AVIA is a company that provides signals for everyone. The single system works with various risks we may note at the right block. We don’t have details about the system explained in a big way.

We have received many requests from our readers to write a detailed review about Avia. So, we analyzed this Forex company, its services, reliability, everything you need to know to make a right investment decision.

What is behind AVIA?

The presentation includes some explanations about how we can use the system and what we should expect from it:

- The advisor executes orders on many accounts with various risk settings.

- The company provides MAM services.

- The advisor executes orders on all major cross pairs.

- There’s a detailed trading plan provided.

- It avoids trading during high-impact news.

- The devs behind the system claim they have the proper trading experience and can handle fundamental indicator data.

- We can decide what risk we are good with.

- We are allowed to handle “Levels of Risk Tolerance” details.

- We can customize drawdown levels until the market is calm.

- We can work with any broker we want.

- We may need help to change our broker to a proper one.

- If an account is less than 40k, the leverage should be 1:500.

- Hedging must be allowed.

- We can work with default lot sizes.

- The support is available during the first 30 days.

- We can give it a try on a demo account.

- It opens orders daily.

- “With conservative risks, we can make 12% monthly with 7-10% drawdowns. The minimum investments are $3,000.”

- “With moderate risks, we can make 18% monthly with 9-12% drawdowns. The minimum investments are $3,000.”

- “With aggressive risks, we can make 25% monthly with 13-17% drawdowns. The minimum investments are $3,000.”

- “With very aggressive risks, we can make 34% monthly with 15-20% drawdowns. The minimum investments are $3,000.”

Key features

- The copy-trading system will work automatically on our account.

- It calculates proper Entry Points, Stop Loss, and Take Profit levels.

Trading strategy

- The advisor uses a no-name strategy.

- We can work with many currency pairs.

The presentation doesn’t include any sign of a backtest report. It means that the devs can use the system they don’t own.

