Climate change is making all kinds of renewable options grow to take some of the places. Oil is leaving. One of the favorites for the job is solar energy. There is a worldwide race to capture the market and benefit from the government’s stimulus to develop this technology.

However, there are always some companies that can do things better than the rest, and those are the ones who will get a larger slice of the pie. By investing smarter, you can benefit from that situation and make a big profit. This article will talk about the best stocks to invest in during 2012/2022. Keep reading to make sure you will bet on the winning horse.

What are solar stocks?

They are the shares of companies related to the global development, manufacturing, or commercialization of solar energy.

One kind of technology stands out among all others because of its abundance and availability for all countries in this new era of green energy. That is solar energy.

Solar energy is probably in its best time ever. The urgency to abandon fossil fuels and the political events like the Paris agreement, the end of the Trump era, and Biden’s presidency have appealed to the industry.

However, not all the expectations have been fulfilled. The sector is decreasing 3%, Far from the S&P 500 rate increasing by 18% this year. This performance can be explained by several momentary factors, including problems with the chain supply or delays in approving certain laws. Nevertheless, in the long run, there is no doubt that solar energy will be one of the leading suppliers of energy in the world, and investing in solar stocks is nothing but a great idea.

How to buy solar stocks?

So, now you are probably convinced about what you have to do. Investing in solar stocks is a long-term investment that will give you great profit with time. But just saying that you have to invest is no investment plan. Having a clear vision of what you are looking for, your chances of getting it, and when is essential. Here are the five steps to buying solar stocks.

Step 1. Choose your platform

The rush to buy solar stocks shouldn’t make you take the wrong paths. Before anything, you need to make sure you comply with the basics, and the first thing you need to do is choose the proper trader for you.

Setting up an account is one of the easiest things in the process, but that doesn’t mean that you shouldn’t make that decision carefully.

The broker is the channel through which you will manage your account every time. A bad broker experience is a bad investing experience. Also, there are many differences between brokers. Fees and commission are probably the most important thing to watch out for when you choose your broker.

Step 2. Open your brokerage account

After you decide which is the right broker for you, you need to open your account on its platform. This is a simple process that will hardly take more than 25 minutes.

The key thing in this process is to confirm your identity and then link your broker’s account to your bank account, where you deposit the funds you use to invest in the company.

Step 3. Search for your solar energy company

You don’t want to buy a stock just because its website says they are a solar energy company. The boom of renewable energies won’t benefit all companies the same, and you have to be careful about it.

Study all companies in detail. Read all the blogs and listen to the experts to know which companies are worth investing in and which aren’t.

Step 4. Decide on how many to buy

You can’t put all your eggs in one basket. You never know which companies will have a breakthrough and which ones will fail in a developing market. Besides which ones, you have to know how many stocks you are buying. So, no matter how good they seem now, investing is always risky, and your job as a good investor is to minimize that risk to your tolerance levels.

Step 5. Check-in on your investment

After you have done all the previous work, you are just getting started. This is a long way to profit. Solar energy is set to make a revolution, but even so, you will see the earnings in years. Also, not every company that started great will keep on, and you have to constantly check your investments to manage them properly and protect your capital.

