Investors who want to hold onto their money for the long run need to know who is footing the bill for the company’s goods and services. It doesn’t matter how cutting-edge and clever a firm is if its consumers can’t afford to buy its goods. Aerospace and military firms are particularly desirable because of the government’s almost limitless funding as its primary client.

These companies make many different types of aircraft and defense-related gear and equipment. As a timely reminder to investors about the significance of these companies in the broader scheme of national security, the House of Representatives enacted a $768 billion military policy bill in September. As a result, there will be plenty more contracts given to the industry’s top names in the future. Moreover, market instability has given rise to some of these companies, indicating that they will take off when it stabilizes.

To help you diversify your investment portfolio, we’ve compiled a list of five aerospace and defense-related equities. In the next section, we’ll go a little more into these specifics.

What are aerospace and defense stocks?

The industrial sector includes civil and military aerospace and defense equipment, components, and products, including defense electronics and space equipment.

How to buy aerospace and defense stocks?

With a few notable exceptions, aerospace and military equities tend to be well-capitalized and well-known blue-chip corporations. Getting into this field is challenging since it is mission-critical and has a high barrier to entry. As a result, you don’t need to worry about a newcomer hurting your business model. Furthermore, in this competitive industry, you have the option to choose and select your online broker based on your preferences and interests.

Top five aerospace and defense stocks to buy in 2022

Let us walk you through the top five stocks to buy in 2022.

No. 1. Northrop Grumman (NOC)

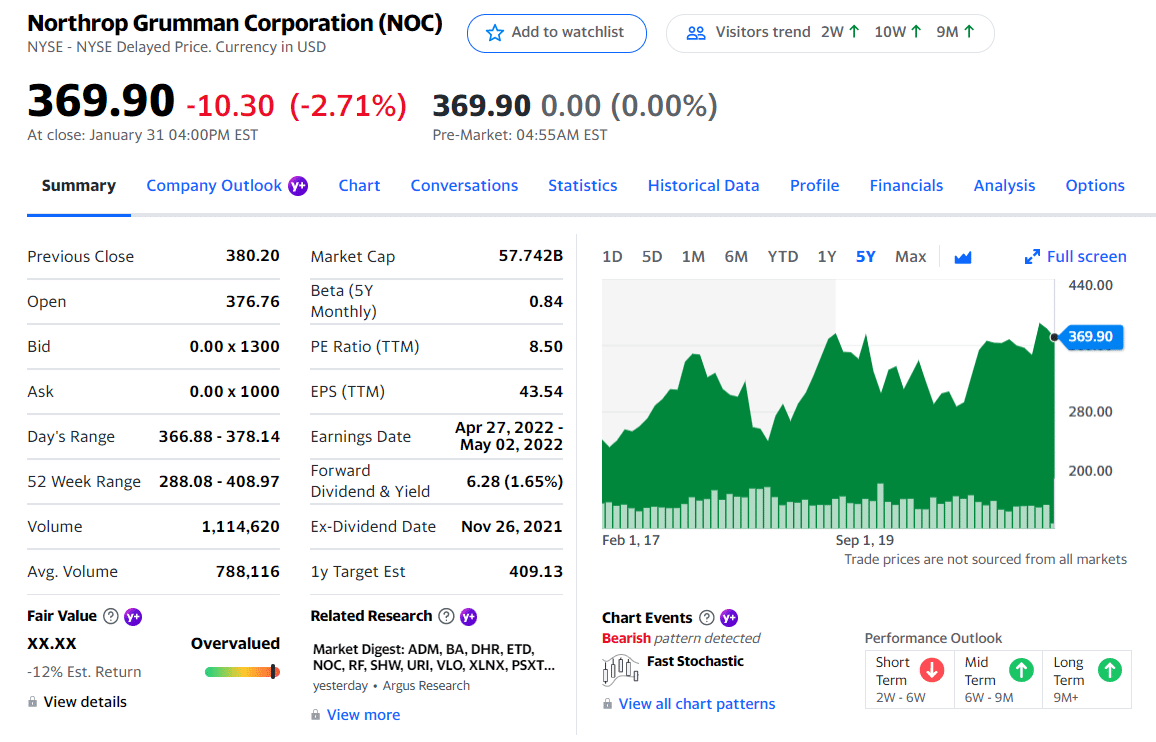

Price: $369.90

Market cap: $59.35B

This is the second-largest military contractor in the United States and one of the best-quality stocks in the aerospace and defense industry, so it should be on your radar for this kind of exposure. Northrop Grumman is an excellent pick because of its several business divisions, including aerospace, military, mission, and space systems.

Future demand for Northrop’s multiple operating industries is likely to be strong. In addition, due to the growing military budget, investors may feel confident in the Pentagon’s ability to award significant contracts.

