The first cryptocurrency, Bitcoin, received lukewarm acceptance when it was introduced in 2009. Over time, it has gained a following, and establishments are gradually accepting it as a form of payment. Later, other cryptocurrencies sprouted here and there, offering better solutions than Bitcoin. As a result, crypto has become the talk of the town.

But what is it in cryptocurrency that drives the attention of many? Why should you consider investing in cryptocurrency? Here are key facts about crypto that you should know:

- The crypto market is open 24/7. It is a market that never sleeps.

- Unlike stocks, crypto allows you to buy and sell.

- Bitcoin is the highest-yielding investment asset in the past decade.

- Cryptocurrencies enable direct payments between two users anywhere in the world.

- Crypto transfer completes in a fraction of a second and involves minimal costs.

- Users have more control over their digital money than fiat currency does.

- Crypto transactions are anonymous, so your privacy is protected.

- There are already 4,000 cryptocurrencies at present, and new coins sprout on a weekly basis.

Tips for crypto investors

Before you buy any crypto coin, you should research to make wise investing decisions. After all, crypto is a new kind of investment. Therefore, you need to learn the risks in this business before you engage. Your reading this article is a step in that direction. Here are six tips that can help you better understand crypto investing.

Tip №1. Find reputable crypto exchanges

A crypto exchange is a place where you buy, sell, and store coins. It is like a bank that accepts loans and keeps the money of clients. An exchange is better than a broker as it allows you to save money on transaction fees.

The biggest names in the crypto exchange include:

- Binance

- Coinbase

- Kraken

- Bitfinex

- Bitstamp

- Gemini

- Liquid

When you buy crypto using an exchange, try to use limit orders instead of market orders. One reason is the lower transaction cost, and another one is better fill price. On the contrary, market orders tend to experience slippage. Plus, limit orders allow you to set and forget your orders.

Tip №2. Apply the cost averaging technique

If you plan to stick around for long, consider using the cost averaging technique. It allows you to build your position little by little over time. This is a better alternative to buying a crypto asset at a single price using all you have.

