Bank ETFs offer investors exposure to the banking and financial sector. Bank funds offer a way for investors to share in these profits by investing in a basket of banks and other financial services companies.

What are bank ETFs?

Some of the ETFs that track the banking sector are financial ETFs with varying degrees of exposure to banks, while others are pure-play bank ETFs. Many of these funds focus on the international financial services sector, while others concentrate on banking segments such as major, regional or community banks.

As you look for investment opportunities, you’ll quickly find many banking-focused funds to choose from. Here are five of the top-rated funds focused on investing in bank-related issuers.

How to buy bank ETFs?

Step 1

Open a brokerage account. You’ll need a brokerage account to buy and sell securities like ETFs.

Step 2

Find and compare funds with screening tools. After you open your brokerage account, it’s time to decide what fund to buy.

Step 3

Place the trade. The process for buying/selling funds is very similar to stocks. Below is a list of the best ETFs and a breakdown of what makes these strong investment candidates for market participants.

Top five bank ETFs to buy in 2022

The following five ETFs are among the most popular for bank investors, and they can help you add banking exposure to your investment portfolio.

№ 1. SPDR S&P Bank ETF (KBE)

KBE ETF summary

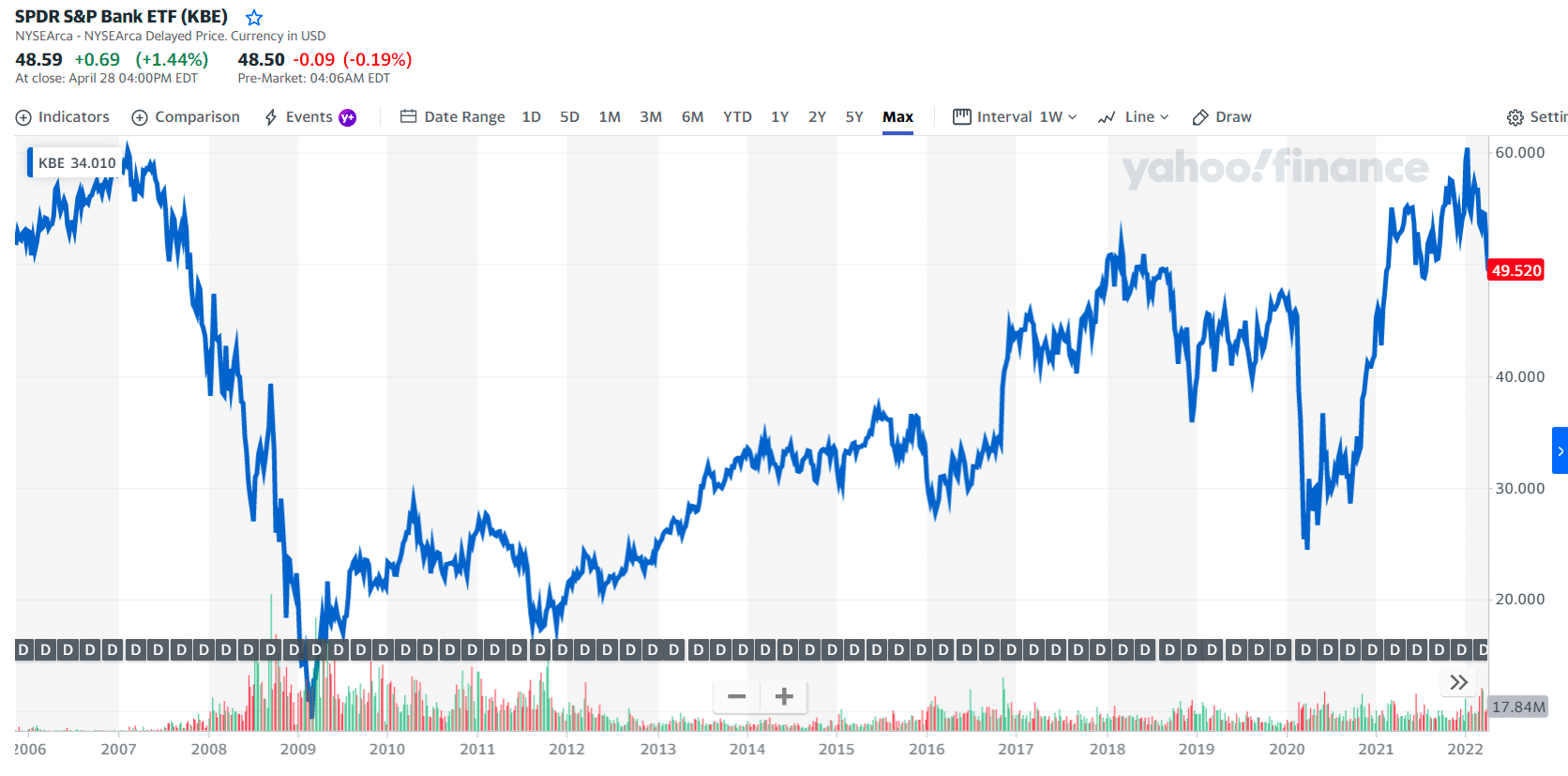

The fund is managed by State Street Advisors, the world’s third-largest asset manager by assets under management. The fund is designed to track the S&P Banks Select Industry Index, which consists of a diversified portfolio of US bank stocks with market caps ranging from small-cap to large-cap.

Over the past year, investors have experienced gains of 67.28%, with 3-year and 5-year returns coming in at 5.63% and 13.44%, respectively. The fund paid a dividend yield of 1.87% in the past 12 months; the forward-looking yield is 2.03%.

KBE price chart

This fund has a strong history of solid performance, with costs below the industry average. Its expense ratio is 0.35%. That’s slightly below the industry average of 0.44%. The lower-than-average expense ratio allows you to retain more of your returns.

The first three holdings with their asset percentage are:

- Silvergate Capital Corp Class A — 1.56%

- Bank of New York Mellon Corp — 1.35%

- PNC Financial Services Group Inc. — 1.34%

№ 2. SPDR S&P Regional Banking ETF (KRE)