Pricing

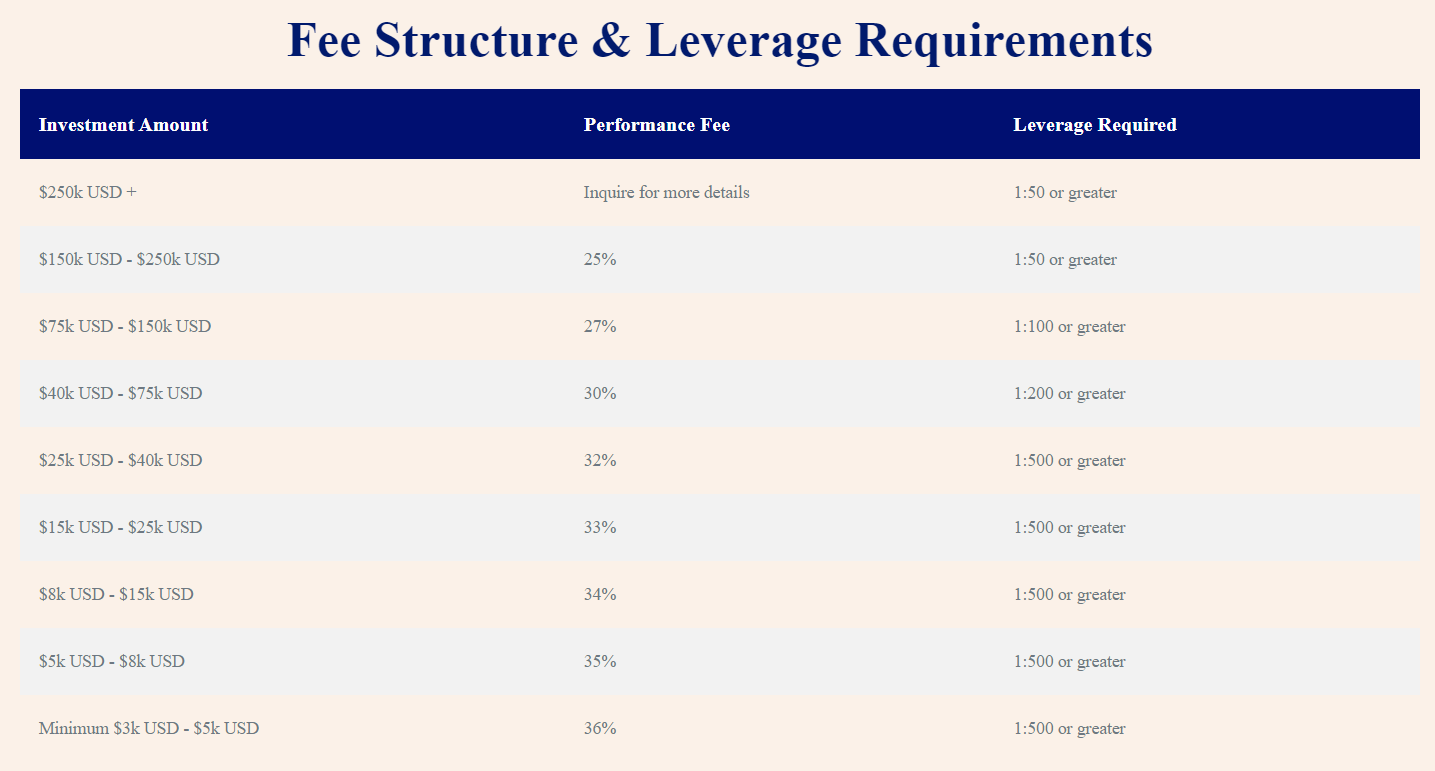

AVIA commissions

The company charges a commission from profits that varies depending on the account balance. The minimum balance will be charged 36%. If we have an account of $150,000, the commissions will be 25%.

