Breaking Equity is a highly regarded trading platform that offers traders a range of powerful tools and resources to help them optimize their investment returns. With features such as technical indicators, automation, backtesting, and educational resources, Breaking Equity provides traders with the flexibility and knowledge they need to succeed in the markets. In this review, we will take a closer look at the platform’s key features, user interface, trading tools, and educational resources to provide traders with an in-depth evaluation of what Breaking Equity has to offer. Whether you’re a beginner or an experienced trader, Breaking Equity has something to offer for traders of all levels.

Features

Breaking Equity’s key features are designed to help traders optimize their investment returns and make informed decisions in the markets. Some of the platform’s key features include:

- Technical Indicators: Breaking Equity offers a wide range of technical indicators that can be added to trading charts. These indicators include moving averages, oscillators, and trend lines.

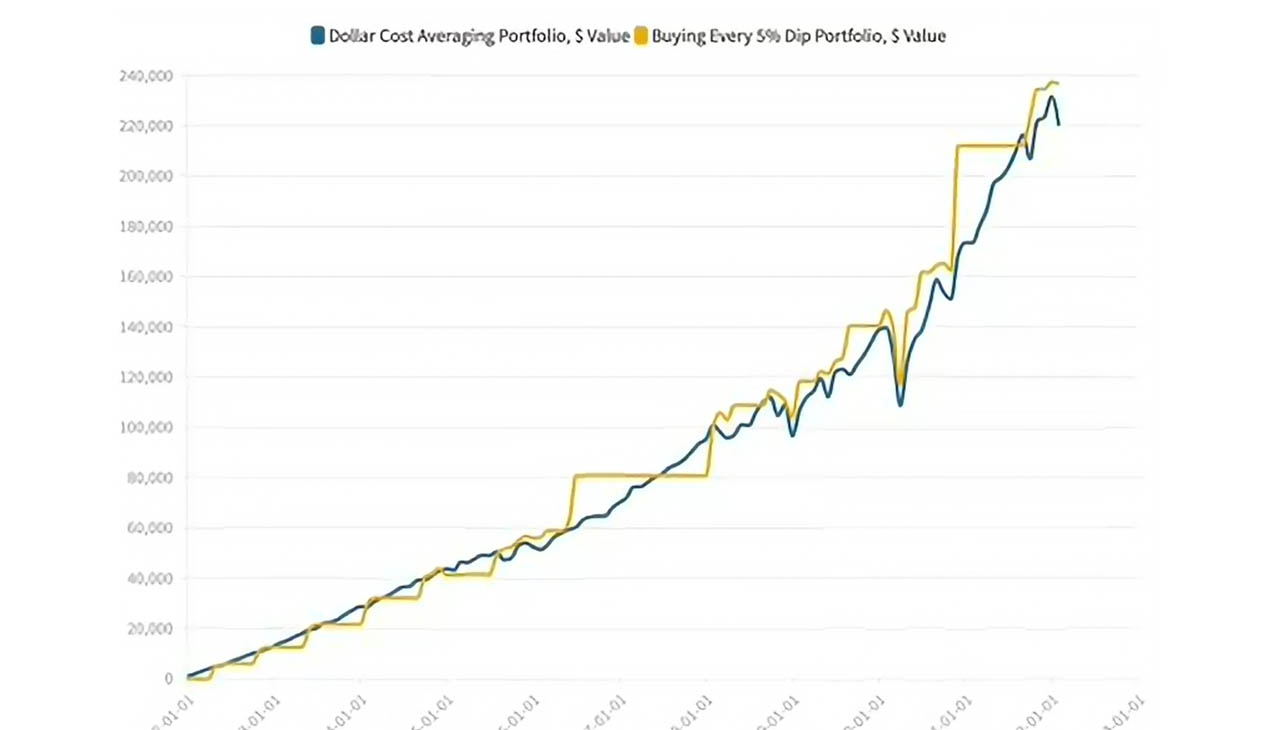

- Backtesting: Traders can backtest their trading strategies using historical data to see how they would have performed in the past. This can help traders identify potential flaws in their strategies before applying them in real-time trading.

- Automation: Breaking Equity’s automated trading feature allows traders to set up rules-based strategies that can be executed automatically. This can help traders save time and reduce the risk of errors caused by human emotions.

- Educational Resources: Breaking Equity provides traders with a range of educational resources, including articles, videos, webinars, and community forums. These resources are designed to help traders develop their skills and stay up-to-date with market trends.

- Customization Options: The platform’s user interface is highly customizable, allowing traders to create bespoke trading environments that suit their individual needs and investment strategies.

Overall, Breaking Equity’s key features provide traders with powerful tools for optimizing their investment returns. By utilizing the platform’s technical indicators, automation, backtesting, and customization options, traders can gain valuable insights into market trends and make more informed investment decisions.

Technical indicators

Breaking Equity’s technical indicators are a key feature of the platform, providing traders with a range of tools to analyze market trends and make informed investment decisions. Some of the technical indicators available on the platform include:

- Moving Averages: A moving average is a trend-following indicator that calculates the average price of a security over a specified period of time. Traders can use moving averages to identify potential entry and exit points for trades.

