You may make money by buying and selling currencies if you understand how the forex market works. So, if you’re interested in working in this field, you should go for it.

People interested in a career in personal finance and asset management can earn a variety of certifications. For example, traders may not have access to extensive skill-building programs such as the chartered financial experts or CFPs, but they may have access to the stock exchange.

Enrolling in a variety of advanced education programs can help market participants increase their output. For example, traders may benefit from several educational programs designed to assist them in improving their skills and knowledge of the market. In addition, CFAs can select from several different certification programs.

To work in the FX business, you must fully grasp the financial rules that regulate trading accounts and account administration.

1. Manager of an institute

Account managers and competent traders are needed to execute buy and sell orders in foreign currency mutual funds and hedge funds that trade FX. Investment firms such as banks, multinational corporations, and central banks hire traders because they fear currency market swings will hurt their bottom lines. Accounts manage separate accounts, making trading decisions and executing transactions based on their client’s objectives and risk appetite.

There are several advantages to working in these fields. Account managers are in charge of a substantial sum, and how effectively they manage it has a significant impact on their professional and corporate reputations.

They must achieve their profit targets while taking an acceptable amount of risk. This work may necessitate a bachelor’s degree in economics, economic theory, or management. Besides, they must achieve financial employment experience and a bachelor’s degree in economics, economic theory, or management.

Expert market participants may be required to trade commodities, options, futures, and other financial instruments in addition to FX.

Trade management system workflow

2. Currency exchange analyst

Investment firms employ forex market analysts, often known as researchers or strategists. They conduct market research and analysis to offer trading volume analysis on exchange rates and the political and social effects on currency prices.

To stay up with the fast-paced FX market, these experts must provide views and high-quality information while doing fundamental and quantitative research.

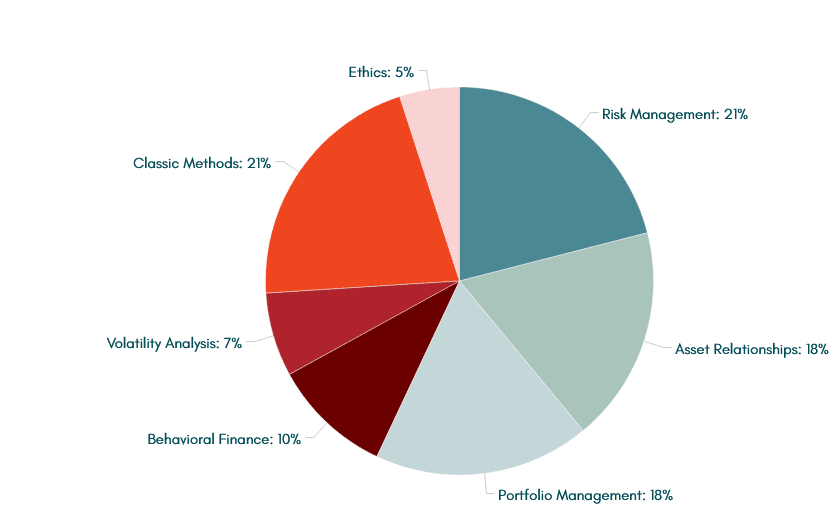

While the CFA program focuses more and more on capital consolidation and portfolio management, a few key study goals need a strong grasp of foreign exchange-related topics.

CFA candidates must be able to integrate financial accounts for income-generating firms in overseas markets, understand the impact of currency values on capital risk, forecast rates, and understand the fundamental principles of the market, for example. As a result, and per the CFA program’s numerous goals, charter holders have demonstrated their ability to assimilate complex financial knowledge and comprehend the whole sector thoroughly.

3. Financial risk manager

While the CFA program focuses more and more on capital consolidation and portfolio management, a few key study goals need a strong grasp of foreign exchange-related topics.

CFA candidates must integrate financial accounts for income-generating firms in overseas markets, understand the impact of currency values on capital risk, forecast FX rates, etc. As a result, and per the CFA program’s numerous goals, charter holders have demonstrated their ability to assimilate complex financial knowledge and comprehend the whole sector thoroughly.

Since global dispersion is becoming an essential part of portfolio management, CFA programs address many crucial issues that shareholders should be mindful of.

4. Certified Market Technician (CMT)

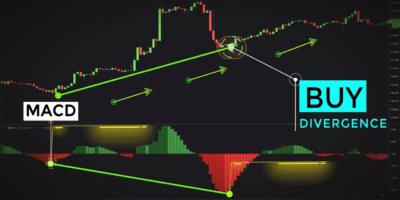

Successful traders use Fibonacci patterns, Bollinger Bands, pivot points, candlestick shapes, Elliott waves, and other chart patterns as indicators.

Market participants that use these technical analysis techniques make for the majority of everyday FX financial transactions. The CMT program is designed to help those who already have a job improve their chart analysis abilities. Like the CFA and FRM programs, the CMT curriculum teaches students how to use chart patterns in real-world situations.

Certified Market Technician (CMT)

The graphical analysis would assist a company’s core strategy or meet fully customizable objectives. In addition, charts can often aid analysts in comprehending the different characteristics of a major currency, which may then be utilized to forecast and anticipate future currency movement.

When it comes to having sophisticated trading strategies, knowing how to connect chart charts with other financial indicators provides charter holders with a significant competitive edge.

5. Trade Audit Specialist (TAS)

Becoming an exchange partner is the third option for completing the top three FX job options. Trade Audit Officials and Exchange Managers are other names for them. Monitoring new client accounts, confirming license information, processing customer payments, and offering customer support are all tasks of the Exchange Operations Officer.

A Trade Audit Associate’s job entails collaborating with customers to resolve trade disputes. As a result, you’ll need strong communication skills and even the flexibility to provide appropriate assistance to clients.

In addition, the Exchange Operations Manager is in charge of FX transaction verification, financing, settlement, and auditing. As a result, you’ll need to be familiar with derivatives markets software like the SWIFT system.

Final thoughts

The FX market has a diversified variety of job choices, impacting the different qualities required to work in the business. For example, the FRM certification is for risk managers, the CFA certification is for investment banks, and the CMT certification is for merchants.

On the other hand, PhDs are more prominent among hedge fund quants. To fulfill their unique needs, determined financial professionals may combine various degrees and training.

Comments