Investing in ETF funds is an excellent use of savings if you want to “make your money work” but don’t fully understand the process. To make as much money as possible in the stock market, you need to leave your investments alone for at least a few years. So don’t invest money that you may need shortly.

Let’s see the three ETFs, which are worth investing in, and the reasons why it is not worth selling them.

Top 3 funds that every investor should pay attention to in 2021

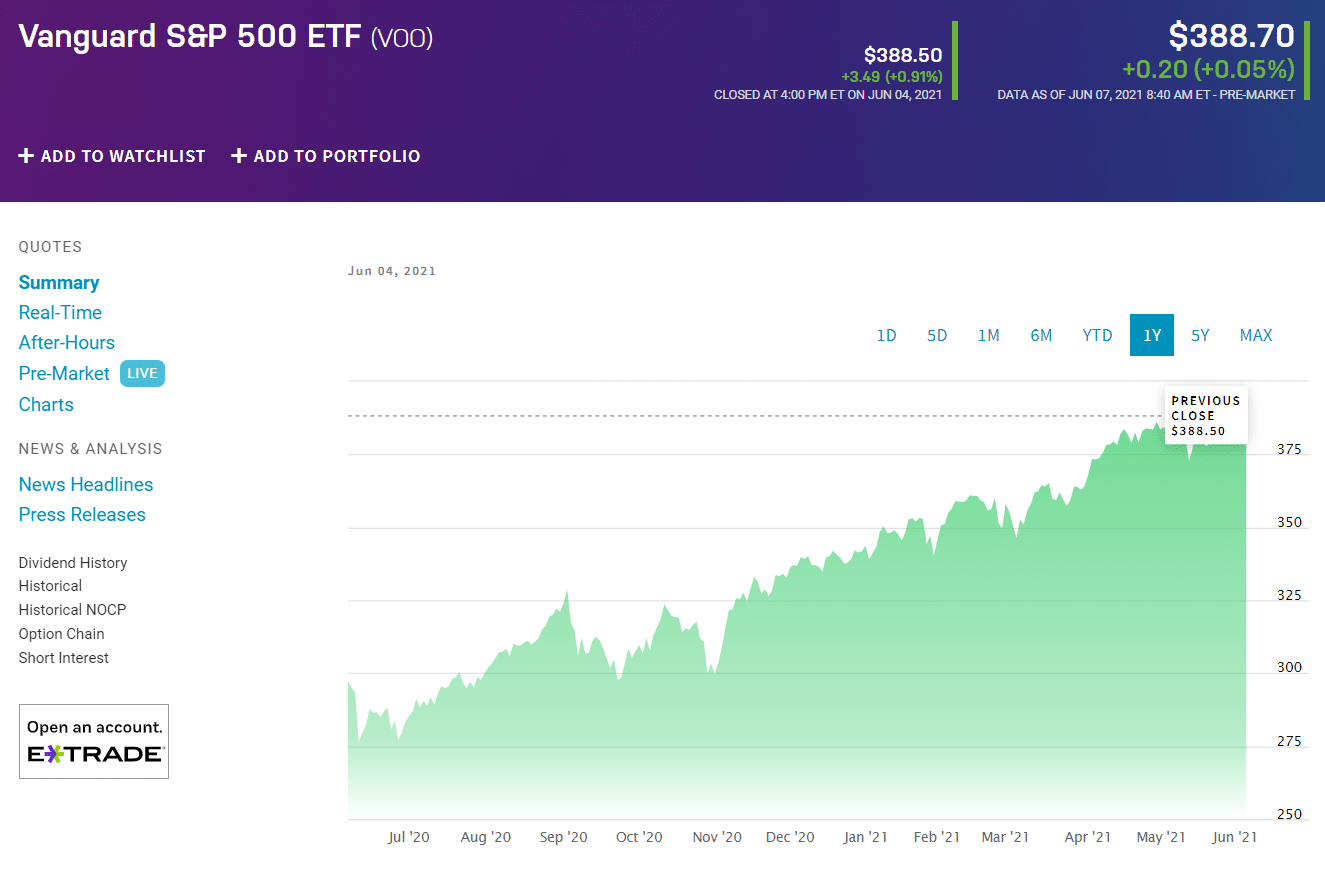

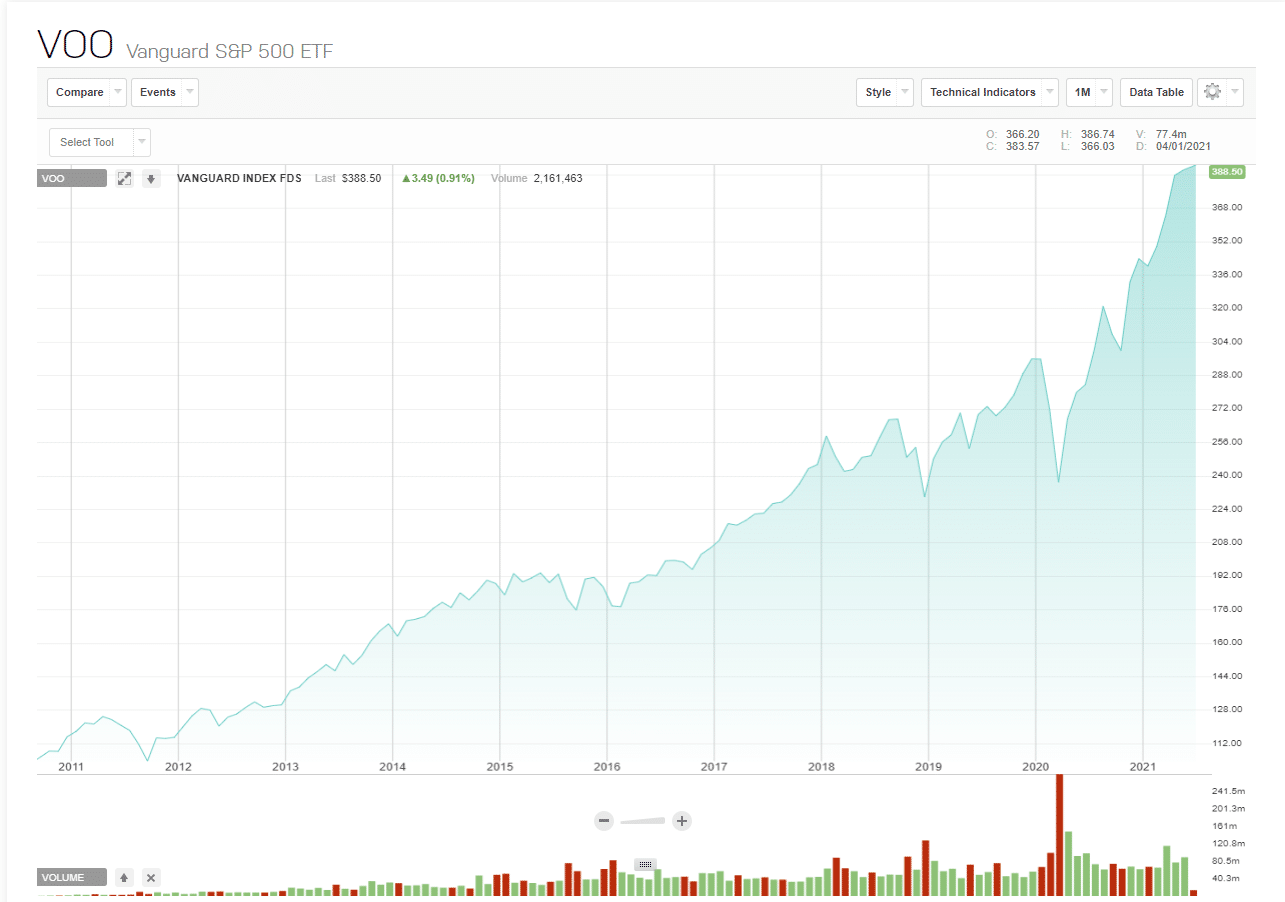

1. ETF Vanguard S&P 500 (VOO)

The Vanguard S&P 500 ETF is an exchange-traded fund that tracks the S&P 500. The fund includes all of the S&P 500 stocks, some of the largest and strongest companies in the United States. This fund has generated an average return of 15% per year since its inception in 2010.

If you want to see your fortune grow faster, you can continue to invest a little each month. For example, if you invest $1,000 in the Vanguard S&P 500 ETF and keep going to invest $100 every month, you could double the initial investment in one year.

