With the explosion of forex trading as the most liquid financial market in the world, more and more brokers keep cropping up. Although the playing field is vast, it does make it difficult to separate the wheat from the chaff.

Fortunately, we’ve recognized this problem and compiled this article looking into the best forex brokers with seven worthy selections. Choosing a broker is one thing, but being equipped with the right information about successfully navigating the forex world is another.

Therefore, this article is also a valuably educational guide looking at how to start trading forex, choosing a good forex broker, and more.

Our website does not give financial advice and this guide should be used for the sole aim of financial education. It is important to conduct your own research and analysis before making any decisions on your investments to avoid the risk of losing capital.

Table of Contents

The Best Online Brokers for Forex Trading in 2022

TechBerry – Leading Social Trading Platform

TechBerry is the first social trading platform that promises firm 10-12% monthly gains and supports over 50 verified brokers regulated by top institutions like CFTC, NFA, IIROC, FCA, ASIC, MAS, etc. For developing a successful trading strategy, it monitors the data from 100,000 accounts by utilizing highly efficient AI.

At TechBerry, you can access the real-time trading history available since its launch in 2015. Additionally, members can benefit from the free trial for 14 days or choose the pricing plan with relatively affordable prices. It offers the best insurance policy that covers your losses with as high as 100% reimbursement. There are earning opportunities for professional traders if they share their trade execution data to the platform via MT4 plugin. It provides services all around the world without any restrictions on any country.

- No country restrictions

- 11.2% monthly gains on average

- Support for over 50 forex brokers

- Personal assistance and customized prices with special benefits

- The platform doesn’t provide much information about its trading strategy

eToro – Alternative Forex Broker for Copy Trading

eToro began making a name in the industry from 2007 as a multi-asset CFD broker. From 2010, the Israeli brand released one of the first social investment platforms called the eToro OpenBook.

Since then, the broker has firmly established itself equally brilliantly in both realms of active and copy trading. For the latter, social trading allows non-active investors to copy the positions of selected experts and discuss trading ideas and strategies.

What makes eToro one of the leaders in copy trading is its methods to provide an enriched investing experience. Some noteworthy features include displaying verified experts or copy traders, improved risk metrics, and a special portfolio of a few non-correlated asset classes.

We should also remember eToro still excels as a trading broker in currencies, stocks, commodities, indices, ETFs, and cryptocurrencies. All in all, they are still far better as a copy trading service for millions of clients globally.

- Accepts US clients

- Been operating since 2007

- Multi-regulated

- Well-known social trading network

- Requires a minimum of $50 for subsequent deposits

- Levies inactivity fee

- Restricted to offering services in tens of countries

XM – Good Forex Broker for Beginners

This Forex broker was launched in the year 2009. Since then, it has won several accolades, and today it has a huge client base. XM is a licensed broker that lets you trade Forex with ultra-low spreads. It supports 16 trading platforms and more than 1000 trading instruments.

At XM, you get free access to market research as well as personal account managers who take care of your investments. Additionally, you get daily access to trading signals, which means you don’t need to spend too much time researching the market. The technical analysis provided by this broker is one of the best there is, and you also get unlimited access to video tutorials. VIP members can access exclusive technical indicators compatible with MT4 and MT5 trading platforms. This helps you make accurate market decisions.

- Multi-regulated

- The easy account launch process

- Tight spreads available

- High-end education tools

- No investor protection for non-EU clients

- No customer support on weekends

FXTM – Forex Broker with High Leverage

FXTM is one broker understanding the benefits of high leverage, proving they are specialists in this field. With leverage up to 1:1000, it’s a brilliant feature for cash-strapped investors and traders who are skilled yet conservative enough to use it.

The broker was formed in 2011, steadily growing by providing continually trading technology, which includes a recognized social trading platform. FXTM currently serves over 2 million clients in most countries globally and offers several accounts catering to the ever-evolving needs of traders.

FXTM ticks all the boxes for tight spreads, quick trade execution, complimentary trading conditions, swift deposits and withdrawals, and accessible customer service.

- Licensed by a few supervisory authorities

- Very high leverage available

- Several depositing options

- Huge selection of forex markets

- Offers copy trading

- Zero spread account minimum deposit is quite high

- Charges inactivity fee

PrimeXBT – Great Choice for Anonymous Traders

One of the best things about PrimeXBT is that it cares about the privacy of its users. This is why it allows you to launch anonymous accounts with no KYC procedure. It features a fully customizable layout with more than 50 technical indicators. You can conduct trades directly from the charts and enjoy swift execution speed.

