Best FX Networks has been developed by a team of software developers who released this product in 2020 and tested it in the currency market. The EA comes with an automatic risk adjustment feature, and the sellers claim that this system has a friendly UI that allows it to be used by any trader. To get more information about this product, we will analyze its performance data and other information to check if it can be profitable in the long run.

There is no information about the range of currency pairs in which this robot works. There seems to be no manual user guide available for this product. According to the FXBlue results present on the website, it can be deduced that this robot has been listed in the open market for sale since 2021.

What is behind the Best FX Networks robot?

Best FX Networks robot has been developed by a team of programmers who claim to be professionals at MetaQuotes Language 4. The vendors state that they have significant experience in trading and producing different Forex trading software like EAs, indicators, utilities, etc. Other than that, they keep us blind to their contact information like whereabouts, telephone numbers, etc. This puts into question their legality to offer their financial services to others.

How it works

The EA works on the MT4 platform. According to the devs, we must follow the next steps to start trading with this system:

- Buy the bot from the website

- Launch MT4 on your PC and log in

- Place the EA files in the Experts’ Directory and press the refresh button

- Drag the files to the charts and start trading

The algorithm will then trade the market depending on the coded information.

Key features

The robot has the following key features:

- It is 100% automated.

- The system is straightforward to set up.

- It works well with all brokers, including ECN, STP, Micro, or Cent Account.

- No scalping or averaging techniques are used.

Trading strategy

The robot uses a neural network to trade the markets alongside money management techniques. There is no further information on the topic so we head to the live records present on FXBlue to analyze its methodology. From there we observe that it trades on EURJPY with a grid approach. The executions may or may not come with a fixed stop loss.

Trading history on FXBlue

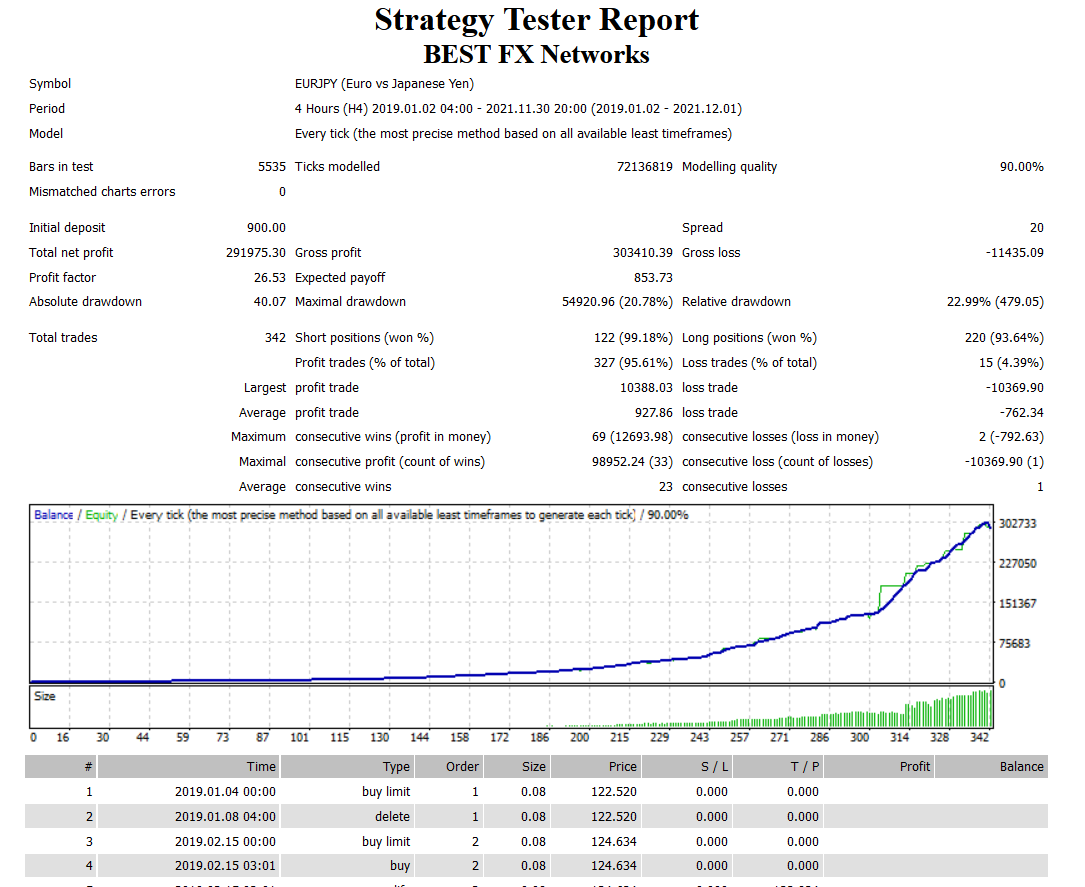

Backtesting records can be found on the robot’s website for the time period of 2019.01.02-2021.12.01. These reports are for EURJPY performed on the H4 timeframe. Modelling quality of 90% was used. These records show that the system turned an initial deposit of $900 into a total net profit of $291975.30. Spread is valued at 20, which is relatively high.

