The Consumer Price Index reported that prices rose 0.6% in January, pushing annual inflation to 7.5%. High oil prices, robust end-market demand, underperforming supply chains, and rising wages contributed to higher costs for consumers and producers alike.

A high-dividend company typically has a cyclical business model that holds up well when prices rise. For example, the oil and gas industry, wood products, food inputs, and consumer staples industries benefit from strong pricing and cost management. This cost management allows them to raise prices, maintain demand, and maximize profits.

Further, the Federal Reserve intends to raise interest rates several times in 2022 to counter inflation. It bodes well for banks that offer significant dividends and derive revenue from interest payments. As inflation is unlikely to subside anytime soon, here are three stocks to consider buying in favorable sectors to protect against inflation.

What are inflation stocks?

Several studies have examined how inflation affects stock returns. However, their results are often contradictory. A historical analysis of returns during high and low inflation periods can clarify investors.

Nevertheless, most researchers have found that higher inflation correlates with lower equity valuations.

Since the 1930s, research suggests that most countries’ actual returns were lower during inflationary periods. The real return is the nominal return minus inflation. The highest actual returns occur when inflation is between 2% and 3% when S&P 500 returns are examined by decade and adjusted for inflation. The same is true in emerging countries, where stocks tend to be more volatile than in developed markets.

This inflation range tends to signal a macroeconomic environment in the US where more significant issues are present and have varying impacts on the stock market. Therefore, investing in an inflationary environment and knowing how to invest is perhaps more important than the actual returns.

How to buy inflation stocks?

There is a reasonable chance that stocks can keep pace with inflation, but not all equities can achieve this. Moreover, when inflation rises, stocks paying high dividends tend to lose value like bonds paying fixed rates. Therefore, it is prudent to invest in companies that can pass on rising input costs to consumers, such as those in the consumer staples sector.

Because Americans import oil and buy it in dollars, oil is expensive in the US. If politicians print millions of dollars and the oil stays the same, oil prices will rise.

As printing money does not create wealth, a result of $1 trillion of stimulus and a continued lack of macroeconomic understanding may well be $4 gas coast to coast. Additionally, LIFO accounting gives oil companies a significant inflation tax boost. In the energy sector, interest rates have little impact.

Due to the significant changes in interest rates and inflation in the 1970s, banks have generally shifted lending to variable rates. In contrast, deposit accounts usually have paid zero, which customers are used to.

Inflation tends to correlate with short-term interest rates, compensating the banks. In addition, most banks have low PE multiples, so investors don’t have to wait too long for a pool of cash flow that banks can reinvest at higher rates.

Top three inflation stocks to buy in 2022

Three stocks are defying the downward pull of inflation.

No. 1. Caterpillar Inc. (CAT)

