Momentum is a method of trading that involves the assessment of a security’s trend. The goal is to buy while the market is gaining steam and then sell at a predetermined high price. The logic supporting momentum trading is that if the price is moving with enough force, it is likely to continue moving in that same direction for a while.

In crypto, traders and investors are looking for signs to buy low when the market is re-asserting the uptrend and selling when the trend loses steam.

How does momentum trading work?

In physics, Newton’s second law of motion states that a moving object is likely to stay in motion until an opposing force acts on it, putting it to a stop and then reversing its direction. An asset will keep moving in one direction until a fundamental influence moves it the other way. You can apply the same concept in crypto trading.

For instance, when a crypto asset gains value, it will draw attention from trading institutions and individuals. This will create an effect known as fear of missing out, thereby pushing the price further beyond a fundamentally possible point. When traders and investors perceive that the uptrend is losing ground, they might judge the price as overbought and start selling their holdings.

Shiba Inu daily chart as of 8 February 2022

Types of momentum trading

Before you engage in momentum trading, be aware that there are two types of momentum trading. These are absolute and relative momentum.

Absolute momentum

It refers to the process of analyzing the individual prices of crypto or another security. When you perform this process, you will compare the recent price of a crypto asset with its past price and performance.

For instance, if you find that the Shiba Inu coin has found a bottom and is making a step-up ladder formation, it means that it has gained an upward momentum and is ripe for buying. This is currently the situation, as you can see in the above picture.

Relative momentum

It refers to the process of measuring the trend of one asset against another. For example, if you find in your analysis that TRX/USD is closely following the direction of Bitcoin, you can start buying this altcoin when BTC starts an upward movement. Take note that not all altcoins move in the same manner. Study the correlation among crypto assets and use it to your advantage.

How to build a crypto momentum trading strategy

Building a crypto momentum strategy is similar to developing a trading plan utilizing any methodology. You have to approach the process step by step. The steps are outlined in this section.

Step 1. Select crypto assets

Decide which crypto assets you would like to trade. Will you buy coins with a high market cap but with low prices? That is a good strategy, but there are other methods available. You might make your selection based on certain chart factors.