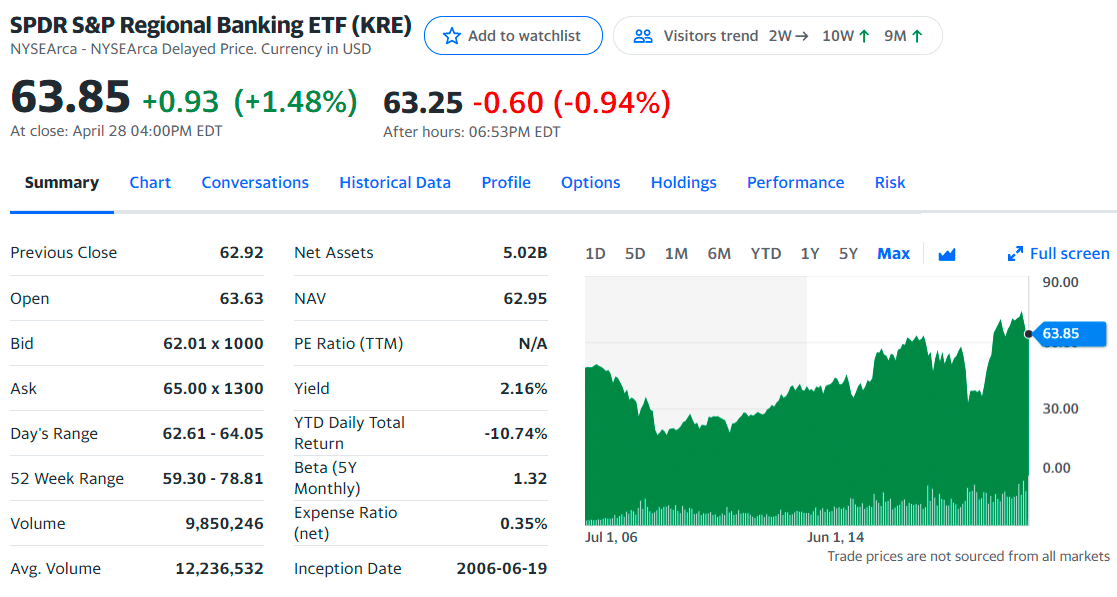

KRE ETF summary

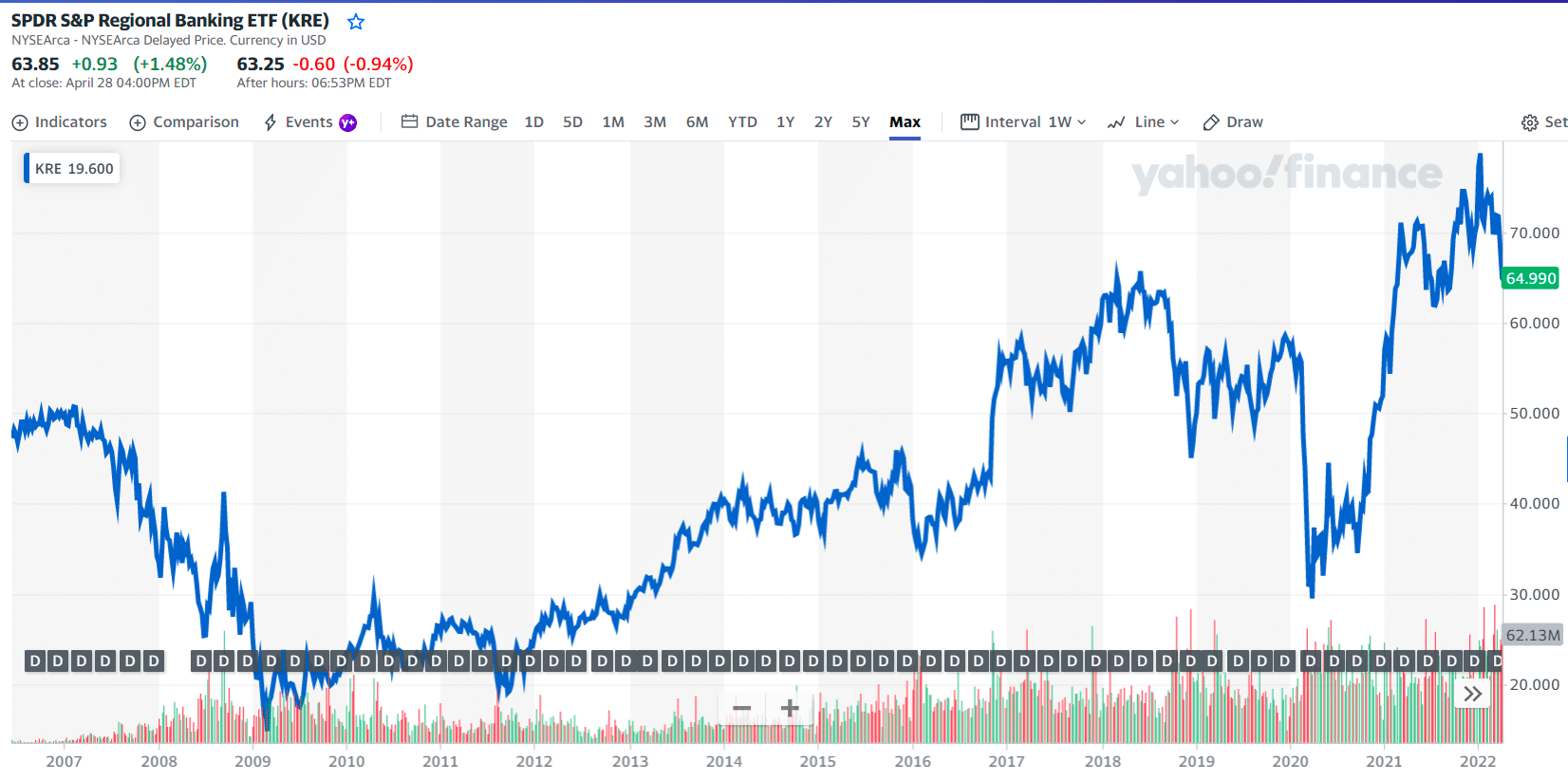

This fund was designed to track the S&P Regional Banks Select Industry Index, an index representing the regional bank’s segment of the US banking industry. As a result of the fund tracking this equal-weighted index, investors gain highly diversified exposure to regional banks in the United States, including small-, mid-, and large-cap regional bank stocks.

Known for generating strong, relatively consistent returns, the fund has led to gains of 67.28% over the past year. Returns have come in at 5.63% and 13.44% in three and five years. Its expense ratio is 0.35%, slightly below the industry average, making it another option that lets you hold onto more of your gains.

KRE price chart

As with most State Street Advisors funds, investors in this fund can look forward to relatively low costs and strong performance, making it another popular option. The fund’s dividend has been overwhelmingly strong, trailing 12-month yields at 2.00%.