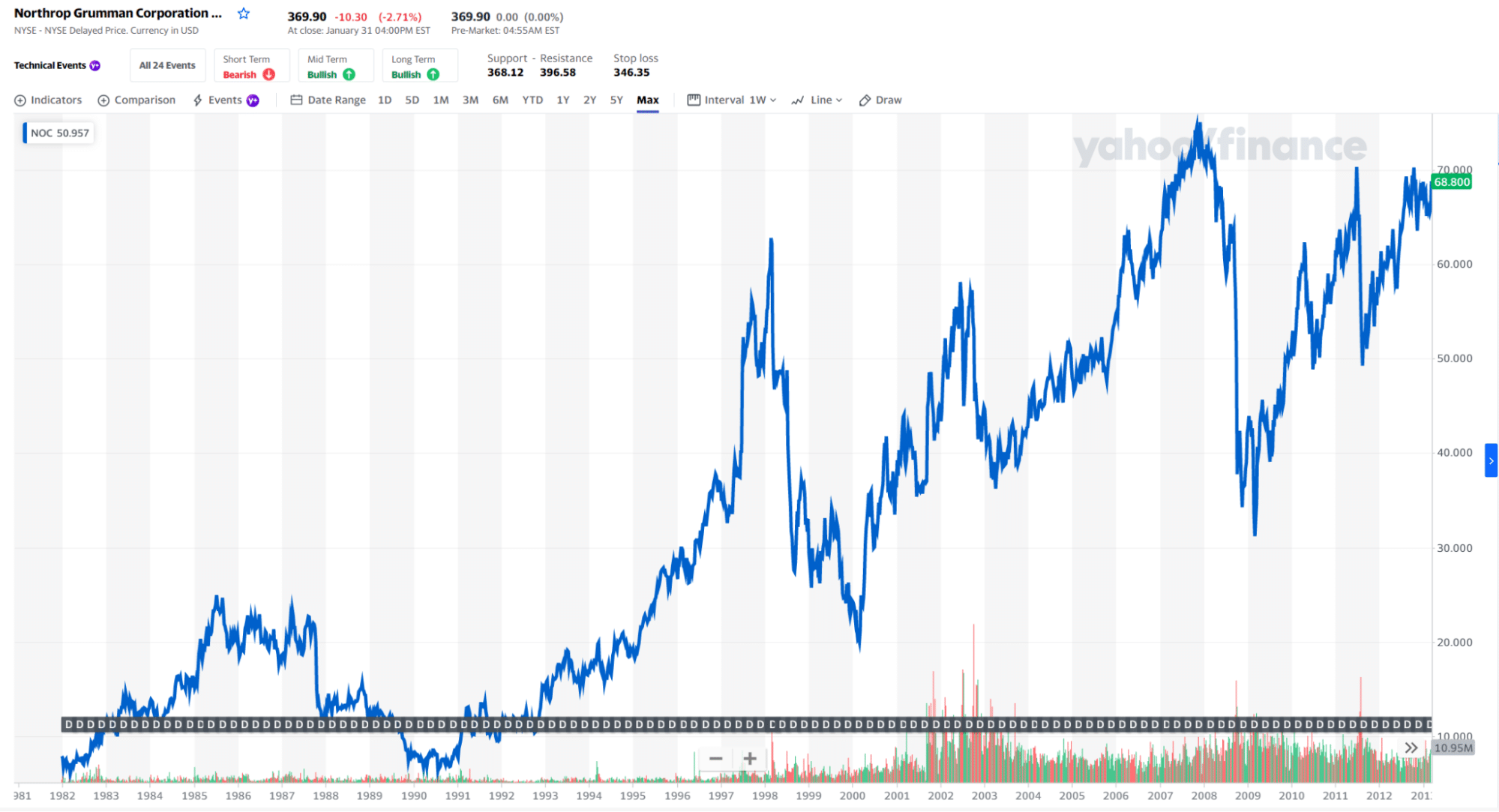

NOC price chart 1983-2013

Another incentive to buy Northrop’s stock is its recent dividend increase of 8% and its Q2 EPS growth of 7%. As a high-tech military contractor, Northrop also has an edge over the competition. There is a lot of potential for expansion, including contracts for Ground-Based Strategic Deterrent and B-21 bomber programs.

NOC stock summary

The first three holdings with their asset percentage are:

- State Street Corporation — 9.53%

- Capital International Investors — 8.55%

- Vanguard Group, Inc. — 7.56%

No. 2. Airbus (EADSF)

