Investment is a long-term journey for every beginner. And it can be overwhelming to choose from so many industries in which you can invest. Among these, one of the top seat takers is the stock market. Investing in stocks is famous around the globe, with some intelligent traders making 30%- 60% of their investment value from stocks.

The investing journey can be challenging and is not possible without knowing how exactly the stock industry works. Experienced traders bag big profits while novice investors lose by committing mistakes and choosing the wrong stocks.

Stock investing, when done well, is among the most effective ways to build long-term wealth. To understand investing, you must learn how the general principles behind the stock market work.

Understanding the stock market

Stock markets have some familiar names, such as share market, equity market, and stock exchange. Stock or shares are the company’s portion that a buyer claims its ownership on. A stock market is a collection of stocks or exchanges where continuous buy and sell of stocks occurs. It allows investors to purchase and sell stocks with low potential risks through stockbrokers.

While both terms — stock market and stock exchange are used interchangeably. For example, if someone says that they trade in the stock market, it means they buy and sell shares/equities on a stock exchange(s) that are part of the overall stock market.

Nasdaq is the leading stock exchange followed by COBE in the US market.

7 powerful tips for investing in the stock market

Investing in stock is a board game, and every professional will have their strategy and plans for investing. After you have a basic understanding of the stock market, let us look into the advice you can consider before investing.

№ 1. Decide how much you are capable of investing

The first approach before starting investing is to know if you can invest at the point in time and, if yes, then how much. Ask this question to yourself: “Do you have money that you can afford to lose?”

We all know investing is risky, so you must take the risk with the money after taking care of your expenses. In other words, risk only what you can afford. Here you mustn’t take loans and invest when you don’t know what industry you are getting involved in.

№ 2. Note your trading objectives

Now comes the point wherein you will decide what made you come to this stock investing space. Having a clear-cut picture in mind is way more important than all the other pointers on the list.

Maintain a journal and write the purpose of your investment. What do you want to achieve from it, and how are you going to do it?

№ 3. Choose your investment strategy

Once you have your money and your trading objective, you need to make or decide the investment strategy you will follow. Well, I would say, ‘No one knows your condition better than you do.’

The task here is to identify your personality and needs that will help you not over or under-invest successfully. It’s always a good practice not to invest in one stock and split your funds to diversify your portfolio.

Diversifying your portfolio is the key here; you must learn how to do it effectively and keep in mind not to overdo it.

№ 4. Open an investment account

To buy individual stocks or mutual funds, you must have a brokerage account. There are wide varieties of brokers, and each has its services and price range. Find some brokers and note down the list of services they provide, the price, their commission, and maintenance charges in your journal. Then compare all the differences for the sake of choosing the best one. The broker will help you align with the specific financial capacity.

Also, try to get in-depth knowledge about the broker you choose to have no hidden charges. A few of them also help you with investment advice and recommendations.

№ 5. Research and choose

You need to select the stocks that, according to your analysis, perform the best in the coming years or for whatever target year you have in mind. Always remember to keep in mind to have a clear and realistic goal.

Some of the advice you can check for while choosing your stocks is to invest in the industry or the business you understand better. Also, try to avoid high-volatile and penny stocks until you see yourself as an experienced investor.