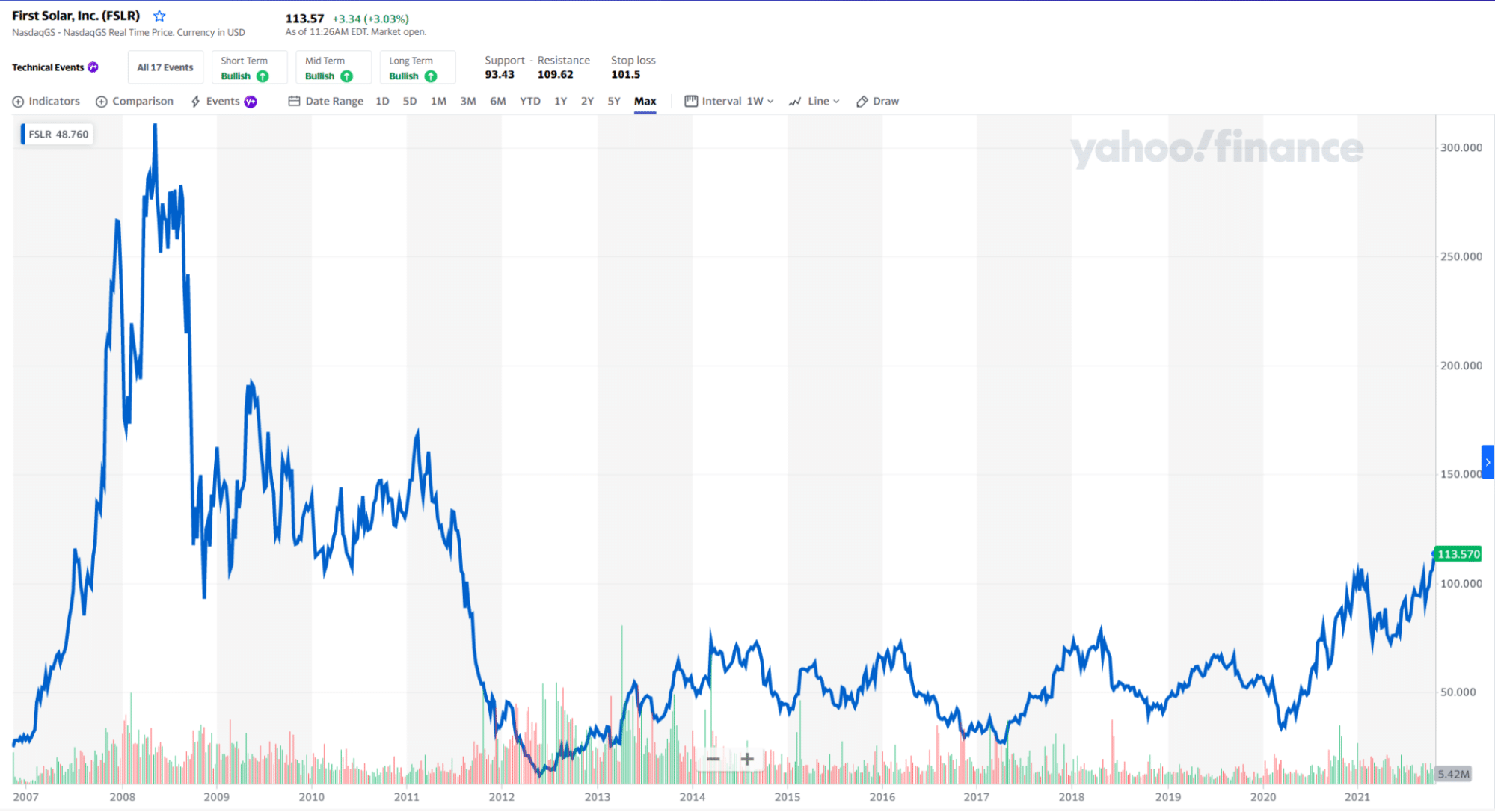

1. First Solar, Inc. (FSLR)

First Solar offers solar energy solutions to meet The United States energy needs. The company engages in the design, manufacturing, and distribution of solar modules and solar power systems. The company’s goal is to make renewable energy secure and affordable for all Americans.

