A modern quote goes like this: “Saving means making your money sleep while investing means making your money work for you.” In the modern era, many people are getting more interested in buying stocks, shares, and other investments that will help them earn even while they sleep.

In this article, we will focus our attention on stocks and look into taxes that could upset your potential gains. Also, we will give you insights on what metrics to consider when deciding which stocks to own.

What is a stock?

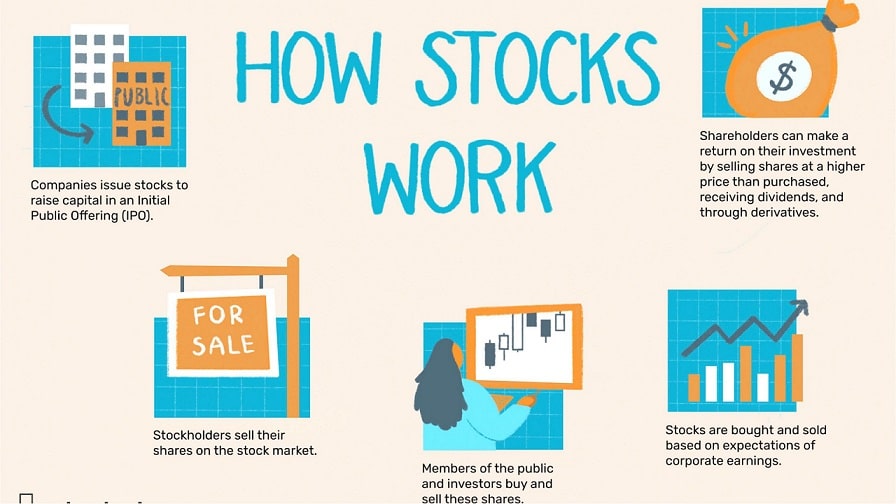

How stocks work

Stock represents the holder’s part-ownership in one or several companies. This entitles the stock owner to a portion of the corporation’s assets and profits equal to the number of shares they own. It is also known as equity, representing ownership of a fraction of a corporation. Also, stock exclusively refers to corporate equities, securities traded on a stock exchange.

Should you pay taxes on your stocks?

You must be wondering if you are required to pay taxes by owning a stock. To cut to the chase, the answer is a big yes. This is because taxes are mandatory charges levied by the government on organizations and individuals to generate funds to finance government projects and public welfare.

The first stock trading known was about the Dutch East India Company. In 1600, the company utilized ships for trading valuable items around the globe. Since funding its massive operation was not easy, it decided to ask people to put money in exchange for a profit share. This method sustained the operation to a point where the company afforded even more majestic voyages, increasing profits for the company and its investors.

Definition of capital gains tax

Aside from constantly monitoring the performance of your stock holdings, you might also be worried about the tax implication of stock ownership. Stocks fall under the category of taxable accounts. By the way, taxable accounts hold taxable assets, such as stocks, bonds, mutual funds, ETFs, etc. This applies when the assets generate profits, and you liquidate them.

The profit generated is considered “realized when you sell a stock.” If the stock is still in your portfolio and you do not sell it yet, the profits thus made are considered “unrealized,” and the tax is not applicable. The image below depicts the concept of capital gains tax.

Capital gains tax explained

Applicability of capital gains tax

As already pointed out, you will not pay taxes related to capital gain unless you liquidate your shares. This is true regardless of the length of time you have kept the stock in the portfolio and how much profit it has earned. When it is time for you to sell these stocks, capital gains tax becomes applicable. Although not all countries impose this tax, it is highly suggested to do your research before investing.

Tax on capital gain was first enacted in 1913 and started at 7 percent until 1921. Several changes were made as years passed by. In 1997, 28 percent was imposed and was eventually reduced from 20 to 15 percent for those individuals whose highest tax bracket was 15 percent or more. The tax percentage continued to drop from 10 to 5 percent for those belonging to the lowest-two tax brackets.

Short-term vs long-term capital gains

Here are two kinds of profit you must note when you liquidate your stock shares:

- Long-term

- Short-term

Under federal law, long-term capital gains are imposed on selling assets kept in the portfolio for over one year. Conditions and rates may differ from one country to another. Again, the actual rates vary based on the taxpayer’s bracket for the applicable year.

On the other hand, short-term capital gains are imposed on liquidated assets less than one year from the purchase date. Profits gained from these transactions are taxed like an ordinary income. Same as the other type of profit, the tax rates also differ depending on your tax bracket.

When to buy a stock?

Things to consider when buying a stock

- Should I buy this stock now?

- Is it time to sell this stock?

How would you know if a stock you are looking to buy will become profitable and yield dividends for you? That is always the question of traders and investors. There is no way to find out at the outset. However, you can use metrics to gauge the potential of a prospective stock. Two such metrics are relative price strength and traditional forecasting. We will cover these metrics in more depth in this section.

-

Relative price strength

RPS evaluates the trend of a stock against the overall crypto market. An RPS that is greater than one suggests that the stock performed better than the market, while an RPS that is less than one shows that the stock pales in comparison with the market. On the other hand, an RPS equal to one implies that the stock has as good a performance as the market.

Relative strength counsels investors to consider what is happening “now” in the stock under consideration and assume that the stock will continue to beat the market. This is called momentum investing, and its goal is to buy high and sell even more heightened. This is different from the more common mantra of buying low and selling high.

-

Traditional forecasting

Meanwhile, traditional forecasting is a method of analyzing the underlying company’s activities and trends from its financial standpoint. You must prepare historical data from the company’s financial statements, carefully reading its balance sheet, profit, and loss over the years or even its cash flows and many other significant statements.

Data gathered may be tracked from the company’s last five years, depending on what time of reference you would like to use in your forecasting. The forecast may be applied for three to five years into the future depending on the data gathered and how competitive you like it to be. Since forecasting is quantitative, you will have a sound basis for your judgment or prediction because something already happened in the past, and it could happen again.

Final thoughts

Every business will come across a hurdle that would help build its empire or otherwise. Choosing a stock that is problem-proof or even pandemic-proof is quite hard. A futuristic attitude toward these decisions will only have two results — succeed or fail, but who knows, building a long-term strategy might keep you on the winning end.

After all, investments carry many risks and best suit those who can handle the stress involved with managing an investment that fluctuates in value every day over the short term and focuses on long-term profitability.

Comments