More than merely the expansion of mobile payments and e-commerce, fintech’s impact on the global banking system goes much beyond that. From Bitcoin to risk management AI to crowdfunding, the world of finance is evolving rapidly in the twenty-first century.

To invest in these trends, you may need to devote considerable effort to studying individual stocks, as well as putting yourself at significant risk. Other options include employing exchange-traded funds to participate in the financial technology revolution.

This article will walk you through what fintech ETFs are, how to buy them, and which are the top five funds you should consider buying in 2022 to level up your profit.

What are fintech ETFs?

It’s often known as “fintech” when referring to financial technology. However, when we say “mobile payment companies,” we’re talking about companies that deal with things like mobile payments, e-commerce, budgeting, and credit. ETFs provide a means to diversify within this narrow market sector since they may be small, volatile startups that are difficult to choose from individually.

As a result of this pandemic, more people are turning to contactless payment solutions that fill a need in the market that traditional banking does not. Consider the likes of Square, PayPal, Apple, and more. In addition, fintech is on the rise, thanks to the widespread availability of smartphones and the internet.

According to polls, most clients are unsatisfied with their conventional large bank, hastening the shift to innovative, online-only, tech-driven banking solutions. Budgeting, credit, insurance, mortgages, and other forms of saving and investing are all included in the fintech industry.

How to buy fintech ETFs?

All of these fintech ETFs should be available via any significant broker. Questrade or Interactive Brokers in Canada provide the ETFs mentioned below. eToro and Interactive Brokers may be used by investors outside of North America.

Let us walk you through the top five finetech ETFs to buy in 2022.

