The next standard for high-speed cellular communication networks, 5G, is expected to take hold. 5G may potentially achieve rates of up to 20 gigabits per second in the real world. The average data rate for 5G is 100 megabits per second, which is much quicker than the previous generation of 4G. 4G LTE standards are limited to 5 to 12 megabits per second, Verizon claims.

Despite the high degree of volatility, trading penny stocks may be a rewarding strategy for investors who have the patience to respond quickly to market fluctuations. For example, investors may purchase hundreds of shares of various penny stocks for the same price as one share of Tesla (TSLA). This article highlights 5G penny stocks to buy in 2022.

What are 5G penny stocks?

We live in a data-obsessed society. TikTok and other video-sharing sites have made fast broadband rates more critical than ever before. As a result, 5G will be more in demand in the future.

Are 5G penny stocks a good investment? The bigger the risk, the greater the reward for investing in penny stocks. Then again, there’s the possibility of a higher payoff as well. Furthermore, compared to traditional blue chips, penny stocks don’t have a lengthy track record of success in the stock market.

These 5G penny stocks, on the other hand, have a good shot of long-term success. As a result, 5G penny stocks are a great option for investors who want to get in on the ground floor of new and fast-growing technology.

While never fully out of vogue, penny stocks are attracting newfound attention from ordinary investors. As a result, the penny stock market has attracted a lot of new traders who believe that they can transform a tiny investment into a huge one. Moreover, penny stocks may seem to be more stable than virtual currencies.

5G penny stocks to buy in 2022

Here are some 5G penny stocks to buy in 2022 to increase profits.

1. Analog Devices Inc. (ADI)

One of the leading high-performance integrated circuits used in signal processing applications is Analog Devices (ADI). According to Arya, as the global 5G deployment advances, Analog Devices should acquire RAN market share from China.

Price

The price of Analog Devices (ADI) is 178.42. Analysts have predicted a median price target of 210.00 for Analog Devices Inc. for the coming year, with a high target of 220.00 and a low target of 185.00. Based on the current price of 178.42, this implies a gain of 17.70%.

EPS

The EPS value of Analog Devices in November 2021 is $4.57.

Market capitalisation

Analog Devices had a market cap of $95.65 billion as of November 2021. Analog Devices is the 161st most valuable company in the world, according to market capitalization.

Price of Analog devices Inc. (ADI) stock

2. Qualcomm Inc. (QCOM)

For over a decade, Qualcomm has been the industry leader in 5G modem production and is known for its sophisticated wireless broadband technology.

Price

Its current price is 175.74 USD on November 28, 2021. Qualcomm Inc is expected to reach a median price target of 200.00 within the next 12 months, with a high estimate of 393.17 and a low estimate of 170.00. This represents a gain of +13.92% from the last closing price of 175.74.

EPS

QUALCOMM Annual EPS for 2021 is $7.87.

Market capitalisation

QUALCOMM had a market cap of $196.82 billion as of November 2021. By market value, QUALCOMM is 61st in the world.

Price value of Qualcomm Inc. (QCOM)

