In 2022, the old rules of investing have mostly gone out the window, but one thing hasn’t changed. Wall Street’s best value stocks continue to be an attractive place for investors to plunk down their money for the long term.

The S&P 500 is down roughly 10% year-to-date. War continues to rage in Ukraine and disrupt energy markets. And significant changes in interest-rate policy continue to upend investment strategies that have been profitable for several years running. That involves looking beyond fashionable growth investments to value stocks that might be roughed up of late but still offer long-term upside.

Many formerly cheap value stocks have already run up sharply given these macroeconomic developments. However, these three value stocks are still poised to benefit in this new market environment.

What are value stocks?

A value stock is a stock with a price that appears low relative to the company’s financial performance, as measured by such fundamentals as the company’s assets, revenue, dividends, earnings, and cash flows. Investors in value stocks assume that the stock price will eventually rise, reflecting the proper health and potential of the company. Because they see the stock as relatively undervalued, they anticipate that its appreciation will outpace the growth of the value stock’s competitors or the market overall.

Characteristics of a value stock:

- Price-to-earnings or price-to-book ratio at or lower than the broader market.

- Priced below peers in its industry.

- They typically are mature businesses.

- Grow their earnings and revenues at a slower pace than the market.

- Relatively stable revenues and earnings.

How to buy value stocks?

After famously lagging since the global financial crisis, value investing is winning again. Nonetheless, some of the best value stocks you will find below. You need to have an account with an online brokerage platform to buy these stocks. When choosing the best stocks to invest in, you should conduct detailed research while considering the volatility found in this marketplace.

Top 3 value stocks to buy in 2022

Here are three stocks with buy rank and strong value characteristics for investors to consider today.

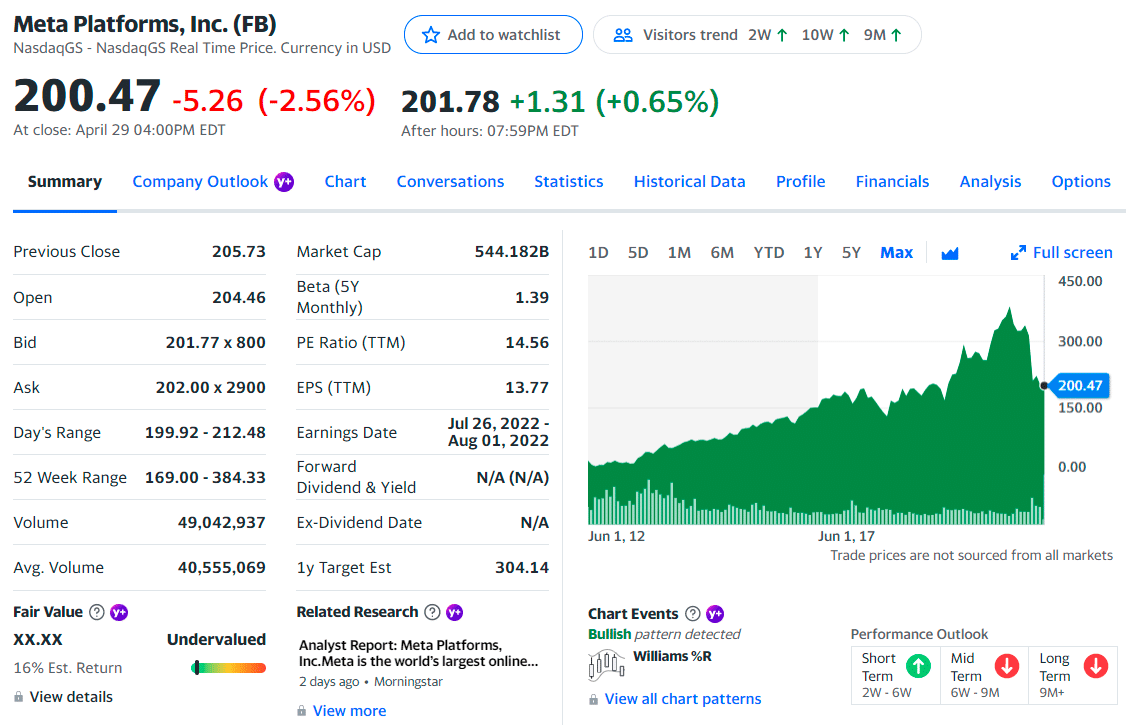

No. 1. Meta Platforms, Inc. (FB)

Price: $200.47

EPS: $13.77

Market cap: $544.18B

META summary

Formerly known as Facebook, Meta Platforms, Inc. is now one of the best value stocks to buy. The parent organization of Facebook, Instagram, WhatsApp, and several other subsidiaries, Meta Platforms, grew to relevance by making social media a necessary component of nearly a third of the plant’s population.