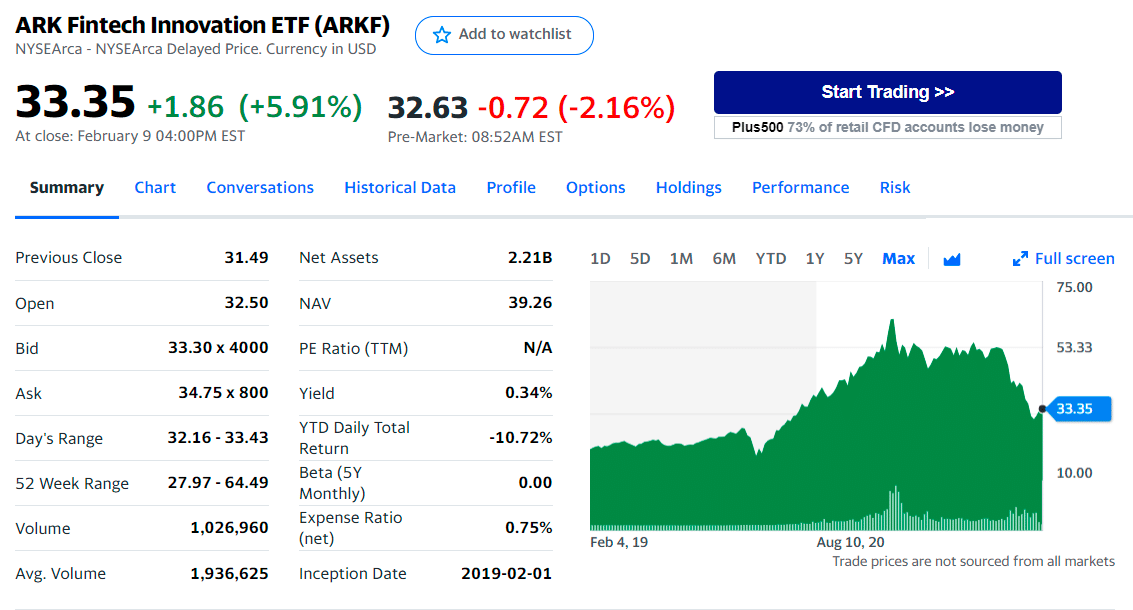

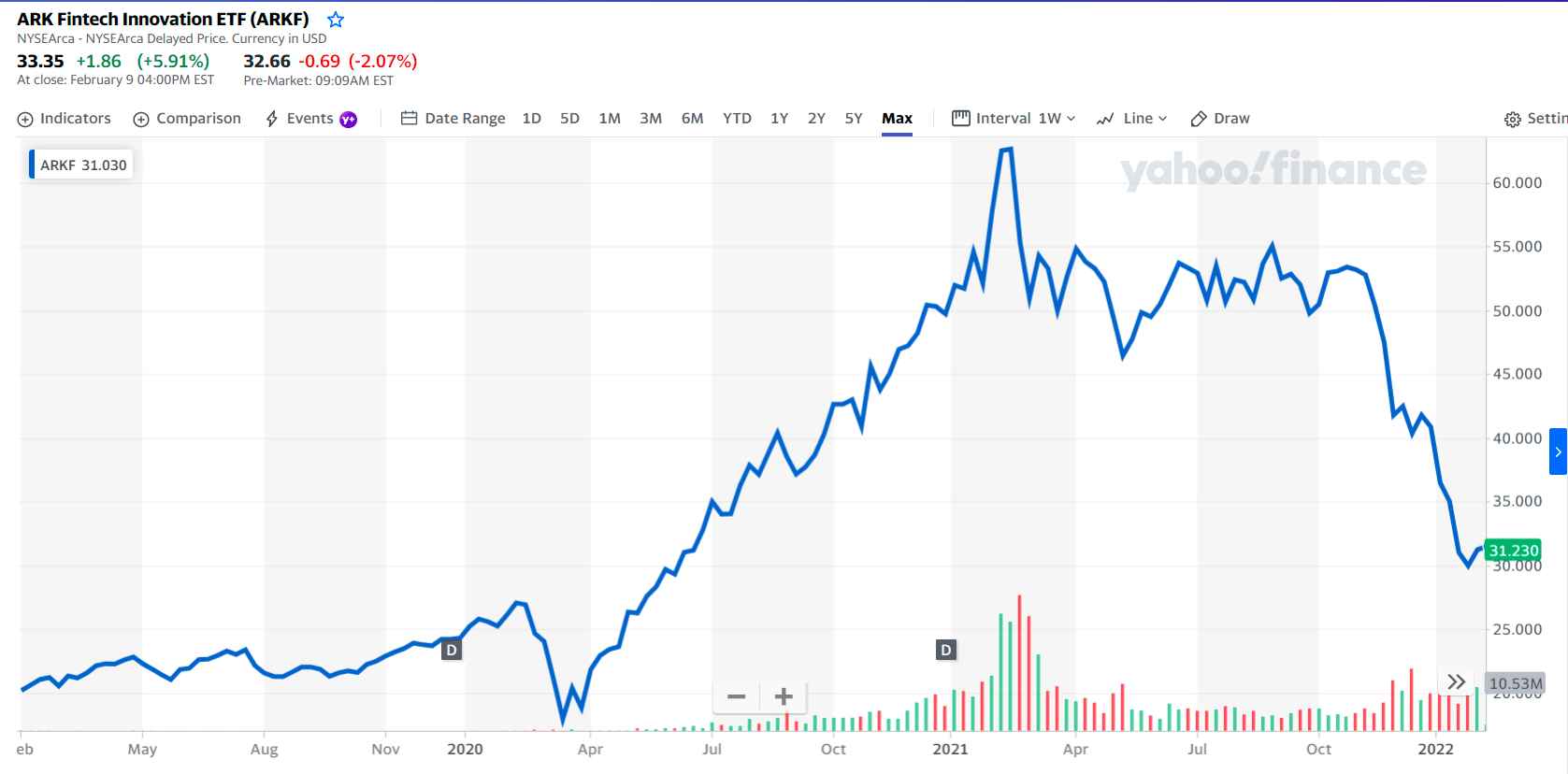

Ark Fintech Innovation ETF (ARKF)

Price: $33.35

Market cap: $66B

ARKF summary

The Ark family of ETFs offers investors a wide range of options for investing in revolutionary technology and research, from biotech to self-driving automobiles. With ARKF’s launch in early 2019, fintech startups working with mobile payments, digital wallets, and blockchain technology now have a platform to showcase their work.

For those who want to invest in high-risk, high-tech companies from a wide range of sectors, ARKF provides access to a wide-ranging fund. The net assets of this Ark fund are $4 billion, with an expense ratio of 0.75 percent. There are more than 40 fintech businesses in the fund’s portfolio that have the potential to alter the financial technology landscape, enabling significant capital development.