Price: $199.28

EPS: $11.83

Market cap: 110.129B

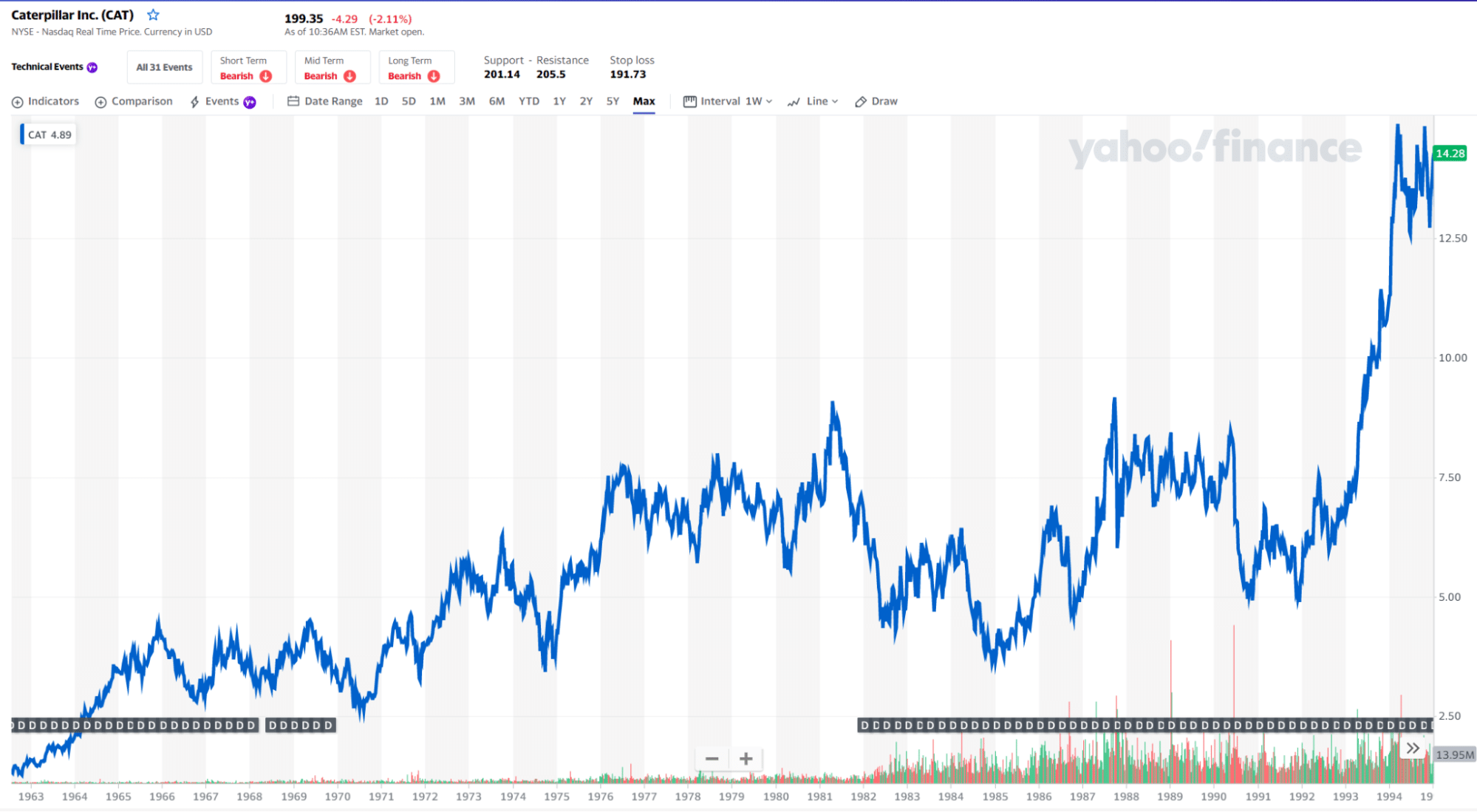

Caterpillar price chart 1963-2022

Caterpillar had an earnings blowout in its last quarter, which proves inflation isn’t hampering customer demand. The company’s latest earnings report reported a profit of $2.69 a share, beating expectations of $2.27, and sales of $13.8 billion, exceeding expectations of $12.6 billion.

According to Credit Suisse, the EPS number beat expectations by 17%, an impressive feat considering aggregate S&P 500 EPS beat estimates by less than 6% for the fourth quarter. The result was due to high prices. The company management informed analysts that pricing increased in the third and fourth quarters of 2021. Stocks are down 1.5% year to date, while the S&P 500 is off 5.1%.