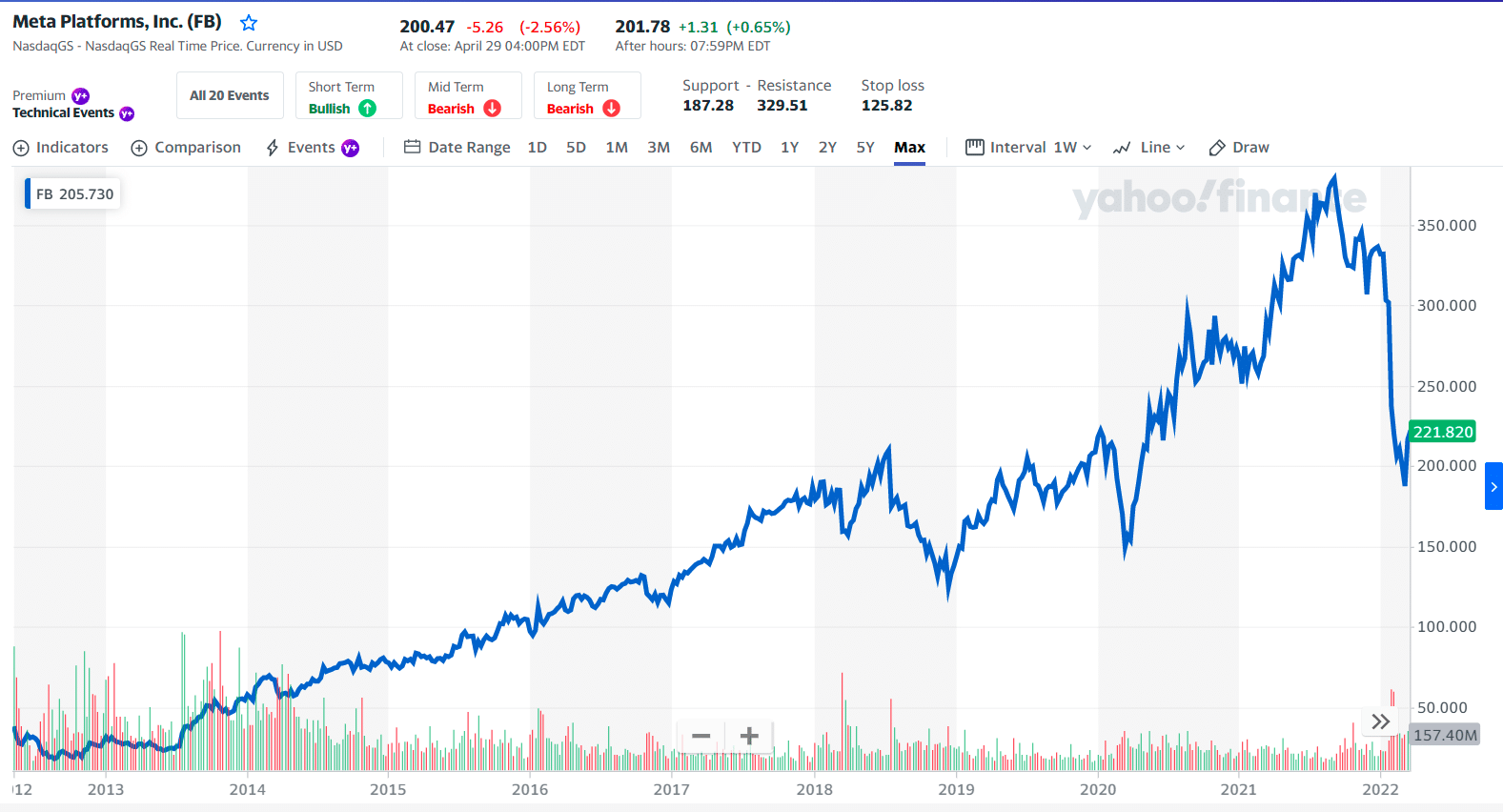

META price chart

Meta’s latest earnings report hinted at slower growth prospects in 2022. Per the report, Q1 revenue is expected to rest somewhere between $27-$29 billion, suggesting growth may top out at 11%. The report blamed headwinds from Apple’s ad-tracking transparency initiative and a slowdown in user growth. As a result, its shares are dropping fast.

