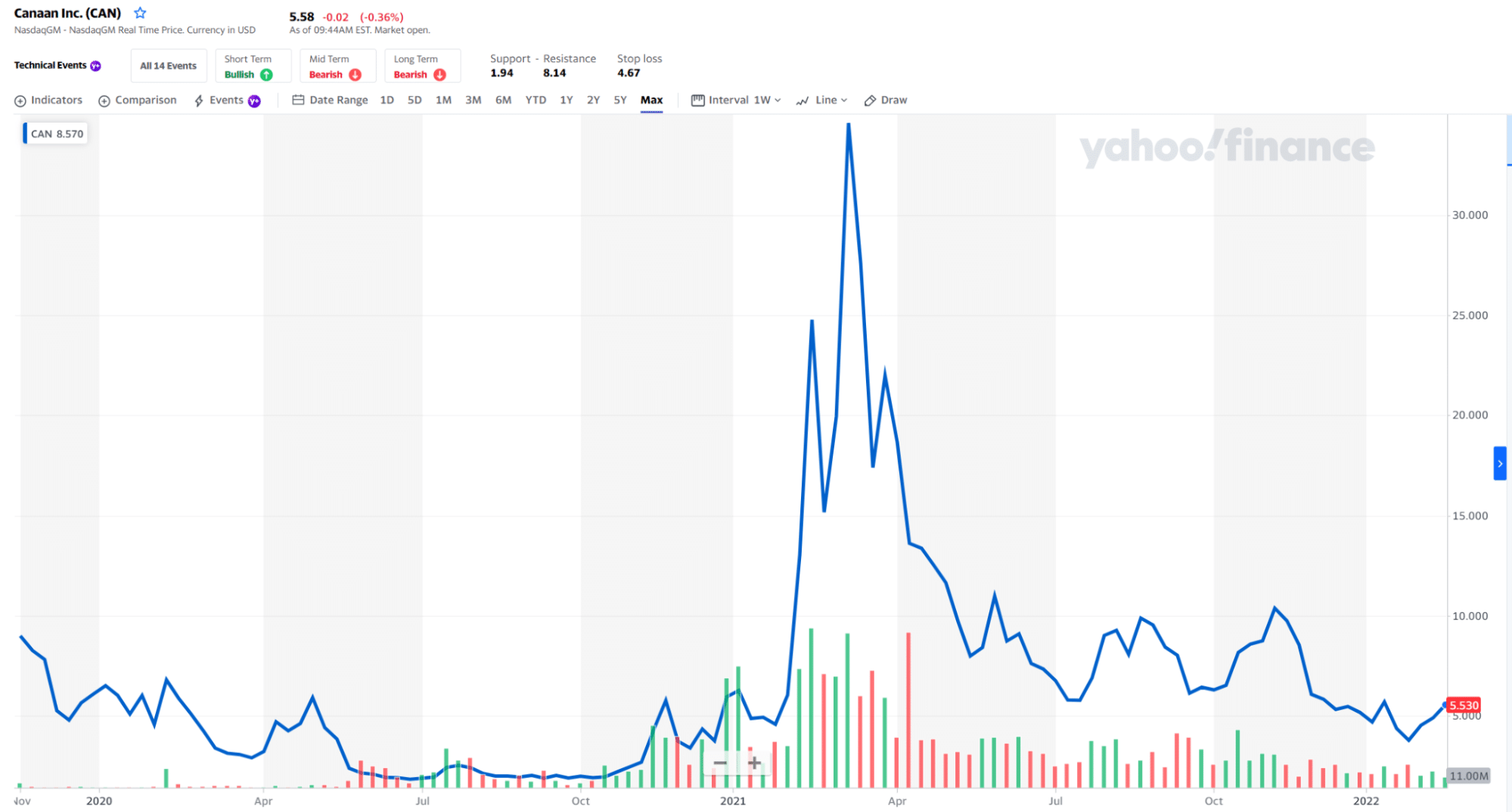

CAN price chart 2020-2022

As one of the few companies that market Bitcoin mining machines, Canaan Inc. (CAN) is a leading player in the sector; Canaan announced on December 15 that Genesis Digital Assets Limited had ordered 30,000 Avalon Bitcoin mining machines from the company.

As part of the original contract, the company received 20,000 machines with an option to add another 182,000. Canaan Inc. will deliver the machines in the first quarter of 2022.