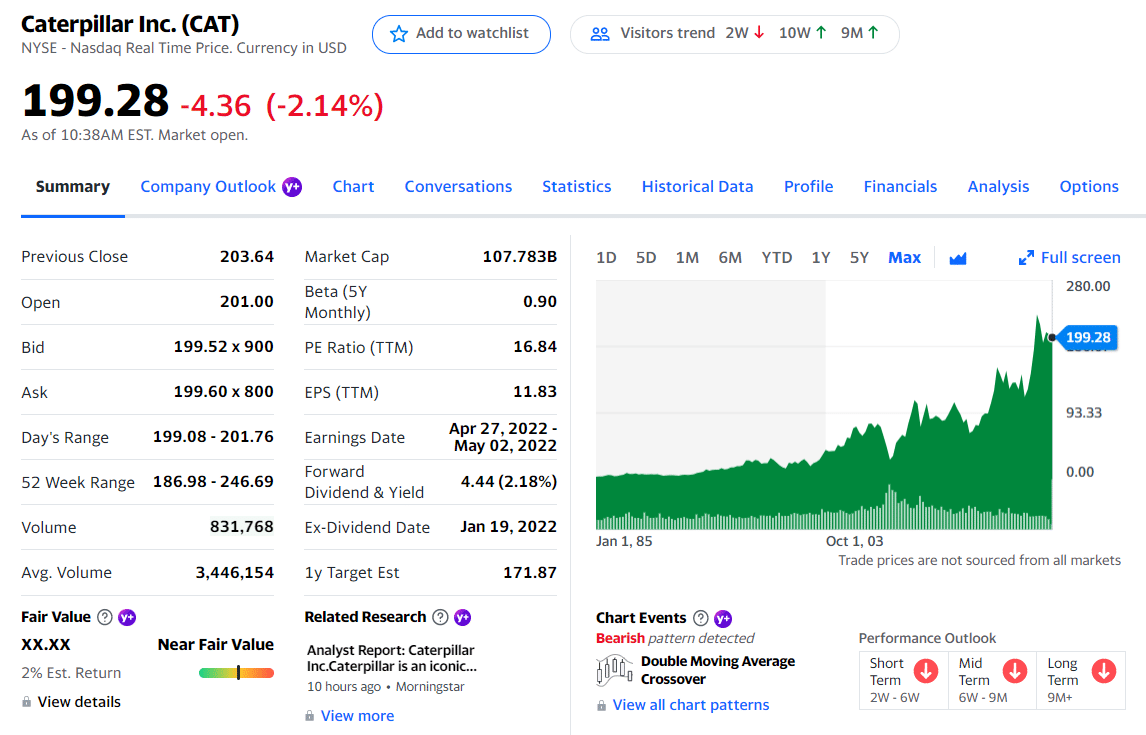

CAT stock summary

Top three holdings:

- State Farm Mutual Automobile Insurance Co

- BlackRock Inc.

- Bill & Melinda Gates Foundation Trust

No. 2. CNH Industrial (CNHI)