ARKF price chart

The first three holdings with their asset percentage are:

- Coinbase Global Inc. – Class A — 9.97%

- Block Inc. — 9.60%

- Shopify Inc. – Class A — 7.85%

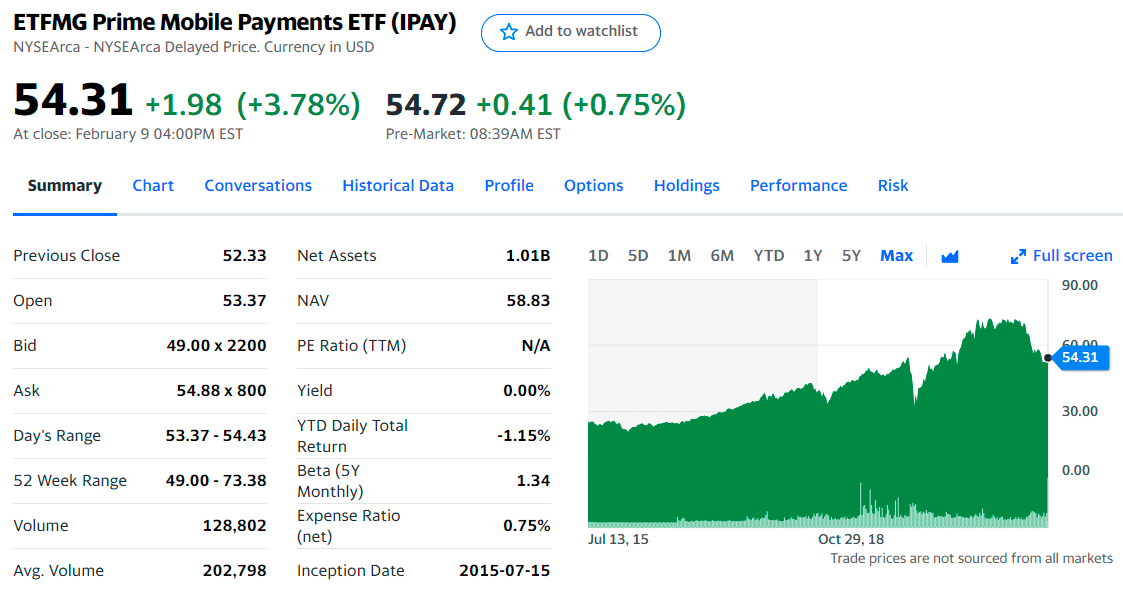

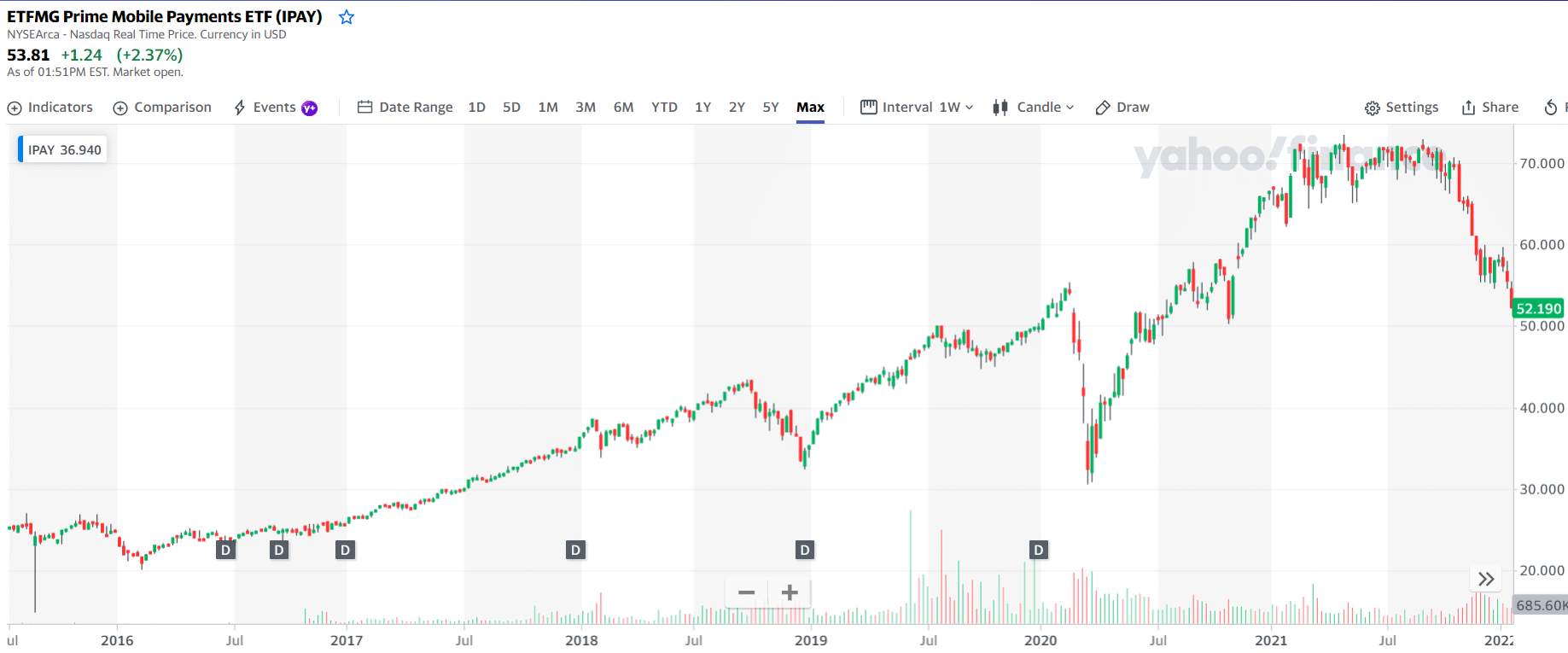

ETFMG Prime Mobile Payments ETF (IPAY)

Price: $54.31

Market cap: N/A

IPAY summary

Many people’s visions of the fintech future hinge on the ability to make payments through mobile devices. Just as the digital revolution has allowed investors to access information, smartphones have made it possible to do business anywhere. A credit card isn’t required to make these transactions, and in some instances, it’s safer. In an attempt to replicate the Prime Mobile Payments Index, an industry standard for mobile and electronic payments, the ETFMG Prime Mobile Payments ETF was created.