This broker has its own trading platform through which you can trade in CFDs on major pairs. It also supports exotic pairs from emerging markets. PrimeXBT shows you daily updated price charts and data feeds on major currencies like GBP, JPY, and USD.

You can create your own strategies and set buy and sell orders with leverage, hedging your positions. This is also one of the select few brokers that allow for margin trading. This lets you borrow funds from the broker to open larger positions.

- High-end technical analysis and charting tools

- Military-grade security

- Margin trading facilities

- Works with desktop, tablet, and mobile platforms

- Fiat deposits not supported

- No spot trading

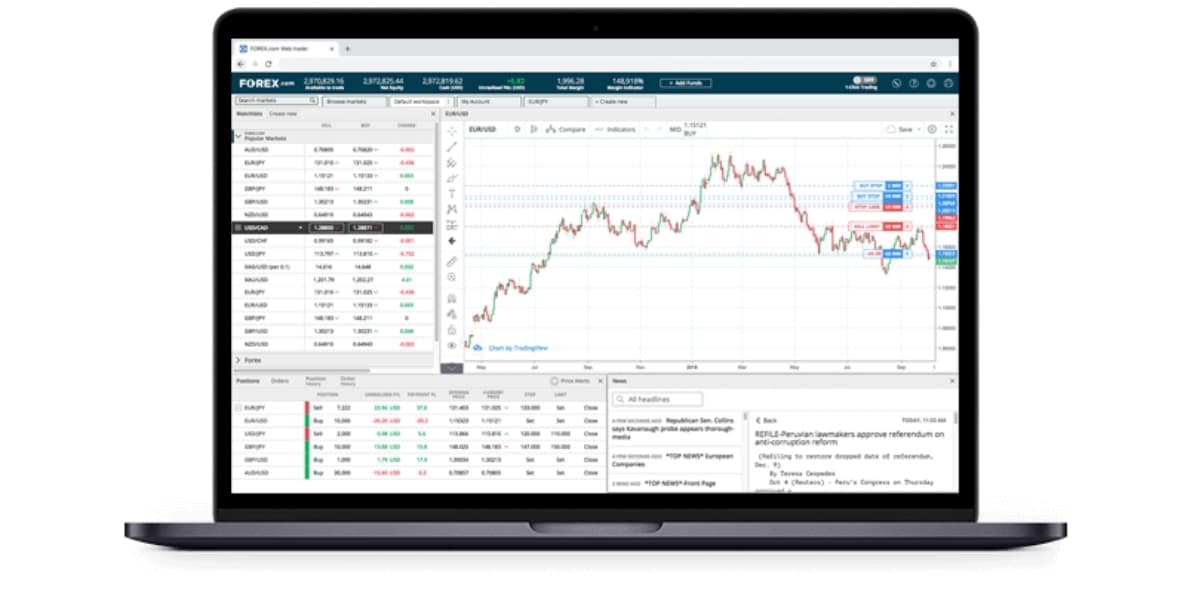

Forex.com – Alternative US-Based Forex Broker

With an average daily trading volume of roughly $15.5 billion, Forex.com is the largest US-based forex broker and one of the largest globally. As a brand started in America, they are one of the few officially licensed to serve US clients.

Forex.com boasts several impressive credentials. The broker started as far back as 2001 and is now a subsidiary of StoneX Group Inc., a NASDAQ publicly traded financial services conglomerate.

While they might have started with forex, the broker is equally adept in more than 4500 other markets, a combination of indices, stocks, cryptocurrencies, and commodities. As a world-class, long-standing financial services provider, Forex.com has everything a trader from the States and anywhere else needs to succeed in the markets.

- Licensed by several regulators

- Started in 2001

- Extensive range of forex pairs

- Doesn’t offer Islamic account

- Charges inactivity fee

- Not many funding methods

CMC Markets – Wide Range of Markets

CMC Markets is undoubtedly one broker that’s stood the test of time. Established in 1989, CMC is one of the UK’s foremost financial services providers in forex and a range of CFD and spread betting markets, combining to just over 9500 products.

