According to Ken Hevert, the top brass at Fidelity Investment, a retirement life full of comfort does not just happen. Instead, it is a series of accumulated decisions and behaviors over an individual’s working life. To him, it all starts with the most critical of all these decisions, committing a defined amount to retirement savings with regular remittances.

What other considerations then act as a support system to this crucial decision of retirement saving to ensure steady passive income for a whole well of cash down the road?

By the end of this guide, you will have a better understanding of:

- Why is an understanding of your retirement expenses critical?

- What role does the time horizon play in retirement planning?

- How and what to invest in for retirement income?

- What is the after-tax rate of returns?

- How does debt downsizing impact retirement income?

Understanding retirement expenses

Statistics show that people are living longer and retirees are after a fulfilling and comfortable life. Unfortunately, the cost of living from year to year is on an upward trajectory. The assumption that on retirement, the spending goes down by 30% to 20% is a fallacy, especially if full mortgage settlement is a way off, unanticipated medical expenses occur, and the ever-present bucket list demands.

As a rule of thumb, the more the anticipated expenditure, the more the savings requirements. Thus, an accurate forecast of retirement expenses informs the retirement accounts to hold and their corresponding investments. It also reports on the withdrawal requirements, how often, and how much per withdrawal.

According to Alex Whitehouse, Vancouver‘s Whitehouse Wealth Management advocates for the factoring of all retirement eventualities. It means ensuring early estimates of early retirement activities with specificities, having what-if retirement medical costs in mind, and accounting for unexpected retirement living expenses.

Time horizon

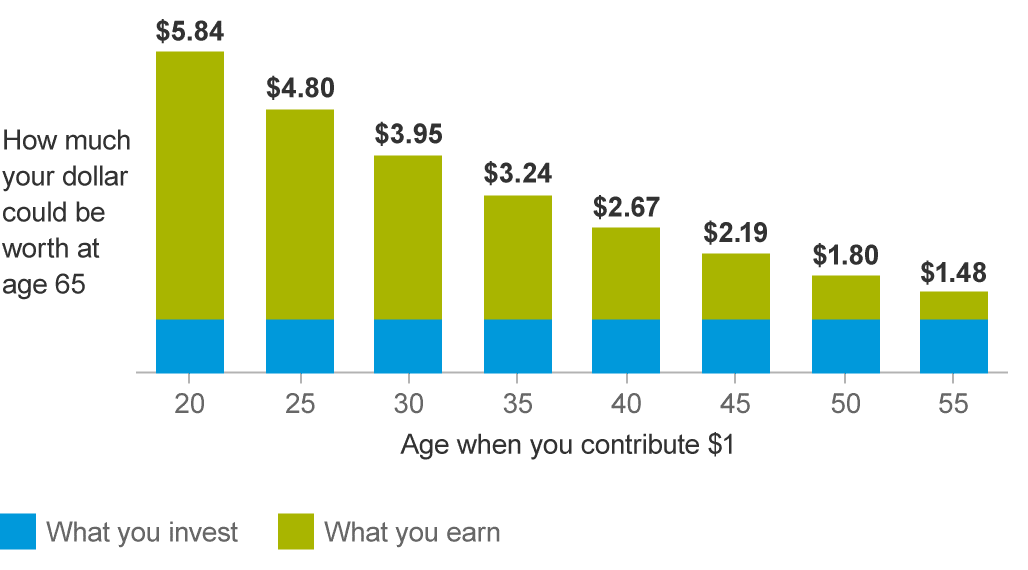

Retirement investment considerations change as one nears retiring. Time horizon refers to the period between now and the point of retiring. Why should this be a bother? The time remaining to retirement living informs the type of assets to invest in and portfolio management strategies.

For example, stocks are high volatility investment instruments, but traditionally, they have proved to perform better than “safe-haven” assets such as bonds. As such, if you have 20 plus years of retirement, bonds would be an excellent addition to your portfolio, unlike someone who has only 5 or 10 years to retirement.

Inflation rates also tend to rise year on year. Your portfolio management strategy must ensure that the net return value at the point of withdrawal retains purchasing power. It provides settling of forecasted retirement expenses hassle-free. The trick categorizes different retirement expenses and their time horizons and then apportioning retirement savings to investment assets that ensure costs are met fully.

How and what to invest in for retirement

It matters not whether you make the investment decision on your retirement accounts or have a portfolio manager. So the balanced portfolio addressing both income goals and risk aversion is a must. In addition, as an investor planning for retirement life, you need to understand investment instruments that ensure you don’t lose all your money.

Retirement investment should be long-term in nature. It means refraining from micromanaging long-term investment instruments and allowing for their market cycles to run their due course as long as in the long-term the portfolio results in the targeted returns. Understanding necessary and luxurious risks are of utmost importance to ensure that retirement accounts management is acceptable.

Portfolio diversification also ensures a balanced retirement portfolio well-cushioned against unprecedented market downturns. Therefore, investing in diverse investment assets provides retirement investment risk management.

After-tax rate of return

Realistically, having an investment asset that results in more than 10% return on investment is next to impossible, and this is pre-tax. For retirement income, the allowable investment instruments comprise long-term investments attracting low-risks. Having an idea of the retirement expense forecasts, the retirement time horizon, and what to invest in provides an accurate assessment of return rate requirements.

For example, if all annual expenses in retirement amount to $45,000, the return rate requirements for an investment account of $500,000 would be a 9%-an unrealistic expectation.

Understanding the tax bracket on retirement and the required return rates allows for a more realistic investment plan-start investing early enough to ensure the retirement accounts support the preferred retirement life.

Debt downsizing

The beauty of retirement life is hassle-free living full of bliss and forfeited activities during working life. However, this is not possible on retirement income when a big chunk of it settles debts. An ideal situation is a retirement life with all loans, including mortgages, in the past. Such considerations ensure that retirement income finances a blissful and leisurely existence rather than pay for interests and loan repayments. Therefore, it is prudent to sacrifice and clear all debts and pay off all credit cards and pay via cash or debit cards for golden retirement life.

Summary

The average lifespan after retirement is 20 years. These are years of doing all the things not done or sacrificed along the way to retiring. They can also be the most productive years of your life but only with the right retirement plan. Blissful retirement life isn’t luck but a result of careful considerations and sound decisions.

Comments