Price: $ 108.94

EPS: 5.26

Market capitalization: $11.582B

First Solar is reaching the price level of the beginning of the year

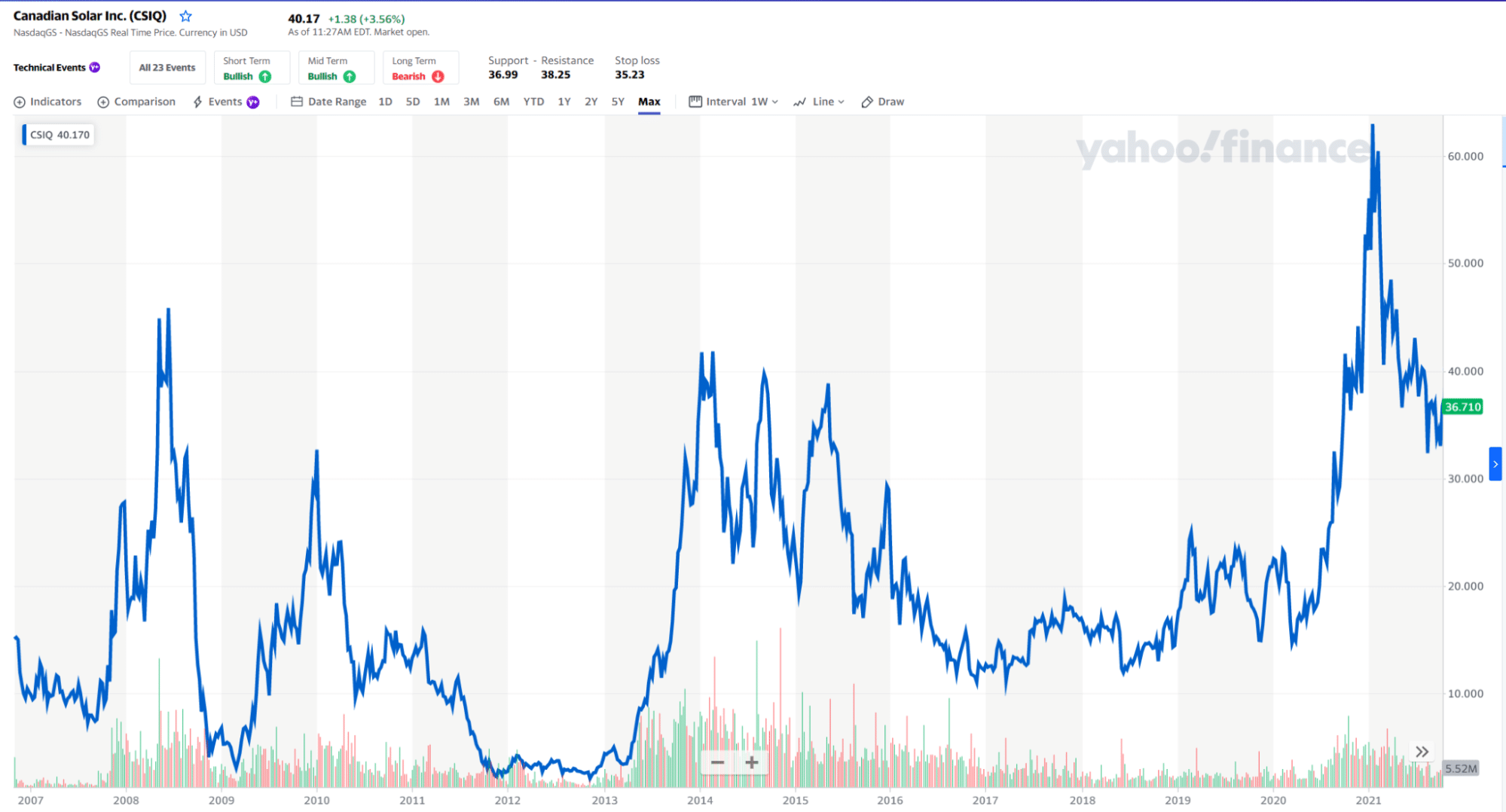

2. Canadian Solar, Inc. (CSIQ)

Canadian Solar Inc. is a Canadian and Chinese company founded in 2001 engaging in the manufacture of solar photovoltaic modules. The company has a presence of Subsidiaries in 23 countries and regions on six continents. Today Canadian Solar Inc. has cumulatively delivered over 59 GW of solar modules, enough to supply the energy needs of approximately 14 million households.