Furthermore, the EA had an absolute drawdown of 40.07%, which is extraordinarily high and way above the safety threshold. The bot participated in 342 trades, out of which 95.61% were profitable. The profit factor is reported as 26.53.

Backtesting results of the algorithm on the website

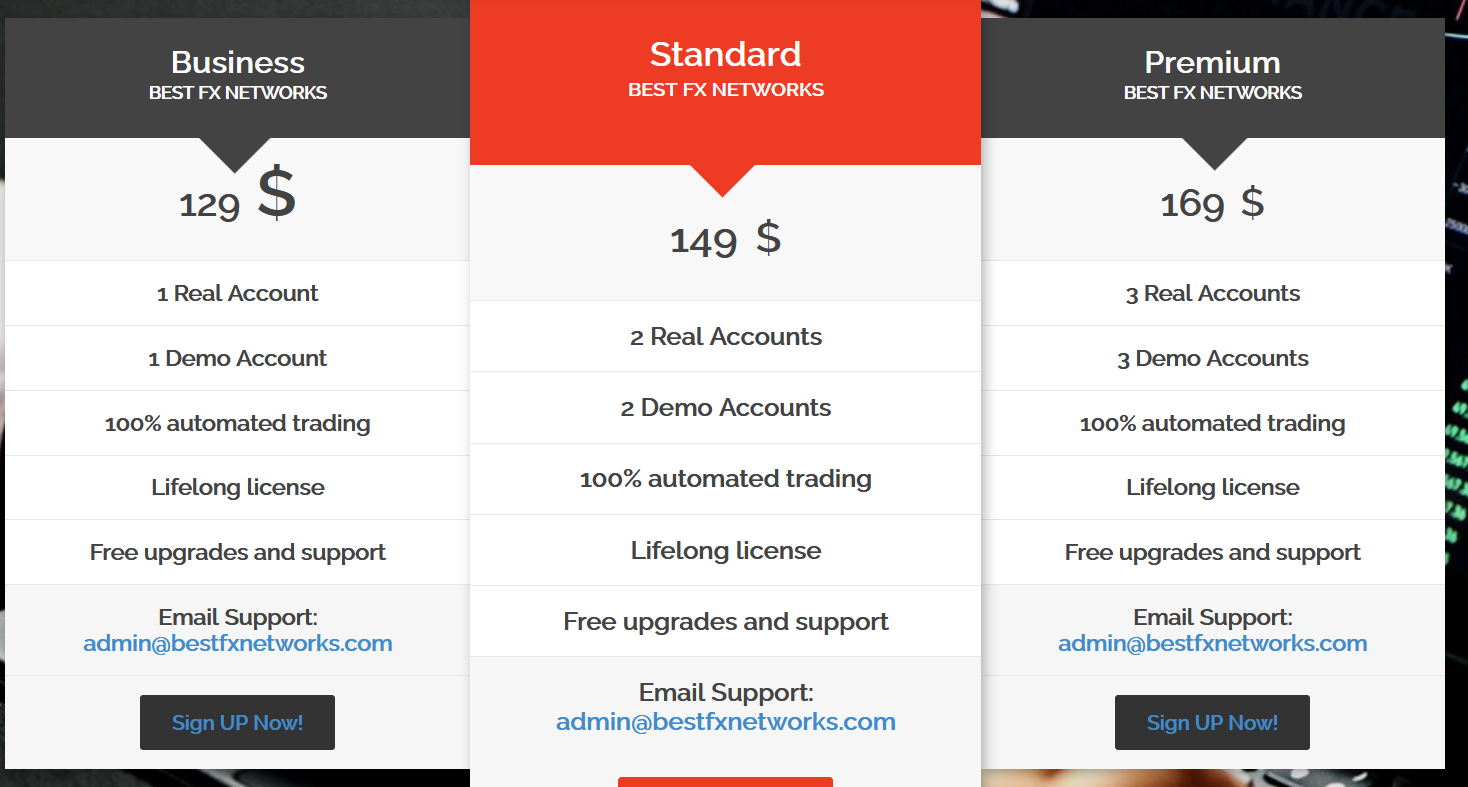

Pricing

The algorithm is sold in three packages: Business, Standard, Premium. Business costs 129 USD and provides access to 1 real and 1 demo account. Standard is sold for 149 USD and includes access to 2 real and 2 demo accounts. Lastly, Premium asks for a fixed 169 USD in which users are offered 3 real and 3 demo accounts.