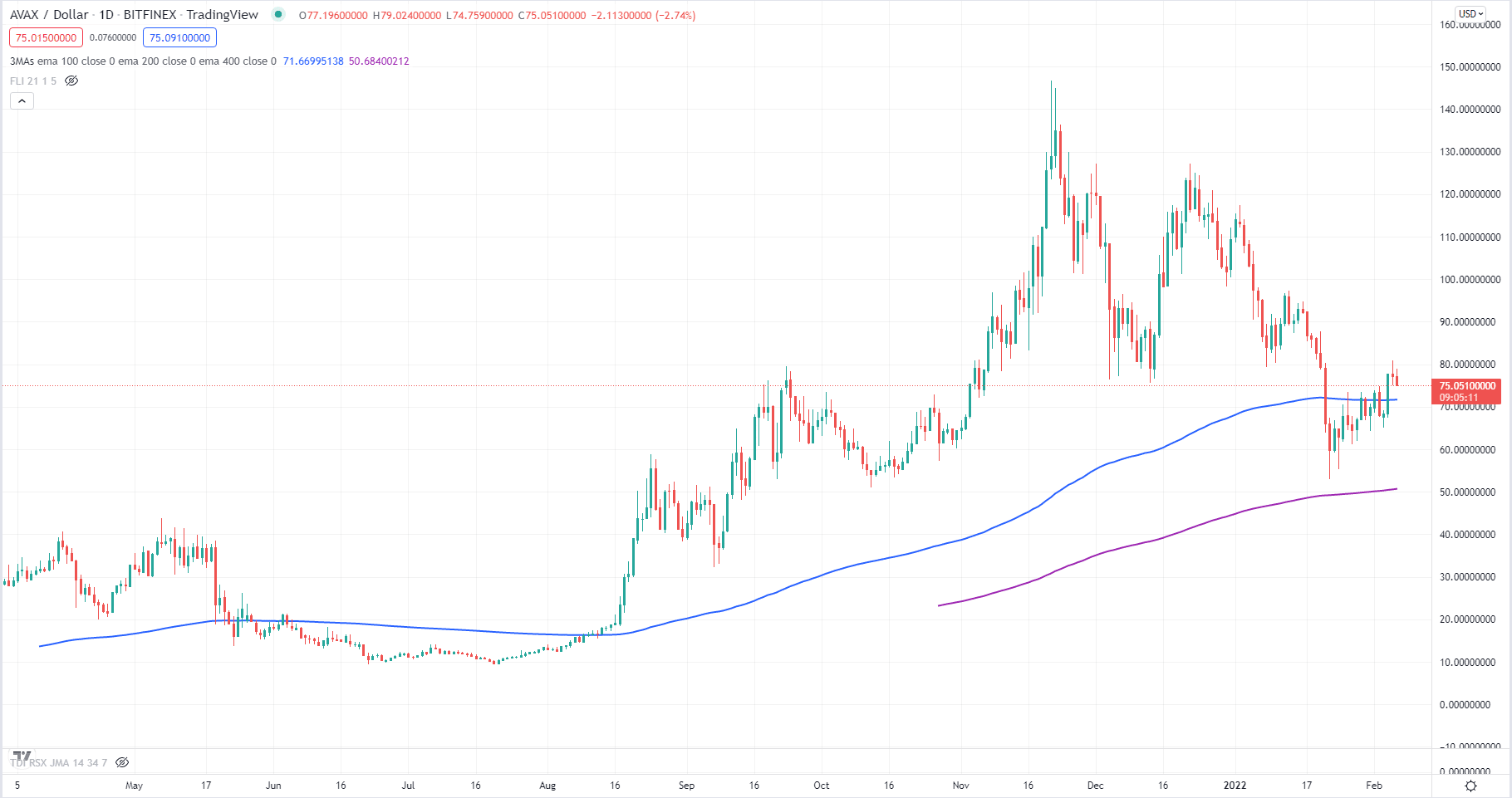

Do you like a clean chart with a clear trend? Consider the daily chart below of Avalanche. Is this chart looks appealing to you? If so, you have to set it down in your trading plan and only trade markets that behave in this way.

AVAX/USD daily chart

Step 2. Build a strategy

You can use an existing strategy you find somewhere online or build your own from scratch. If you use another person’s strategy, scour your charts and find scenarios defined by the method. If the method works, move on to the next part. You may also modify the strategy as you see necessary.

To build your momentum strategy from scratch, you can start by opening some charts, noting common themes, and applying indicators. Do not overwhelm yourself by putting too many indicators at the get-go. Test out two to three indicators and not more. While building your strategy, it is best to record everything in a trading plan.