Specifically, the company has the opportunity to become an industry leader in developing what has been dubbed Web 3.0. While relatively early in concept, it has been estimated that Web 3.0 may coincide with an $800 billion opportunity by 2024.

The first three holdings:

- Vanguard Group, Inc. — 7.91%

- Blackrock Inc. — 6.87%

- FMR, LLC — 5.54%

If Meta Platforms can retain even a tiny portion of Metaverse’s market share in the future, today’s price point places the company squarely on the “best value stocks” list.

FB price prediction

According to long-term forecasts, Meta will reach $272 by the end of 2022 and $360 in 2023. The stock of FB will continue to increase in value, reaching $470 in 2025, $580 in 2027, and $765 in 2030.

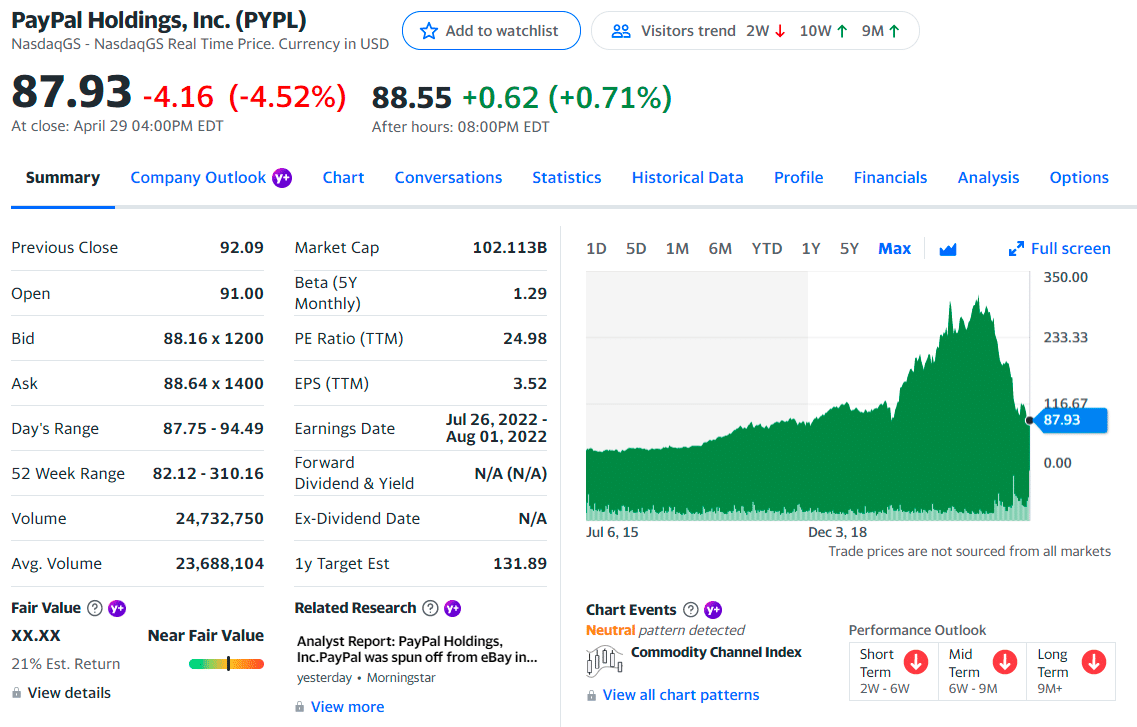

No. 2. PayPal Holdings, Inc. (PYPL)

Price: $87.93

EPS: $3.52

Market cap: 102.113B

PYPL summary

PayPal is the digital payments platform that pioneered the term “fintech.” Officially founded in the late nineties when it was part of eBay, PayPal formally spun out of the online retailer, and IPO’d as its own public company in 2015. Since its initial public offering, PayPal has amassed hundreds of millions of active user accounts and helped each of its customers conduct online digital payments in more than 200 markets across the globe.

Despite a solid showing in the first quarter of this year, PayPal (PYPL) stock has continued to fall. Although the firm reported earnings that exceeded forecasts, shares of the online payment service major closed down.

