Bid and ask is a common term in financial market trading, but its significance in making trading decisions is strong. These prices represent a story where investors focus on how buyers and sellers are willing to pay the best rate in their activity. Deep knowledge about the bid and ask price would indicate when to buy and sell, building a profitable trading strategy.

A deep understanding of bid and ask price is needed to make money from FX trading. If you are interested in building a suitable trading method using the bid vs. ask price, the following section is for you.

After completing the whole section, you will implement the bid and ask price in your trading strategy and make money online.

What is the bid vs. ask price?

If we look closely, the global financial market is where worldwide traders come together and buy and sell currency pairs, stocks, or other assets. In that case, the bid and ask price helps to define the best price to buy and sell a trading instrument at a particular price.

The bid price is the highest available price that bulls are willing to pay. On the other hand, the ask price is the lowest available price that sellers are willing to pay. The difference between the bid and ask price is the spread, which is another price indicator for forex traders.

Let’s simplify the term:

- The bid price is the highest price bulls are ready to pay for buying a trading instrument.

- The ask price is the lowest price that bears are ready to pay for selling a trading instrument.

Trading instruments with the bid and ask prices

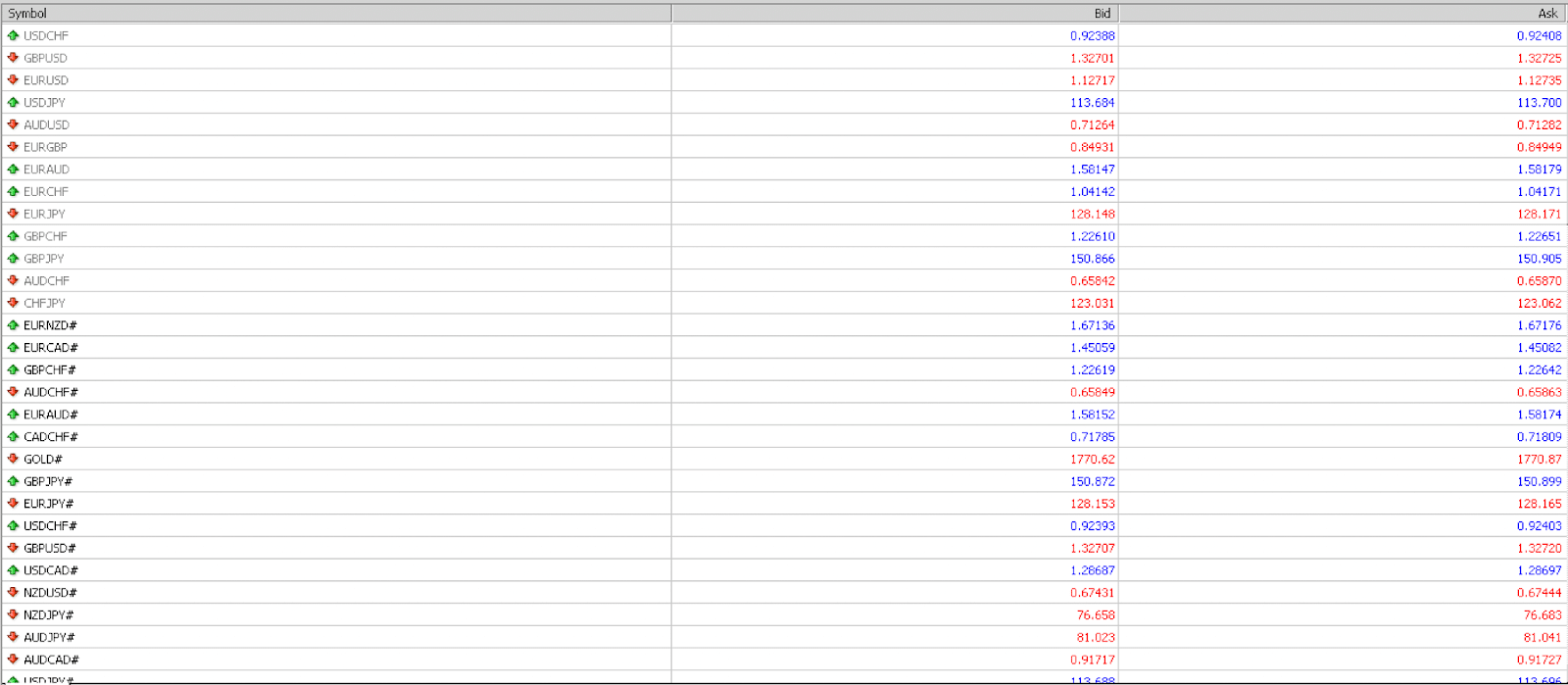

The above image shows the list of trading instruments where the bid and ask prices are shown on the right side. Among the list, the USDCHF has a bid price of 0.92388 and an ask price of 0.92406 if we calculate the difference as a spread of 2 pips.

As per the bid and ask price in the above image, sellers will pay 0.92388 to sell while buyers will pay 0.92406 to buy the trading asset. A decent understanding of the bid and ask price in any trading method would indicate the perfect buying, selling, stop loss, and take profit levels.

How to determine the bid vs. ask price?