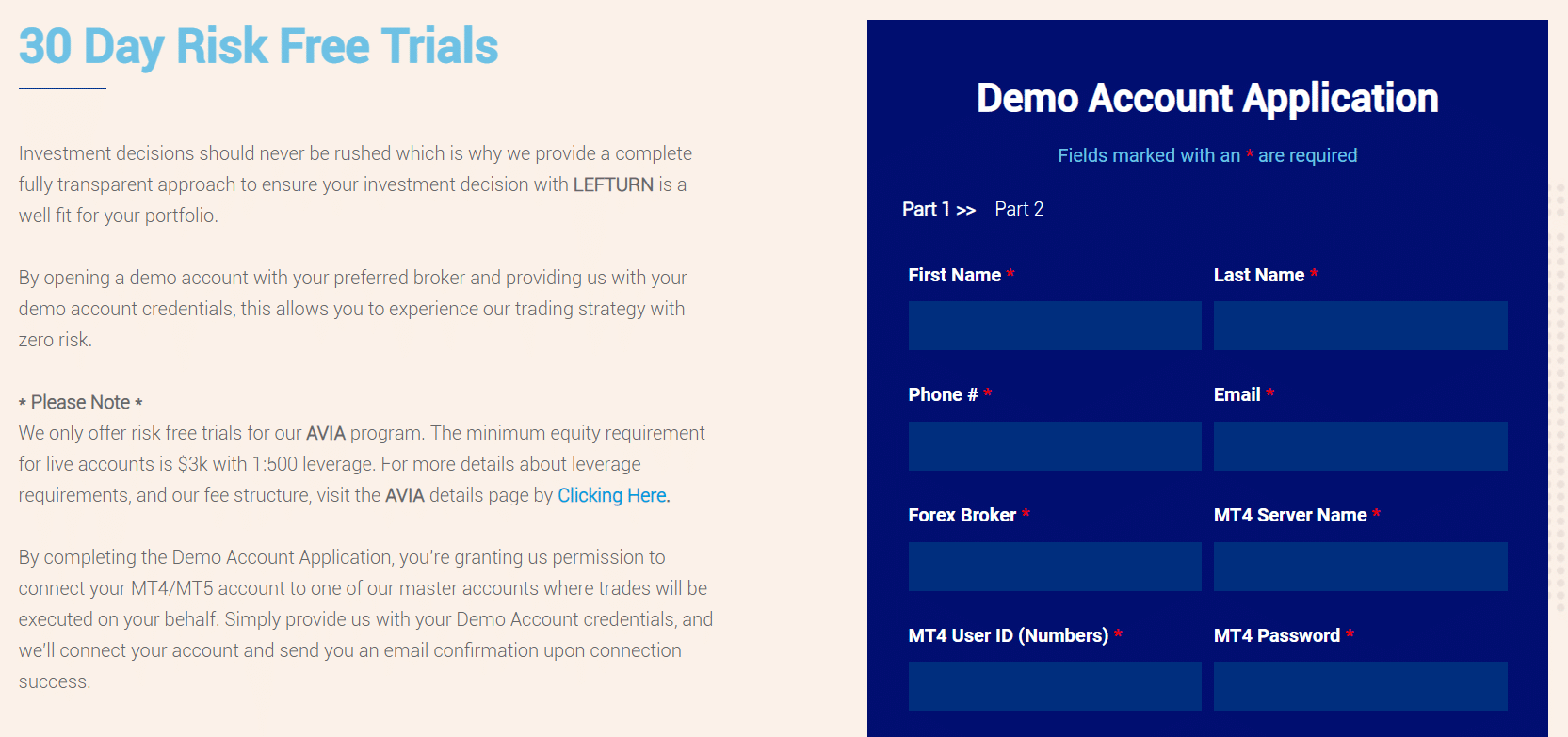

A 30-day free trial

We can give the system a 30-day try.

Trading performance of AVIA

AVIA trading results

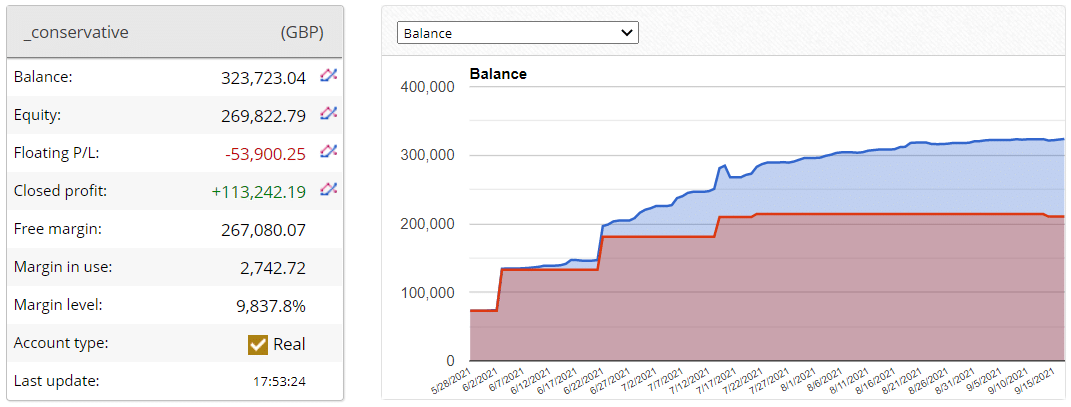

Trading results are important because the system must trade well here and now. The advisor has been running a conservative account. It has £323,724 on balance. The floating loss is always almost the same and deep – £53,900. The closed profit is £113,242. The margin level is high and stable.