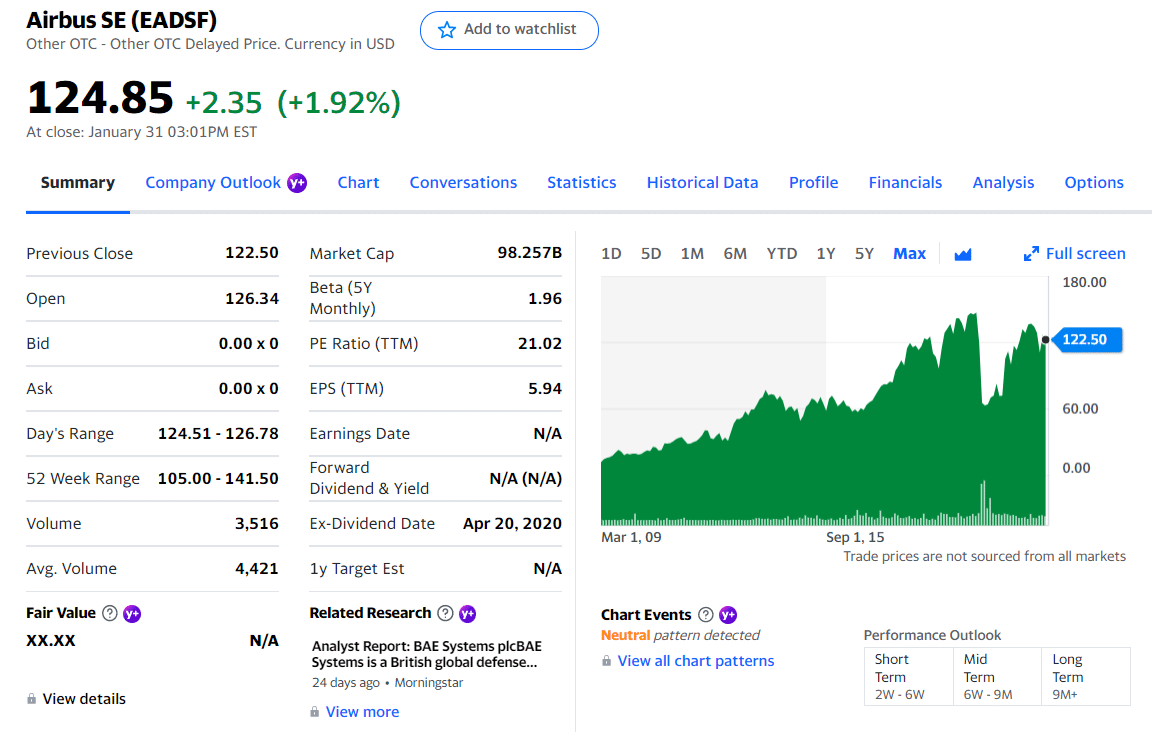

Price: $124.85

Market сap: $97.94B

Airbus is Europe’s most prominent civil aircraft manufacturer and the world’s largest producer of helicopters.