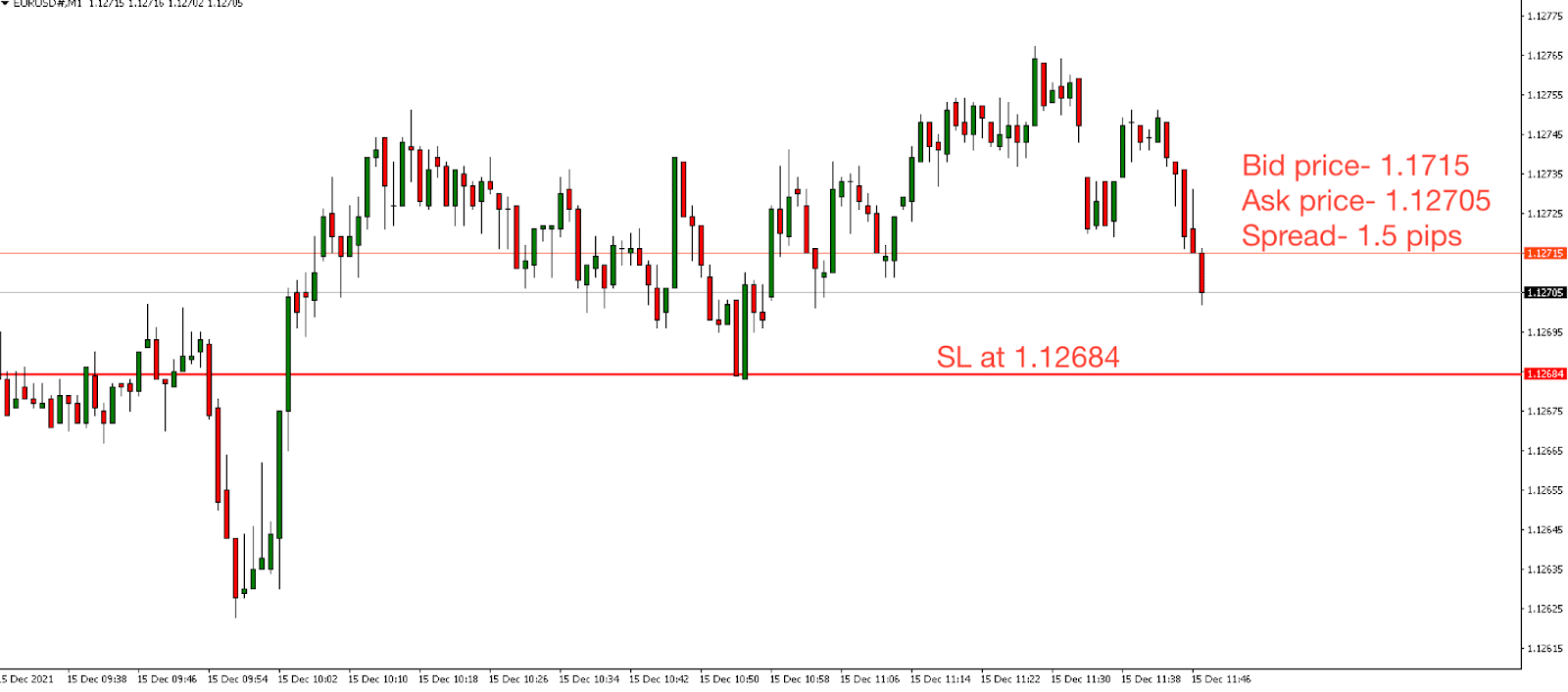

The above image shows that the bid price is vital for buyers while the ask price is essential for sellers. Therefore, traders should consider the bid and ask price in any trading method to precisely determine the trading and SL/TP level.

Let’s see how to include bid vs. ask price in determining trading decisions.

Stop loss

If you are selling a trading instrument, you should set stop loss (SL) and take profits (TP) in every trade. While developing the SL & TP levels, make sure to consider the bid and ask price.

The SL level

As per the above image, the SL is at 1.1284, taking profit levels, while the spread is at 1.5 pips. Therefore, the perfect stop-loss would be the SL+spread (1.12684+1.5 pips= 1.12669).

Take profit

In setting TP levels, you should consider the ask and bid prices. In the above example, 1.12684 would be a TP level for a sell trade or SL level for a buy trade. Add the spread for both setting SL and TP levels if the targeted level is above the current market price.

