Aeron Scalper and Grid robot has an updated presentation. The developers have connected the second account after the frilliest one was grounded. The presentation looks short and not informative. It’s suspicious because usually the developers explain how their system is going to be profitable. The presentation lacks those explanations.

The system works with a risky Grid of orders strategy. This means that the robot adds some extra orders after the first one is placed to make more profits.

What is behind Aeron Scalper and Grid?

So, let’s talk about what we’ve got as explanations about settings, details, and other parameters.

- The system opens and closes orders for us automatically. We shouldn’t interact with the robot.

- The advisor focuses on scalping profits from the market.

- The supported strategy is a Grid of orders that can increase profitability with risks.

- It’s a high frequency trading advisor.

- The robot can work with two extra risky strategies like Hedge and Martingale.

- Money management provides us with calculating and placing proper SL and TP levels.

- It can calculate lot sizes for every placed order.

- We can be sure that the robot works with any market conditions.

- The EA has to work on a VPS server to protect the system from placing orders during the high spread periods.

Key features

- The system can help us with automated trading.

- It places SL and TP levels for us.

- It manages all implemented strategies automatically.

- Trading is possible on a MT4 terminal only.

- The time frames are M1 and M5.

- We are allowed to open orders on EURUSD, EURJPY, USDJPY, CADJPY, and USDCAD.

Trading strategy

We can work with the following strategies: Scalping, Grid, Hedge, and Martingale. The presentation doesn’t include backtests. This looks suspicious especially taking into account several blown accounts in the past.

Pricing

The robot is sold for $230. There are no refunds applied to get our money back if we don’t like the service.