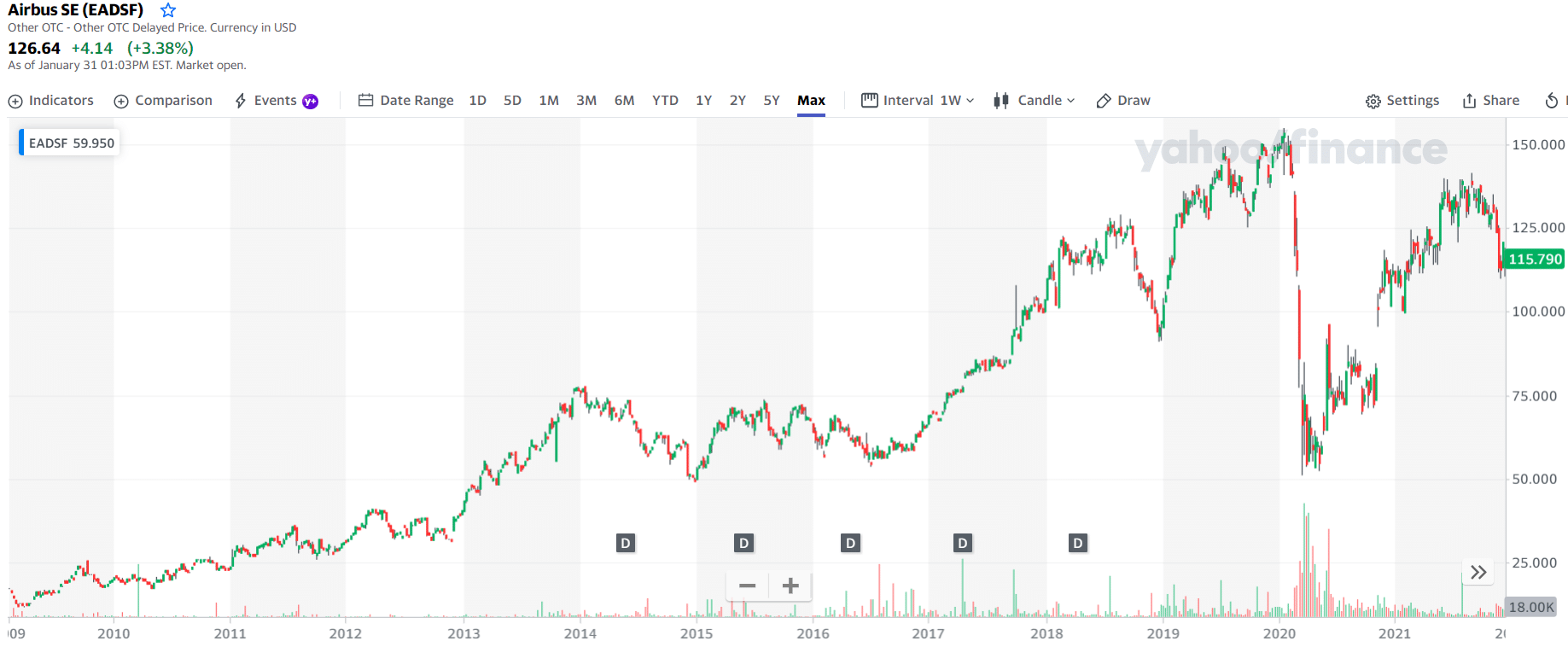

EADSF price chart 2009-2021

There is little doubt that Airbus was established in Holland, but the company’s headquarters and primary production facility are located in Toulouse, France. This stock is traded on six European stock exchanges, and the French government holds around 11% of the company’s equity.

EADSF stock summary

The nine-month period that concluded on September 30, 2021, saw a 17 percent growth in revenue at €35.2 billion, with a net profit of €2.6 billion.

The first three holdings with their asset percentage are:

- American Funds EuroPacific Growth Fund — 2.91%

- American Funds Capital World Growth and Income Fund — 1.09%

- Vanguard Total International Stock — 0.93%

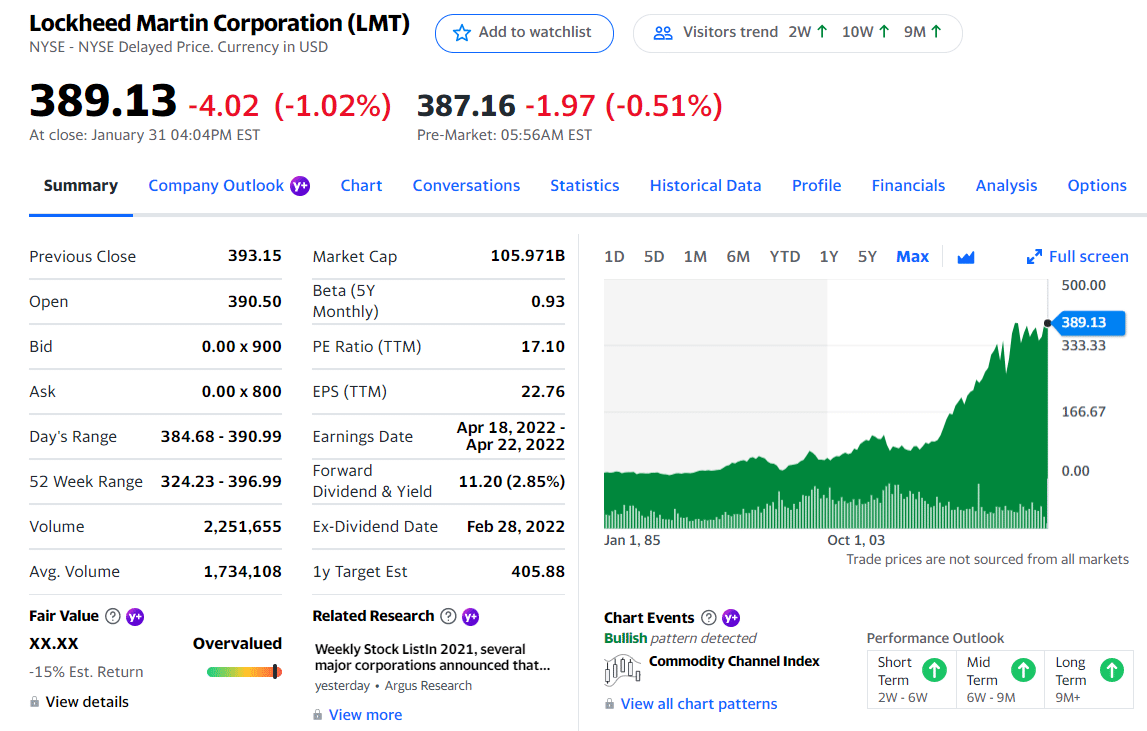

No. 3. Lockheed Martin (LMT)

Price: $389.13

Market сap: $107.07B

As a prominent military contractor, Lockheed Martin (LMT) generates half of its revenue from sales to the US Department of Defense. Net sales for the third quarter of 2021 for Aeronautics, Missiles and Fire Control, Rotary and Missions Systems, and Space divisions were $16 billion.