To date, it is one of the first exchange-traded funds dedicated to the mobile payments industry. With approximately $1.2 billion in assets under management, it is one of the more considerable specialized fintech funds. PaySign Inc. and PayPal are only two of the big players in this market, including Visa Inc. and smaller firms like PaySign Inc.

IPAY price chart

The first three holdings with their asset percentage are:

- Square Inc A — 6.56%

- Paypal Holdings Inc. — 6.43%

- Visa Inc Class A — 5.83%

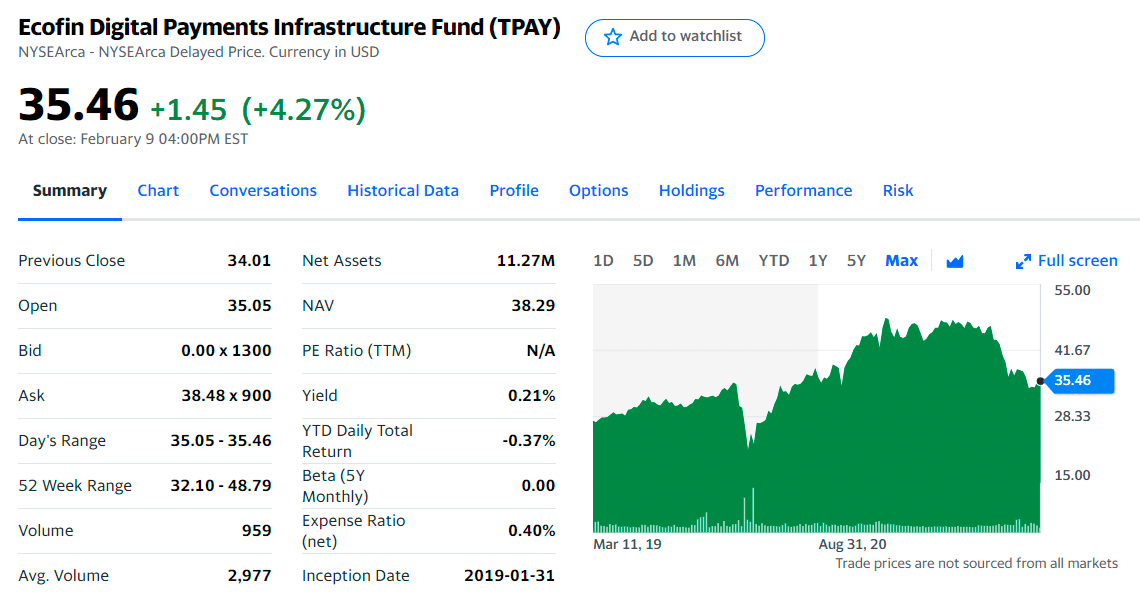

Ecofin Digital Payments Infrastructure Fund (TPAY)

Price: $35.46

Market cap: $803,836

TPAY summary

With $14 million in assets, TPAY is a smaller and younger digital payments company that emphasizes the infrastructure required for 21st-century transactions rather than focusing on the number of transactions a company handles. More than half of TPAY’s revenue comes from electronic transaction processing.