Trading performance of Aeron Scalper and Grid

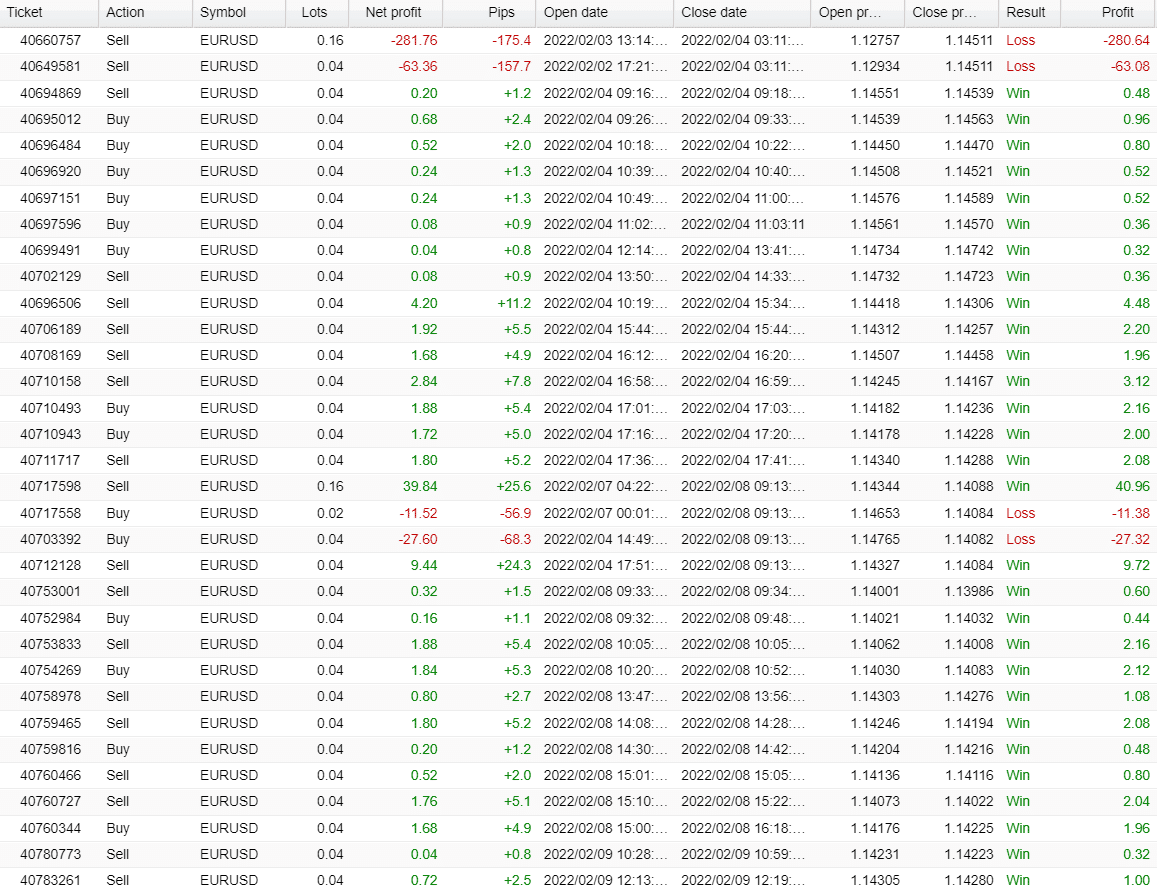

Aeron Scalper and Grid trading results on Fxblue

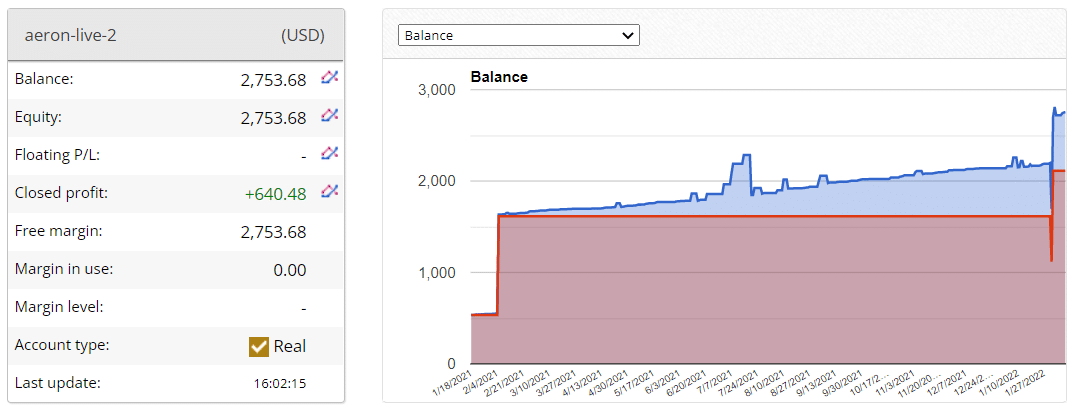

Aeron Scalper plus Grid has been running on another account automatically. The closed profit is $640.48. There are no open orders on the market. The current balance is $2,753.68.

Aeron Scalper and Grid statistics

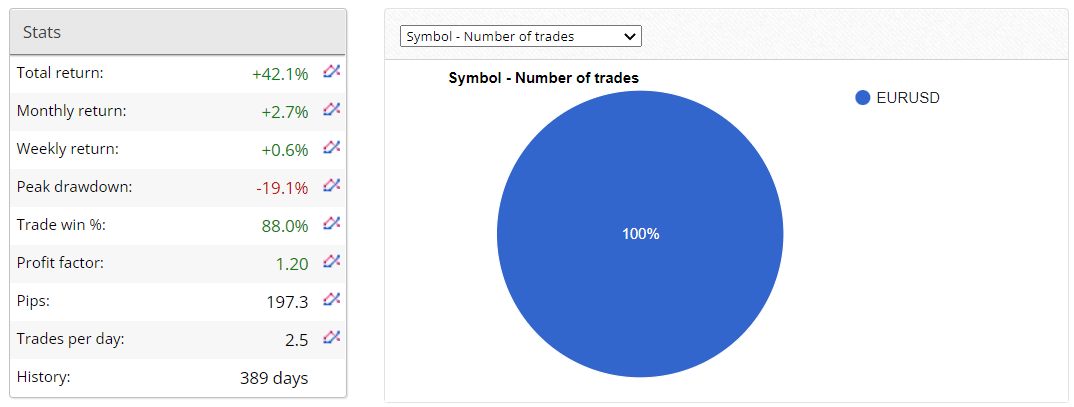

The total return has amounted to 42.1%. An average monthly return is 2.70%. The maximum drawdown is high, 19.1%. An average win rate is 88.0%. The profit factor is 1.20. An average trade frequency is 2.5 orders a day. The system worked for 389 days.