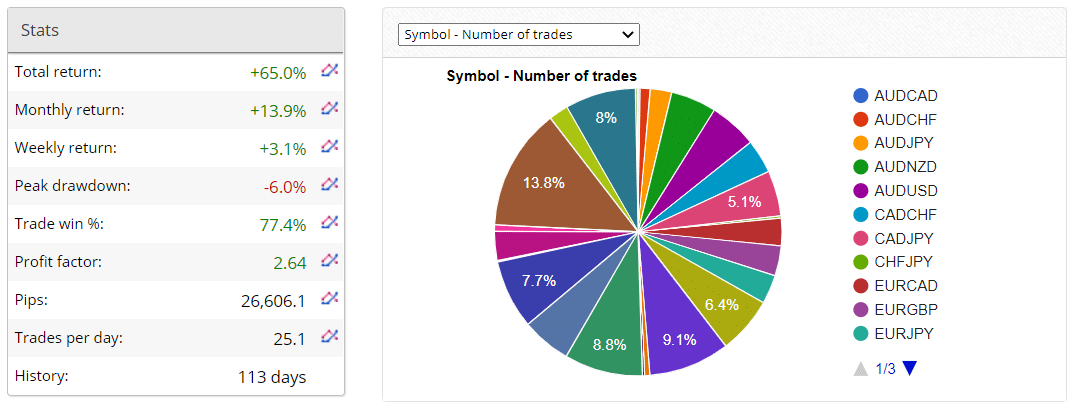

AVIA statistics

The absolute gain has become 65%. It has grown a bit after our last visit approximately a week ago or so. An average monthly gain is 13.9%. The maximum drawdown is 6.0%. The accuracy rate is 77.4%. The profit factor is 2.64. It’s a solid number. The robot has been working for 113 days. An average trade frequency is 25.1 orders daily.

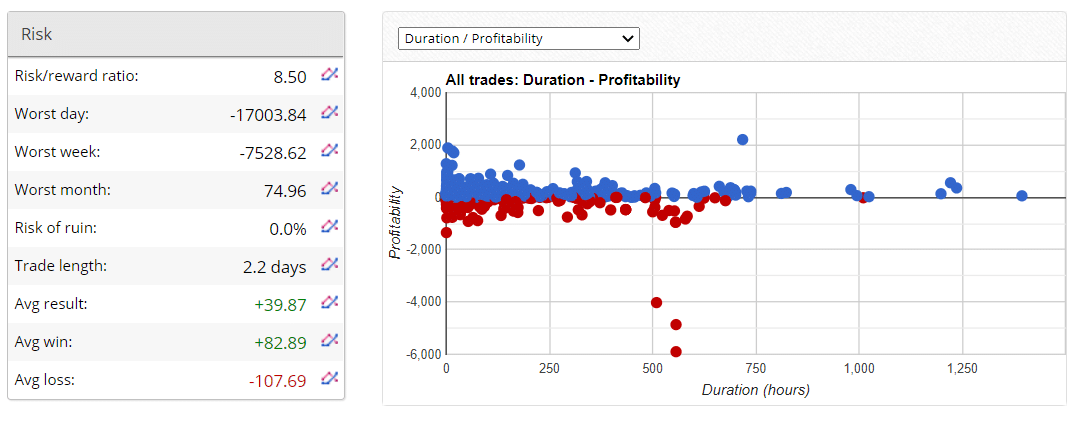

AVIA risk details

The system’s ROI is 8.50. It works with low risks to the account balance. The robot trades with an average trade length of 2.2 days. An average win is $82.89 when an average loss is -$107.69.