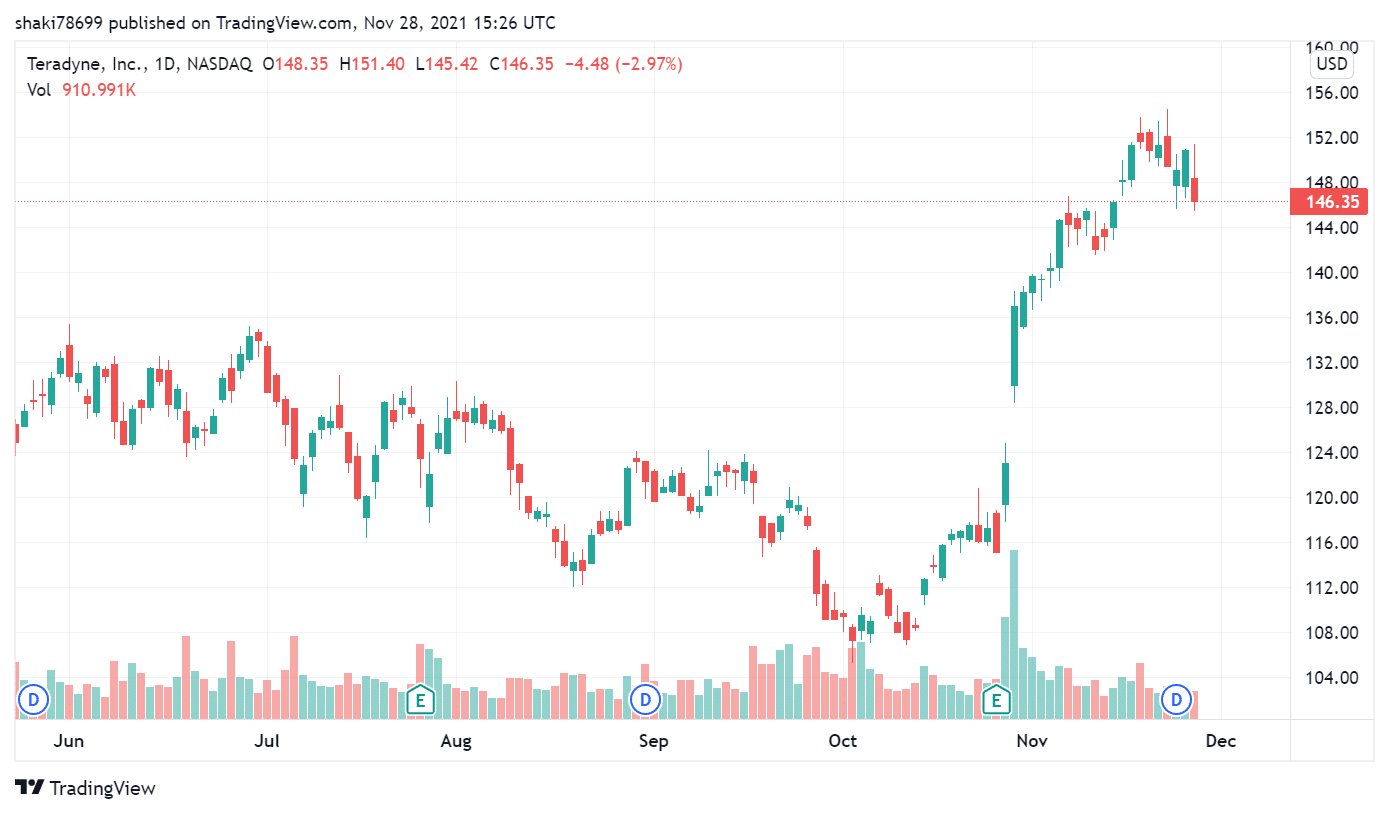

3. Teradyne Inc. (TER)

Automated semiconductor, telecommunications, and industrial testing equipment are designed by Teradyne Inc. (TER). Teradyne, according to Arya, is a parody of the increasing complexity of 5G semiconductor testing.

Price

Its current price is 146.35 USD as of November 28, 2021. According to analysts offering 12-month price forecasts for Teradyne Inc, the median estimate for the stock is 153.00, with a high estimate of 180.00 and a low estimate of 121.00. The median estimate represents a +4.12% increase from the last price of 146.94.

EPS

The annual EPS rate of Teradyne Inc is $5.31.

Market capitalisation

Teradyne has a market cap of $23.85 billion as of November 2021. As a result, Teradyne is the world’s 829th most valuable company by market capitalization.

Price of Teradyne Inc. (TER)

How to buy 5G penny stocks?

Buying stocks on the exchange market is as simple as following these steps.

Step 1. Make contact with a broker

The broker enables you to buy and sell stocks, as well as collect dividends from them. You must give basic financial information, such as your bank account number, to open an account with the company.

Begin by searching for a broker on the internet. The majority of brokers do not charge fees for stock trading and do not need a minimum initial investment. You might utilize a trading app if you want to trade less often.

Step 2. Determine the investment funds

Before proceeding, determine how much stock you can purchase at present. The good news for first-time investors is that many brokers provide fractional share trading. Consequently, you may be able to purchase a small portion of the most expensive equities. Begin with a little budget. Using no-commission internet brokers might save you a significant amount of money.

To invest more than a few thousand dollars, diversify your portfolio by purchasing many different companies. To invest more than a few thousand dollars, diversify your portfolio by purchasing many different companies.

Step 3. An understanding of the stock market

Before deciding whether or not to invest in a firm, you must first do thorough research about it. It will take a significant amount of time and effort to do this.

To make sensible investments, you must first understand the firm, its products, finances, and the industry. As a result, you’ll need to go through the company’s SEC filings (SEC). This is the best place to learn about the business you’re considering investing in and its potential. You may also be able to employ expert strategies to your advantage, such as researching.

Step 4. Make a trading plan

At the present market price, you may either buy or sell. You will not be able to influence the trade price in any way. You can buy or sell at a specific price using a limit. Depending on the broker, limit orders may be valid for up to three months at a time.

When there are limited shares available or the company is very liquid, market orders perform better. Therefore, limit orders are better for smaller companies and those who do not want to impact the stock price since fewer shares are traded.

Step 5. Keep track of your stock in the market

When shares are acquired, the investment process does not come to an end. Keep track of your new job’s profits on a quarterly or yearly basis, as well as market trends. If your firm is functioning well, you may be able to negotiate a raise in compensation. In addition, as your knowledge and experience expand, you may decide to increase the size of your portfolio by purchasing more stocks.

Your stock price will decline at some point, even if it is just for a little time. Knowing more about the firm may assist you in deciding whether to purchase more shares at a discount or whether to sell your existing shares.

Final thoughts

Penny stocks often have more volatility, resulting in larger potential profit and, thus, higher inherent risk. Investors who buy penny stocks on margin risk losing their whole investment, or more, if they borrow cash from a bank or broker to acquire the shares.

Because investing in penny stocks has a higher risk, investors should take extra safeguards. For example, an investor should know where to place a stop-loss order before making a transaction. Stop-loss orders establish a price limit that triggers an automated trade.

Comments