The death cross appears when the short-term moving average (MA) of a stock or index descends below its long-term average, possibly indicating an impending sell-off.

A technical chart occurs when the 50-day SMA of a stock or index crosses below the 200-day MA.

As a short-term indicator, the 50-day is considered a more accurate helper of price volatility than the 200-day SMA, representing 200 days’ worth of prices.

However, the 50-day and 200-day MAs are lagging arrows by definition. This means that they only capture the past. Yet some typical crosses have succeeded in forecasting major recessions, although false signals are also possible. Many people are getting benefits from this trading strategy. If you are also interested in learning how the strategy works and how you can make profitable trades using it, read on.

What is the death cross pattern?

Technical, it indicates the prospect of a significant drop. When the short-term MA crosses below the long-term MA, it is called a death cross. Typically, the 50-day MA and 200-day MA apply in this pattern.

As a good predictor of severe bear markets over the past century, the indicator has been effective in 1929, 1938, 1974, and 2008. These investors avoided significant losses in the 1930s when losses exceeded 90% for those who sold out at the beginning of the bear markets. Investors worried about locking in gains before a new bear market breaks are more reliable than the Doji because the strategy is a long-term chart pattern. In addition, these helping strategies are usually associated with an increase in volume.

When accompanied by chart patterns like Head and Shoulders, Double tops, etc., these patterns confirm the signal without any bias, and the trend produces steep price corrections. Price confirmation can be significant in understanding a movement. If supported by other instruments such as a trend line breakdown, a consolidation breakdown, a gap down, or a bearish engulfing, the weakness takes on strong negative momentum. Eventually, the price enters the bearish phase.

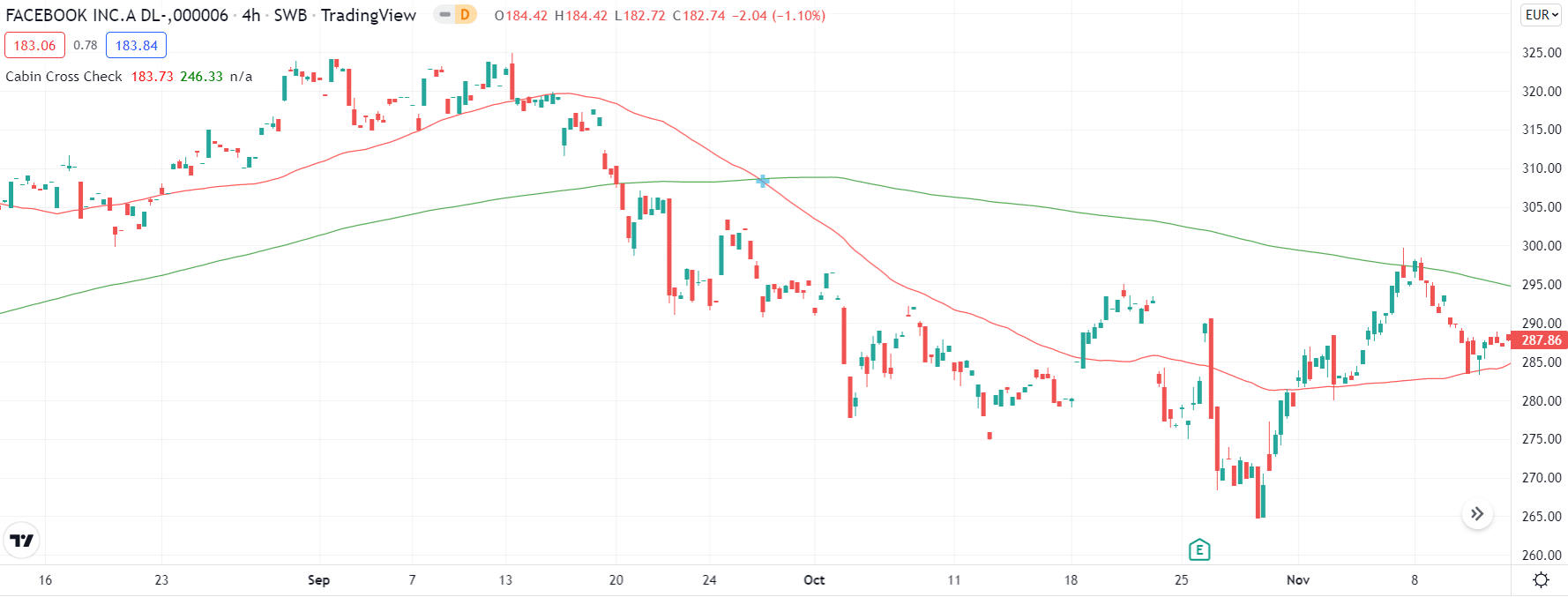

Death cross pattern on the chart

How to test the death cross trading system?