For 12 months, PayPal shares have sold off on the heels of a broader market selloff and misunderstood quarterly reports. In as little as eight months, shares have dropped 222%, going from an all-time high of $310.16 to today’s $86.03.

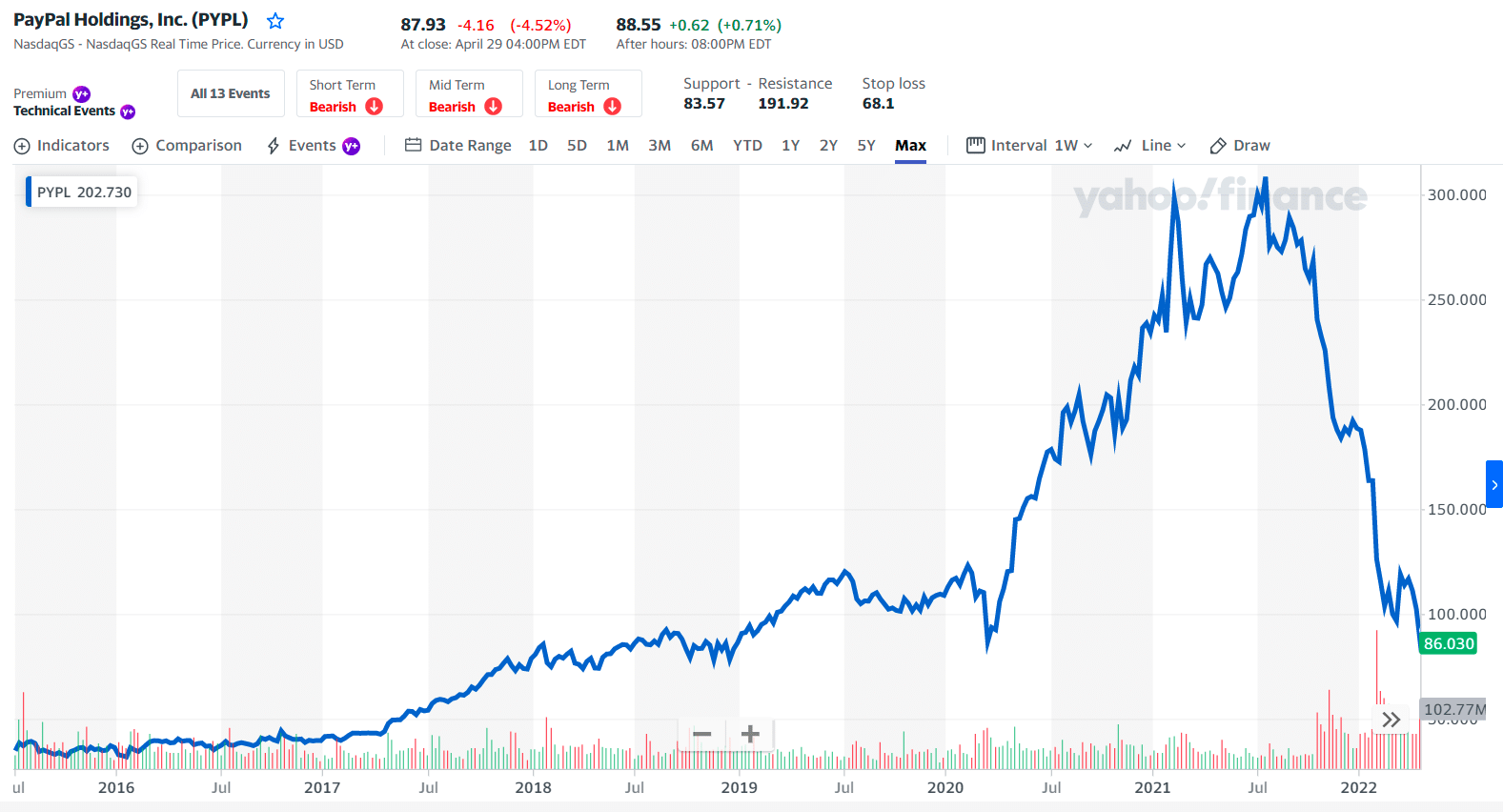

PYPL price chart

The company has not been spared by the headwinds that have eroded its stock value. In addition, digital payments are expected to slow with consumers returning to shop in physical stores as the Covid-19 pandemic has eased. The company’s stock has dropped more than 56% this year and about 69% in one year.

