With the number of investment options available, you might get confused about where you should put your money. You can invest in stocks, bonds, currencies, real estate, cryptocurrencies, and many others. Whatever you choose, you must get a good balance between risk and reward.

Often, this depends on your time horizon. You should focus on safer investments, such as bonds and cash, if you are nearing retirement. You can still add riskier investments but keep them to a minimum. For example, you can allocate 70% of your funds to bonds and the rest to stocks.

Investing is a time game. The more time you let your money grow in an investment, the bigger your potential return is. The equally important factor is the investment amount. Regardless of your age right now, it is not too late to start investing. The key is to get started as soon as possible.

In this article, we will look into five investment options. We will dig deeper into each option to understand the potential returns. Then we can analyze later which one is the most profitable.

Types of investments

Below are some of the most common types of investment vehicles. When going through each option, consider the profitability and the potential risks.

High-yield savings account

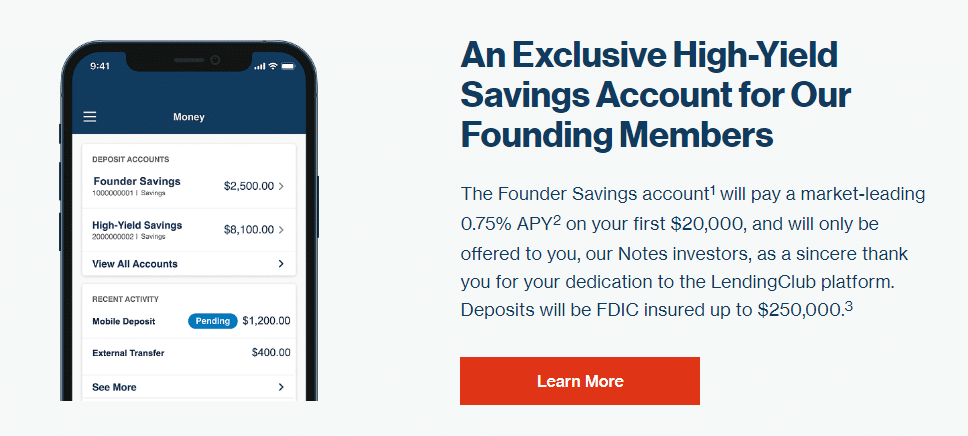

You can get high-yield savings account from digital banks. Compared to the rates provided by traditional banks, the rates offered by digital banks are generally 10 to 20 times higher. The current national average is 0.06 percent APY, according to bankrate.com. At this time, the digital bank that offers the highest rate (i.e., 0.75%) is LendingClub Bank.

If you have $5,000 in your savings account, you will only gain $15.02 in interest after five years if you put your money in a traditional bank. If you put the money instead in LendingClub Bank, you would earn $190.33 in interest, which is way higher than the first option. The two computations consider the effect of compounding.

LendingClub individual account offering

Savings bonds

You loan money to the federal government when you get a savings bond. At your option, you can designate yourself or another person even below 18 as the owner or beneficiary of this bond. No one can withdraw this investment other than the owner or the beneficiary. Note that the savings bond rate varies every six months, i.e., May 1 and December 1. The term of the savings bond is 30 years.

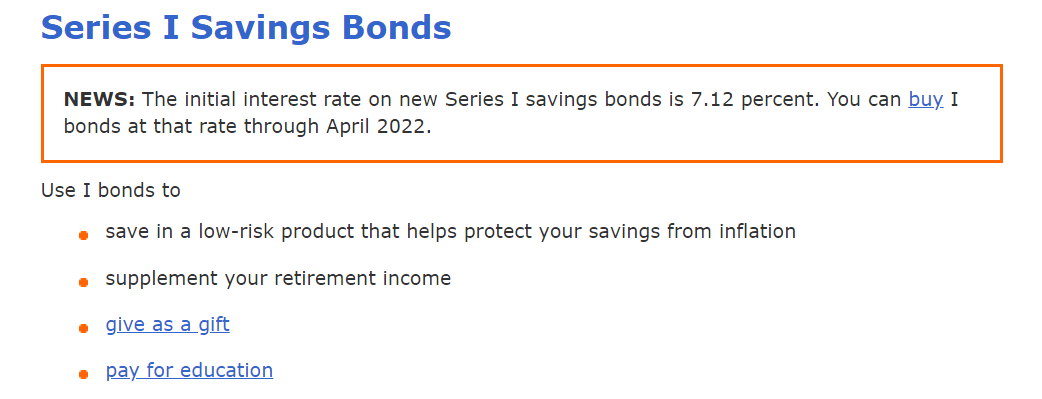

At this time, you can purchase either series EE or series I bond anywhere between $25 and $10,000. Until April 2022, you can purchase series I bonds at 7.12 percent, according to treasurydirect.gov.

