The truth of the matter is every single person desires financial independence. However, it is impossible to achieve financial freedom without being part of the investment period.

On the other hand, there exists a fallacy that for one to be part of the investment world, the requirement is hundreds of thousands of dollars. Fortunately, this fallacy is a thing of the past, as unraveled by a recent study by the Pew Research Institute, “More than half of the American populace has a stake in the investment world, especially in the stock market.”

The good news is that the investment world is no longer a playground for the super-rich but a ripe fruit for anyone brave enough to dare deep a toe. It now has many financial assets available at relatively low cost but with the potential to generate income and grow wealth consistently.

The problem then is no longer the amount of money to start with but the ideal investment instrument to begin with, given the plethora of choices available. If you have decided to grow your money and start with only $1000, the following investment assets give you the best chance.

№ 1. Fractional investing

Although you can always invest in stocks that are worth $1000 or less and other investment instruments within that range, in most cases, it excludes you from established blue-chip companies whose stock value is more.

Brokers have tapped into the investment appetite by providing fractional investing. It involves buying a fraction of an investment instrument share rather than the whole unit, with some brokers providing as low as 1/1000000.

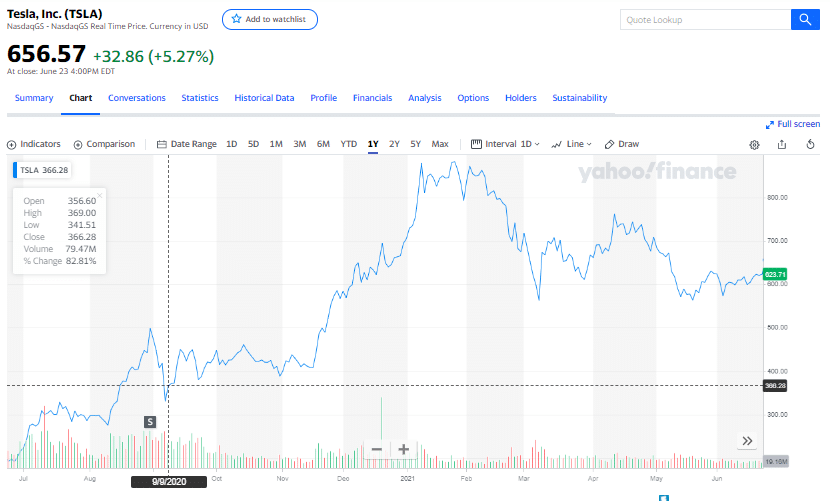

For example, Tesla shares currently are trading at $656.57. Without fractional investing, it is only possible to own a single Tesla share. However, with fractional investing, you can own 0.076 of Tesla shares worth $50 and diversify the portfolio by picking other blue-chip companies. Tesla’s diluted earnings per share growth at present stand at 2301.4%.

№ 2. Real estate micro-investments and REITs

It is impossible to become a landlord with a $1000 budget. However, this amount is still plenty to be part of the real estate investment market through fund-raising real estate investment funds. Crowdfunded REITs expose investors to the real estate markets without the hassle of fees and property management. Through a deposit account with the crowdfunding REITs firms, an investor gets to choose the REITs options that align with their investment objectives and risk tolerance. Most of these firms have a minimum allowable deposit of $500.

You get to invest your $1000 on a diversified real estate portfolio through these firms, both publicly traded and private. The annualized 20-year returns for publicly-traded REITs are approximately 8%, while private REITs are 12%.

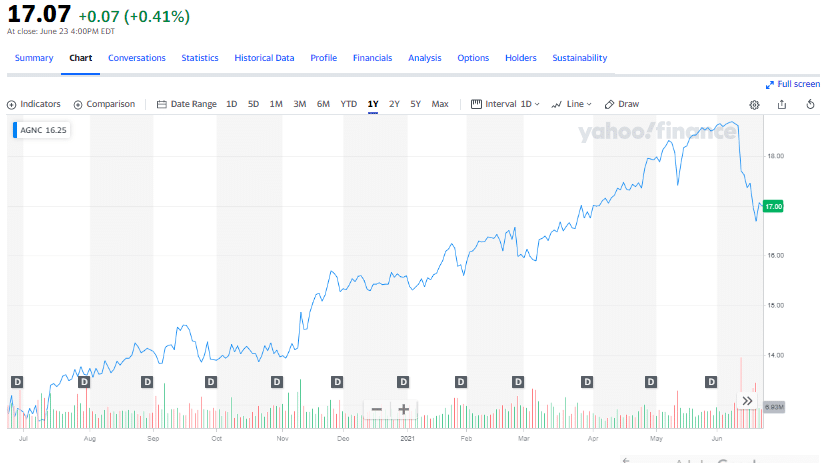

In addition to crowdfunded REITs, $1000 are enough to be part of the real estate market through REITs. For example, AGNC Investment Corp. is a REIT currently trading at $17.07. With $1000, you easily purchase 58 shares of this real estate organization. Such structured real estate organizations expose one to an investment asset that by law distributes 90% of its taxable income to shareholders via dividends. AGNC dividend yield is approximately 9%.

№ 3. High yield savings account

If you are a skeptic with a very low-risk tolerance, high-yield savings accounts are your best bet to grow $1000. While the stock exchange and investment markets offer significant returns, they also come at high risk.