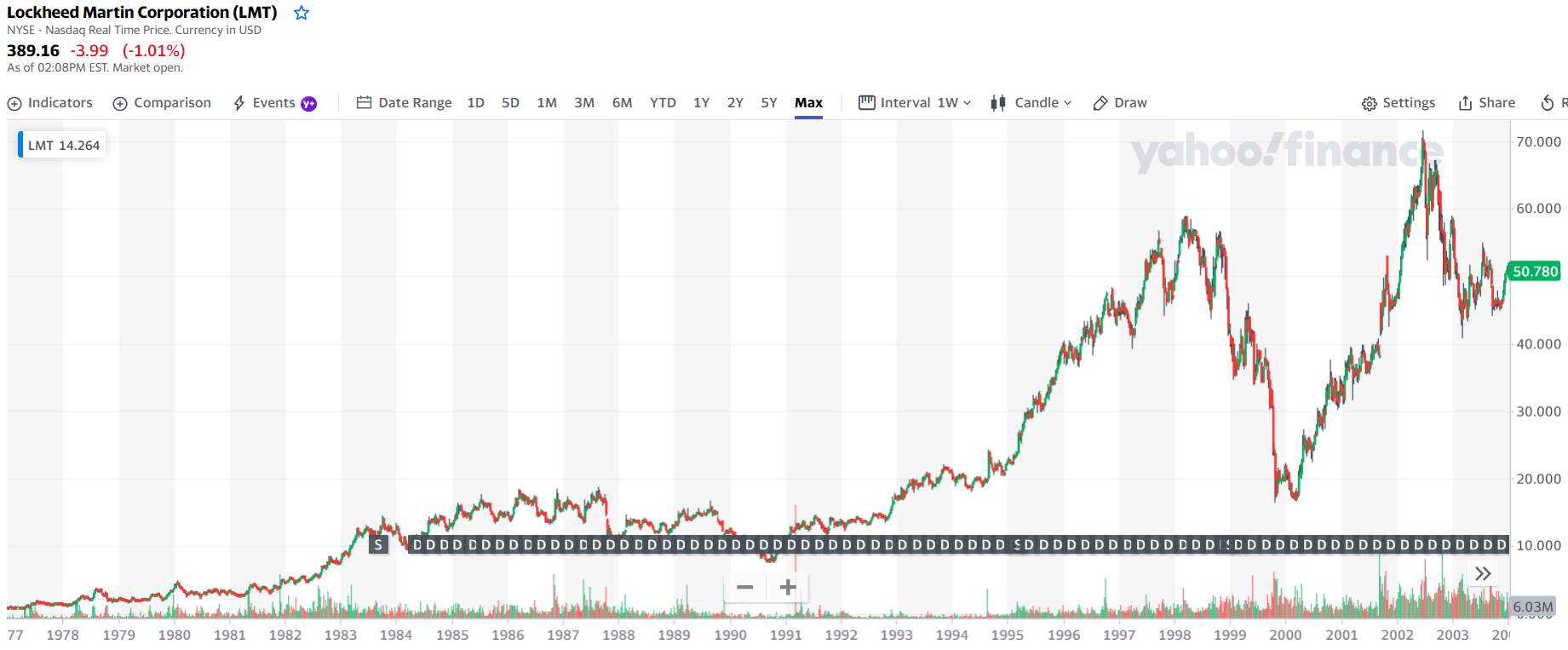

LMT price chart 1978-2004

Markets are always volatile, so bear that in mind. Market capitalizations and stock prices are not stable. Never invest money you can’t afford to lose, and always do your research before you invest.

LMT stock summary

The first three holdings with their asset percentage are:

