FOMO or Fear of Missing Out is a relatively recent addition to the English language, but it is an integral part of our daily life. A true phenomenon of the modern digital age, FOMO affects 69% of millennia, but it can also significantly impact trading practices.

For example, a feeling of missing out can lead to deals being closed without sufficient deliberation or closing deals at inopportune moments because others seem to be doing it.

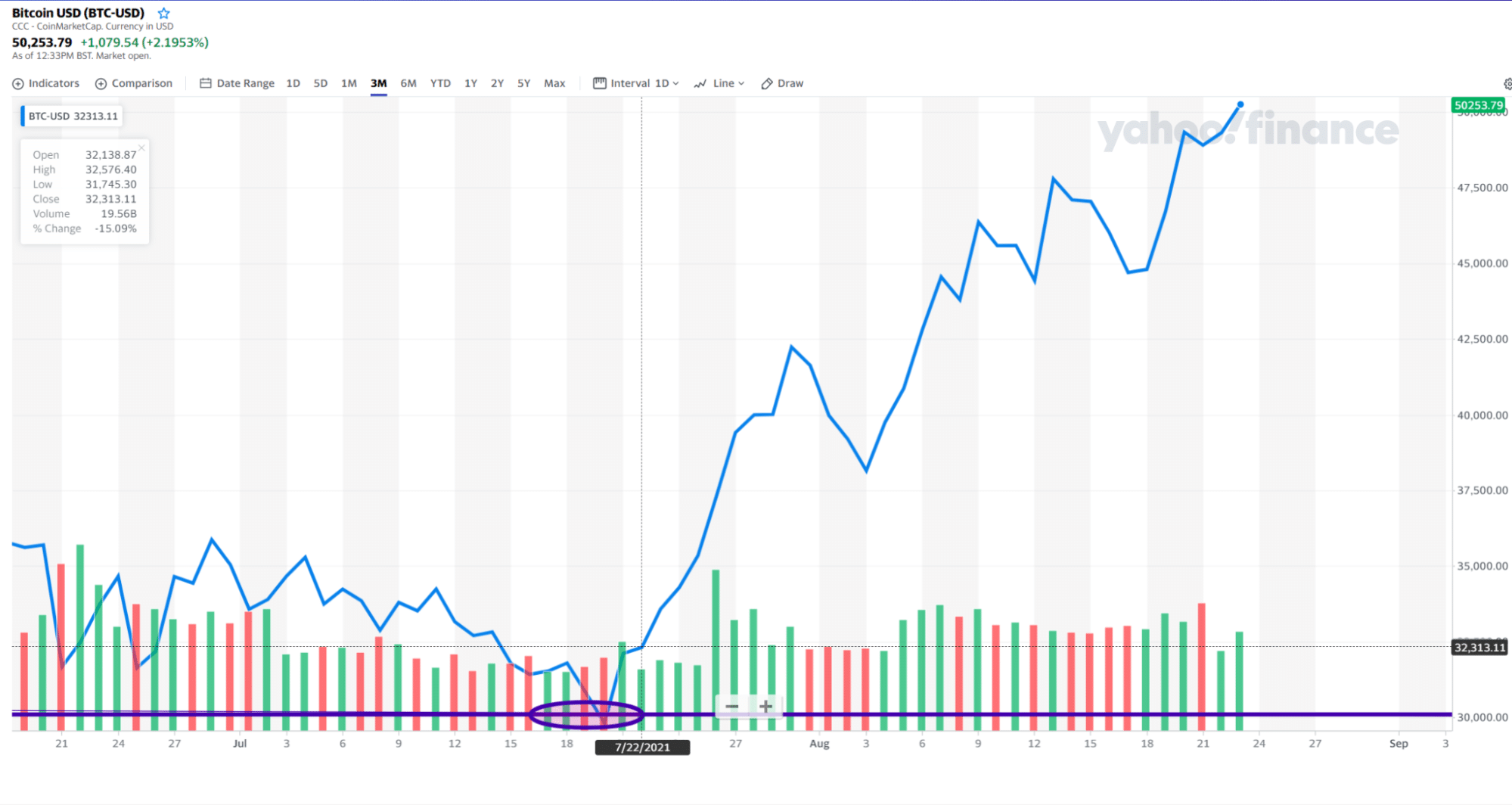

In mid-April 2021, the value of Bitcoin reached a historic high of $64.8 thousand. After that, the price of cryptocurrency began to decline. On May 19, the asset price per day fell by a third, to a local minimum of $30 thousand. Fear has completely taken over the entire community, and the level of panic has reached its peak.

