The human body is so active that life has a clock on it-level of activity that declines with age. If you have a nest of investments churning passive income, then retirement life is quite blissful, as it should be. IRAs are one of the best retirement savings options.

What are IRAs?

The unabbreviated name for IRAs is individual retirement accounts. However, the Internal Revenue Services department defines IRAs as separate retirement arrangements. The last definition encompasses all retirement plans, excluding 401k, savings accounts, retirement income provisions, retirement annuities, and investment assets expressly set aside for retirement income, coupled with tax benefits.

So how do all these IRA plans work?

IRA accounts invest in different assets, including private placements, stocks, commodities, bonds, mutual funds, real estate, and EFTs-exchange-traded funds. The yearly contributions that fund this IRA account range from $6000 to $16500, depending on the account type. No need to worry since we comprehensively cover these IRAs below.

What are IRA options there?

Individual income and other retirement plan engagements dictate the IRA type ideal to a person. In addition, the IRA option informs on the annual contribution capping and whether they are tax-deductible or not.

There are four IRA options available as a choice:

-

Traditional IRA

Contributions remitted towards traditional IRA accounts happen pre-tax-tax burden reduces by the contribution amount. The taxman, however, gets their due on withdrawals during retirement at the prevailing income tax rate and bracket.

For example, if contributing $5500 yearly, the taxable income reduces by an equal amount. The maximum lawful contribution in a year is $6000, providing an additional $1000-those for aged 50 years and over. They attract mandatory withdrawal past 72 or a 50% tax fine on the required distribution. Initially, the capped age for contribution was 70 and a half years, but there was a revision as long as one earns an income.

-

Roth IRA

Roth IRA contributions attract an immediate tax-comprise part of the taxable income. However, the taxman has no claim on the withdrawals or any coupled interests and returns. Account-holders here also don’t have to deal with mandatory withdrawals. The annual max contribution capping is to the traditional IRA accounts $6000 with an allowable extra $1000 add-on contribution for those aged 50 years and above.

-

SEP IRA

Small organizations helping people earn a living through self-employment and create jobs for a few employees have a tailor-made IRA option, simplified employee pension, SEP IRA. It borrows the 401k concept of employer contribution for their employee.

However, employees cannot contribute to this account. The contributions occur pre-tax hence reducing the income tax reliability. The tax burden settling happens during withdrawal-taxed as income. Annual contributions capping is at 25% of income or $58000, the lesser of the two.

-

Simple IRA

When you marry 401k and IRA accounts, the result is a savings incentive match plan for Simple IRA. Moreover, it is a plan available to small enterprises whose objective is self-employment income and job creation, albeit on a small scale.

Borrowing from 401k plans, employer and employee both contribute to the account. For this option, contributions are tax-deductible. The annual amount max capping is at $13500, with a provision for an extra $3000-those aged 50 years and above.

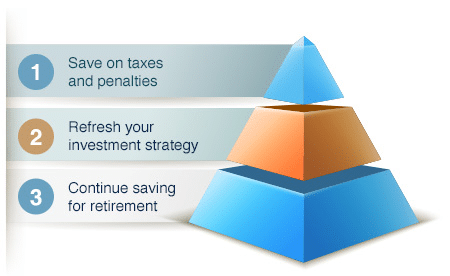

IRA benefits

Traditional retirement plans, like 401k, offer a safety net on retirement on small-scale-take a vacation locally as opposed to a Caribbean island vacation. On the other hand, IRAs are vehicles offering retirees the life of their choice depending on how aggressive they choose to be during investments.

In addition, investors get to enjoy:

-

Tax benefits

Depending on the IRA option adopted, individuals enjoy either lower tax burdens at present or wealth growth through untaxed returns and expenses until withdrawals occur.

-

Investment choices

Unlike traditional retirement plans, IRAs provide their holders with various investment options to suit their particular risk tolerance and investment objectives:

- stocks

- mutual funds

- bonds

- EFTs

- real estate-both physical properties

- real estate investment funds

-

Retirement income

Working during an individual youth is so that future generations and retirement life is stress-free and enjoyable. In addition, IRAs are avenues for saving a portion of the current income and having it work for you for enhanced returns in the future.

IRA custodians

The IRS requirement is that all IRA accounts be under custody for management and administration purposes. The type of custodian chosen is dependent on the level of account control sought in the investment decisions:

-

Managed accounts

Here the majority of the investment decisions are the custodian’s responsibility.

-

Self-directed accounts

Account owners enjoy leeway on investment decisions outside the main investment instruments such as REITs, precious metals, physical property, and closely-held business ventures.

The authorized IRA custodians available for use according to the IRS include:

-

Banks

They are suitable for investors interested in money markets, the federal insurance deposit corporation, certificates of deposits. They also offer brokerage services for other investment instruments but at a steep fee.

-

Insurance companies

Offer IRA management services in addition to fixed and variable annuities, account value protection, and death benefits. Management fees are relatively steep, yet IRA accounts already have tax benefits.

-

Mutual fund companies

Present IRA holders a chance to invest in mutual funds or the exchange-traded funds in their portfolio.

-

Robo-advisors

They are the most cost-friendly custodian choice. They are automated account managers via an online investment platform. Are the new kid on the block for IRA account custody.

-

Brokerage firms

Represent an all-encompassing custodian providing all your investment choices under one roof-stocks, bonds, ETFs, commodities, and mutual funds.

-

Administrators and facilitators

Lack accreditation as actual custodians from the IRS but act as middlemen for investments outside the conventional IRA investment options.

Ensure the custodian chosen is up to date on the IRS investment requirements since any infringement attracts steep penalties.

Bottom line

IRA accounts are a great way to safeguard a laid-back retirement life. The level of control over the investment decision determines the custodian of choice and the available investment assets to ensure account growth and returns.

All that’s needed is ensuring the IRA account and custodian have a wide variety of investment instruments, attractive commissions, low-cost investment fees, and low management fees.

Comments