Bullish trade setup

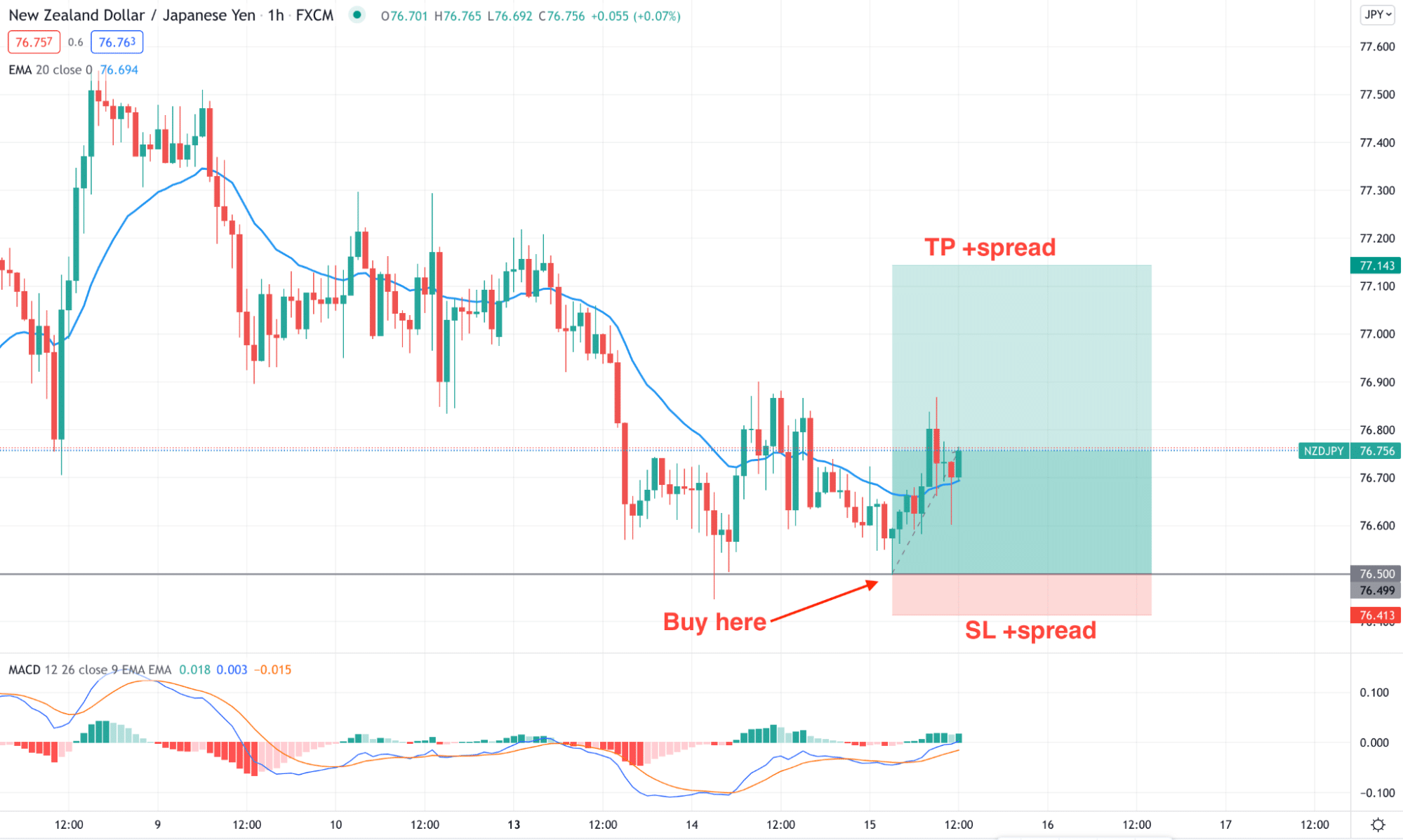

In the bullish trading system, we will see a simple trading system where we will buy an instrument from the support and sell from resistance while the broader market context remains bullish. Moreover, we will use additional indicators like MACD and EMA to increase the trading accuracy.

The 20 EMA will work as dynamic support or resistance level in the buy trade. Moreover, the MACD histogram should be above the zero level in a buy trade and below the zero line for taking a sell trade. While opening and managing trades, make sure to use bid and ask price.

Enter

Open the buy trade when the price rejects the support level with a bullish rejection candle while the MACD Histogram is above the zero line. While opening the buy trade, make sure that the trade will extend from the ask price. Therefore, consider the gap between the bid and ask price to determine the trading cost.

Take profit

TP is higher than the opening position for a buy trade. The ideal TP level with the ask/bid price should be the original TP level+ spread.