Furthermore, CMC has been publicly traded on the London Stock Exchange since the turn of the millennium and forms part of the FTSE 250. Putting innovation at the front, CMC provides its award-winning proprietary trading platform, Next Generation.

The software has more impressive features than MetaTrader, including tens of technical indicators, over 10 chart types, over 70 chart patterns, full order ticket capabilities, and more. Next Generation is available for iOS and Android mobile and smartphone users.

All in all, CMC ticks many boxes for being an unmatched global broker.

- Licensed by numerous regulators

- Publicly-traded entity

- Has 14 regional offices

- Traders can open accounts in several base currencies

- Minimum deposit from $1

- Offers guaranteed stop loss orders

- Charges inactivity fee

- No zero spread account available

- Limited funding options

IC Markets – Low-spread Forex Broker for MetaTrader

Since MetaTrader is the most well-known forex trading platform, it only makes sense to trade it with one of the most prominent forex brokers. IC Markets is one of the largest worldwide for daily trading volume, processing at least $1 trillion in March 2021 alone.

Along with having over 180 000 clients, this achievement exemplifies their strength in numbers and dominance in the industry since 2007. IC Markets is also the go-to broker for low spreads on their standard account and even lower spreads on their ‘raw’ spread account.

The broker is built by traders for traders with a firm dedication in providing a rich and beneficial trading experience. Asides from 61 forex pairs, IC Markets also provides 22 commodities, 1659 stocks, 25 indices, 11 bonds, and 13 cryptocurrencies.

In short, IC Markets is definitely one of the elite choices for trading a myriad of instruments on MetaTrader.

- Licensed by numerous regulators

- Competitively low spreads

- Several depositing methods available

- Charges no inactivity fee

- Traders can open accounts in many base currencies

- Licensed by numerous regulators

- Competitively low spreads

- Several depositing methods available

- Charges no inactivity fee

- Traders can open accounts in many base currencies

XTB – xStation Trading Platform

X-Trade Brokers or XTB is no run-of-the-mill financial markets broker. With close two decades in the business, XTB is one of the oldest brands in forex. Such are their credentials that the broker has been a publicly-listed entity on Poland’s Warsaw Stock Exchange since 2007.

With so much dominance and experience, XTB is also one of the few brokers with its exclusive trading platform, xStation. xStation is in web, mobile, and desktop format and sports a simplistic yet sophisticated trading package.

Aside from its superior charting capabilities, XTB’s clients gain access to market news, analysis, screeners, and other perks. Traders use this platform to trade thousands of markets in forex, indices, equities, commodities, and digital currencies.

In summary, XTB is a jack-of-all-trades broker and a worthy alternative for anyone looking to trade with a more distinct software package than MetaTrader.

- Regulated by a few supervisory authorities

- Offers proprietary trading platform

- Exchange-listed

- Traders can open their accounts USD, EUR, GBP, HUF, and PLN

- Zero minimum deposit

- Charges withdrawal fees

- Levies inactivity fee

- No negative balance protection available for anyone outside the EU

Swissquote – Forex Broker for Advanced Traders

It’s not every day a forex broker also happens to be a bank; Swissquote is both. The banking group began specializing in online financial and trading facilities from 1996 and got listed on the SIX Swiss Exchange in May 2000.

Close to 450 000 clients worldwide currently use Swissquote for their fair and industry-leading pricing and execution in a sizeable range of derivatives with no hidden fees or commissions.

Swissquote also provides award-winning trading platforms for a premier (trading experience. Due to the high minimum deposit, Swissquote might be a preferable option for experienced, advanced traders. This distinction doesn’t, in any way, take away from the broker’s superiority and formidable recognition in the markets.

- Multi-regulated by various authorities

- Publicly-traded company

- Offers over 80 forex pairs

- Traders can open accounts in one of 15 base currencies

- Not recommended for less monied traders

- Lower leverage than most brokers

- Charges inactivity fee

How to start trading forex

Learning to start trading forex is an intensive process but can be very rewarding in the end. Below are the main steps any potential trader should follow to have the best chance of success.

Learn how the forex market works

Although learning how the forex market works is rather intricate, the fundamental concept is simple. Trading forex is about buying and selling currencies where profits are made from speculating on the differences between the exchange rates.

It takes harnessed skill to consistently predict the likelihood of exchange rates increasing or decreasing in value through the study of technical, fundamental, and other kinds of analysis. Equally important is the ability to know precisely when to place an order, cut losses and take profits.

