- In the ‘80s, the cost of a movie ticket was on average $3.50

- In 2001, it was around $5.66

- Today, the price of a movie ticket is on average $9.16

What is causing the price increase of goods year on year?

The short answer is inflation. In the USA, the CPI increased to 5% in May of 2021; it’s the highest since 2008. And in the UK, the inflation rate rose to 2.1%, small compared to the USA but not insignificant as the UK’s economy is much smaller than the USA.

When we hear discussions about increasing inflation, we have to pay attention.

The increased inflation rate is not a good sign as it means consumers will have to spend more on the things they need. In addition, it’s also worrying for investors as they cannot foresee the possible impact on their investments.

However, the government has to control inflation to ensure the country’s economy is not at risk. Inflation impacts investments, but it’s not all bad news; we will share ways that can help you protect your investment against inflation.

What is inflation?

It is a result of rising prices for goods and services. These items include food, housing, clothing, recreation, transport, and industrial goods. The Bureau of Labor Statistics measures the inflation rate and reports it as the CPI, which stands for Consumer Price index.

There are three main types of inflation:

Cost-push

When businesses’ operating costs become too expensive, they transfer this onto consumers by increasing the cost of the goods they produce.

Higher production costs could be related to increased raw material costs such as oil, workers’ demand for higher salaries or wages, and property rentals increase.

Demand-pull

It is defined as when the supply of an item cannot keep up with its demand. This is because consumers have more money to spend and are therefore depleting the supply of goods. The increased demand for goods causes an increase in the price of the item.

Built-in

This type results from other inflation that could push up the living costs for consumers. When workers demand salaries to increase due to increased living costs, this creates built-in inflation. With higher labor costs, production costs go up, which in turn can lead to cost-push inflation.

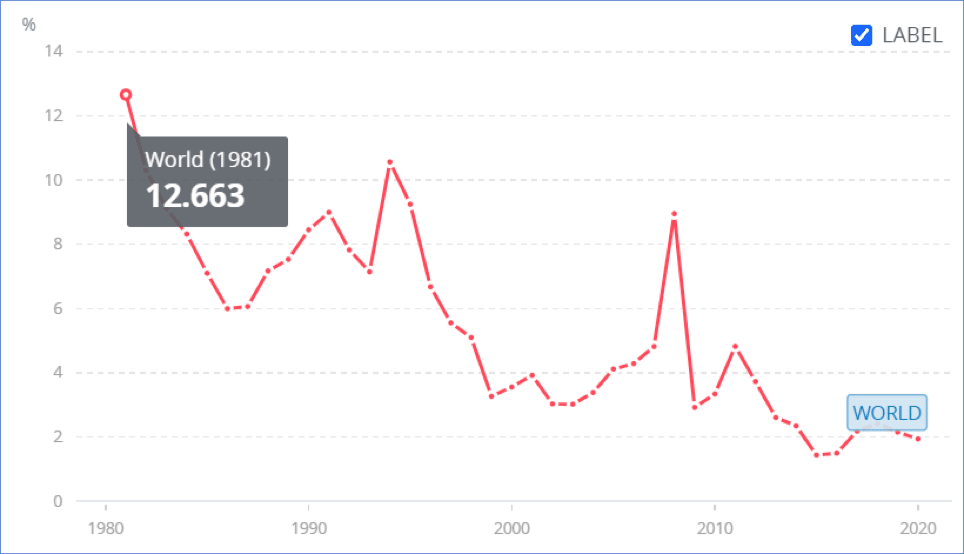

World annual inflation data from 1980 – 2020

How does inflation impact investments?

Inflation is not all bad for investments. However, it depends on what asset class you have invested in, as certain investments react differently to a rise in inflation. We will review the main types, and the impact inflation has on them.

Stock investments

Historically, stocks have prevailed over the rise of inflation, which is due to a few reasons. One of them being the increase in the cost of goods produced, and the consumer pays this cost.

Thus, when the demand for goods increases, producers’ prices rise, which fuels their earnings. This type of growth is perfect for large corporations because their brands and competition are stronger; therefore, if the profits grow, the returns for shareholders are higher.

Fixed income investments

Fixed income investments are bonds, securities, and treasuries, and these types of investments provide a stable income. This is because the interest rates from these investments generate revenue, but these interest rates remain fixed. Therefore, if inflation rises, the returns on these investments are less because the interest earned is lower.

Real assets

The inflation rate has a positive correlation with investments like property and commodities. Precious metals and oil prices rise when inflation increases and are therefore suitable investments. However, commodities are volatile and have been outperformed by stocks and bonds historically.

Real estate prices also increase with inflation since landlords can increase rent and bring more money to investors.