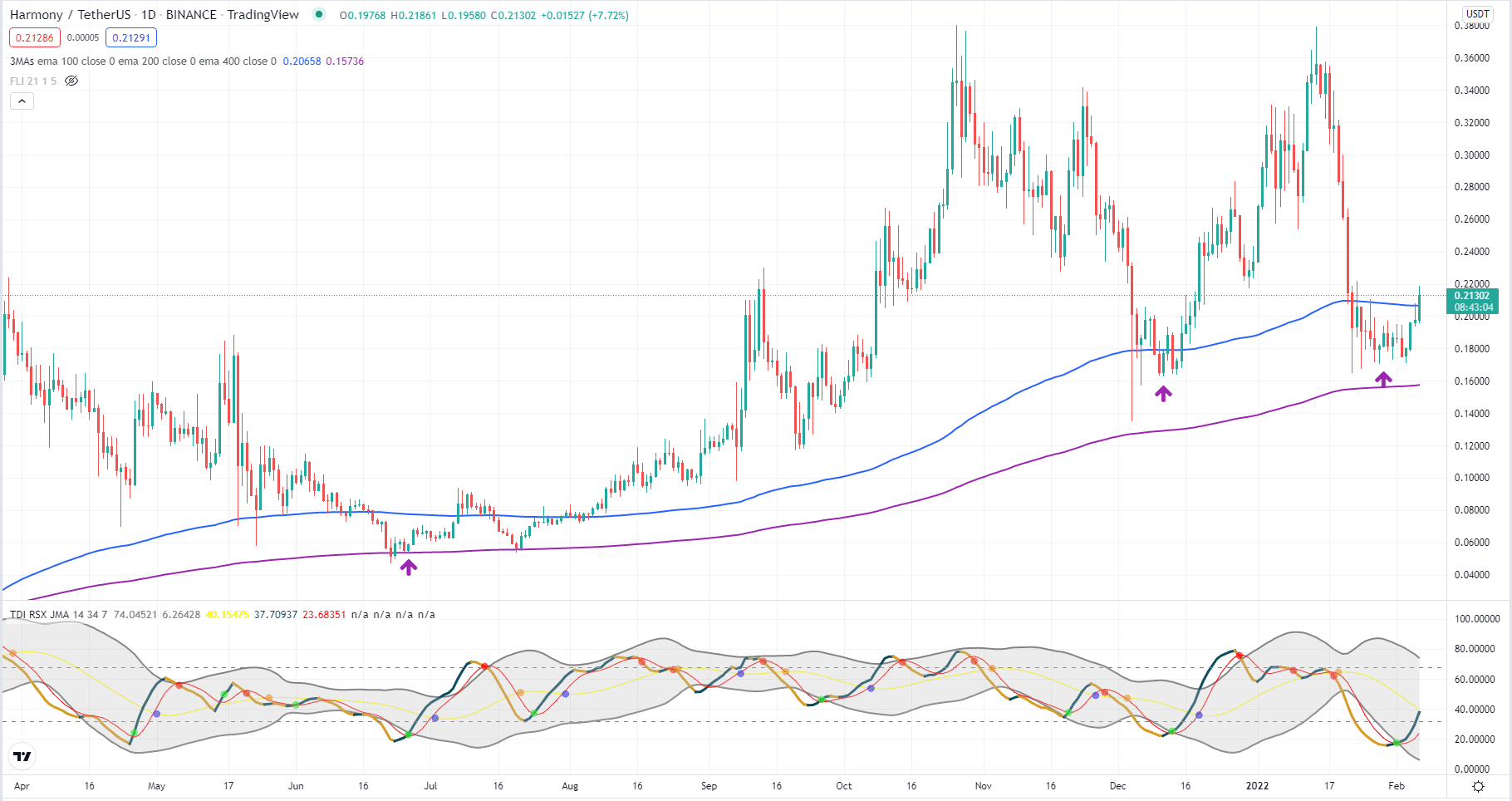

One simple momentum strategy is a combination of a trend indicator and an oscillator. In the image shown below, we use 200 and 400 EMAs and the TDI indicator. This strategy has two rules.

- First, 200 EMA should be above 400 EMA; the market is trending up.

- Second, the price must retrace and reach the oversold territory.

Three such scenarios are shown in the chart below, marked by the purple up arrow.

ONE/USDT daily chart

Step 3. Test your strategy

Test your momentum trading strategy in a practice account and find out if the signals are accurate and how accurate. To avoid a false sense of effectiveness, give your strategy at least three months to prove itself. Conduct demo trading for a reasonable time to see if the method holds water.

Step 4. Finetune your strategy

Any trading strategy is not set in stone. You can modify as you find necessary. While testing your strategy through demo trading, it is good practice to record your performance in a journal. This is how you will evaluate your performance regularly and find areas for improvement. If you find that your strategy leads to late entries during the review, you can tweak your entry technique. Maybe you can enter before the RSI price line and RSI signal line cross up.