- Oscillators: Oscillators are indicators that measure the momentum of a security. They can help traders identify overbought or oversold conditions in the markets.

- Trend Lines: Trend lines are lines drawn on a chart that connect two or more price points. They can help traders identify the direction of a trend and potential support and resistance levels.

- Relative Strength Index (RSI): The RSI is a popular oscillator that measures the strength of a security’s price action. It can help traders identify potential reversals in the markets.

- Bollinger Bands: Bollinger Bands are a volatility indicator that consists of three lines drawn on a chart. They can help traders identify potential breakouts and trend reversals.

Overall, Breaking Equity’s technical indicators provide traders with a powerful set of tools for analyzing market trends and making informed investment decisions. By utilizing these indicators, traders can gain valuable insights into market trends and optimize their investment returns.

Backtesting

Backtesting is a crucial feature of Breaking Equity’s platform, allowing traders to test their trading strategies using historical data to see how they would have performed in the past. The platform’s backtesting feature provides traders with a range of benefits, including:

- Identifying Flaws: Backtesting allows traders to identify potential flaws in their trading strategies before applying them in real-time trading. By analyzing past performance, traders can make adjustments to their strategies to optimize their investment returns.

- Building Confidence: Backtesting can help traders build confidence in their trading strategies by providing evidence of their effectiveness in past market conditions.

- Saving Time: Backtesting can save traders time by allowing them to test multiple strategies simultaneously and quickly identify which ones are most effective.

- Improving Performance: By analyzing past performance, traders can gain valuable insights into market trends and develop more effective trading strategies.

Breaking Equity’s backtesting feature is easy to use and provides traders with a powerful tool for optimizing their investment returns. By utilizing this feature, traders can gain a deeper understanding of market trends and improve their performance in the markets.

Automation

Breaking Equity’s automation feature is a powerful tool for traders who want to execute rules-based trading strategies with minimal intervention. The platform’s automation feature allows traders to set up and execute trades based on specific criteria, such as technical indicators or price movements. Some of the benefits of automation on Breaking Equity’s platform include:

- Saving Time: By automating trades, traders can save time and reduce the risk of errors caused by human emotions.

- Reducing Risk: Automation can help traders reduce the risk of losses caused by emotional decision-making or missed opportunities due to manual trading.

- Improving Accuracy: Automated trading can help improve accuracy by ensuring that trades are executed according to specific rules and criteria.

- Testing Strategies: Automation can also be used to backtest trading strategies and identify potential flaws or areas for improvement.

Overall, Breaking Equity’s automation feature provides traders with a powerful tool for optimizing their investment returns and reducing the risk of losses. By using automation, traders can save time, reduce risk, improve accuracy, and test their trading strategies to optimize their performance in the markets.

Educational resources

Breaking Equity’s educational resources are a valuable feature of the platform, providing traders with a range of tools to develop their skills and stay up-to-date with market trends. Some of the educational resources available on the platform include:

- Articles: The platform provides a range of articles covering various topics related to trading, such as technical analysis, market trends, and risk management.

- Videos: Breaking Equity offers a library of videos covering a wide range of trading-related topics. These videos provide traders with an engaging and interactive way to learn about different trading strategies and market insights.

- Webinars: The platform hosts regular webinars featuring expert traders and market analysts. These webinars provide traders with an opportunity to ask questions and gain valuable insights into market trends and trading strategies.

- Community Forums: Breaking Equity’s community forums allow traders to connect with each other, share insights, and discuss trading strategies. This feature provides traders with a supportive and interactive learning environment.

Overall, Breaking Equity’s educational resources provide traders with a range of tools to develop their skills and stay up-to-date with market trends. By utilizing these resources, traders can gain a deeper understanding of market trends and develop more effective trading strategies to optimize their investment returns.

Customization options

Breaking Equity’s customization options are a key feature of the platform, allowing traders to create bespoke trading environments that suit their individual needs and investment strategies. Some of the customization options available on the platform include:

- User Interface: The platform’s user interface is highly customizable, allowing traders to create personalized trading environments that suit their specific needs. Traders can choose from multiple layout options, customize charting tools, and create their own watchlists.

- Charting Tools: Breaking Equity offers a range of charting tools that can be customized to suit a trader’s individual needs. Traders can add technical indicators, draw trend lines, and save custom chart templates.

- Real-time Data and News Feeds: The platform provides real-time data and news feeds that can be customized to show only the information that is relevant to a trader’s investment strategy.

- Order Execution System: Breaking Equity’s order execution system is highly customizable, allowing traders to set up rules-based orders that are executed automatically based on specific criteria.

Overall, Breaking Equity’s customization options provide traders with a powerful tool for optimizing their investment returns and creating personalized trading environments that suit their individual needs. By utilizing these customization options, traders can gain a deeper understanding of market trends and develop more effective trading strategies to optimize their performance in the markets.

Review

- Technical Indicators – 10

- Backtesting – 8

- Automation – 8

- Educational Resources – 8

- Customization Options – 10

Comments