Price: $16.01

EPS: $1.27

Market cap: 21.114B

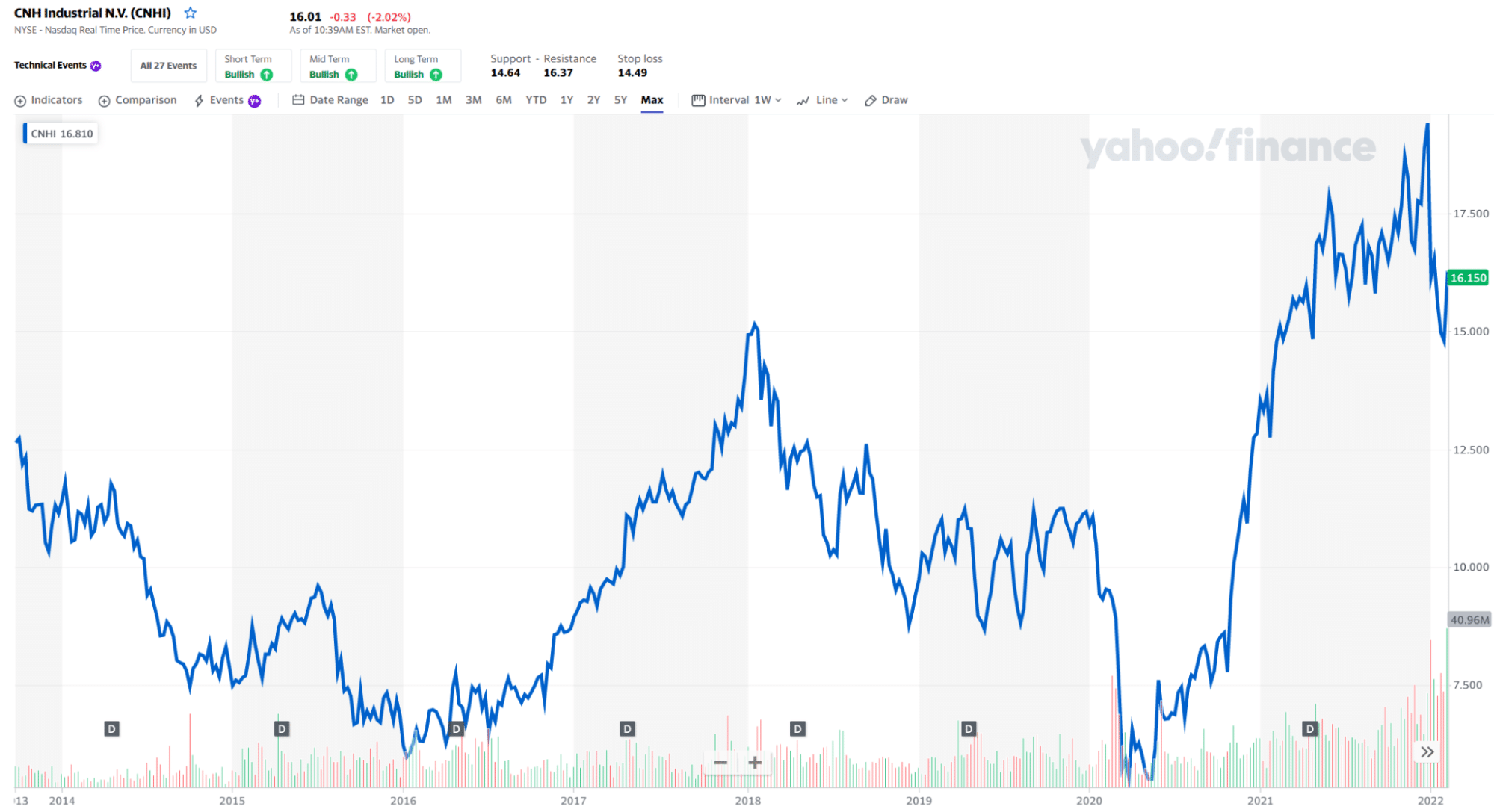

CNHI price chart 2013-2022

CNHI, which makes farm equipment, surpassed profit estimates by 19%. It reported a profit of 25 cents a share, above expectations of 21 cents, on sales of $9 billion, compared to $8 billion. Again, the company attributed the blowout to higher prices on its earnings call, particularly in North America. The share price has declined 0.7% so far this year.

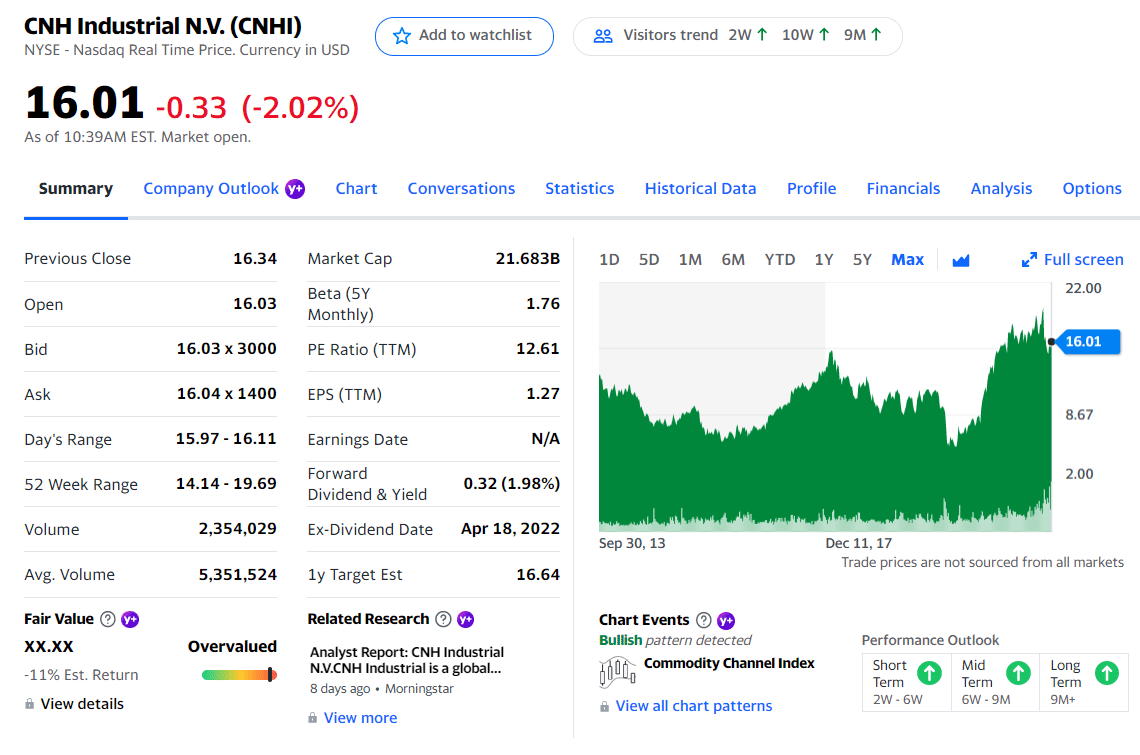

CNHI stock summary

Top three holdings:

- Harris Associates LP

- Amundi Asset Management US, Inc.