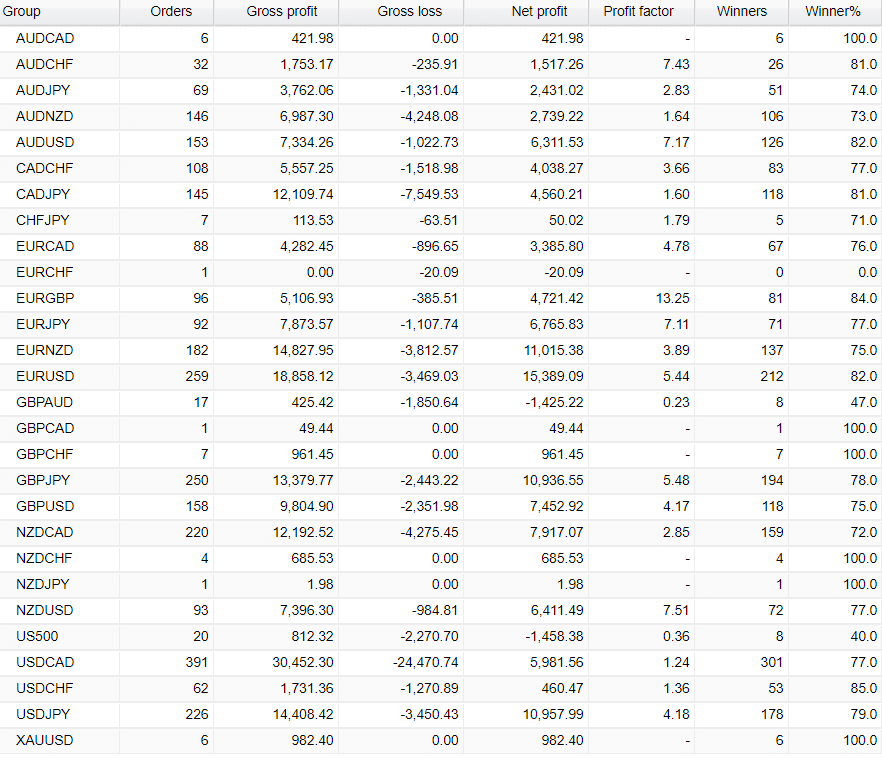

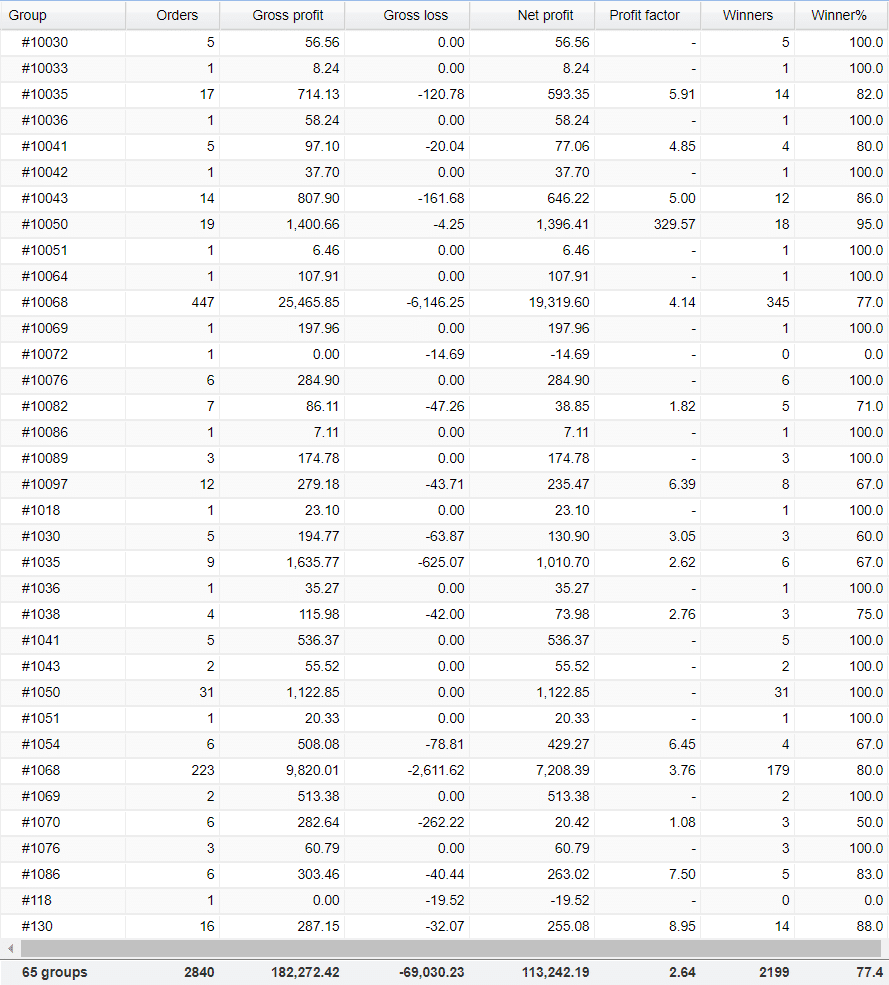

AVIA cross pairs

There’s intel that many pairs were traded. USDCAD, with 391 orders, is much ahead among others.