BTC/USD chart

The article will identify potential triggers and how they can affect the success of a day trader for a better understanding of the concept of FOMO in trading. Let’s look at crucial examples and what a typical trade looks like when driven by fear or frustration.

How fear and frustration affect traders

The truth about trading is, it involves risk and stress for every type of participant. Institutional participants in the market do sufficient research, and they have enough liquidity to operate trading. Still, the issue comes to individuals as often they begin with little knowledge and tiny investment. The FX market is volatile, and the price movement of currency pairs depends on several factors.

The professionals do not always make winning trades; they also make losing ones, but they overcome and do not affect the next trade. On the other hand, novice traders who don’t have sufficient knowledge to overcome fear and frustrations will make wrong trading decisions.

In most cases, they take emotional and revenge trades and end up losing capital. Millions of novice traders leave the FX market as they can’t overcome the trading stresses of frustration and fear.

Ways to overcome fear and frustration

This part contains the list of the best ways to overcome the fear and frustrations of trading. The best ways are:

-

React wisely

Successful traders mainly seek potentially profitable positions by observing the price movements of currency pairs. The FX market is always unique, where the price movement depends on various factors.

Freshers in this market often have no control as they often react worst, and that causes them to lose. For example, a trader may make some profitable trades and become overconfident or perform some losing trades and be unwilling to take risks or handle stress. If you want to be a successful trader, you need to react wisely every time. Besides, remember every trade is unique, and you are playing a probability game, so don’t trade without planning.

-

Realistic expectation

Always set a realistic expectation for return. Treat FX trading as other businesses. Most losers come to this market with heavy expectations as they want to become a millionaire quickly. That affects their trading, and they end up losing.

It is possible to make $2000 from a trade with a $1000 investment from trading, but you have to take too much risk on your capital that may lead to blowing down your balance. Therefore, you should be realistic about the profit expectation. For example, you can grow your capital by 36% yearly if you expect a 3% return monthly. That’s a logical return by the year-end you can expect as a return from an investment.

-

Consider uncertainties

The price movement of currency pairs depends on several factors, such as the strength and weakness of each currency of every pair. The FX is a decentralized marketplace that central banks and prominent financial institutes run. Individual traders like us have no impact on price movement for any currency pair.

Trading is more like a probability game to the individuals; the best setup of individuals can fail. So it’s better to prepare for any uncertainty and learn how to overcome your feelings.