- Hotchkis & Wiley Capital Management LLC

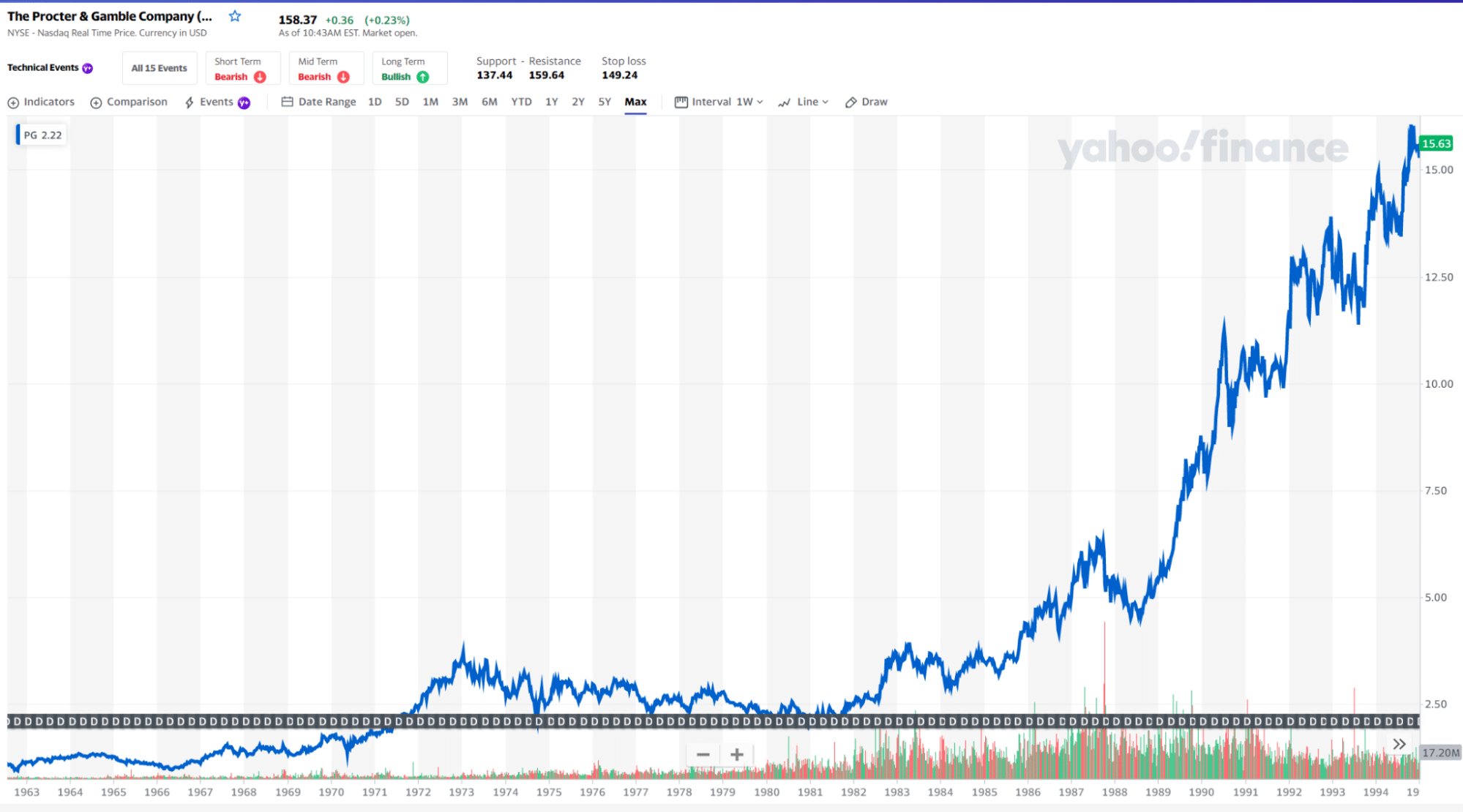

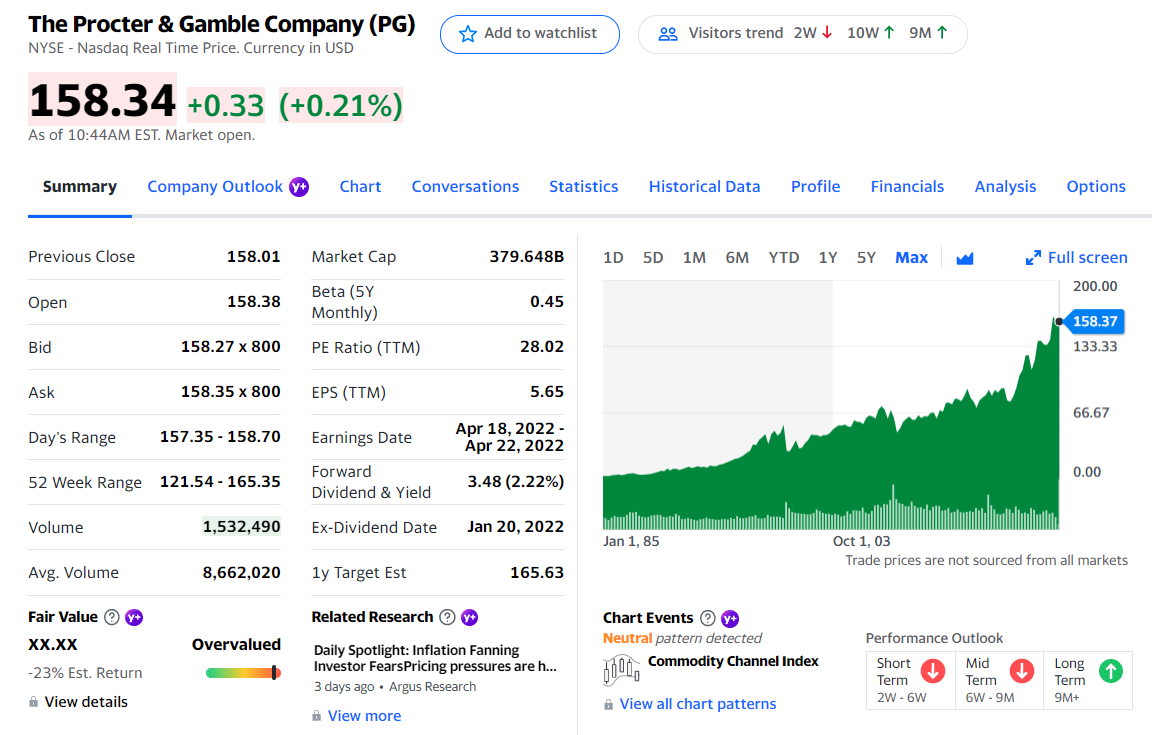

No. 3. Procter & Gamble (PG)

Price: $158.34

EPS: $5.65

Market cap: 377.16B

PG price chart 1963-2022

PG beat earnings expectations. As reported by the company, a profit of $1.66 a share, topping estimates of $1.65 a share, and sales of $21 billion were above expectations. Additionally, the company reported that it would raise prices across a range of products throughout this year, which will lead to higher earnings. The stock is down 3.5% this year.

PG stock summary

Top three holdings:

- Vanguard Group Inc.

- BlackRock Inc.

- Wellington Management Group LLP

Final thoughts

Traditional views of the stock market have been that it serves as a hedge against inflation. The best way for investors to protect against inflation is to invest in companies with pricing power, which means they can quickly raise their prices when costs rise and sometimes add to their profit margins.

The US supply chain and inflationary pressures impact the merits of anything from cars to clothing, threatening profits at companies that cannot pass on these costs to customers quickly. The prices of growth stocks remain historically high, but inflation fears could create opportunities for investors.

As a result of inflation, growth stocks would also become less valuable. High-multiple growth stocks could be affected by the fear that rising costs could decrease their earnings power.

Comments