Suppose you bought $5,000 worth of series I bond and did not make additional purchases. You will have $40,784.25 in 30 years without factoring rate variation using a compound interest formula.

Series I savings bond rate

Certificate of deposit

A CD is a special type of savings account wherein you put a specific amount of money and do not touch it for a set period. In return, the bank will pay you a fixed interest rate. Depending on the term defined by the bank, the CD may expire in five years, one year, six months, etc. This type of savings is also known as a time deposit. You can get back your savings plus interest at the end of the term. If you buy a CD from a bank insured by the federal government, up to $250,000 of your deposit is insured.

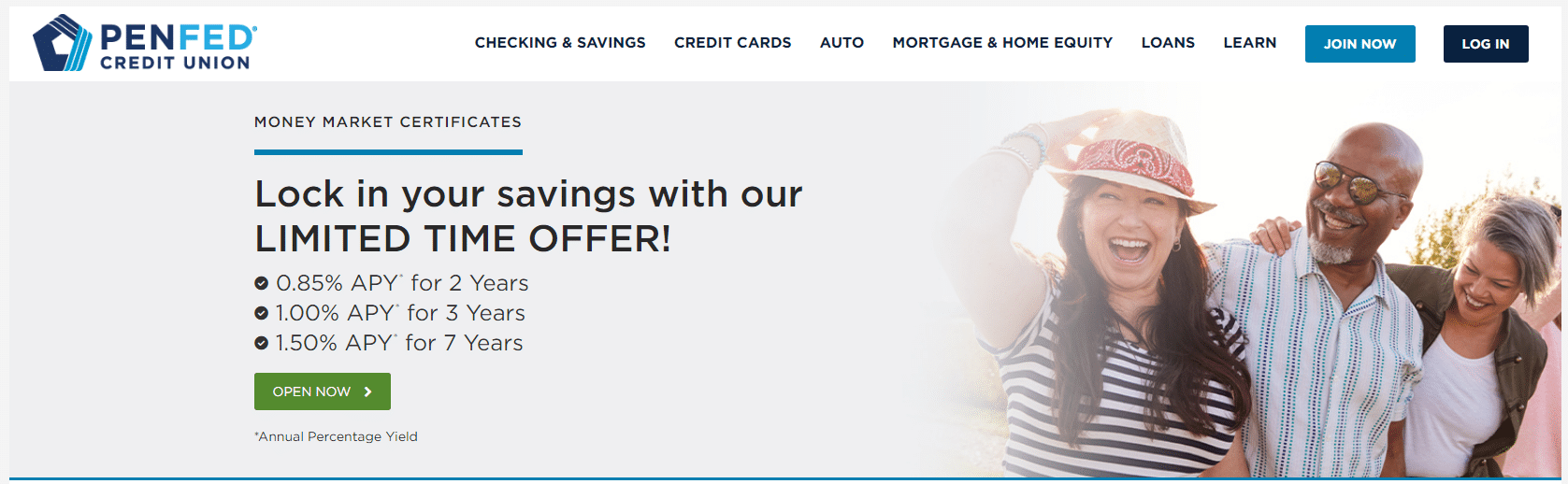

The bank offering the highest CD rate is Pentagon Federal Credit Union. On December 12, 2021, the highest offer is 1.5 percent APY for a seven-year deposit. You can qualify for this rate if you save a minimum of $1,000. Using the same initial savings amount of $5,000, your investment would become $5,549.22 after seven years using the compound interest formula.