The first three holdings:

- Vanguard Group, Inc. — 8.10%

- Blackrock Inc. — 6.54%

- State Street Corporation — 4.00%

Today, PayPal is trading at the same level it was five years ago, before adding hundreds of millions of users. That, combined with the growth of PayPal’s flagship product Venmo, suggests Wall Street is underestimating the company’s prospects. Therefore, PayPal looks like one of the best value stocks to buy.

PYPL price prediction

According to long-term forecasts, PYPL stock could increase to $92.582 in one year, reaching $104.88 by April 2025 and $106.305 in April 2027.

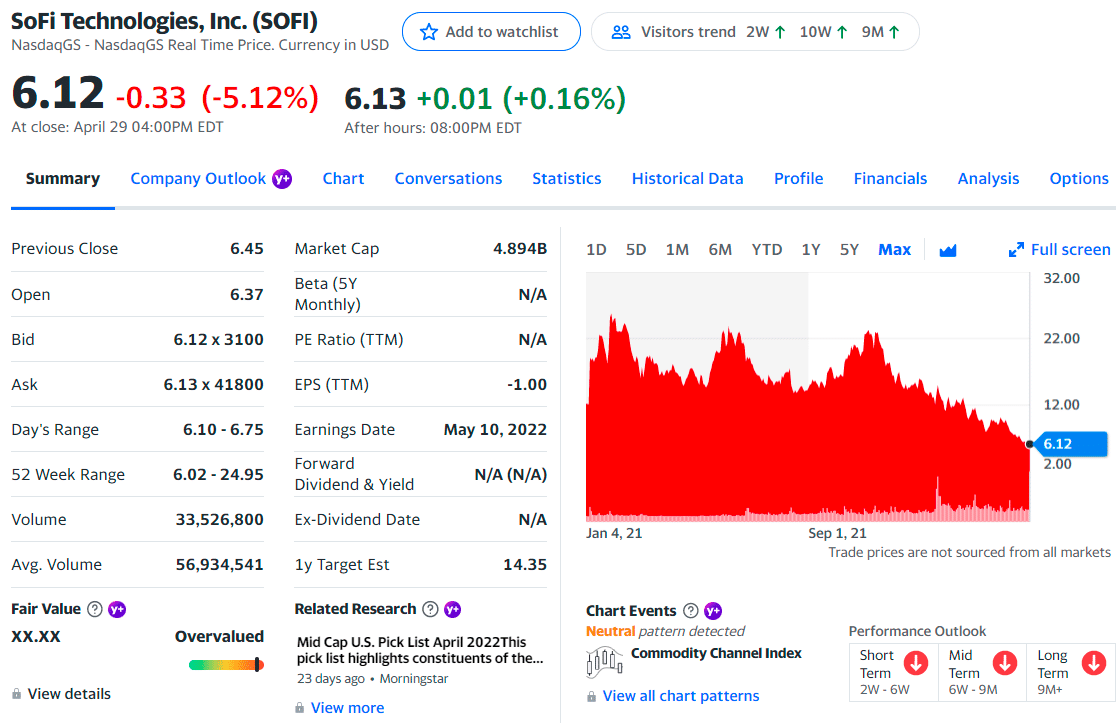

No. 3. SoFi Technologies, Inc. (SoFi)

Price: $6.12

EPS: $-1.00

Market cap: 4.894B

SoFi summary

SoFi first came to market in June 2021, the product of a particular purpose acquisition company (SPAC) merger with Social Capital Hedosophia.

The new company aimed to provide a one-stop-shop for financial services. SoFi operates across three business segments:

- Lending (covering student loan refinancing, personal loans, and home loans).

- A technology platform.

- Financial services, including SoFi Invest, SoFi Money, and credit cards.

Today, customers can expect a wide array of services, including student loan refinancing, private student loans, personal loans, auto loan refinance, home loans, mortgage loans, and investments.