It is an ideal means of identifying shorting opportunities in the short-to-medium term. An index that forms an indication in a particular sector will prevent the price of all shares in that sector from rising. Regardless of whether the stock has included the cross or not, it is. If the counter closes in the negative for more than three days, the volumes increase. A death cross formation strongly discourages finding a bottom.

This strategy uses the exponential 50 as a fast-moving arrow and the EMA 200 as a slow-moving arrow.

- EMA 50 crossing over EMA 200 indicates that it is time to buy.

- EMA 50 crossing below EMA 200 identifies a sell signal.

Trades in this strategy typically last more than a day, so leverage should not be excessive.

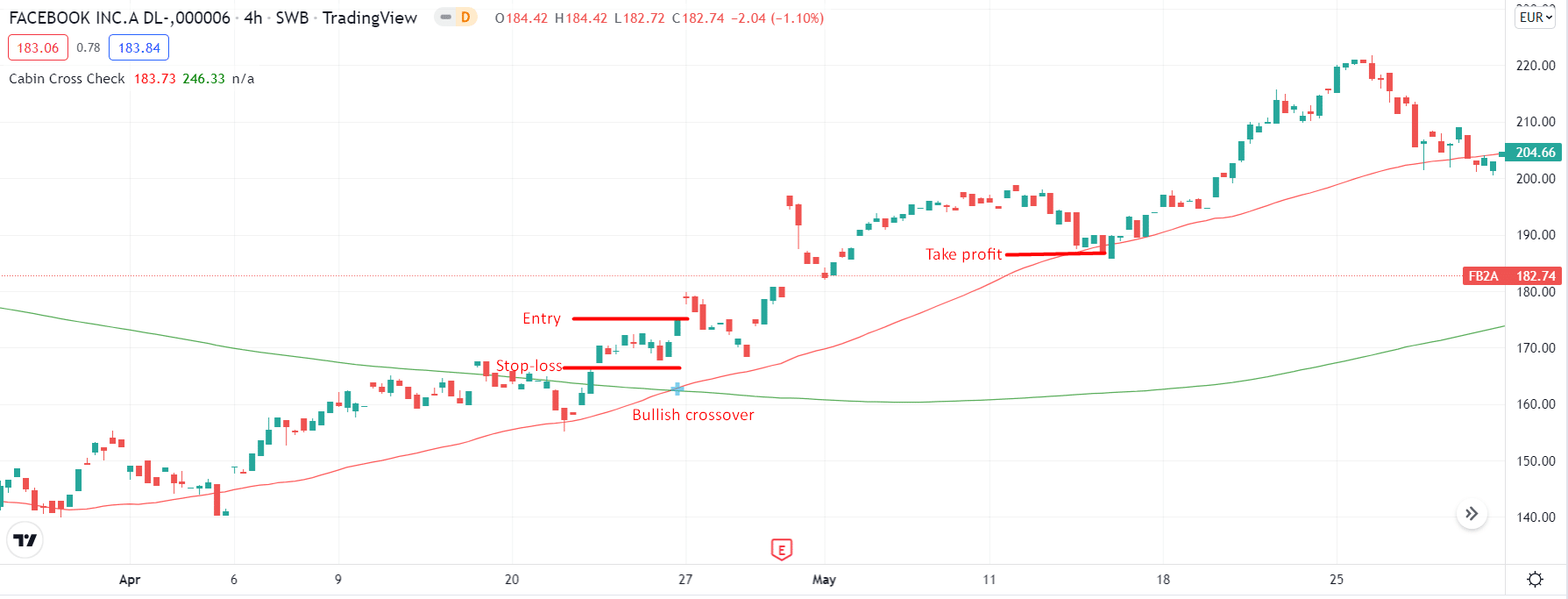

Bullish trade setting

Let’s learn through the real-time chart setups.

Bullish crossover

Bullish trading conditions

The 200-EMA should cross the 50-EMA to the upside. As a result, the price should be above the EMAs.

Best time frames to use

The best time frame is 4-hour and higher. Lower time frames may come up with plenty of noise.

Entry

Wait for the bullish candle to appear after the bullish crossover is formed on the chart.

Stop-loss

Place the stop-loss slightly above the highs of the entry candle.

Take profit

Exit the trade in profit when a candle closes above the 200-EMA. Alternatively, you can place a fixed take profit level twice the entry distance to stop-loss.