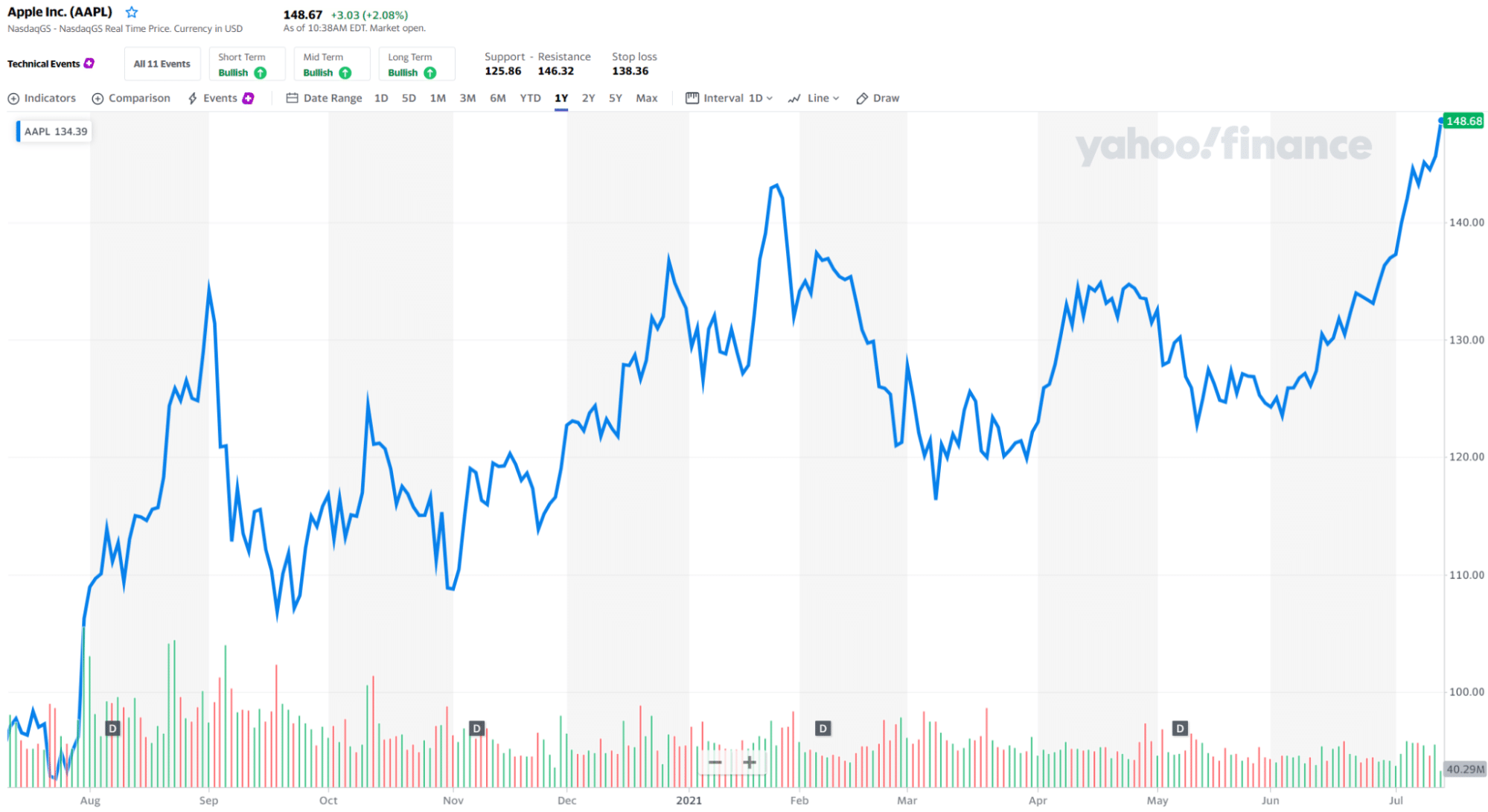

For example, you can see the Apple Inc. chart where the price is showing a significant rise. Apple Inc., based out of Cupertino, United States, is a technology company dealing in the consumer electronics industry with 1,00,000 employees. The total market cap of Apple Inc is 2.485 trillion. The product that Apple produces we all know given out in the market is fantabulous. The tech company has had incredible growth over the years, making it an excellent stock to invest in.

№ 6. Invest in the stock

This is probably the foremost step of your investing journey. Once you have done your research and found out the best stock for yourself to invest in, you can start with a bit of investment and not go all in one.

Just remember the words from the world’s best investor Warren Buffett: “You do not need to do extraordinary things to get extraordinary results.” Invest in stocks and wait for the results in the future.

№ 7. Be it in the long term

You would have heard a famous proverb that says, “patience is the key.” Every investor or even trader who is successful in his career has this one quality in them.

Yes, I also must agree that it won’t give the best feeling but trust me, it will be worth holding those stocks for the long-term. For example, if you invested $5,000 in the S&P 500 index 50 years ago, it would be worth nearly $6,00,000 today.

The risk involved in stock investment

Any form of investment is risky and needs proper attention and knowledge to avoid losses. Stock is highly volatile, meaning the prices fluctuate every sec, making you anxious.

One of the most known risks is the economy — countries’ overall economy and the inflation rates will affect the stocks price. Being too conservative in your investment approach is also a risk, which may delay achieving your financial goals.

Final thoughts

Investment is always a better approach for every individual. It is often quoted that a successful investment can make you wealthy, and jobs can only make you rich. Your life without investing would be nothing but just a mediocre one that will have some money in your bank account after retirement.

Choosing the right stock to invest in is one of the significant tasks that needs research, time, and dedication. Listening to the crowd and investing is a wrong choice to make, as it’s always better to rely on your strategy and analysis than others.

Comments