Aeron Scalper and Grid risks

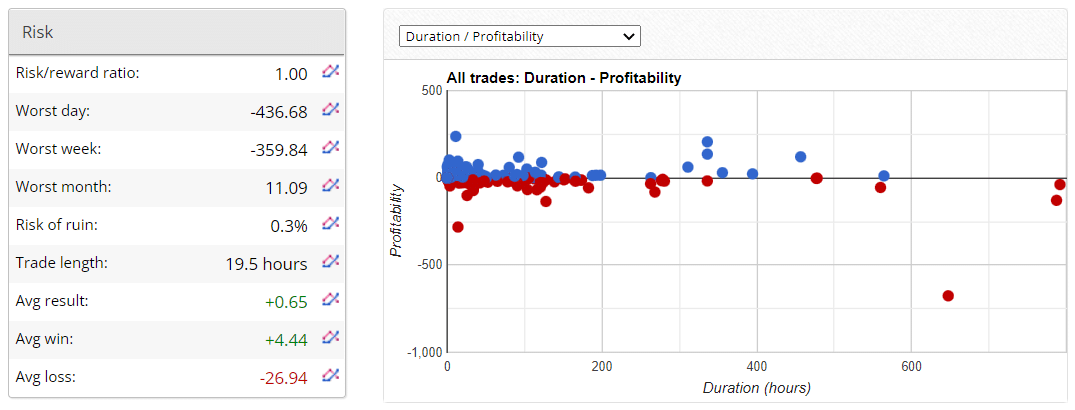

The ROI is 1.00. The risk of ruin is 0.3%. This is high as for a paid advisor. An average trade length is 19.5 hour, win is $4.44 when an average loss is -$26.94.

Aeron Scalper and Grid directions

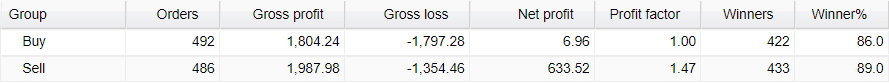

The profit factor in the Buy direction is 1.00 ($6.96). It’s dangerous.

Aeron Scalper and Grid trading strategies

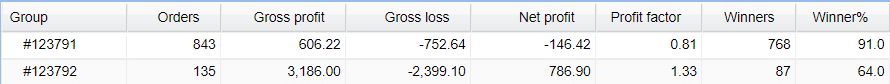

There are two magic numbers behind the system. The first one provides losses, -$146.12.

Aeron Scalper and Grid daily activities

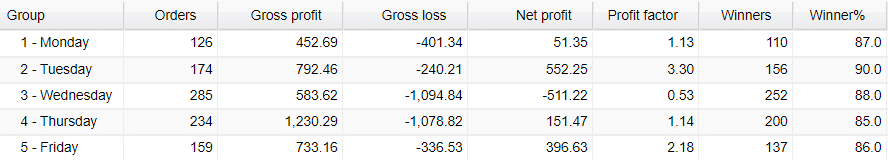

Wednesday is the most traded day with 285 orders closed.

Aeron Scalper and Grid hourly activities

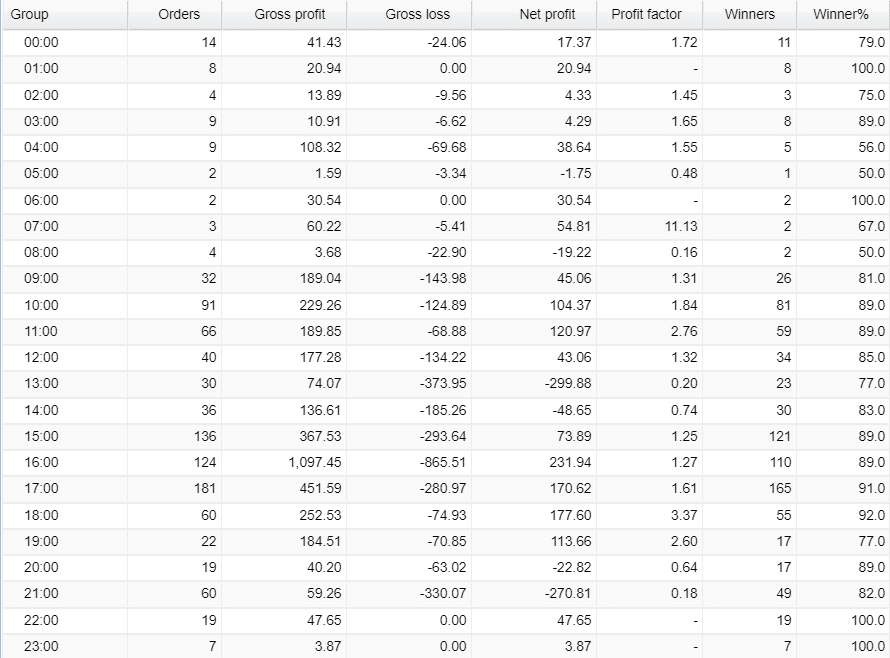

Aeron Scalper and Grid trades European and American sessions.