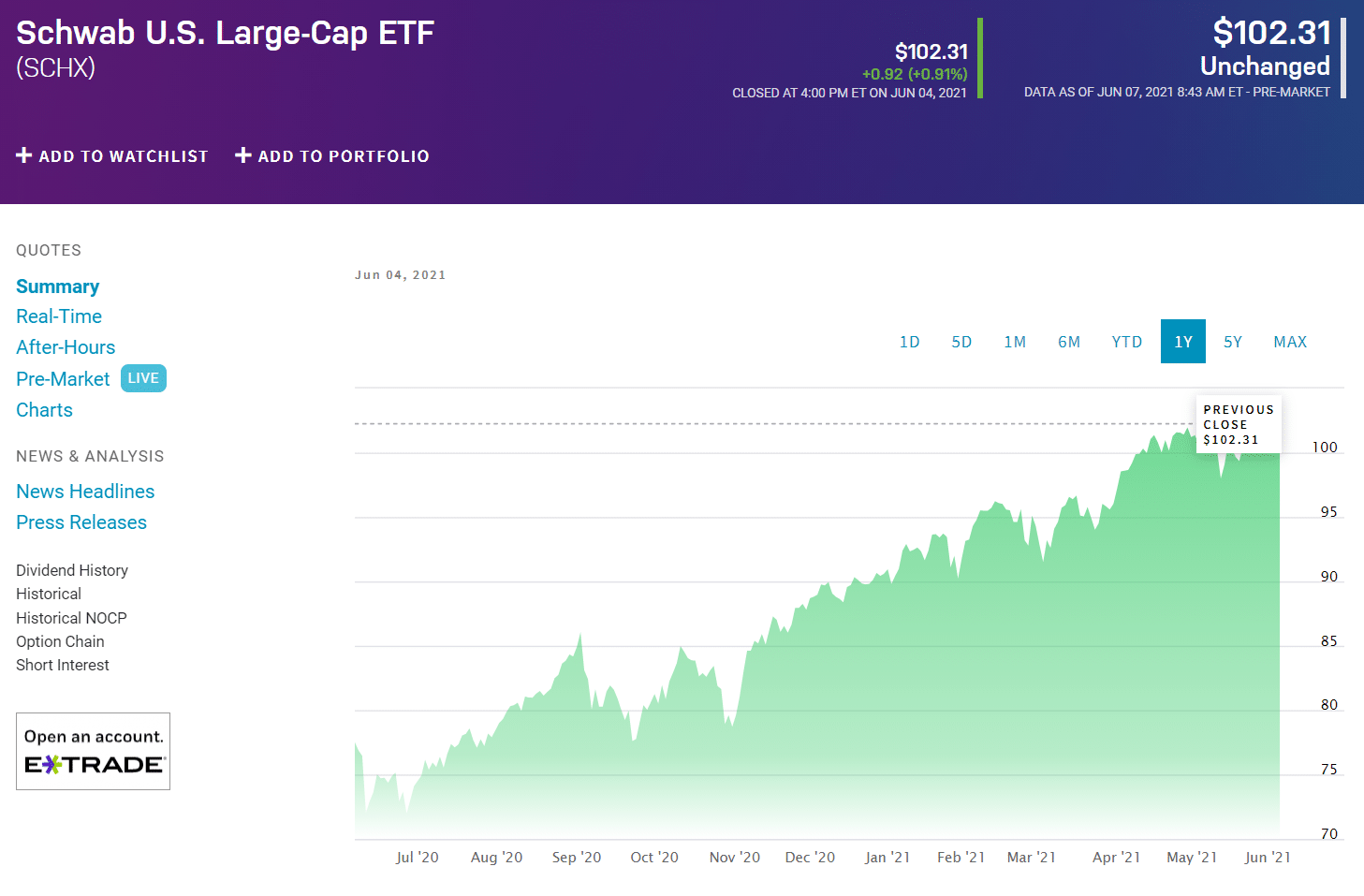

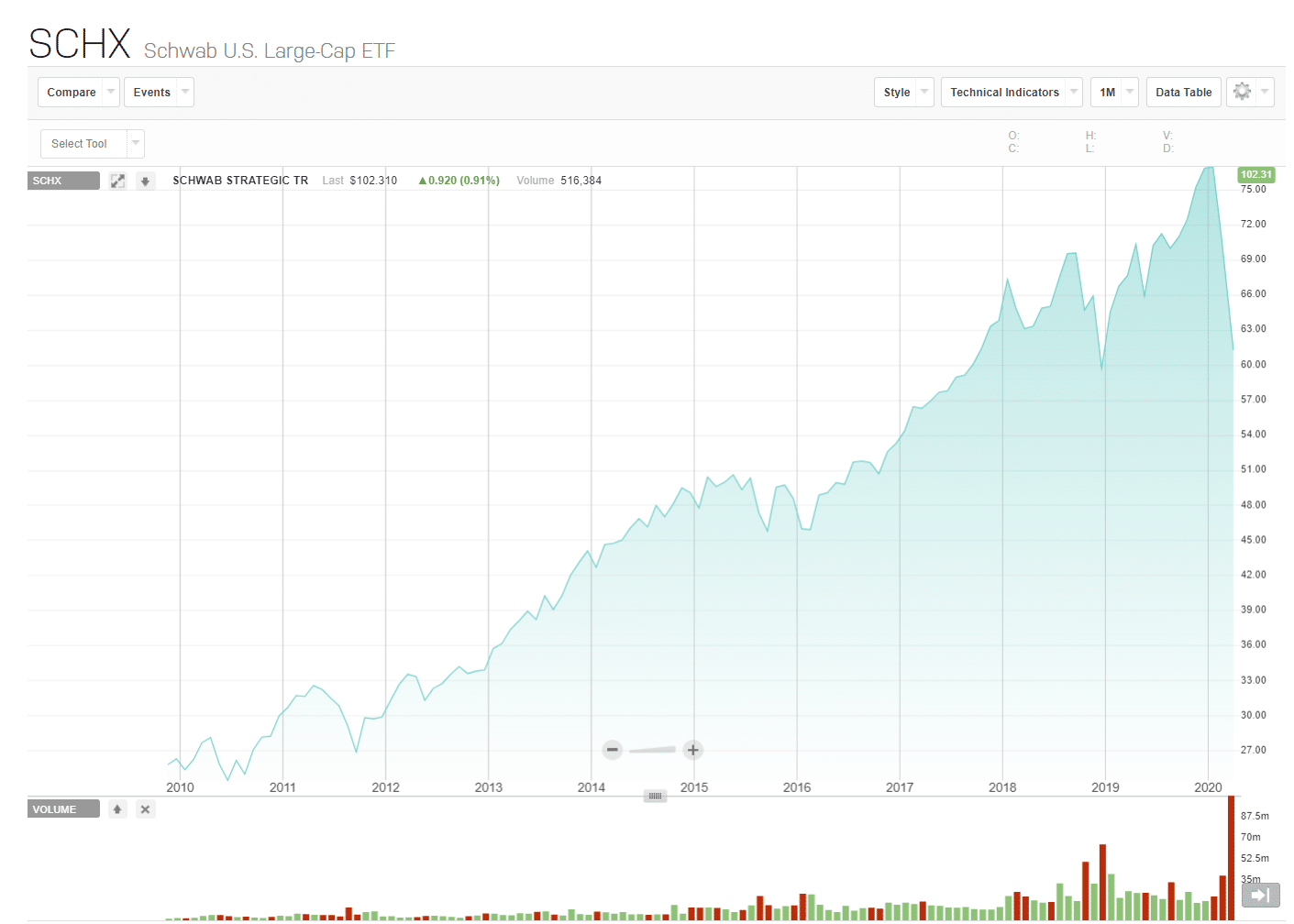

2. Schwab U.S. Large-Cap ETF (SCHX)

ETF Schwab U.S. Large-Cap ETF includes over 700 shares of large companies. Like the S&P 500 ETF, it carries less risk than some other funds as it contains stocks of some of the most robust and stable US companies.

This fund has also generated an average rate of return of around 15% per year since its inception.