So, navigating the forex market requires a combination of knowing what moves prices, managing the risks, and maximizing the profit potential.

Choose a broker and a trading platform

- One of the first steps for navigating the forex world is opening a demo account and choosing the appropriate broker. A demo account is a perfect gateway to learn the art and science of trading without any monetary risk.

The broker must be reputable and fully regulated to ensure their safety, capitalization, and ability to provide a competitive service. - Before someone ventures into the actual demo trading after chosing the broker, they should have already understood the basics of the inner workings regarding opening hours, what each of the currency symbols means, the different trends, etc. The trader will also need to learn crucial terminology like margin, leverage, and spreads and how they are interconnected.

- The next phase is deciding on the type of trading style one would pursue, whether it’s scalping, day trading, swing trading, or position trading. Usually, new traders tend to choose any of the former three as the latter is more for the experienced.

Choosing the right style aligns with the type of strategy, which would naturally be the following progression. - Regarding trading platforms, MetaTrader 4 is the most widely used in forex. MetaTrader 5 is somewhat popular. Other well-known software packages include cTrader, NinjaTrader, and TradingView.

For simplicity, the MetaTrader platforms are the go-to options. In contrast, the others have a bit more sophistication and might be better choices once a trader has more experience and skill.

One of the detrimental mistakes new traders make is staying for either too long or too short at the demo stage. At least one year is normally sufficient, assuming one can commit at least 2 hours a day studying the charts.

By this stage, the trader should have thoroughly back and forward-tested their strategy and concluded its ability to produce a positive expectancy. Numerous methods such as manual journaling and testing software exist for someone to know how well a strategy is likely to perform in a live setting. This is a step most tend to skip or not give the proper thought it deserves, but it’s crucial to prevent many errors in the real markets.

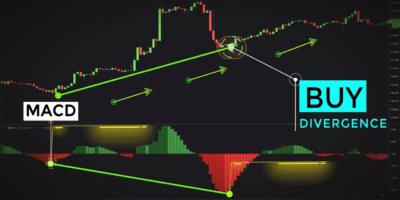

Technical and fundamental analysis

The two broad analysis strands in forex are technical and fundamental analysis. Technical analysis refers to analyzing past price action using patterns and indicators to predict future movements. Both methodologies are used in various degrees to essentially forecast where price will go.

This form of observation sets the foundation for entry and exit points. While technical analysis is not easy, it’s more widely used than fundamental analysis. However, it isn’t to say fundamentals are not significant.

Fundamental analysis aims to study the currency’s intrinsic value through mostly economic but also political and social factors. It is these elements fundamental analysts consider the primary drivers of exchange rates.

Since the advent of forex trading, debates continue over which approach is better. In reality, it may not be wise to separate the two, and many traders will include both in their decision-making process.

Familiarise yourself with basic trading strategies

Strategies in forex are abundant. As with any complex subject, everyone starts with the basics before moving towards the advanced. One of the simplest strategies, which is still widely implemented, is the moving average crossover.

Traders use this system to identify trend changes with a higher-period moving average and a lower-period moving average. While having a strategy is necessary, context is just as important.

When analyzing, traders need to ask themselves how the market is looking at that point in time. If it’s trending, is it a normal trend with normal retracements or a trend with very shallow pullbacks? Is the market in a range, is it approaching a key support or resistance level?

Identifying this information beforehand provides one with an edge as some strategies work better in other conditions than others. Some traders may employ more than one strategy to take advantage of different scenarios or wait until the most optimal condition appears for an individual strategy.

Using discretionary approaches to make decisions can take several years, emphasizing the importance for traders to continually improve their skills. There are several ways one can achieve this.

One way is actively using a journal to track performance and ensure rules are followed to the tee. Another useful tip is looking at less commonly used tools and seeking somewhat unconventional techniques that could provide a heads-up.

Having a brilliant mentor can shorten someone’s learning curve by several years and condense any outstanding information into simple, actionable advice. A trader’s journey is often a marathon than a sprint; the more they learn, the better they should become.

How to choose a good forex broker

Choosing a good forex broker involves logical steps considering several things:

Types of forex brokers

Because forex is a completely decentralized market without an exchange, we have two main brokerage models. The first is commonly referred to as ECN (Electronic Communications Network) or STP (Straight-Through Processing).