Aeron Scalper and Grid monthly profits

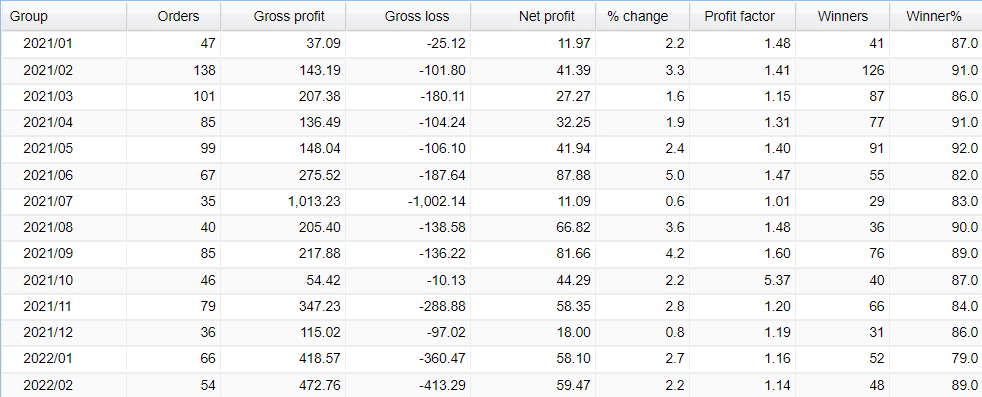

We may note that trading frequency isn’t predictable.

Aeron Scalper and Grid closed orders

We can easily note x4 Martingale from time to time.

Customer support

We don’t know how good their support truly is. Comments below meant nothing about it.