Gold

Many people looked at gold as an “alternative currency,” especially in countries whose currency is losing value. These countries tend to use gold or other strong currencies when their currency fails. Gold is an actual physical asset that retains its value for the most part.

However, gold is not a genuinely ideal inflation hedge. When inflation rises, central banks tend to raise interest rates as part of monetary policy. Holding an asset like gold that does not generate income is not as valuable as owning an asset that does, especially when the rates are higher, which means that the yield is higher.

There are better assets to invest in if you want to protect yourself from inflation. But as with any strong portfolio, diversification is critical, and if you are considering investing in gold, the SPDR Gold Shares ETF (GLD) is worth considering.

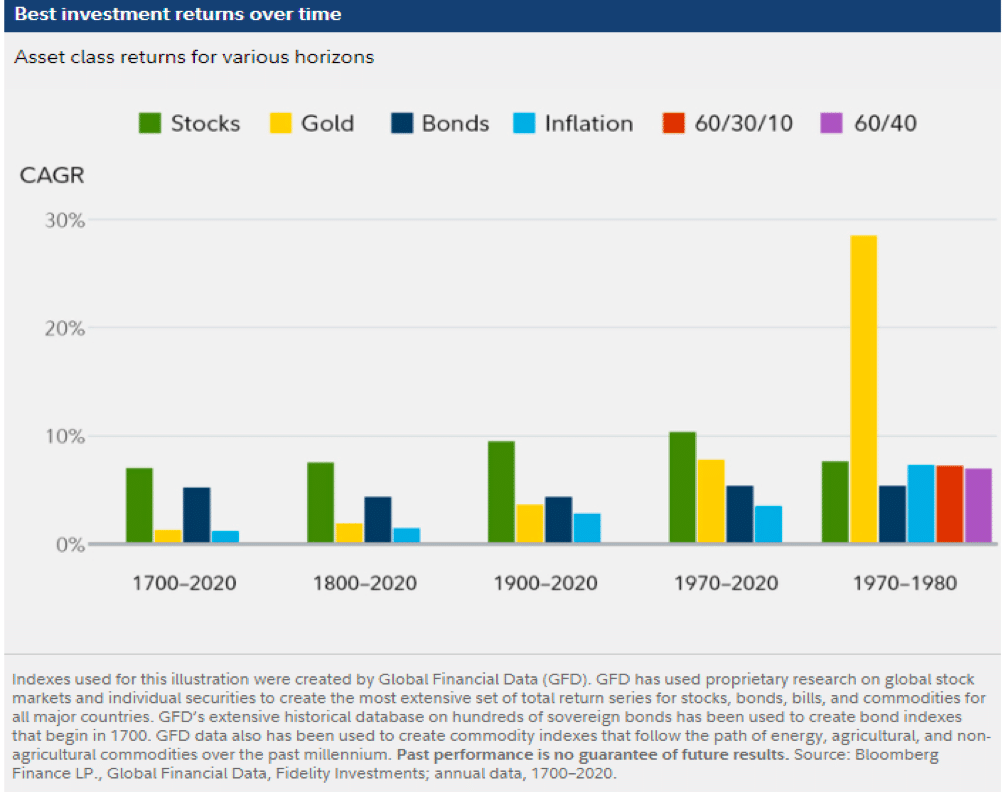

Asset class returns for various horizons

How to guard against inflation

There is no full-proof method for guarding your investments, but there are alternatives you can consider during times of high inflation.

Equity investments

Investing in real estate trusts, stocks, and commodities is a safer option as a positive correlation exists with inflation. Equity investment prices tend to rise with inflation, and they are not affected by the weakening currency.

Fixed income investments

Yes, we highlighted that fixed-income investments do not yield returns during rising inflation, but there are a few exemptions from this rule:

-

Treasury-inflation protected securities (TIPS)

Unlike other bonds with fixed interest rates, TIPS’s interests align with the inflation rate and, therefore, are more profitable in the long run.

-

International bonds

They allow you to benefit from exposure to foreign currencies.

-

Short duration bonds

They mature faster, on average, five years, therefore your money will not be tied up over a long period.

-

Essentially hedging against inflation

It is what it comes down to; in addition, you can spread your investments across these asset classes to mitigate the impact of inflation.

Final thoughts

Avoiding inflation is not an option, and as an active investor, you would want to choose products that will add value to your money in the long term, and therefore taking a proactive approach will help you achieve this.

As we mentioned, diversifying into assets that are more resistant to inflation is an excellent place to start. The bottom line is that increased inflation can be suitable for investors as long as you take the necessary precautions to protect your money.

Comments