System’s trading directions

The advisor prefers working on the Sell direction.

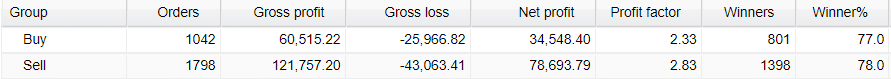

Applied strategies

The system uses 65 magic numbers. It looks like a mess. We don’t know what the reason for this was. Updating this advisor can be a problem.

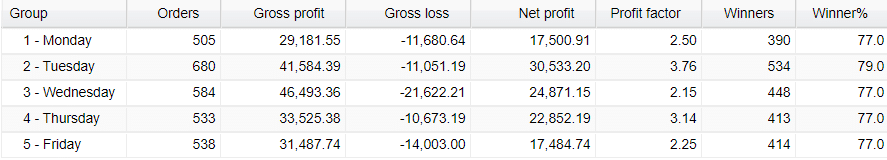

AVIA weekly trading activities

Tuesday is the most active day – 680 deals.

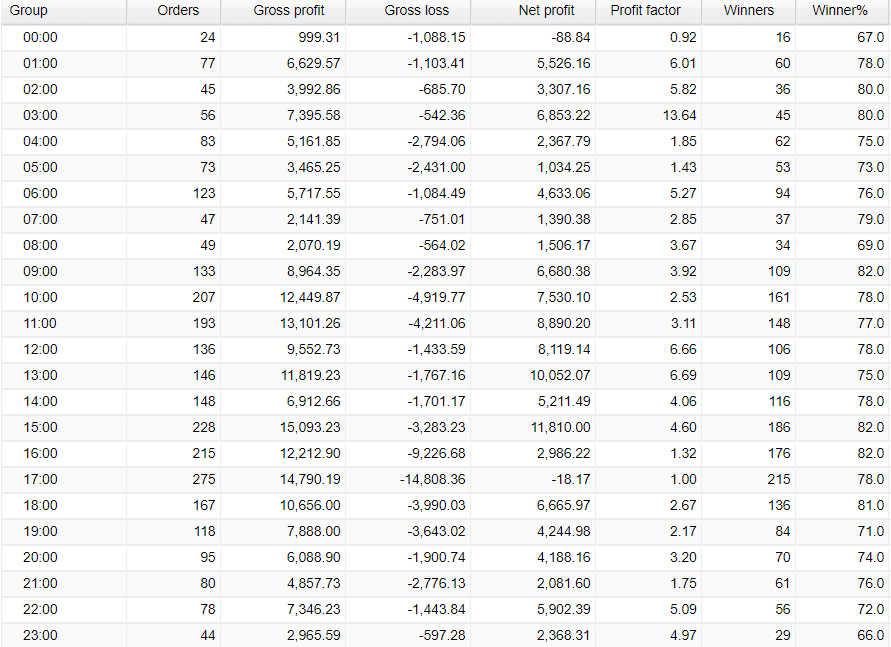

AVIA hourly activities

The robot opens the most orders during the European and the beginning of the American session.

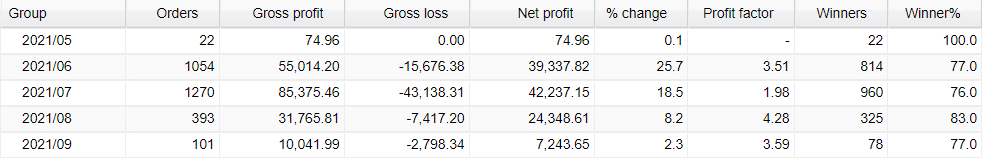

AVIA daily activities

In September the advisor started working less actively than in the previous months.