Both terms are often used together but essentially mean the same thing, direct market access through a digital portal of recognized liquidity providers. The second model is the market maker, but some refer to it as a dealing desk or B-book.

Both execution systems present advantages and disadvantages to different traders regarding trading costs, offered accounts, and market conditions. Although the STP model is seen more favorably, which many brokers will base their marketing around, it’s still difficult to confirm as a retail trader.

One way to ensure a broker is reliable is to verify they are duly regulated with a reputable supervisory authority.

These bodies include the likes of CySEC (Cyprus Securities and Exchange Commission), FCA (Financial Conduct Authority), ASIC (Australian Securities and Investments Commission), NFA (National Futures Association), and others primarily from Europe.

Such regulators may have certain policies pertaining to clients from their respective regions, such as leverage limits. In general, non-native traders can rest assured their broker is well-capitalized, safe to make deposits through, and generally act ethically.

Deposits and withdrawals

Deposits and withdrawals should be treated fairly at all times with forex brokers. Using an unregulated broker or one from an offshore nation with inadequate supervision increases the risks of financial malpractice.

However, using a regulated provider gives confidence to clients in depositing small to vast amounts of money with proper acknowledgment. Traders will also have assurance the broker will be able to process any withdrawals of any magnitude, assuming all terms and conditions have been met.

Check payment options, minimum requirements, commissions

Most brokers provide a plethora of payment options nowadays, including debit and credit cards from numerous payment processors (VISA, Maestro, Mastercard, etc.), Skrill, Neteller, PayPal, and even a few cryptocurrencies. Fortunately, many also do not charge any commissions for the majority of these options.

For convenience and instant clearing, cards and e-wallets tend to be the best ways to fund. A bank transfer, another popular method, isn’t as preferable since it often incurs fees and may take a few days to settle.

Generally, it should be a last resort when all the other choices have been exhausted. The advantage of cards and e-wallets is users can deposit the minimum required by their broker. However much one decides to fund will, of course, depend on their realistic disposable income.

On the other hand, it is useful to note different accounts will require various minimum deposits. For instance, the zero spread option needs at least $200 or even $500; a VIP account may demand a few thousand dollars.

Forex trading conditions

An acclaimed broker will provide favorable trading conditions for their clients in several ways. They will start by offering the most cost-effective spreads to minimize trading costs. Although this is now the standard due to the competitiveness, traders should still compare primarily for exotic pairs where there might be notable differences.

One account type to lower costs overall is the zero spread. It’s not an option offered by the majority of providers, but still beneficial and emphasizes the importance of a broker providing different account types catering to different needs.

For instance, one problem for many traders is low capital. While a standard account accommodates most, a cent or nano account is advantageous, especially for newer traders who don’t have much disposable income and experience.

Another critical point to note is the leverage offered, which also relates to the capital. By and large, the higher the leverage, the less money one needs to put down. Still, it’s just as crucial for a trader to be comfortable with the monetary risk they have per trade regardless of the leverage ratio.

Although having greater margin can leave a trader susceptible to over-leveraging, it’s fully accepting the dollar amount at risk that matters more.

Customer service

Like any business, excellent customer service is non-negotiable. All brokers should have a functioning and highly responsive live chat function to conveniently and quickly accommodate most of their clients’ inquiries.

This option has certainly reduced the need for telephonic support. If we couple this with a detailed FAQ page on a broker’s website, most questions and issues are typically solved without speaking to someone.

Needless to say, this doesn’t mean helplines aren’t crucial. However, most traders should rely more on live chat and email and use the phone as a last resort.

Reviews from other users

Reviews from other users tend to be subjective and not a reliable indicator. Services such as TrustPilot and Forex Peace Army try their best to provide objective experiences, and some brokers do respond to any constructive assessments from traders.

The key thing to watch out with negative comments if a pattern persists of users complaining about withdrawals. A better option for a recommendation is from a friend or trusted expert who can provide objective encounters and constructive feedback.

Conclusion

Trading forex is a career and needs to be treated seriously both in terms of the charting aspect and working with a broker. We hope readers will have a sufficient choice into the providers they might consider, along with a wealth of information on other helpful considerations to make.

In formulating this guide, we performed thorough research using each broker looking at their overall safety, features, trading costs, user-friendliness, market range, payment options, and customer support facilities.

Comments