- State Street Corp. — 15.1%

- Vanguard Group Inc. — 7.9%

- BlackRock Inc. — 6.2%

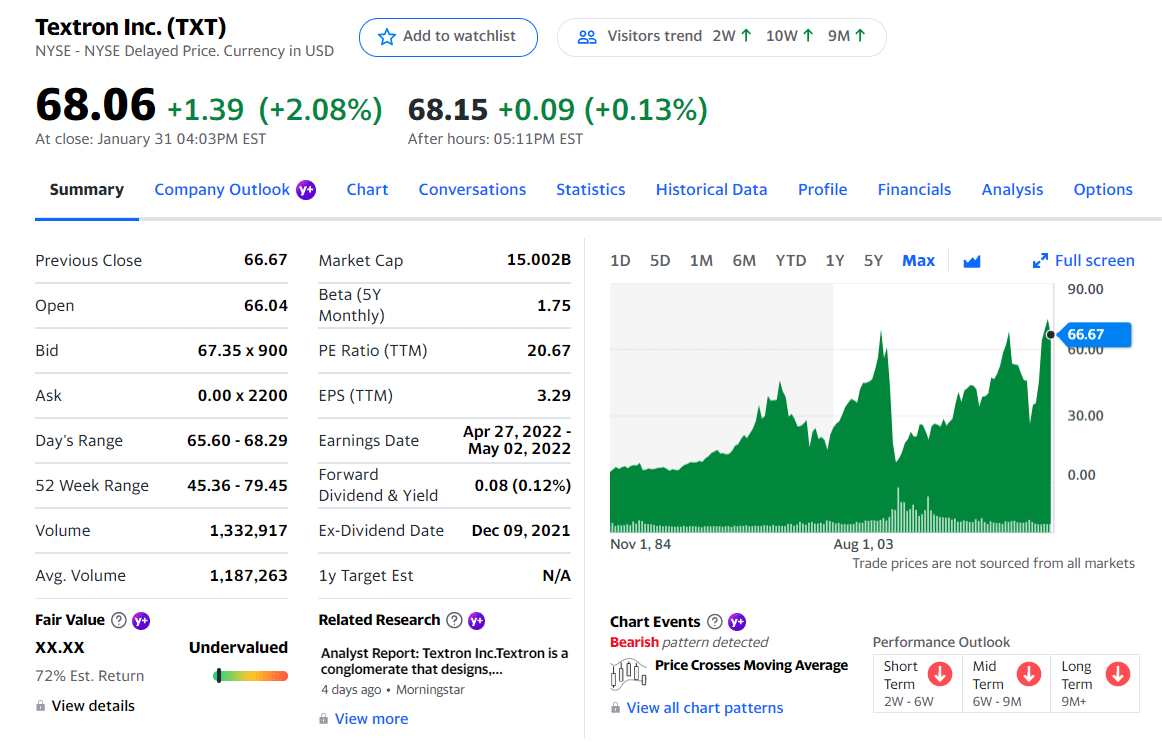

No. 4. Textron (TXT)

Price: $68.06

Market cap: $14.7B

This is another industrial behemoth with a lot of room for growth. Textron Inc. is a conglomerate that operates in the following areas:

- Textron Aviation manufactures light-to-medium-sized aircraft.

- Bell Helicopter.

- Textron systems.

- Industrial products manufacture golf/turf machinery and equipment, wire and cable installation systems, plastic fuel tanks (Kautex), pumps, gears, and gearboxes.

- Commercial lending firm Textron Financial specializes in equipment financing.