Price: $39.54

EPS: $ 0.81

Market capitalization: $ 2.372B

Canadian Solar Inc. had a good start in 2021 but has been falling since

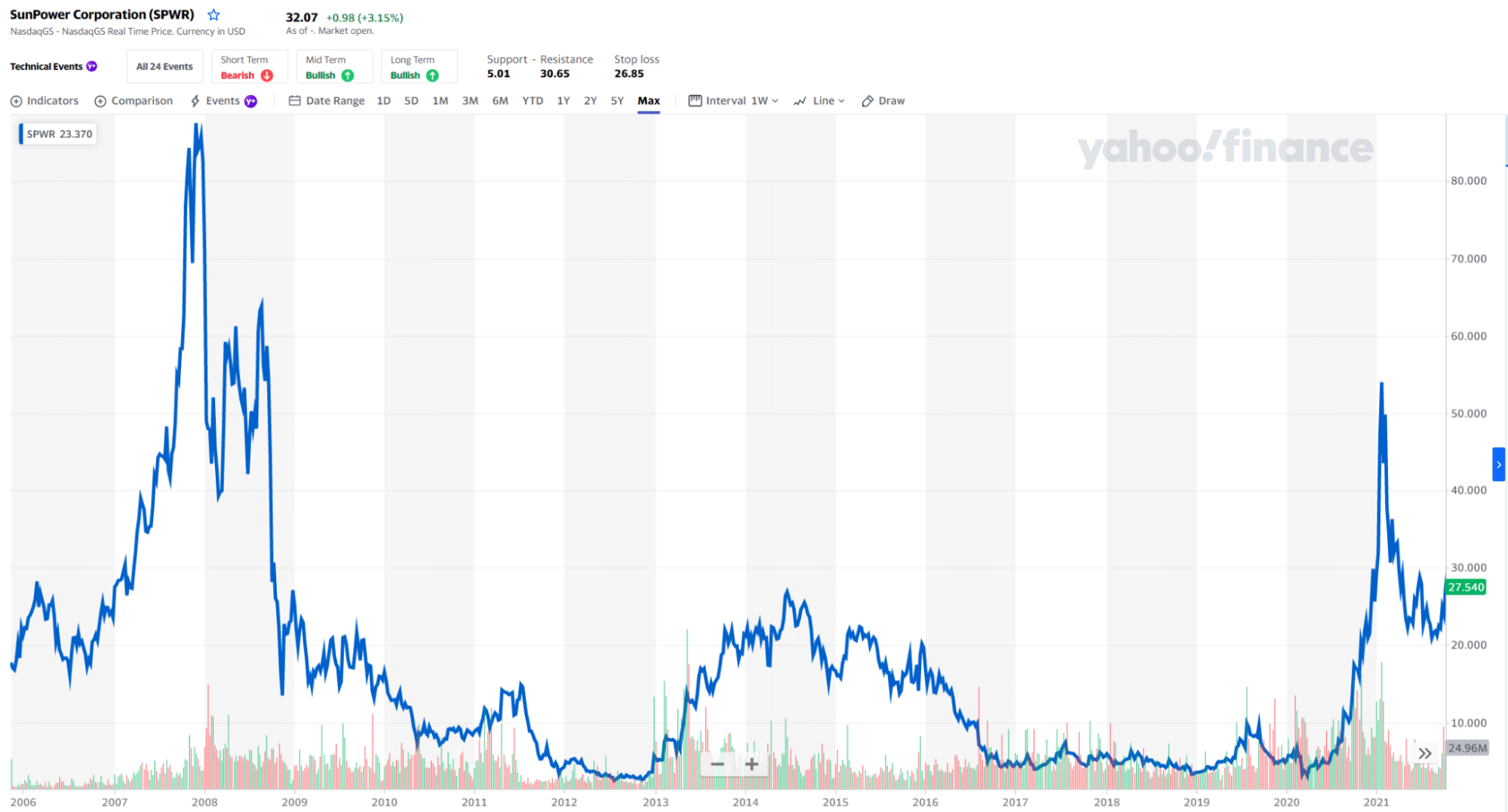

3. SunPower Corp. (SPWR)

SunPower designs, manufactures and commercializes solar systems for residential, commercial, and industrial purposes. The company founded in 1985 has its headquarters in Silicon Valley.

Price: $ 31.26

EPS: 2.54

Market capitalization: $ 5.409B

SunPower is currently quoting above $30

Final thoughts

Solar energy is the star of renewable energy for residential, industrial, and commercial purposes. There are even projects to make solar energy cars, so the industry seems to have no limit to reach all the spaces the oil will leave behind. Thus, investing in solar stocks is a long-term investment that will pay off in the next year.

Comments