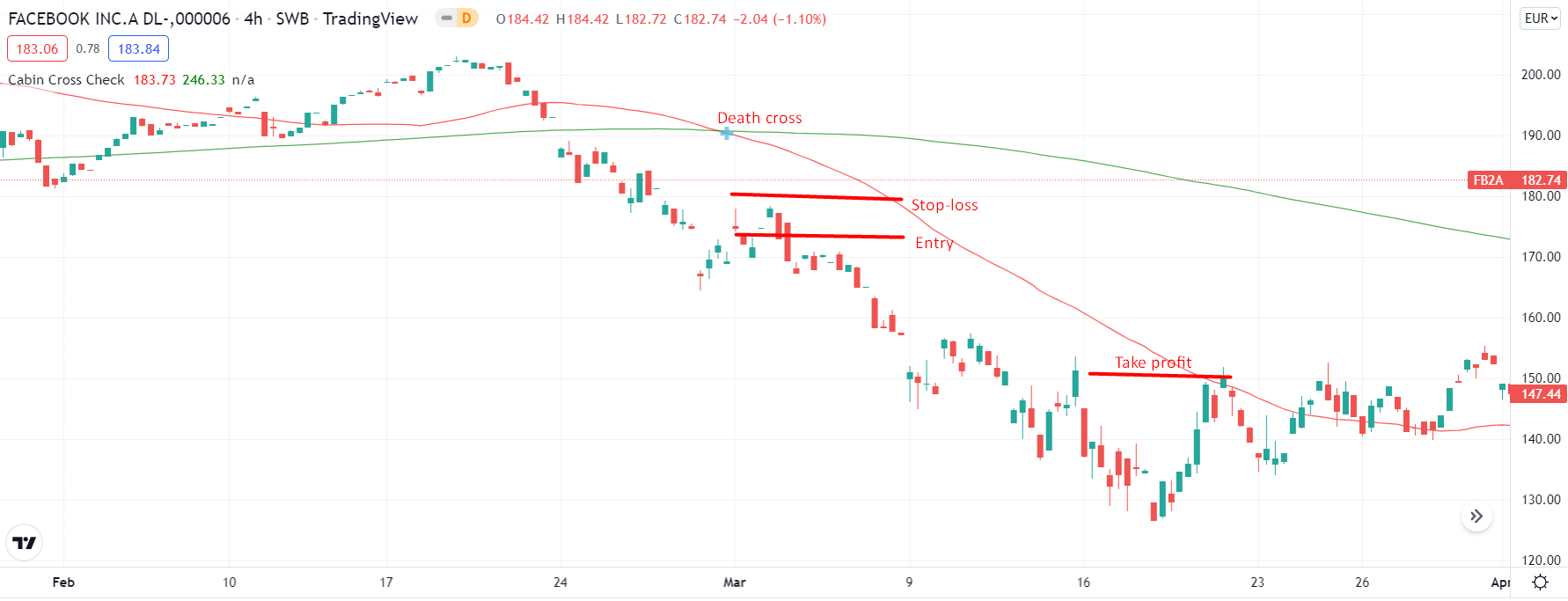

Bearish trade setting

Let’s explore further the setup using the real chart.

Death cross bearish trade setup

Bearish trading conditions

The 200-EMA should cross the 50-EMA to the downside. As a result, the price should be below the EMAs.

Best time frame to use

The best time frame is 4-hour and higher. Lower time frames may come up with plenty of noise.

Entry

Wait for the bearish candle to appear after the death cross is formed on the chart.

Stop-loss

Place the stop-loss slightly above the highs of the entry candle.

Take profit

Exit the trade in profit when a candle closes above the 200-EMA. Alternatively, you can place a fixed take profit level twice the entry distance to stop-loss.

Pros and cons

| Pros | Cons |

| The death cross has predicted many major crashes and corrections despite its popularity. | In the case of death crosses, they are lagging indicators since they show us what has already happened. |

| These are long-term indicators, and they could have even spared you the dread of a bear market. | It can also generate false signals, especially when other technical indicators do not confirm them. |

| In addition to its simplicity, the death cross pattern is also reasonably easy to use-even someone who is technically unacquainted can learn it. | Rather than predict the bear market, the indicator has often been to “buy the dip.” |

Final thoughts

Some investors regard death crosses as essential indicators. They are, however, merely a reflection of past trends. As an investor, the strategy needs to work with other hands, such as the MACD, trading volume, and other news and information related to the security you intend to buy.

It’s commonly believed that this type of pattern can predict a downturn in a particular security or market in general, but it’s not that reliable. Instead, death crosses are produced by a stock’s short-term and long-term moving averages, which may or may not indicate a bearish turn of events.

Comments