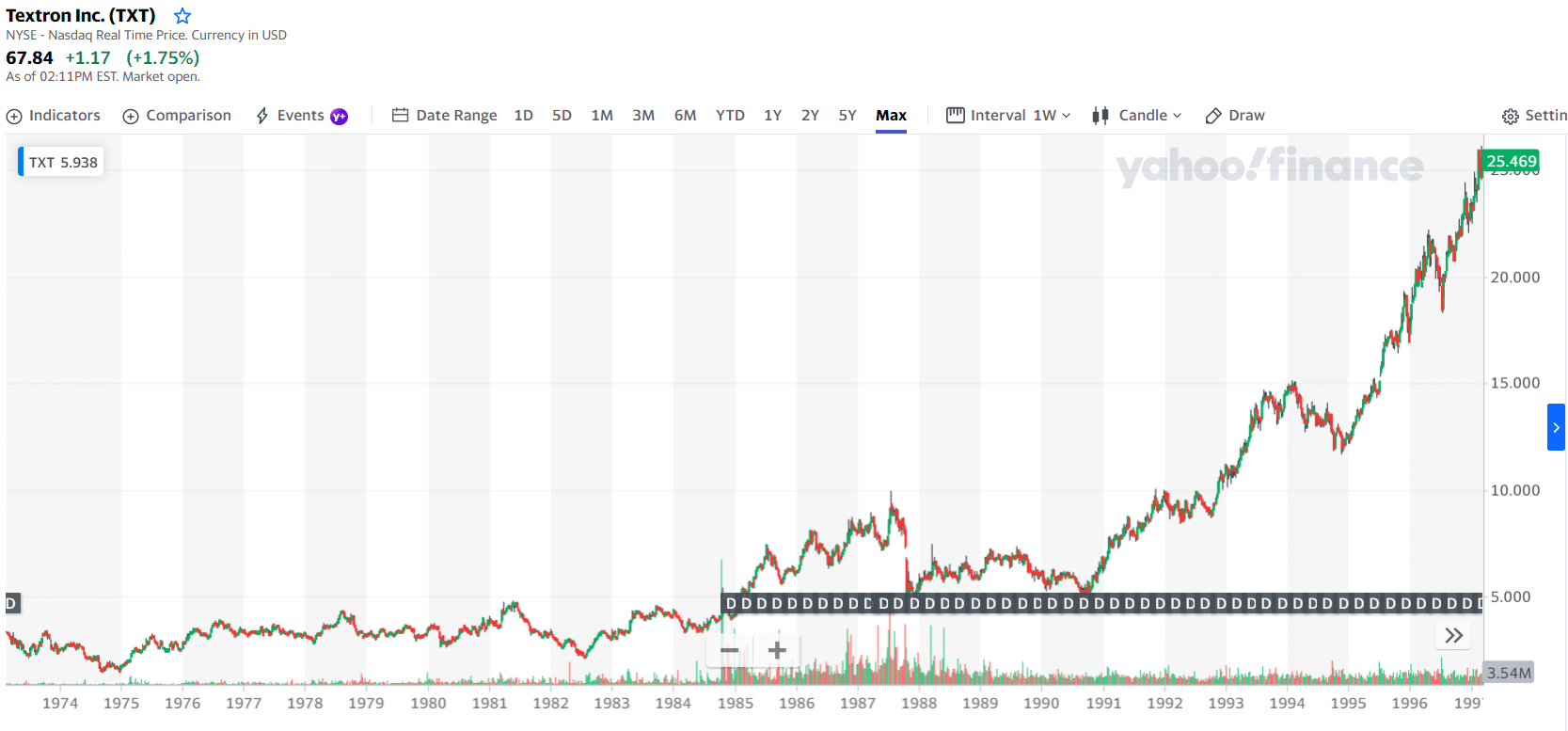

TXT price chart 1974-1997

Experts feel that the company’s robust new product pipeline proves that new items are the best approach to cope with challenging end markets. TXT is well-positioned to profit from more volume and better pricing in a fundamentally more vital business jet end-market, particularly in light/mid-cabin aircraft.

We also see favorable factors in the other firms. We think the company’s share price has a lot of room to grow, mainly because it is now trading at a significant discount to other aerospace companies. In addition, shareholders get a 0.12% dividend. The $91 price forecast from Goldman Sachs is much higher than the $86.00 consensus aim.

TXT stock summary

The first three holdings with their asset percentage are:

- T. Rowe Price Associates, Inc. — 15.36%

- The Vanguard Group, Inc. — 10.35%

- BlackRock Fund Advisors — 5.91%

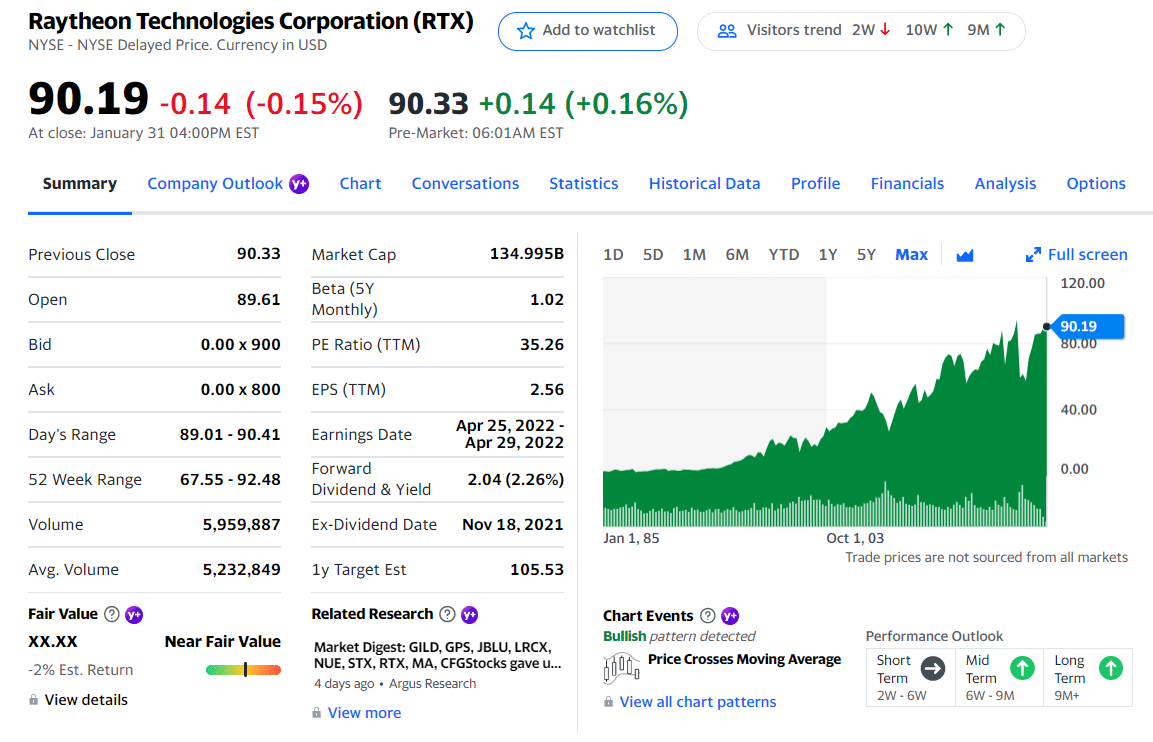

No. 5. Raytheon Technologies (RTX)

Price: $90.19

Market cap: $135.42B

The price of this stock has just increased, making it the best deal in the business right now. Military, government, electronics, space, information technology, and technical services firm Raytheon Technologies Corp. is a subsidiary of Raytheon Company.

More than 80 nations worldwide rely on Raytheon’s electronics, mission systems integration, C5I products, services, sensing, effects, and mission support. United Technologies and Raytheon will merge to form a new aerospace and military conglomerate this year. In a unanimous vote, the boards of directors of the two companies approved the merger, and Raytheon Technologies was chosen as the new company’s name.