Pentagon CD rates

Exchange-traded fund

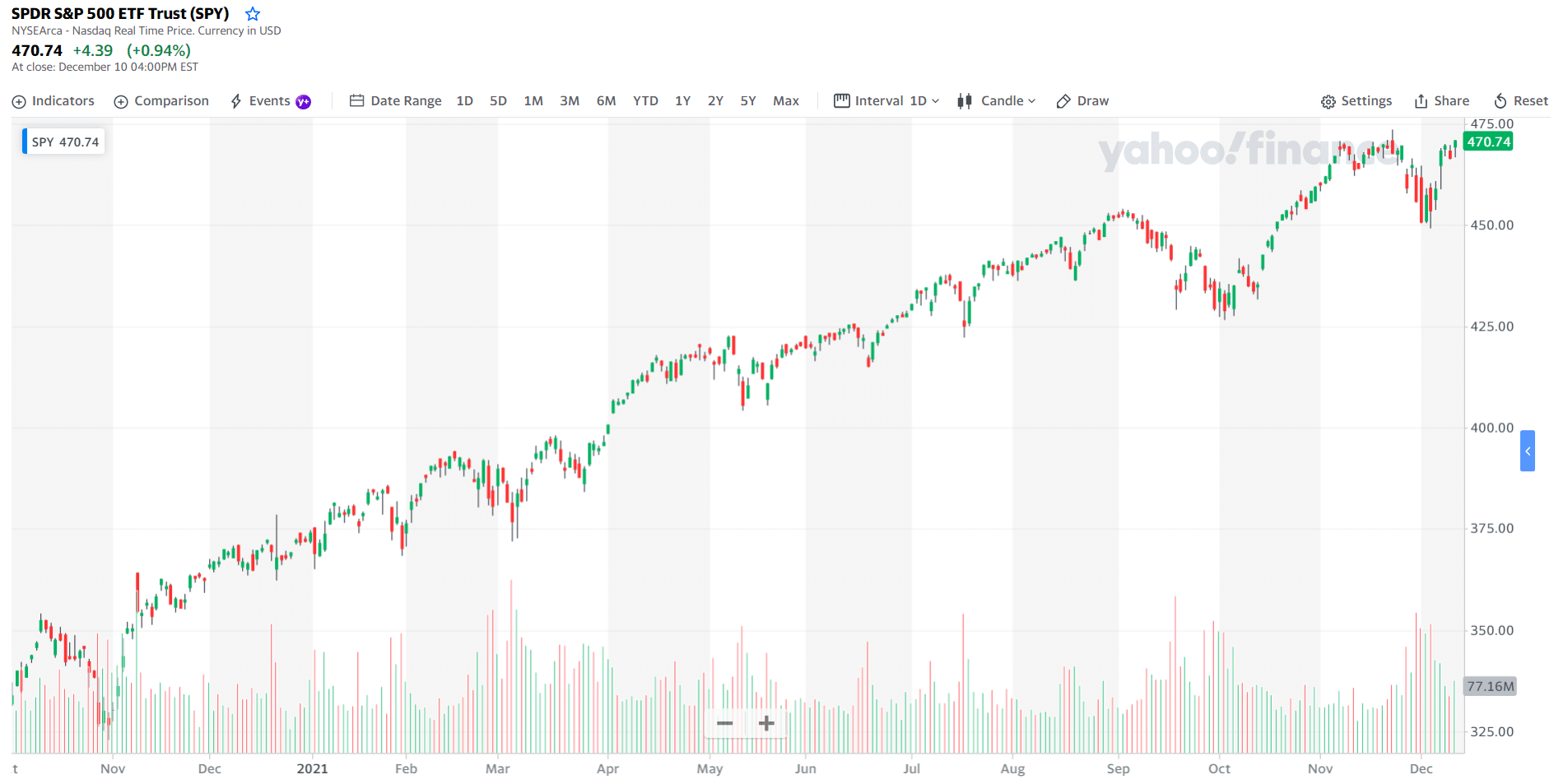

An ETF is an investment security that follows an index, commodity, sector, or another asset. You can buy and sell ETFs in stock exchanges. An ETF can track a single or a set of assets. One example of a popular ETF is SPDR’s S&P 500 ETF (SPY).

According to investopedia.com, the average annualized return of SPY from its establishment in 1926 to 2018 is around 10 to 11 percent. Let us compute the potential return if you invest $5,000 at a rate of 10% APY for five years. Using the compound interest formula, your total investment after five years will be $8,052.55. The profit is $3,052.55.

SPY daily price chart

Dividend stocks

Dividend stocks are publicly traded companies that regularly share a portion of their revenues to stockholders. Such companies have often established a strong foothold in the industry, have proven track records, and steadily generate profits year after year. This revenue share is known as a dividend, and companies give them out either as additional stock or cash.