High yield savings account returns are a guarantee without risk to the initial money deposits since they are FDIC insured. In addition, while conventional banks charge withdrawal fees, deposit accounts have 0 withdrawal fees and a higher interest rate, making them a cost-effective way of growing the $1000 by 1%-2%, depending on the monthly remittances.

Look for a savings account provider that encourages high-yield savings through higher interest rates for higher deposits.

№ 4. Low-cost high-yield ETFs

Exchange-traded funds have become the go-to investment instruments not only for beginner investors but seasoned market veterans. They are a basket of investment assets in either a specific industry or theme or cutting across the economic divide.

ETFs’ primary objective is to track the index of the economic segment of interest and replicate its performance:

- Conventional ETFs

Replicate the performance of the index they track with minimal variance.

- Leveraged ETFs

Track the index they track but seek amplified results to those of their index.

- Inverse ETF

Track an index to provide a hedging strategy in times of market downturn, negatively correlated to the index they track.

- For short-term growth of $1000, go for high-yield dividend ETFs, resulting in regular income without necessarily registering share growth.

- For long-term investment, choose ETFs in emerging markets since they have the highest potential for share price growth, technology sector, financial services sector, among others.

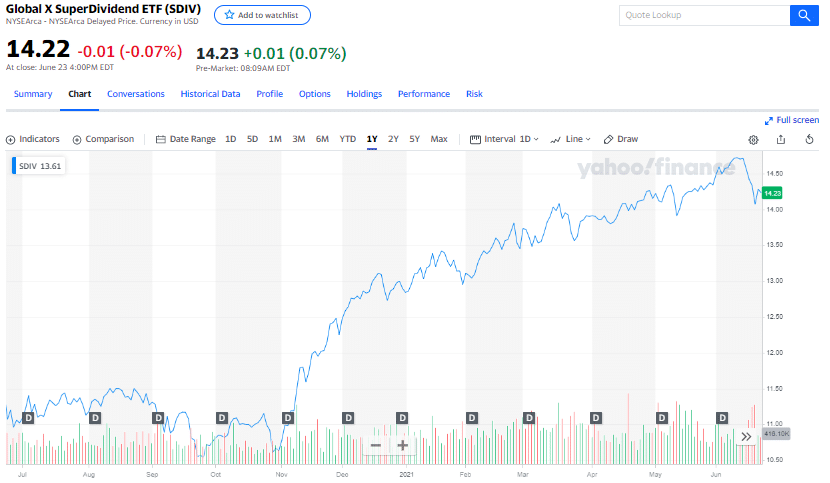

For example, the Global X Super dividend ETF has so far in the current year churned out 13.46% returns to its investors.

№ 5. Day trading

Day trading is not for the faint-hearted. Approximately 70% of the market participants lose money in the markets. This is by no means a doom statement. With the correct money management strategy and trading skills, day trading is a viable option for a relatively quick investment scheme. Experts discourage having more than four concurrent active trades that have not broken even in a single trading week.

Day trading allows one to invest as low as $10, depending on the online broker chosen. For most brokers, any deposit above $500 qualifies one for a 100% matchup bonus trading account which allows for bigger position sizes when trading. These broker platforms also allow for leveraged trading, activating positions on borrowed cash for payment later. The beauty of day trading is that you have access to trading tools such as CFDs and contracts for differences, hence no need to own any investment asset.

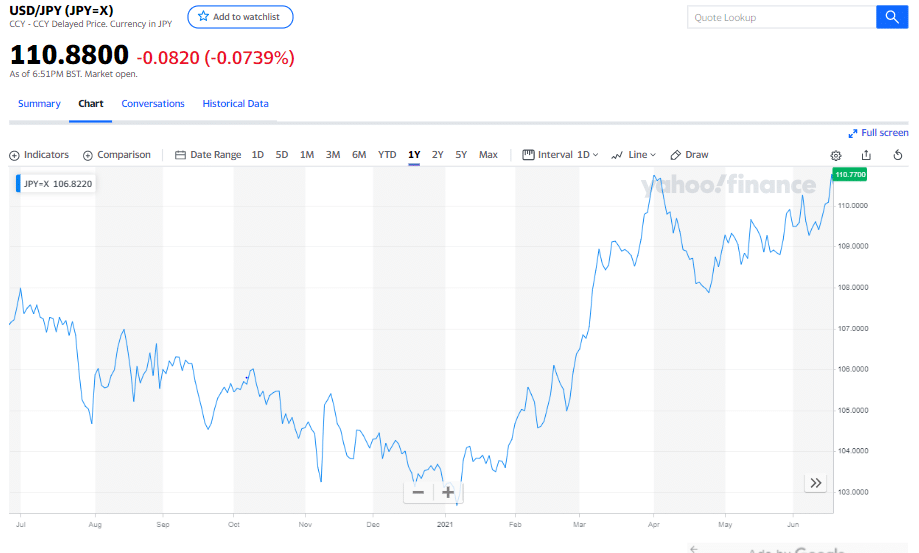

For example, an investor can speculate on whether the price of the USD/JPY pair will go up or down. If the prediction is correct, then you make money. If not, it is a loss of the amount staked.

For example, an investor can speculate on whether the price of the USD/JPY pair will go up or down. If the prediction is correct then you make money, if not it is a loss of the amount staked.

Comments