The company has also increased its investment in mining itself and sales of coin mining machines. CAN stock climbed over 4% after it announced that it had made deals with multiple companies in Kazakhstan for joint mining business, utilizing 10,000 machines at first.

CAN stock summary

Top three holdings:

- Vanguard Group Inc.

- Torso Investments, LLC

- Ariose Capital Management LTD

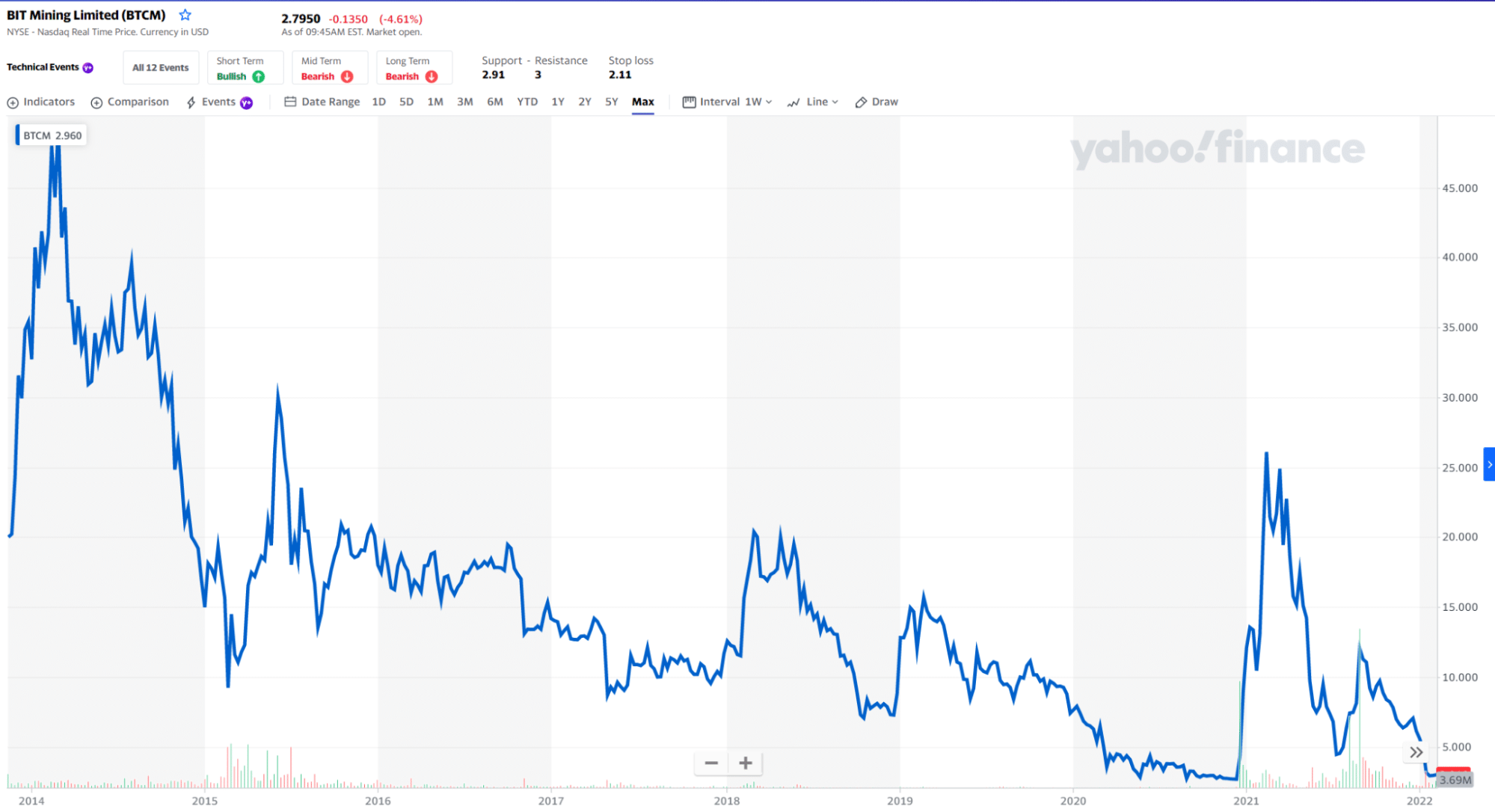

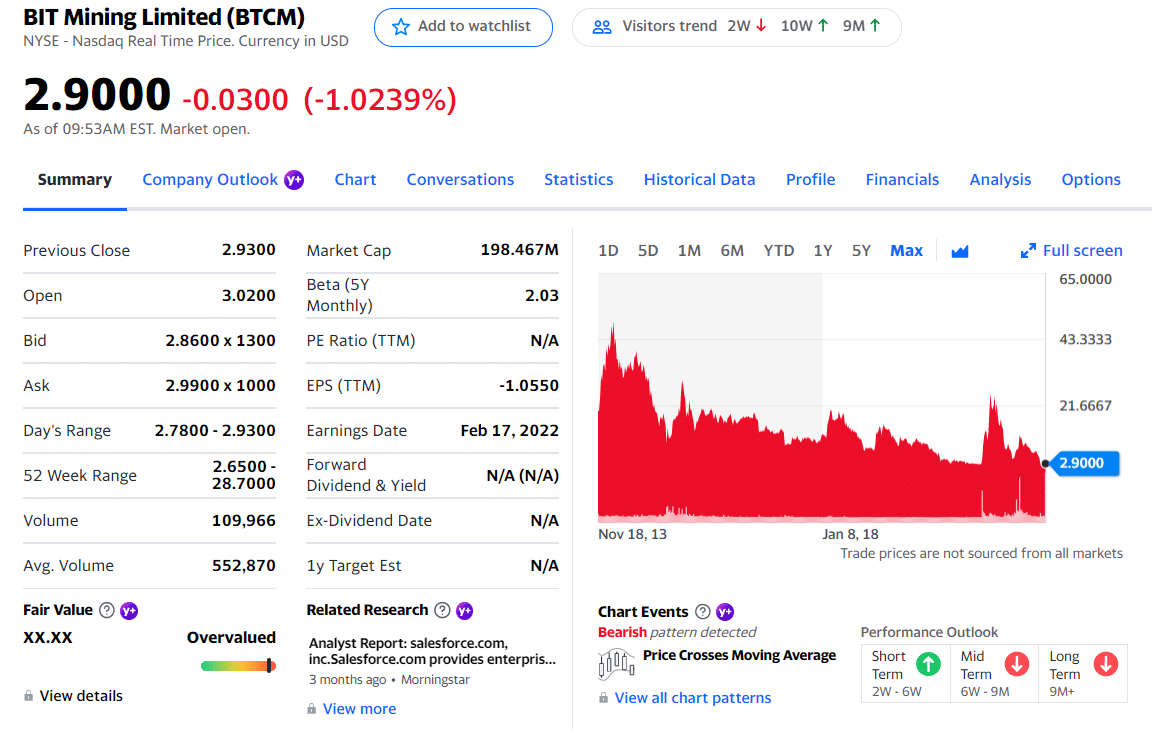

No. 3. BIT Mining Limited (BTCM)

Price: $2.9800

EPS: $-1.0550

Market cap: 223.603B

BTCM price chart 2014-2022

Bit Mining Limited (NYSE: BTCM) has gotten rid of non-crypto assets and is now trying to establish itself in the challenging Chinese market by using crypto coins.

Mining company BIT Mining Limited (NYSE: BTCM) holds thousands of Bitcoin and Ethereum. The company also contains more than 61 million Dogecoin. This year, the company plans to produce tens of millions of digital coins. BIT Mining Limited (NYSE: BTCM) recently acquired Bitcoin mining machines worth over $6 million for this purpose and increased its stake in an Ohio crypto mining site.

As a result of the crackdown against cryptos in the Chinese market, BIT Mining Limited (NYSE: BTCM) has relocated operations overseas. Additionally, the company has operations in Texas and Kazakhstan. According to Insider Monkey, the hedge funds that own BIT Mining Limited (NYSE: BTCM) own a stake worth $32 million.

BTCM stock summary

Top three holdings:

- SC China Holding LTD

- LVW Advisors, LLC

- Hudson Bay Capital Management LP

Final thoughts

Cryptocurrency stocks’ most significant benefit is that they are not pure plays on the industry — providing investors with adequate diversification. Companies exposed to the crypto sector will often experience wild swings in revenue and earnings due to currency fluctuations. However, cryptocurrency is becoming increasingly mainstream.

US second-largest mortgage lender, United Wholesale Mortgage (UWMC), will begin accepting Bitcoin as mortgage payments in August 2022. In addition, Crypto stocks will continue to gain momentum as more companies join the blockchain revolution.

Comments