Buy trade setup

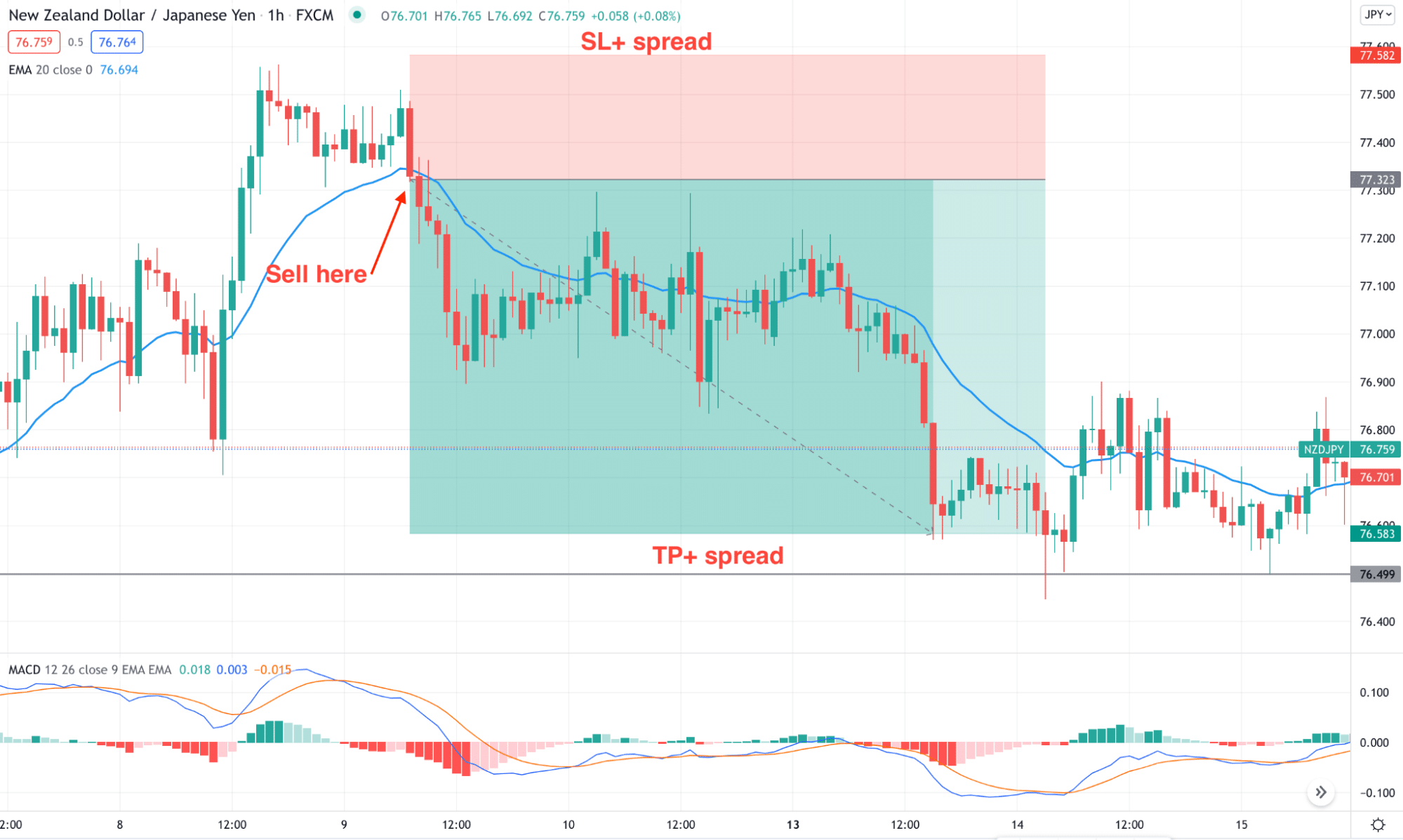

Bearish trade setup

We will follow the same concept of selling from the resistance where the MACD histogram is bearish in the bearish trade setup. Due to price changes in different brokers, we will add the spread with the SL/TP level.

Enter

Open the sell trade when the price rejects the resistance level with a bearish rejection candle while the MACD histogram is below the zero line. While opening the sell trade, make sure that the trade will open from the bid price.

Take profit

The TP is lower than the opening position for a sell trade. The ideal take profit level with the ask/bid price should be the original TP level+ spread.

Sell trade setup

Is the bid vs. ask price strategy profitable?

Bid and ask price are important terms that every trader should consider while opening and managing trades. Any wrong decisions could affect the trading result by unexpected SL hit and return. Moreover, these terms are an integrated part of any financial market, and it is easily compatible with any trading method.

So whether you are a price action trader or intraday trader, you should include the bid vs. ask price in your trading decision to perfect the trading result.

Pros and cons

Before opening a buy or sell trading using the bid vs. ask price, you should consider the following pros and cons.

| Pros | Cons |

| Compatibility

Bid and ask price is an integrated part compatible with any trading method. |

Incomplete method

After understanding the bid vs. ask the price, you should know the details of the trading method. |

| Spread calculation

The difference between the bid and ask price is spread, which is the broker’s charge. |

Trading strategy

Besides having a trading method, you can consider the bid vs. ask price as a side tool. |

| Market uncertainty measurement

The spread will expand during a volatile market structure, increasing the trading cost. |

Irrelevancy

Some brokers offer zero spread account where the spread is irrelevant. |

Final thought

Besides having a deep knowledge about the bid vs. ask price, investors should build a trading strategy that considers institutional investors’ attention to the market. Moreover, you should follow a sound risk management system to avoid unexpected market behavior.

Comments