People feedback

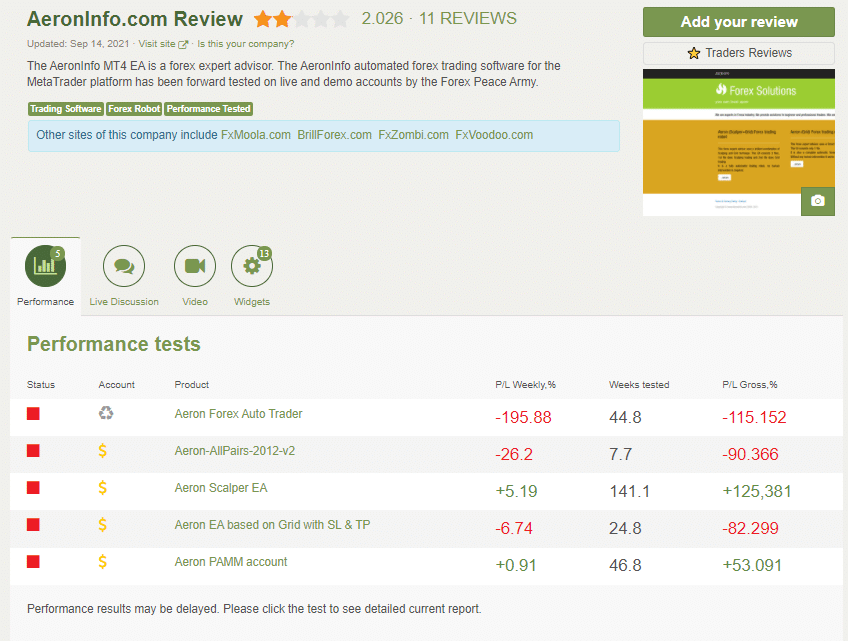

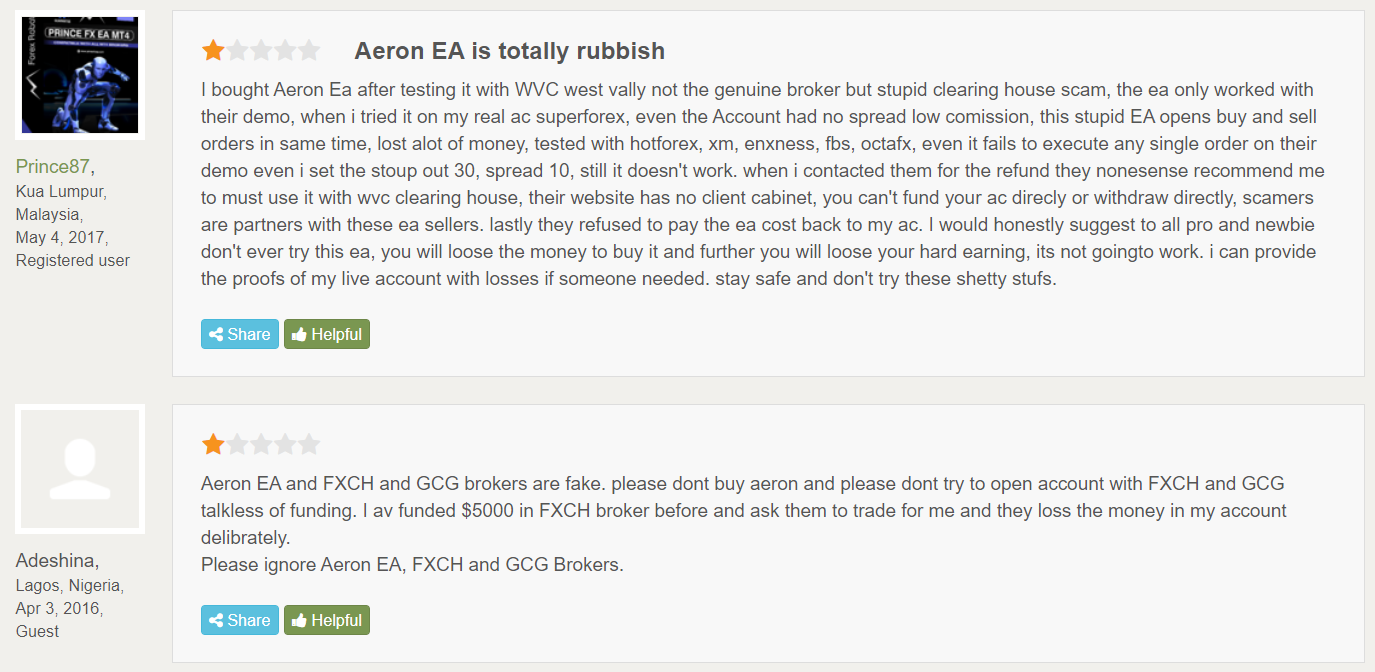

AeronInfo page on Forex Peace Army

There’s a page of Aeron Scalper plus Grid on Forex Peace Army. There are 11 reviews published that formed a 2.026 rate. There are five accounts stopped where three of them were blown.