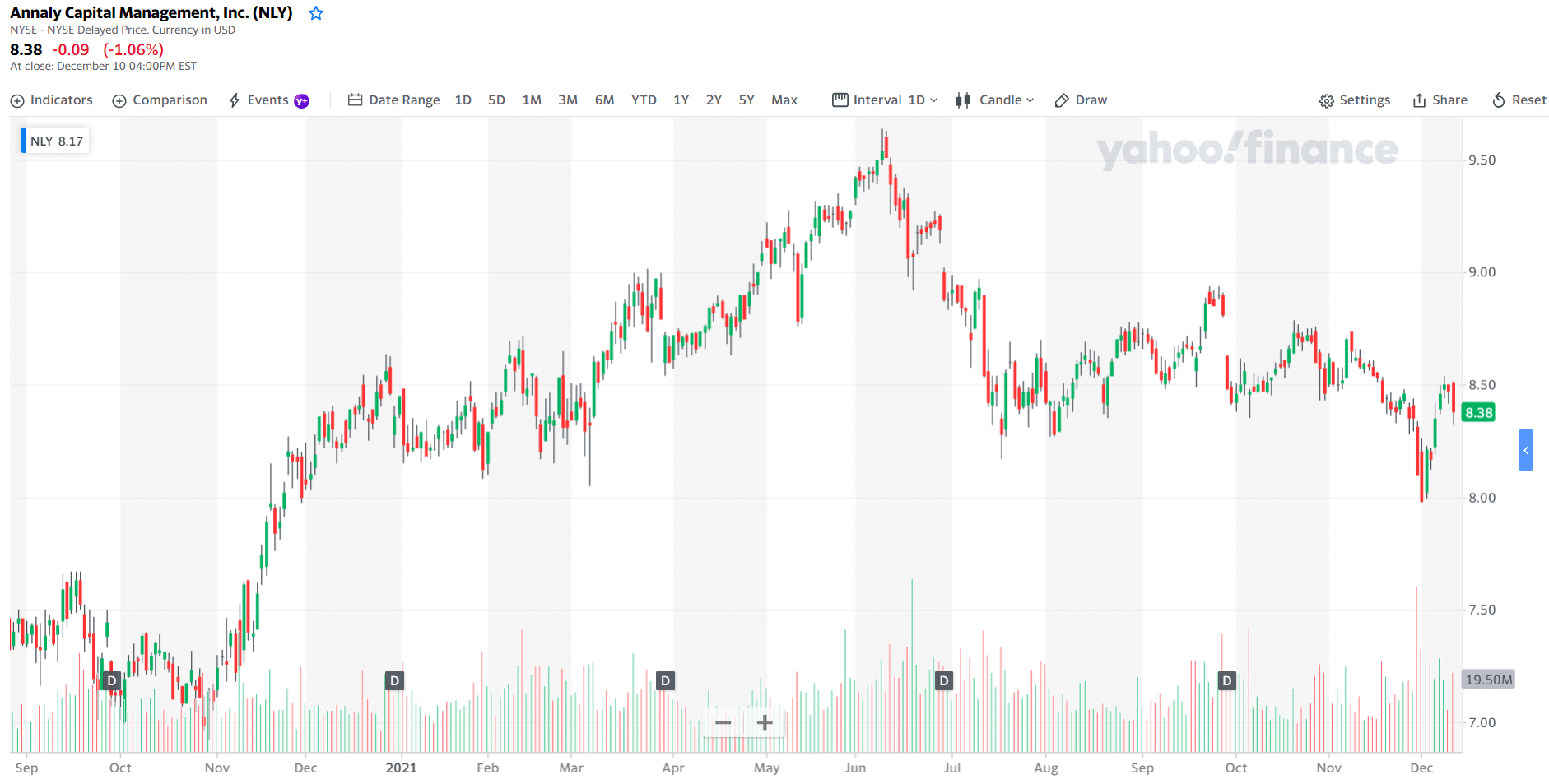

The number one dividend stock listed by investopedia.com as of November 29, 2021, has a dividend yield of 10.5 percent. This stock is known as Annaly Capital Management (NLY). Let us understand the total return in five years when you invest $5,000 today. The current NLY price is $8.38. Refer to the price chart below.

NLY daily price chart

From 2016 to 2020, NLY generated an average yearly return of 11.054 percent based on data provided at annaly.com. Let us assume further that you reinvested all dividends made each year and that the dividend rate is flat over the course of five years.

Based on the dividend alone, your investment will be $8,237.23 at the end of five years, using the compound interest formula. Since the price of NLY is assumed to grow by 11.054 percent in five years, you will also earn from capital gain. You are going to buy NLY at $8.38 today and sell it at $9.31 after five years. With a capital of $5,000, you can buy around 597 shares ($5,000/$8.38).

After five years, your investment would amount to $5,558.07 (597x$9.31). Therefore, your total return is $3,795.3 ($3,237.23+558.07), and the total investment amount is $8,795.3 ($3,795.3+$5,000). Then your investment has grown by 75.9 percent in five years using the percentage change formula.

Final thoughts

You can quickly tell which one offers the highest return from the five investment vehicles covered in this article. Just look at the annual rate of each option. It means you get the most significant return when you invest in dividend stocks. This is because you can generate income from two sources: dividends and capital growth.

As a seasoned investor, you might be interested in investments with low or moderate risks. In the above examples, the investments that carry the least risk are CD and savings bonds. Your CD is safe as long as you entrust your money to a federally insured bank. Meanwhile, loaning money to the government through savings bonds is equally safe investing.

Comments