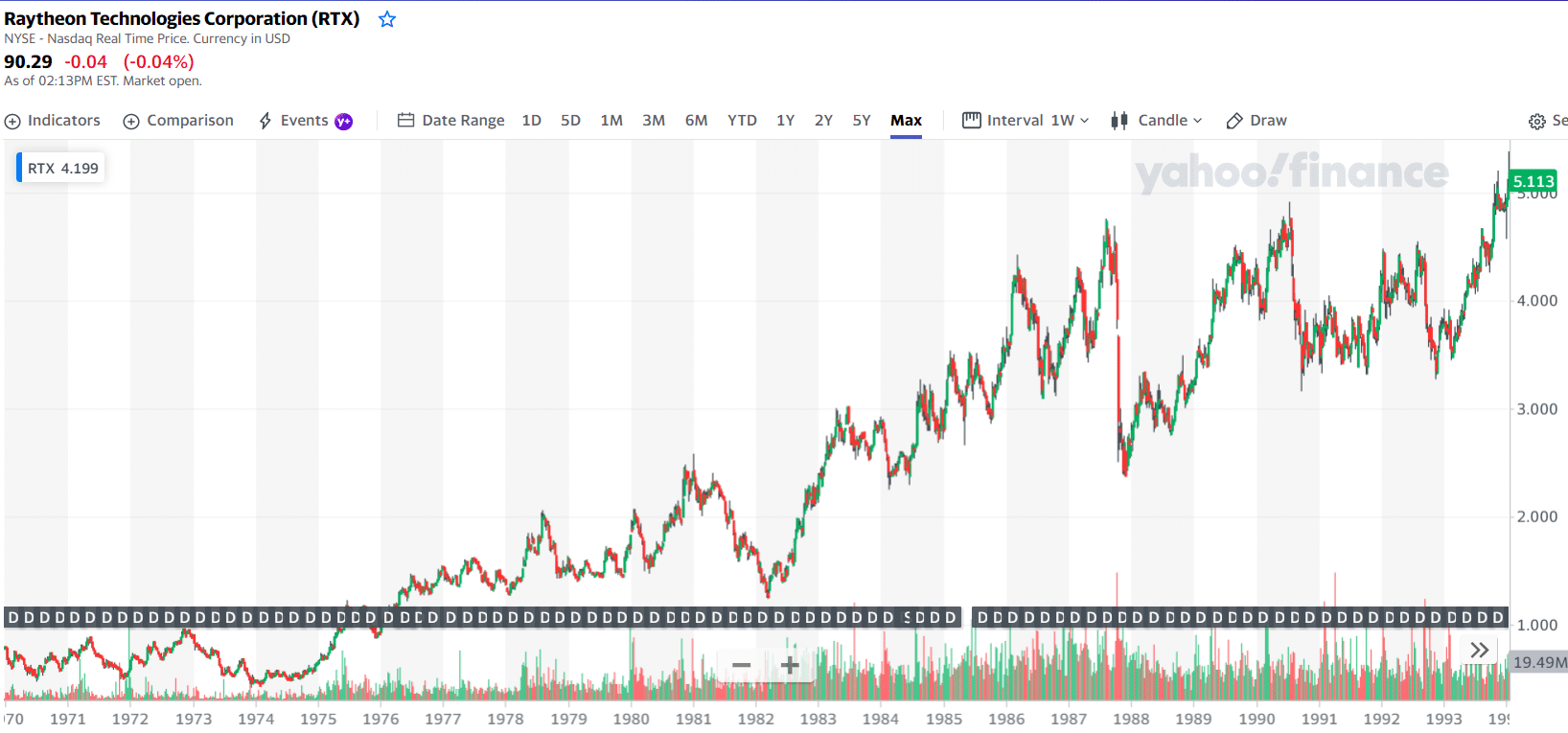

RTX price chart 1970-1994

The Goldman Sachs team remains optimistic and said this in the report:

Normalized over the long term, this high-quality aftermarket and defense firm is still reasonable, and the path to it is becoming more apparent. In 2022, we expect to see further growth in the defense sector, which will lead to an increase in aftermarket and narrow-body OE recovery. Shareholders of Raytheon Technologies are entitled to a dividend-yielding 2.42 percent.

RTX stock summary

The first three holdings with their asset percentage are:

- SSgA Funds Management, Inc. — 9.40%

- The Vanguard Group, Inc. — 7.54%

- BlackRock Fund Advisors — 4.73%

Final thoughts

It’s fascinating to see the contrast between aerospace and military stocks. While military innovations positively affect civilian applications, the other way around is accurate. Since the fundamental components are so potent, the defensive part remains controversial.

Stocks in the aerospace and military industries provide investors the opportunity to make two investments for the price of one. During bull markets, aerospace components are in high demand because of the global nature of tourism.

On the other hand, taking a protective stance may be a viable option for investors during global turmoil. To put it another way, this market is constantly worth watching.

Comments