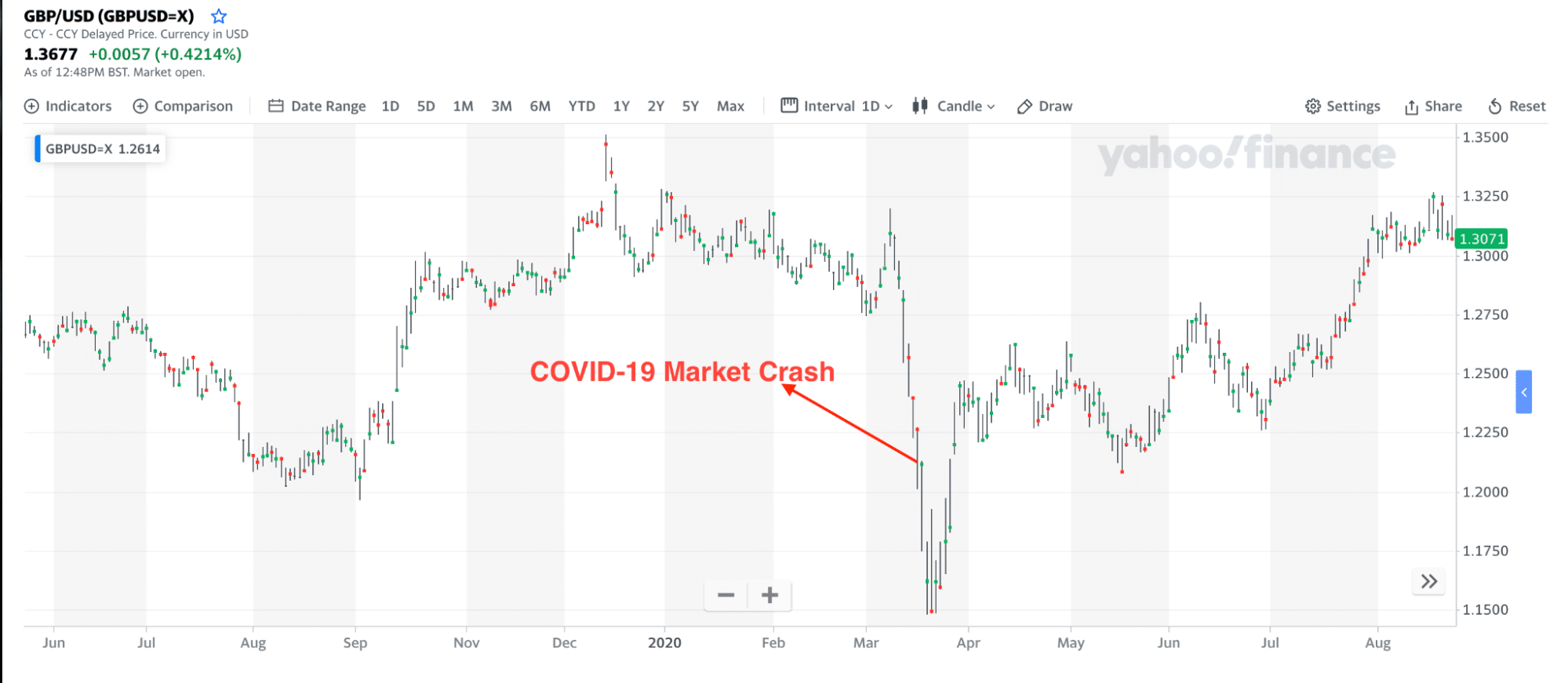

GBP/USD daily chart

The above image shows how Covid-19 crashed GBP/USD from 1.32 to 1.1420 levels. The market moved higher, breaking above the near-term high, and immediately moved lower with more than 1700 pips in just eight trading days.

So, if you buy GBP/USD during the market crash, you would indeed become frustrated after making a considerable loss. But using a proper stop loss, you can quickly get yourself out of the market with a minimum loss.

-

Human contact

If you spent more time in the market, you might increase your profitability by making better trading plans. Unlikely, that’s not entirely true. Moreover, you can lose control, and doing the same thing without taking a break can drive you insane. So it would help if you spend more time with family and friends. It will help you to get good mental health. It will refresh your mind and help you to deal with the stress and boredom of trading. Additionally, increasing conversations with different people will help you see things from different angles and increase your vision and focus.

-

Discipline trading

You must follow disciplines in trading to become successful, which means:

- Enter trades logically.

- Define stop loss and profit-taking areas before making orders.

- Having a proper trade and money management manner, etc.

You have to obey the rules over and over again. An individual trader becomes successful by making the appropriate trading decisions. So the decisions you make, good or bad, must affect you. That’s why you have to follow disciplined trading to overcome that stress and obtain success.

-

Consider market moving

In addition to impacting traders on an individual level, FOMO can have a lot to do with the markets. Moving markets can be emotionally driven — traders look for opportunities and entry points as they sense a new trend is forming.

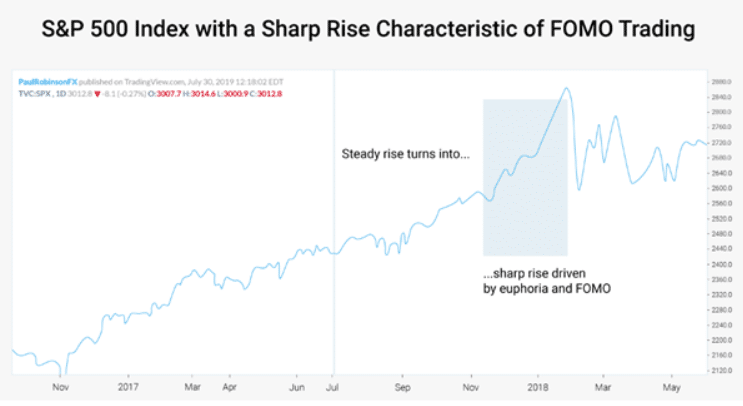

Chart showing S&P 500 Index with FOMO trading

This chart uses the S&P 500 Index to illustrate how markets can move due to mass trader sentiment. Stable bull markets can jump quickly when people start jumping on the bandwagon for fear of missing out. They can also crash, as seen here immediately after the sharp climb. People late to a long position would lose money, which is the worst-case scenario in FOMO trading.

Final thoughts

Finally, you can’t be a successful trader only by practicing and gathering knowledge. You also have to follow some methods to overcome the fear and frustrations involved in trading. The main difference between successful and unsuccessful traders is the decision-making process.

So overcoming these fears and frustrations will help you to conquer a successful career in financial trading. We list the best ways to overcome the trading fear and frustrations. You only need to follow and master the rules. We can guide you, show you the ways, but performing depends upon you. You are your boss, as long as you are an independent trader.

Comments