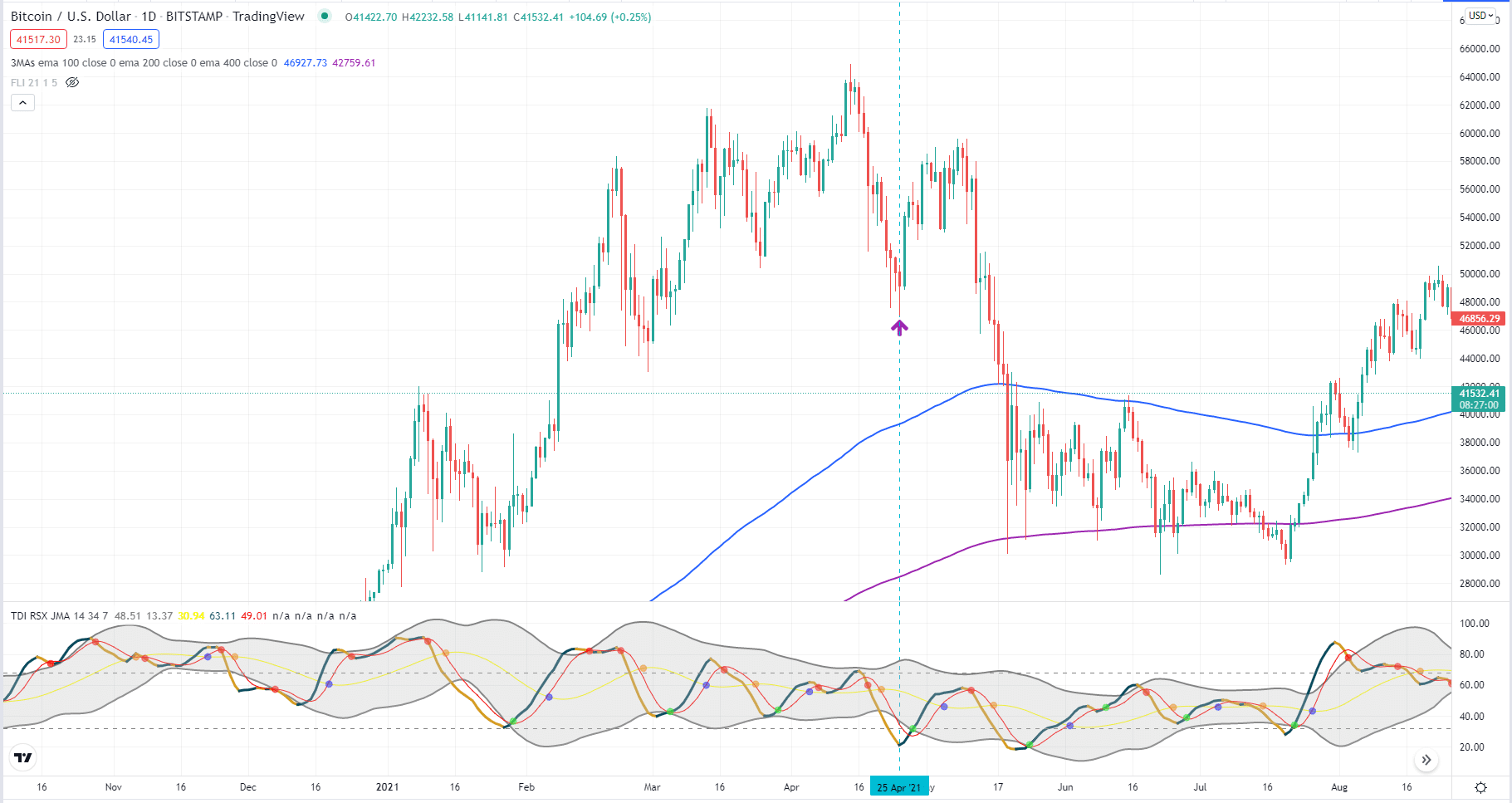

You can buy when TDI becomes oversold, and you see a bullish candlestick signal in the image below. This is marked with a purple up arrow. Revising the whole strategy is often a bad idea. Instead, gradually update your strategy. Perhaps you can do this finetuning activity every time you make ten trades or every month.

Bitcoin daily chart

Step 5. Put your strategy to use

If your testing produces good results for a fair amount of time, it is time to start applying the strategy in real trading. There are some steps you must take before you can trade live. First, you must find and open an account on a trading platform. One such platform is StormGain, but there are many platforms out there. Once you open an account, you can deposit money into the account.

When trading the crypto market, make sure you invest an amount you are comfortable with losing if your strategy does not convert at the initial campaign. When you start trading, carefully follow your trading plan and do not digress. That is how you can evaluate if your momentum trading strategy works in the live market environment.

StormGain crypto trading platform

Final thoughts

Momentum trading is suitable for any trader. It works great when applied in high time frame charts such as hourly and above. If you are a day trader, swing trader, or position trader, you can use momentum trading strategies. Once you find a strategy that works, risk management is the next thing to focus on. This can make or break you as a trader.

Comments