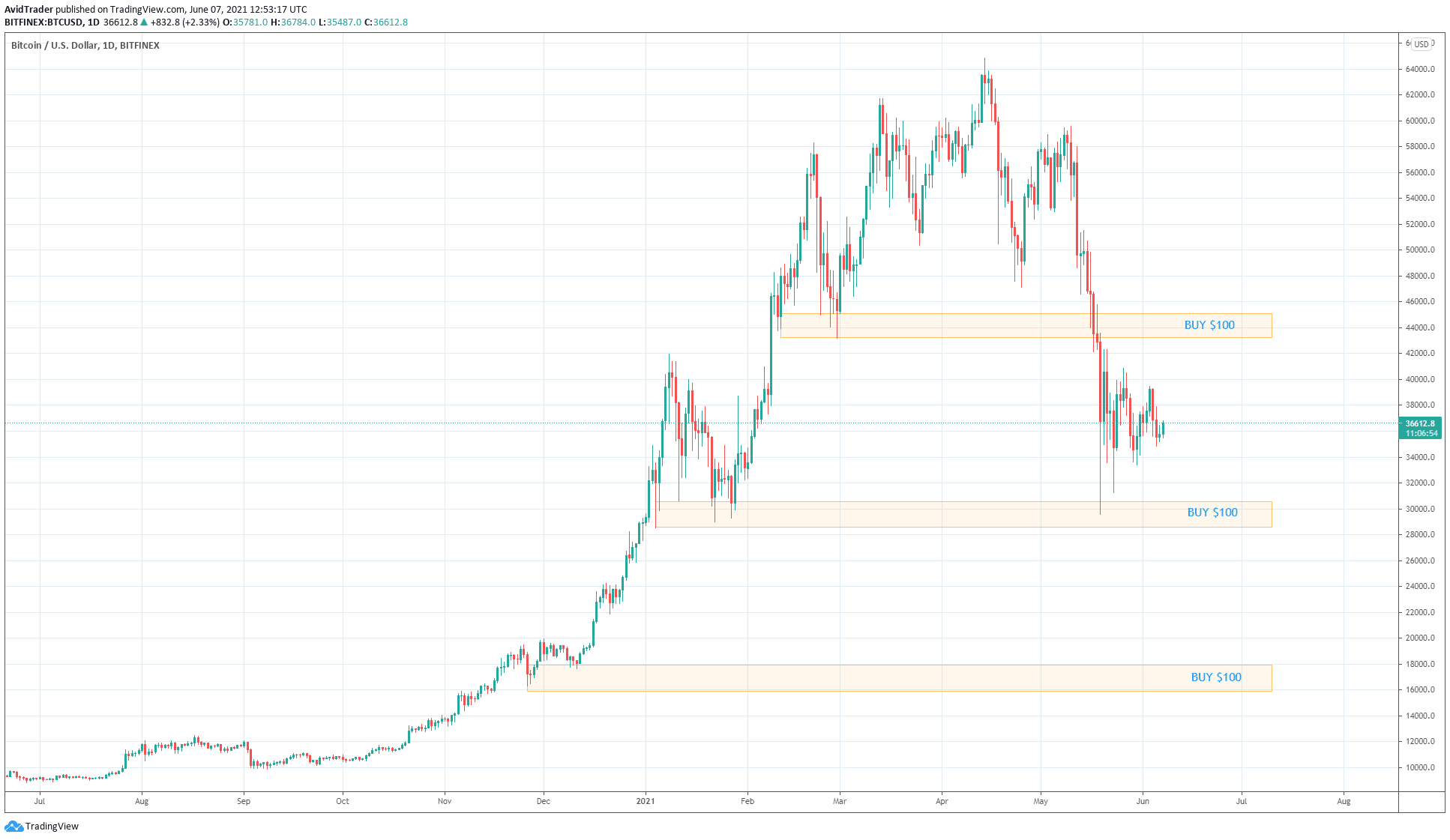

Cost averaging involves buying the same volume at different prices. For example, if the Bitcoin price drops a certain percentage, you will buy the same amount of Bitcoin each time. You will continue doing this until you reach your desired investment allotment.

Another entry method is to open a position when the price touches a support level. Refer to the chart above for guidance. That is an example of this entry method. You take equal buy positions every time the price goes down to a support area.

This technique will allow your investment to survive the volatile crypto market. On the other hand, if you put all your positions in one entry, you might find it emotionally challenging to manage your investment. It is hard to see your investment lose value when the price goes against you.

Tip №3. Learn how to store your coins safely

You can store cryptocurrency via hot and cold wallets. A hot wallet is accessible online, while a cold wallet is not connected to the internet. Most novice investors would prefer hot wallets to cold wallets due to ease of access. However, this convenience is fraught with dangers. Hot wallets are more prone to hacking than do cold wallets.

This is not to say you should not use hot wallets at all. You can store a small amount of crypto in hot wallets for your online transactions. Then you can keep most of your investment in a cold wallet to reap a bountiful harvest in due time. Here are some of the most popular wallets today:

| Hot wallet | Cold wallet |

| Exodus | Trezor |

| Electrum | Electrum |

| Mycelium | Mycelium |

| Ledger |

Do not mistake wallets for exchanges. As already discussed, you do your investment activities in exchanges. Meanwhile, wallets are the medium you use to transfer money or make purchases online. Do not put all your crypto in exchanges. Use crypto wallets as well. If an exchange is hacked or goes bankrupt, your investment will go down the drain too.

Tip №4. Diversify your investments

Many experts say that cryptocurrency is here to stay. However, nobody knows which digital currencies will remain and which ones will leave for good. Many will likely fail, and only a few will make it. That is why it is not wise to put all your investment in one crypto asset. Instead, diversify your portfolio and spread the risk among a handful of crypto options. Diversification is a mantra among good investors.

Do your research to find the best coins. Consider investing in coins belonging to different sectors or specializing in particular services. As a new type of investment, crypto is uncharted territory. Build a portfolio of promising cryptocurrencies. It will allow your investment to thrive even if one or two assets fail to perform.

Tip №5. Brace for volatility

Compared to fiat currencies, cryptocurrency behavior is unpredictable. It can stay quiet for a while and then suddenly become wild. This turbulence in price can go both ways, up and down. Therefore, you have to be ready when it happens.

Have a plan in place whatever situation the crypto market is in. Sometimes investors buy at the top of the move, only to find out the trend ends as the hype pushing it upward loses its effect. At other times, the crypto price may still go up despite negative speculations.

Tip №6. Ignore the noise around you

Some people say that cryptocurrency has no intrinsic value and relies entirely on speculation. Others would go so far as to say it is a pyramid scheme. Meanwhile, a growing number of merchants are starting to adopt cryptocurrency as an alternative form of payment.

You can hear good news and bad news anywhere, and there is a lot of noise. The noise level will only increase as time goes by. As a well-informed investor, you need to stand your ground and hold fast to what you believe. Market analysts may say that something will happen, but another thing comes to pass. Just ignore the noise and stick to your plan.

Final thoughts

This article has provided you with a lot of helpful insights into the exciting world of crypto investing. You are now wiser than before on this aspect. While this venture is replete with dangers, the great promise that lies ahead is still worth pursuing. Let no one dissolve your conviction. Instead, use what you learned here in making wise investing decisions.

Comments