Adaptive EA is a self-learning expert advisor that executes trades across currency pairs, metals, oil, or cryptocurrencies. According to the MQL5 website, the owner of this robot is Svetlana Visnepolschi. She is based in the United States. As per her profile on MQL5, Svetlana has a total of 2 products and 1 signal in her portfolio. In this review, we will cover the pros and cons of this item to help traders make the right purchase decision.

This review aims to dig out the crucial aspects of this bot and list them for traders who are in the market looking for purchase. This product was listed for sale in the end of 2021 and received multiple updates along the way.

What is behind the Adaptive EA?

Adaptive Robot works by using a neural network that operates using two sessions. During the first phase, the service makes random transactions and gathers market learnings. In the second one the algorithm uses the observed market analysis to produce the best executions.

Traders must follow these steps to run this service properly:

- Make a payment on the MQL5 website

- Download the EA files onto your PC

- Launch MT4/5 platform

- Drag the service files to the charts section

- Begin auto-trading

Key features

This EA can trade across all types of currency pairs. There is no information about the timeframe(s), recommended amount for deposits, and supported brokers compatible with this bot. This points toward a lack of transparency by the seller.

Trading strategy

The developer does not provide any information regarding the strategy of the algorithm. From the history present on Myfxbook records, we observe that the system uses averaging and martingale strategies. It will use currency correlation and hedging techniques which is observed as multiple traders on different instruments close at the same instance.

Trading history on Myfxbook

Unfortunately, there were no backtests that the seller gave. This makes us bling to construe the past performance of the robot based on critical metrics like deposits, profits, drawdown value, gain rate, etc.

Pricing

This Robot is sold for an asking price of 185 USD. Payment is accepted through PayPal, UnionPay, Visa, MasterCard, and Webmoney.

The vendor provides absolutely no information about the availability of a money-back guarantee, customer support, a detailed user manual, etc. These add-ons are essential for the sale of financial products like EAs.

Pricing of the EA on MQL5

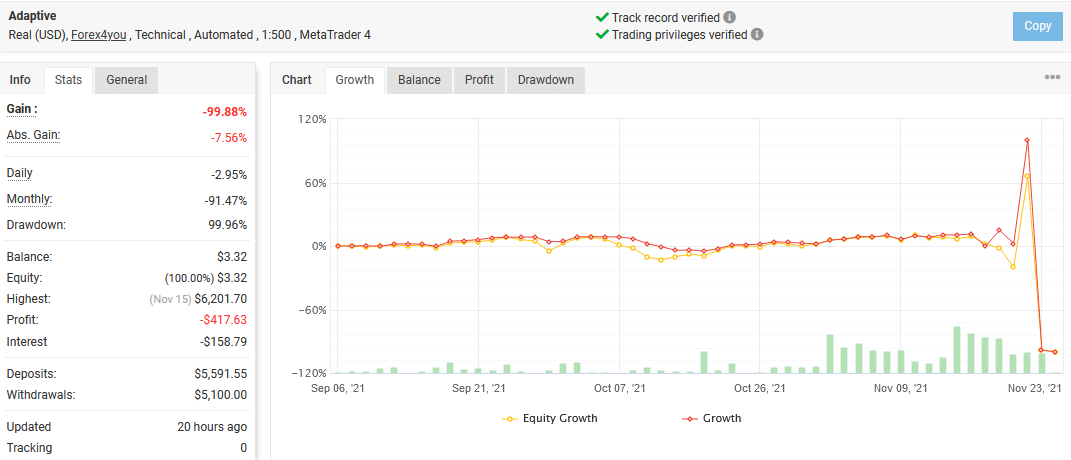

Trading performance of Adaptive EA

Live trading results are available for this robot on Myfxbook. The account was created on September 06, 2021. These results are in USD currency, reported for MT4 with leverage of 1:500. The monthly gain rate stood at -91.47%, which means that this robot has incurred a margins call on the account. The drawdown value was stated as 99.96%, which is extremely high. Deposits were mentioned as 5,591.55 USD, while profits stood at -417.63 USD.

The robot made a total of 320 trades, of which 45% resulted in a loss. The profit factor was written as 0.93, which is not impressive. The dollar value of the algorithm’s worst trade 0f -470.10 USD was way above that of the best one, which was 380.25 USD. The average trading length of the system was 3 days.

Live trading results on Myfxbook

Customer support

Usually, 24/7 customer service is part and parcel that is provided along with all good EAs. However, their owner mentions absolutely nothing about delivering user support.

Again, this is a poor approach from the author, raising concerns about the product’s authenticity.

People feedback

We could find some negative customer reviews for this seller on the MQL5 forum. Past users have made multiple accusations about this service regarding poor response rate from the seller, unstable working of the bot, and fraudulent practices. This paints a very negative picture of the algorithm.

Customer reviews on the MQL5 website

Customer reviews on the MQL5 website

Comments