For example, take Fiserv Inc., a provider of risk management, compliance, and technology services to banks, which is a significant position of the fund. The security and verification services provided by DocuSign Inc. are one example. Treating banks as clients rather than consumers offers an innovative twist to the digital payments movement by not depending on an app’s growth or desire for billions in connected accounts. With Ecofin, long-term investments are prioritized by integrating ecological and financial interests to generate a positive social impact.

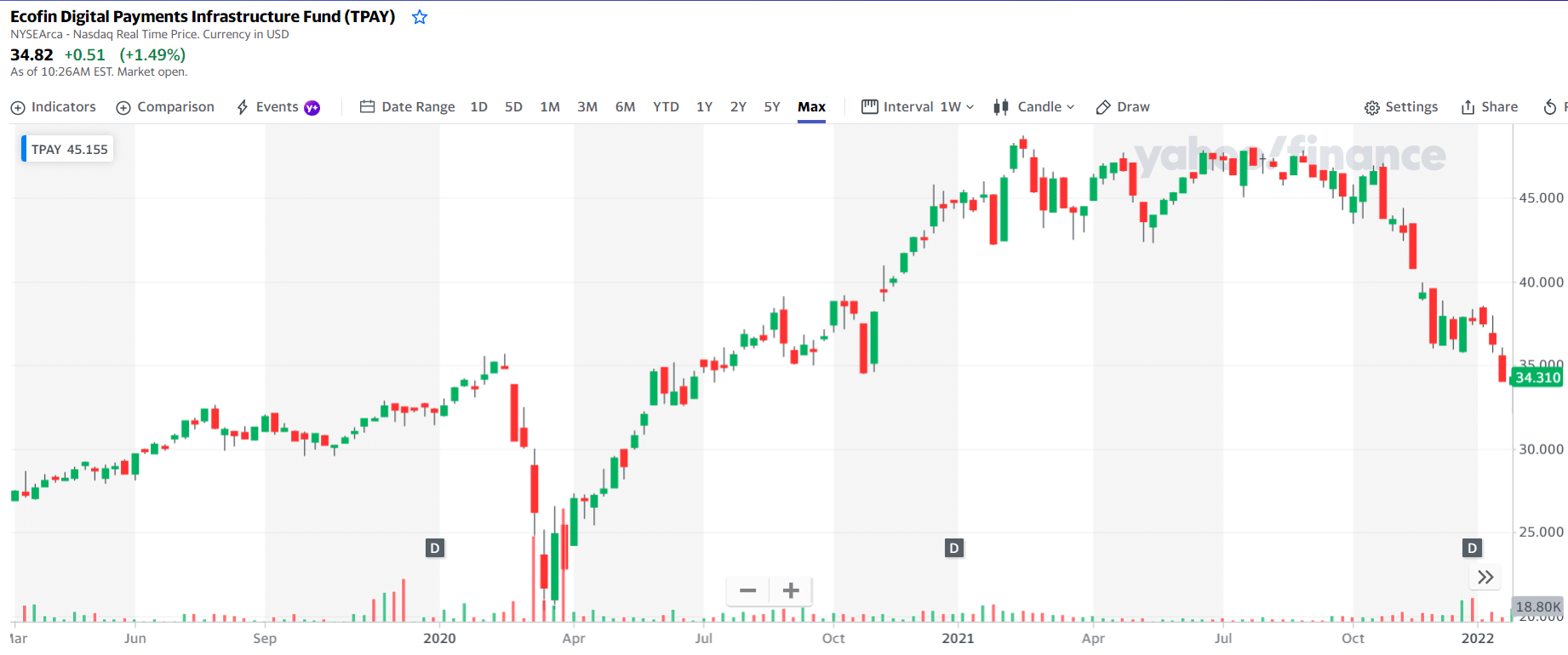

TPAY price chart

The first three holdings with their asset percentage are:

- Adyen NV — 5.91%

- Afterpay Ltd. — 5.53%

- Square Inc A — 5.47%

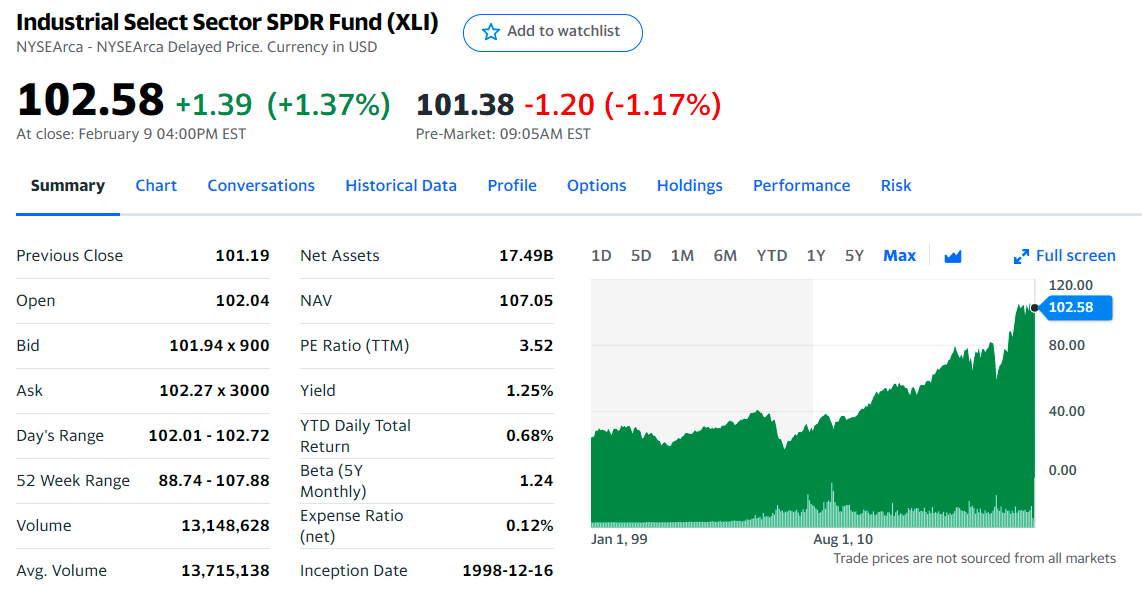

Industrial Select Sector SPDR ETF (XLI)

Price: $102.58

Market cap: $13.85B

XLI summary

S&P 500’s Industrial Select Sector Index serves as the benchmark for XLI, which seeks to match its benchmark’s performance and content. Because of the increasing influence of financial technology in the industrial sector, including blockchain and artificial intelligence, businesses will streamline operations, boost efficiency, optimize the management of their supply chains, and make other enhancements.

It is, therefore, possible to bet on the efficiency implications of fintech in other industries by investing in this fund. With a year-to-to-date return of about 17% in 2021, XLI has surpassed its benchmark since 1998.