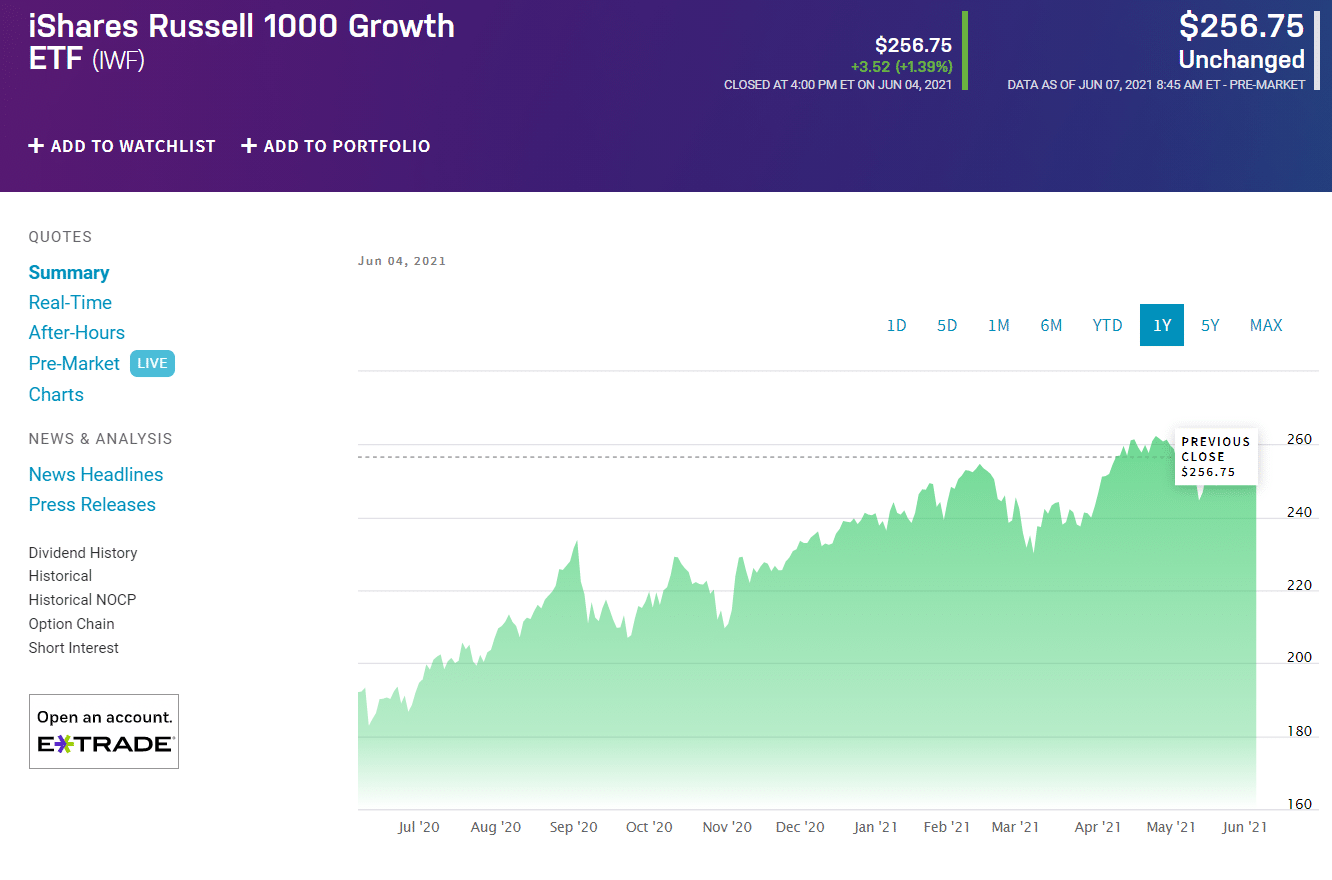

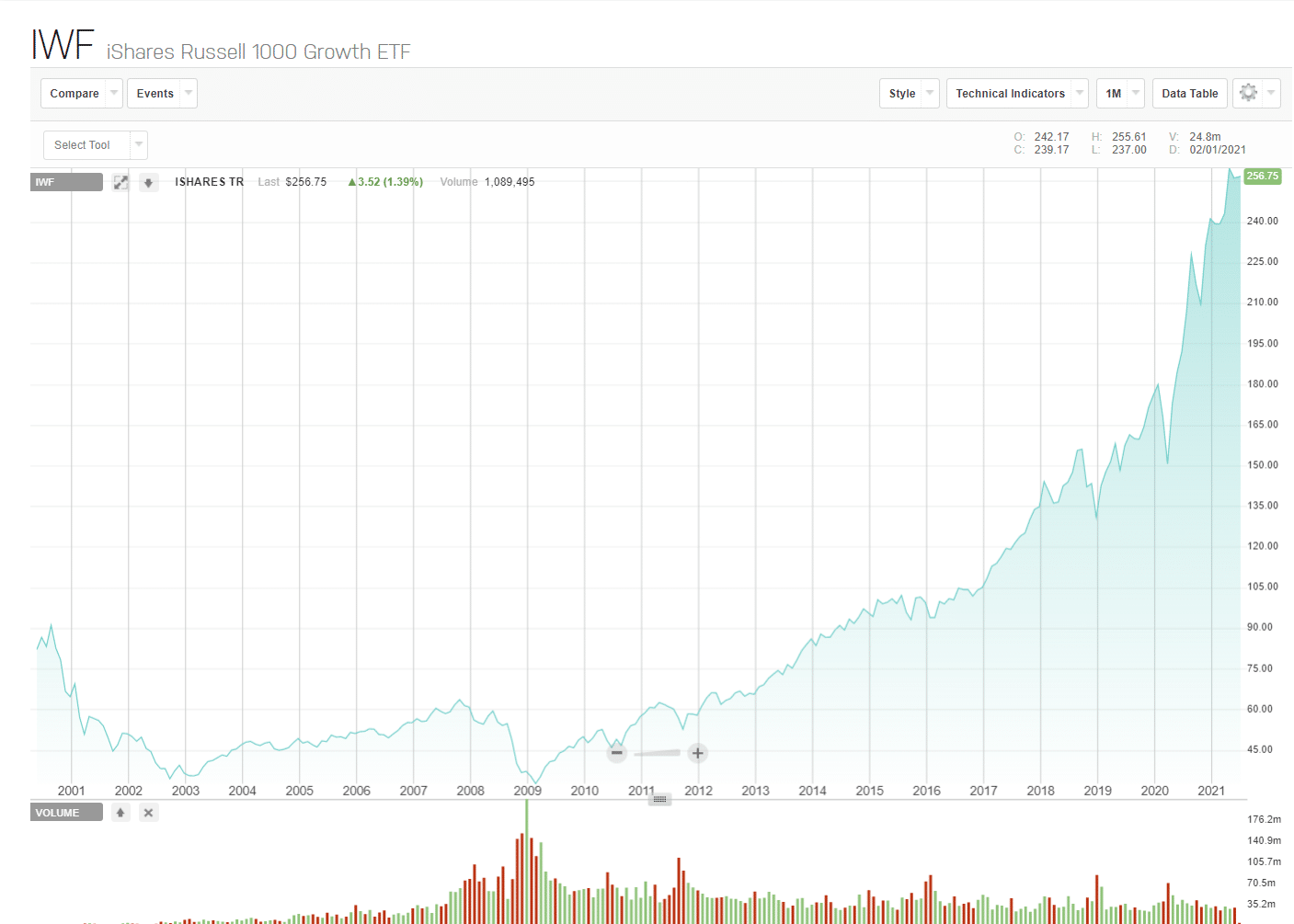

3.iShares Trust – iShares Russell 1000 Growth ETF (IWF)

The iShares Russell 1000 Growth ETF is slightly different from the other two funds. Rather than focusing exclusively on large companies, it includes organizations that can overgrow.

These ETFs can be riskier than funds that only include large corporations because high-growth companies tend to be more volatile than established businesses. However, many of the companies included in the iShares Growth ETF are fast-growing and well-established companies such as Amazon, Apple, Microsoft, Facebook, etc.

These businesses have experienced rapid growth, but they are also some of the largest organizations in the world. Over the past five years, the average return of this fund has been about 22% per year.

Whatever ETF you will choose, there is one rule for investors: “Buy when the market gets down, and sell them when the market gets high.”

Why is it important not to sell during a crisis?

No one likes to see their portfolio lose value. However, market volatility is worrying and can alarm even the most disciplined investor.

Logically, you know that your asset mix should only change if your goals change. But in the face of extreme market fluctuations, it can be challenging to convince yourself of this.

If you are tempted to convert your ETFs into cash when the market is down, consider the two points before taking action:

-

Selling the ETFs when the market is in a downturn, you will “lock in” your losses

Once you have sold your assets, your trade cannot be changed or canceled, even if market conditions immediately improve. So, for example, if you liquidate your portfolio today and the market recovers tomorrow, you will not be able to “reverse” the previous deal.

If you are retired and rely on your portfolio as a source of income, you may have to withdraw money from there when the market falls. While this may mean fixing some losses, keep the following in mind.

First, you probably only withdraw a small percentage — perhaps 4% or 5% — of your portfolio each year. Second, your retirement plan should be designed to withstand market fluctuations, which are a normal part of investing. If you maintain your set of assets, your portfolio will still have the opportunity to rebound in value after the market falls.

-

Decide when to return to the market

Since the days with the highest value increase and the days with the most significant decline are usually close together, you may have to act very quickly, or you will miss your window of opportunity. Ideally, you will always sell when the market peaks and buys when it’s bottom. But this is unrealistic. No one can effectively manage the market over time — not even the most experienced investment managers.

Investing in ETFs is one of the best ways to multiply your money.

Comments