In the year 2020, most of the global indices were seen in green and in their best position they could be. And if you are a trader, you should have seen many strategies recommending you to always go long in Indices, especially NAS100, US30, and S&P 500.

In March 2020, WHO announced Covid-19 as a global pandemic, and just in no time, most of the indices were in red, shredding anywhere between 25%-30% of their price. But to everyone’s surprise, these indices started covering their losses and eventually came back to their current price in a matter of two months.

This was the time to buy more stocks to average the ones bought at higher prices, known as Buying the Dip. These are frequently occurring due to news and major events, and you must know how to apply them in your investing carrier.

How does Dip Market strategy work?

US100 4hr chart

Buying the dip is a simpler term for buying the stock, indices, or any financial asset once its price has fallen. Prices of any asset go in a waveform, but most of the time, the lower trading price is the pullback that does not require a long time to recover.

In this case, it can be called a Dip for a day trading, meaning a dip doesn’t have a fixed value attached to it. Even a 1% fall in the price can also be considered a dip. A short-term investor may call a 10% fall a dip, while a long-term investor can be 20%.

The reason behind the Buying the Dip strategy

When an asset price follows a trend, it tends to go in the same direction for a long time. For example, if an asset moves in an uptrend, it comes down for a pullback and then again goes up, filling up the market orders. However, there are risks when the trend starts to change.

There are a few reasons why the buy the dip strategy works, and why it is famous at certain times, we have mentioned a few of them below:

-

Central bank stimulus

It is good for stock trading when the central bank prints more money as more money floating around means the value of a currency starts trading down. This is the time when traders use buying the sip strategy by waiting for the overall market to come up.

-

Market stimulus

It is like a central bank stimulus. Lower corporate taxes or a decrease in consumer taxes could be one of the examples of market stimulus as a reduction in taxes means there is more money to spend or invest, ultimately pushing the stock prices higher. Many traders buy the dip here because they understand that the uptrend is backed up by news and could drive more prices.

-

Mean reversion

It is how to average the price used to buy an asset. This is one of the main reasons traders do it. Let’s say you purchased ten shares at $20 each, which means you invested $200. If there is a price drop of $10 in the shares, you will buy ten more shares at $10 each and average the total to $15 per share.

How to use the Buy the Dip market strategy?

The first and most important thing is to understand that BTD is not a strategy but a catchline, and it becomes a strategy when an individual sets some rules or protocols on how to trade a dip.

So, you may use any strategy already available in the market or make your own. The best-recommended strategy is to trade using price action or combine it with indicators.

Rules to follow while trading through BTD strategy:

- Analyze the trend as you do not want to go against the trend and end up in a loss.

- When the market is in an uptrend, look for higher highs and higher lows formation and take the trade after the end pullback.

- Price should not break the higher low instead shows some reactions after making the swing low.

- Apply 20 and 30 moving average (MA) and wait for the 20MA crossing the 50MA moving up.

- Buy the dip where the price action and moving average shows confluence.

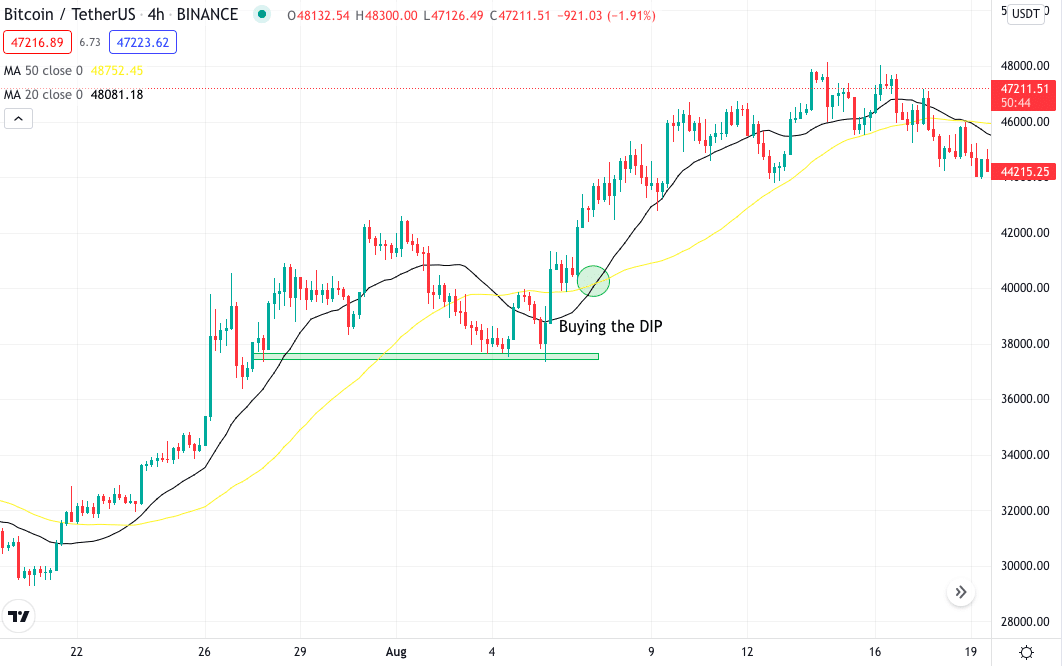

BTC/USDT 4hr chart

The above chart is an example of buying a dip. Here we have BTC/USDT 4hr chart that shows the market moving in an uptrend. We have a golden crossover of 20 and 50 MAs. According to the price action, the price came down to a major support zone, and the golden cross could be seen giving a better buy trade confirmation.

You will buy the position and let the trade run further. It is always better to buy the dip and leave for long, meaning at least go for a swing trade if not long-term.

How to manage your risk when Buying the Dip?

Buying the dip is not as easy as it sounds. No one knows how the market could perform, especially when there is news or event. Buying the dip can sometimes lead to a tremendous loss because sometimes it can be a reversal, and you purchased the asset when it is starting to go down.

The best practice is to put your stop loss at the major support zone. Look for a higher frame, say daily, for the trend confirmation and then 4hr for price movement.

You must never trade just because the asset price is falling; you need extra confirmation from price action and the indicator you are using. Also, never enter the trade if there is no clear sign of the market trend.

Pros and cons

Unfortunately, the strategy has more disadvantages than advantages, but it depends on the individual thought process and trading style.

| Pros | Cons |

| Lock in a lower average cost for your shares of a particular asset. | Extremely difficult to predict in advance, especially when it comes to magnitude. |

| May create psychological comfort to know you didn’t buy “at the top.” | No guarantee the asset recovers if the underlying business is damaged. |

| May miss out on further gains if the asset doesn’t drop as expected. |

Final thoughts

Buying the dip is an investment strategy that predicts future price movement. If you can time the market — purchase shares at a low price just before they gain value — you can earn a clean profit. However, timing the market can be difficult, and you’re just as likely to buy shares that continue to fall rather than shares experiencing a temporary dip in price.

If you’re confident in your abilities as an investor, trying to buy the dip can be worth the effort. Still, a more straightforward, more long-term strategy like dollar-cost averaging is likely to be better for most investors.

Comments