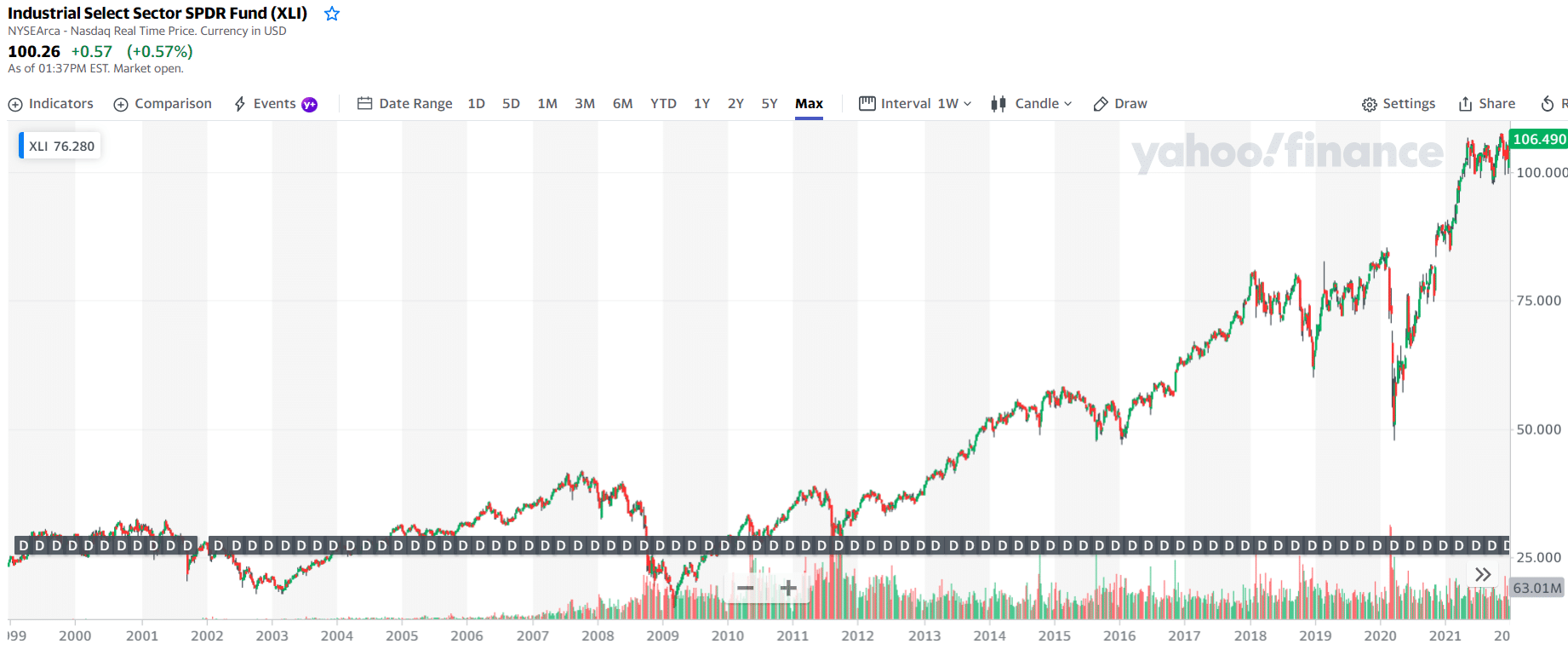

XLI price chart

The first three holdings with their asset percentage are:

- Berkshire Hathaway Inc Class B — 12.83%

- JP Morgan Chase & Co — 11.47%

- Bank Of Americal Corp. — 7.57%

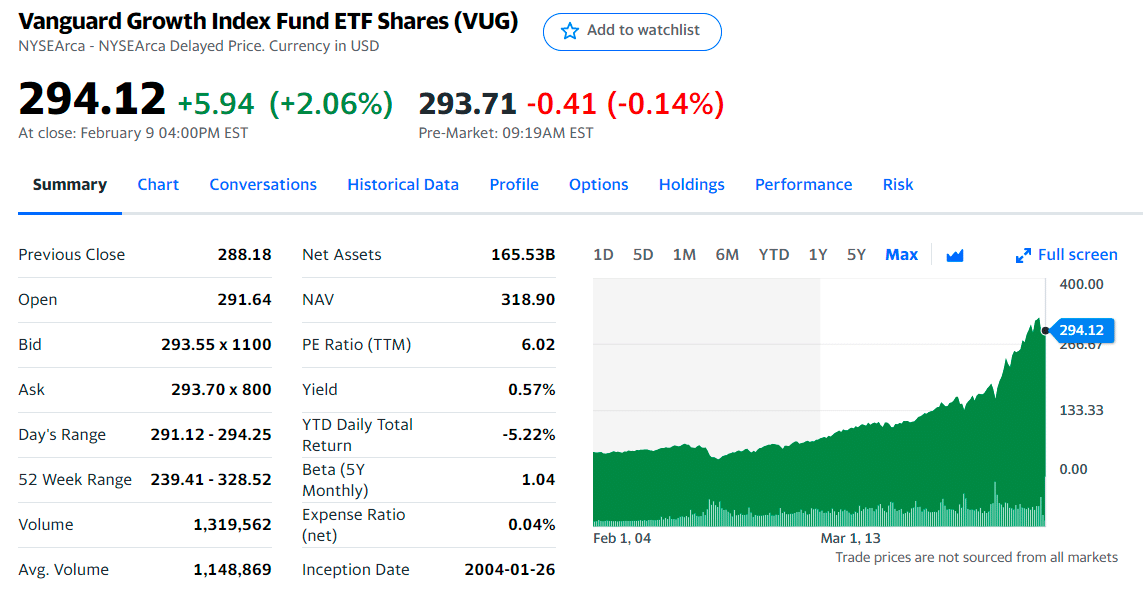

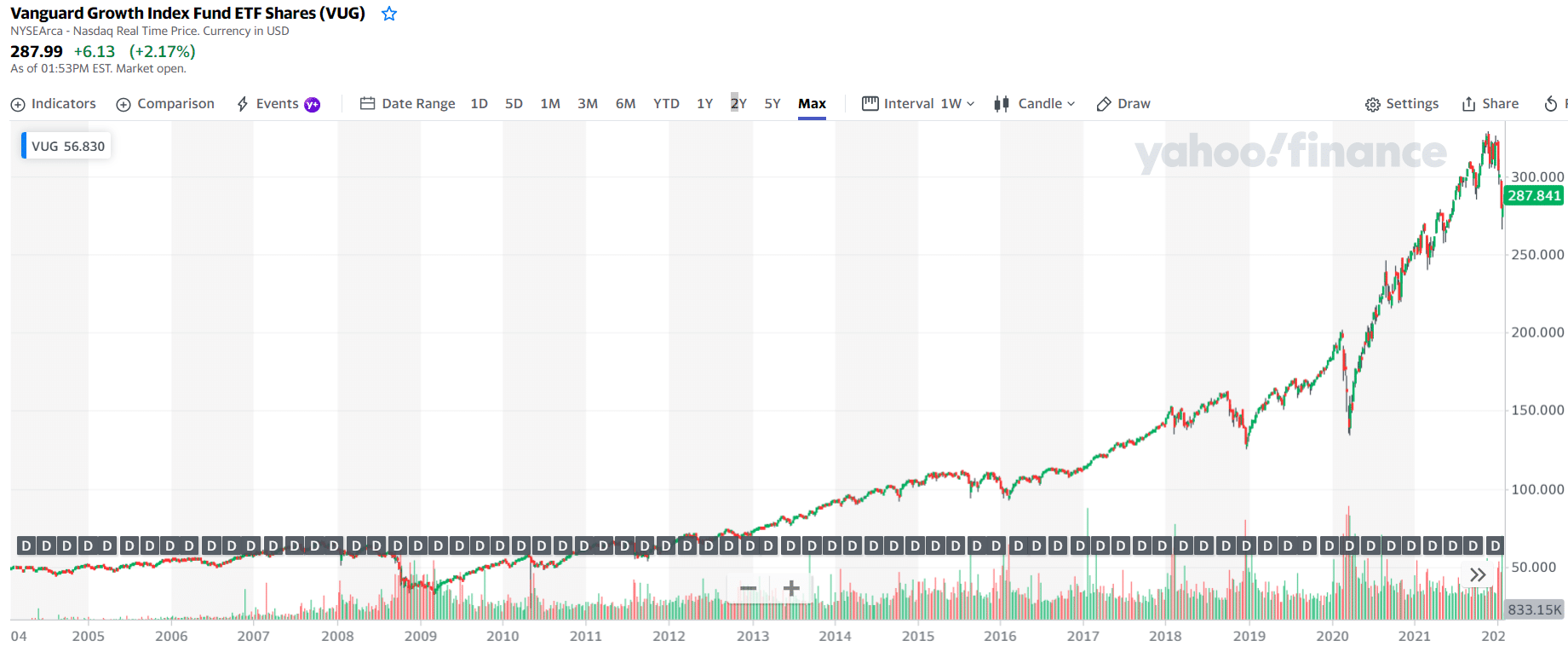

Vanguard Growth ETF (VUG)

Price: $294.12

Market cap: $79.03B

VUG summary

High-growth stocks at affordable prices may be found in VUG. If you’re looking for a way to take a risk on the ripple effect of fintech innovation, this fund may be a good alternative. This growth ETF also has the lowest expense ratio, only 0.04 percent. The fund is suitable for long-term investors who prefer a passive investment approach since it has some of the fastest-growing companies in its portfolio. It also provides some diversification since the fund only invests in technology for 48 percent of its assets, with the rest invested in various stock markets.

VUG price chart

The first three holdings with their asset percentage are:

- Apple Inc. — 10.13%

- Microsoft Corp. — 9.52%

- Amazon.com Inc. — 6.88%

Final thoughts

Stocks of technology companies have grown in value during the outbreak. However, due to the possibility of rising interest rates and inflation, investors may no longer be willing to pay the same premium for these businesses. That’s why the high-growth equities in the information technology sector have been losing ground recently.

Despite this, long-term investors may choose to bet on the revolution that fintech businesses are bringing: money digitization and payment online and non-bank services online and increased credit availability.

Comments