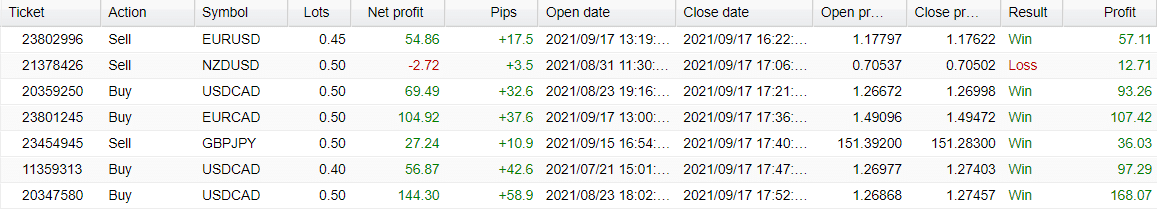

AVIA closed orders

The system uses different lot sizes in trading.

Customer support

The support is common, and there’s nothing special. It’s not the quickest and not the most informative.

People feedback

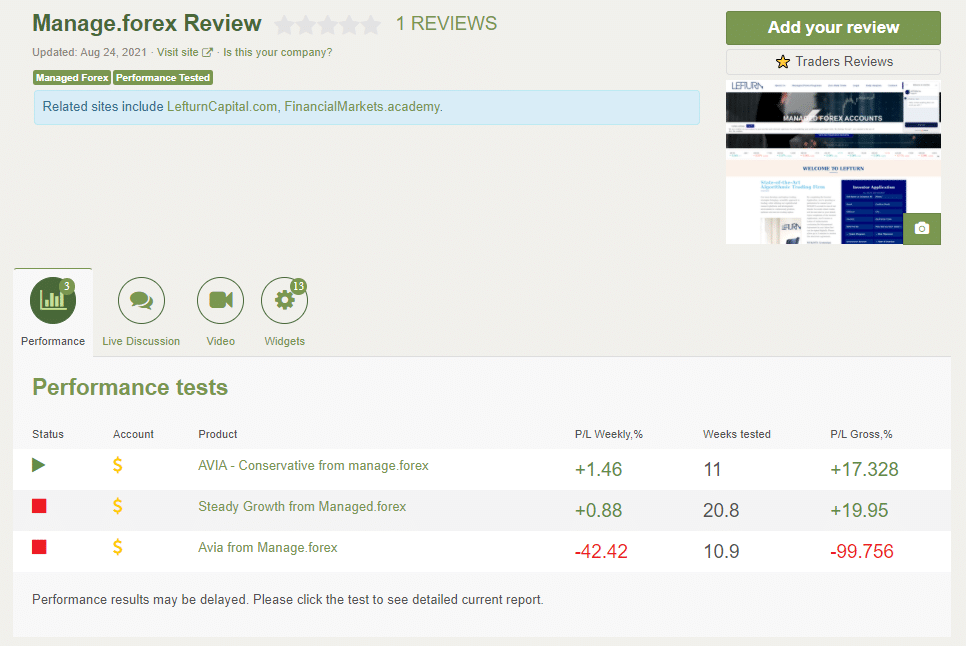

AVIA’s page on Forex Peace Army

We have a page on Forex Peace Army deployed. There’s a single review and three accounts connected. We were surprised to see that two of them were stopped.

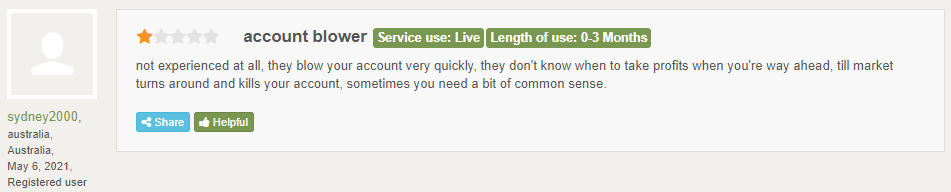

Customer feedback on FPA

We have a negative comment from a real client.

Do not trust Lefturn!

The Lefturn company is a total scam. People say that Avia is an ‘account blower’ that can easily ruin your trading account. For this reason, we think, most traders decided not to trade with Avia. We suspect that this was the reason Lefturn decided to break all ties with Avia. Now they offer the same services under another name – Alphi. There is no guarantee that it will end up the other way.

Comments