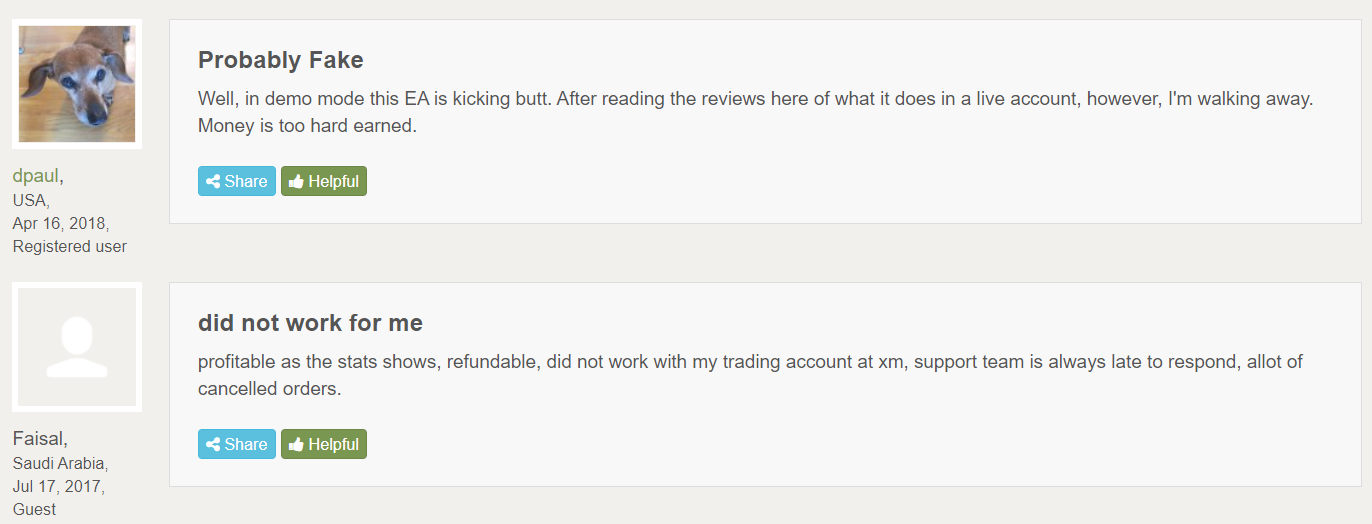

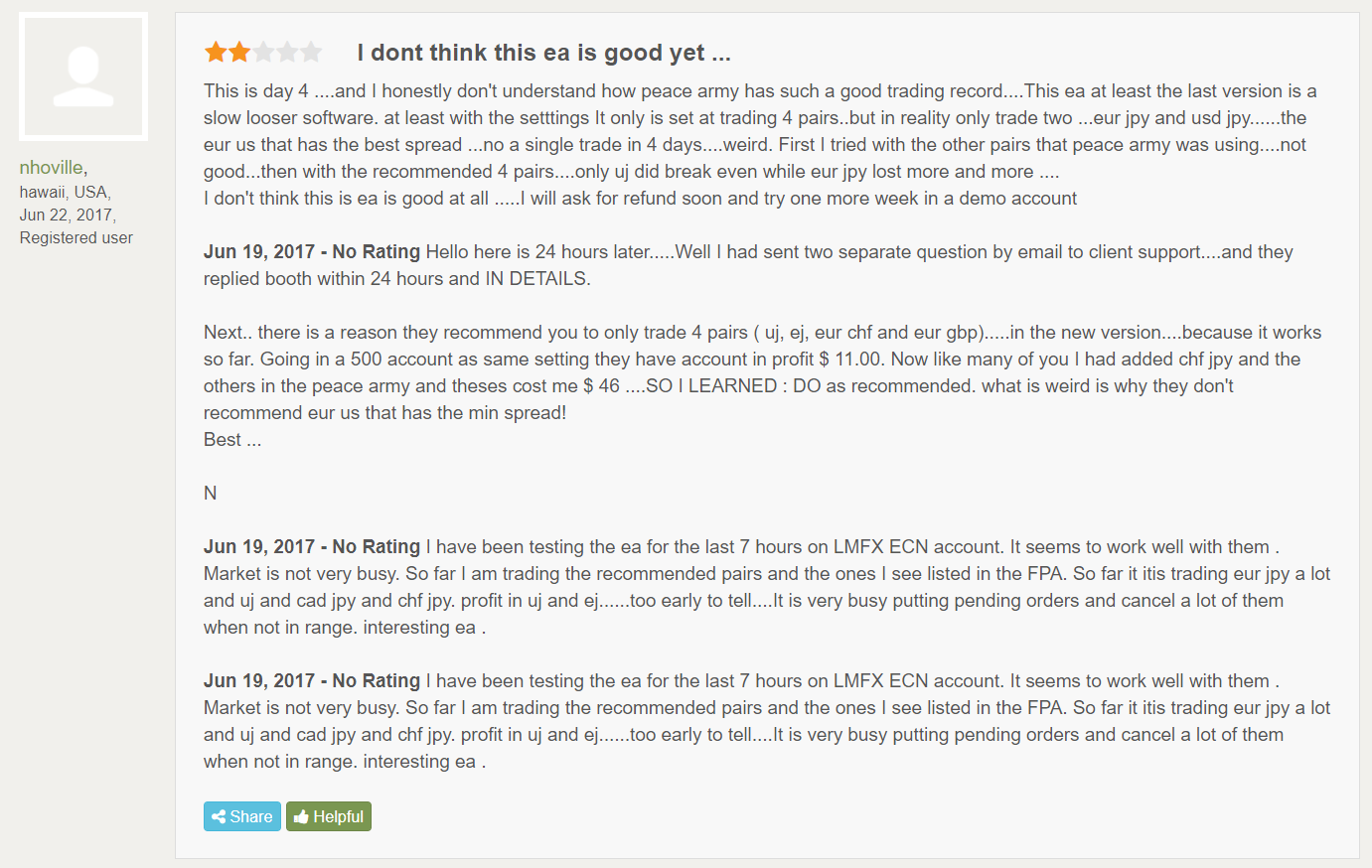

People testimonials on Forex Peace Army

Customer testimonial on Forex Peace Army

People testimonials on Forex Peace Army

There are so many negative testimonials provided about people’s experience of working with this system.

Comments