All packages come with lifetime upgrades support. Also, customers can get in touch with the vendors using the company email. A 30-day money-back guarantee is available if the robot’s drawdown value exceeds 50%.

Pricing of the EA

Trading performance of Happy Way

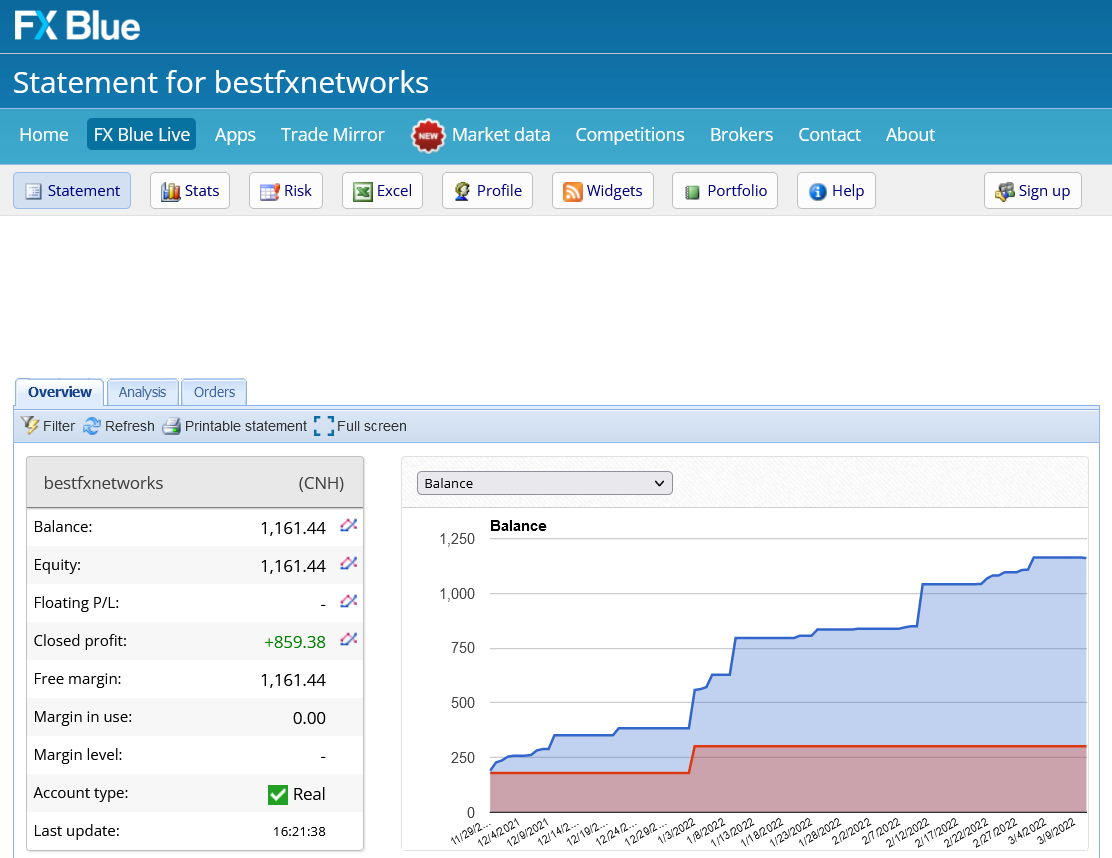

Live trading results are present on FXBlue. These statistical values are for the CNH currency. We can see performance from 11/29/2021 till 03/09/2022.

The system gave an average monthly return of 56% for this period, with a peak drawdown value reported as -0.2%. This falls very inconsistently with the abnormally high drawdown reported in backtests.

The winning rate is 89.9%, with a profit factor of 29.12. The average trade length is stated as 34.4 hours. The current balance of the robot is $1161.44.

Live trading records on FXBlue

Customer support

The company provides customer support through a contact form that customers can use for their queries. An additional company email has been provided as well.

People feedback

Unfortunately, no customer review is present for this robot on trusted third-party sites like Forex Peace Army and TrustPilot. This reduces the amount of trust we can put in this robot due to a lack of honest and unbiased past customer feedback.

Comments