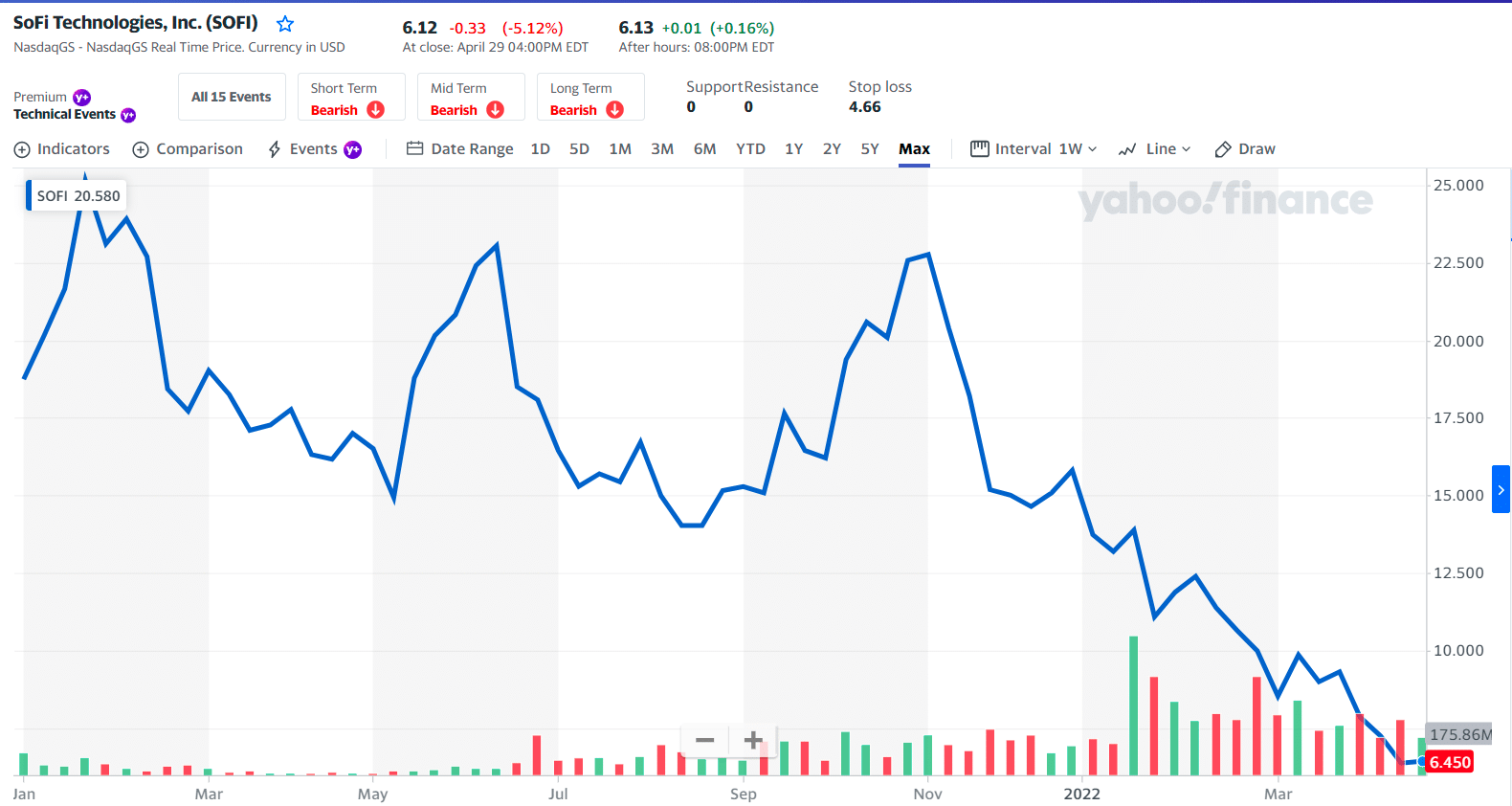

The stock looks expensive on paper, but today’s valuations don’t account for the company’s ability to disrupt one of the biggest industries in the world. SoFi’s price-to-sales ratio makes the stock look expensive from traditional valuation metrics.

SoFi price chart

On the other hand, the price to book is only slightly above the industry median. Additionally, many analysts have already started adjusting their price targets, with several big names suggesting nearly 100% upside over the next 12 months.

The first three holdings:

- Softbank Group Corporation — 14.22%

- Vanguard Group, Inc. — 6.44%

- Price (T.Rowe) Associates Inc. — 4.26%

The company still has a long way to go, and competition in the fintech industry is a real threat. However, if they can increase their customer base, the company will continue to look like one of the best value stocks in today’s market.

SoFi price prediction

According to long-term forecasts, its share price forecast suggested that the price could rise to $11.86 by July 2022.

Final thoughts

The value of investments and their income may go down and up. It is possible that investors will not recover their initial outlay. Past performance is no guarantee for future returns.

Comments