The first three holdings with their asset percentage are:

- Silvergate Capital Corp Class A — 1.95%

- PNC Financial Services Group Inc. — 1.68%

- East West Bancorp Inc — 1.65%

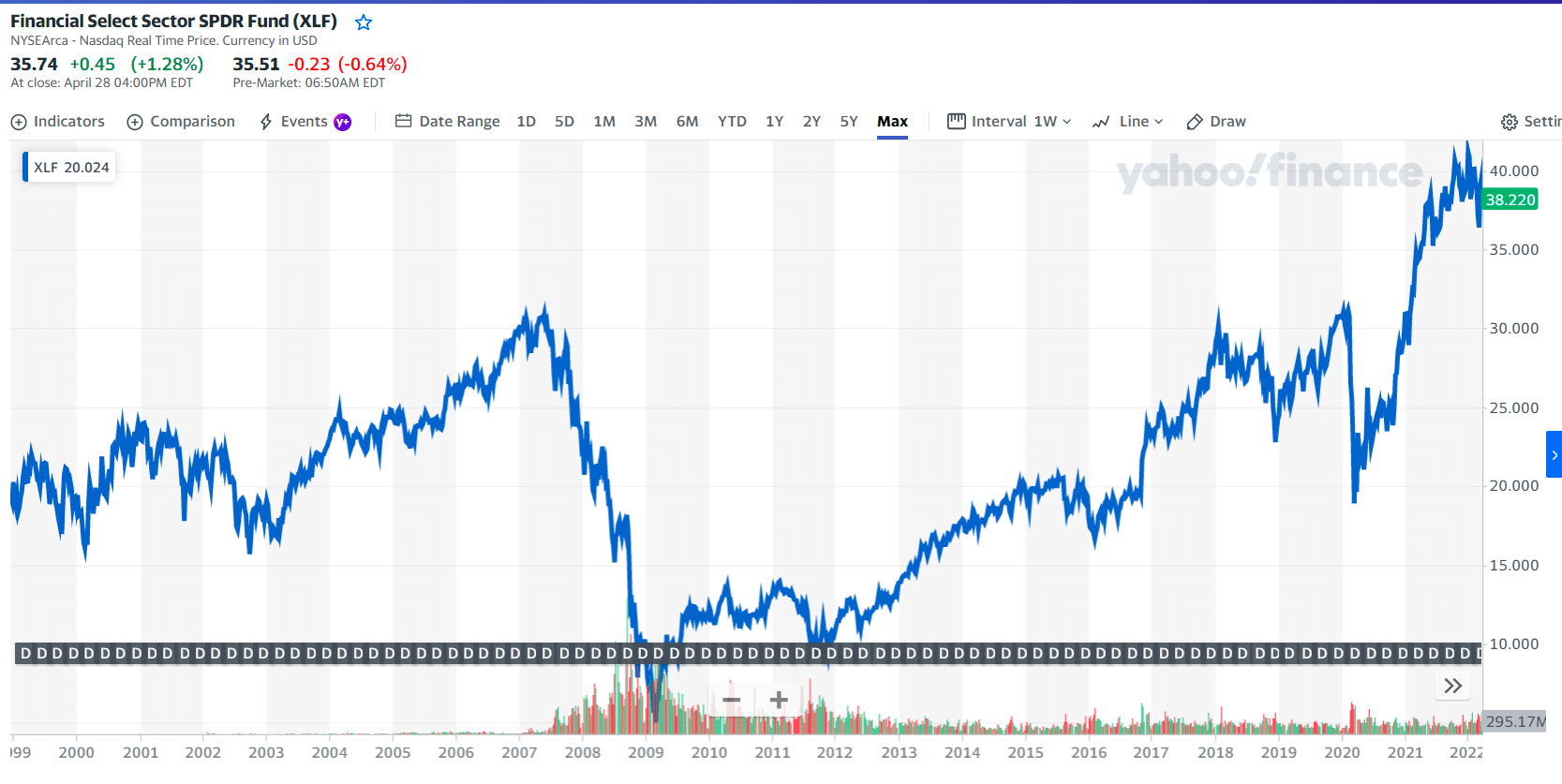

№ 3. Financial Select Sector SPDR Fund (XLF)

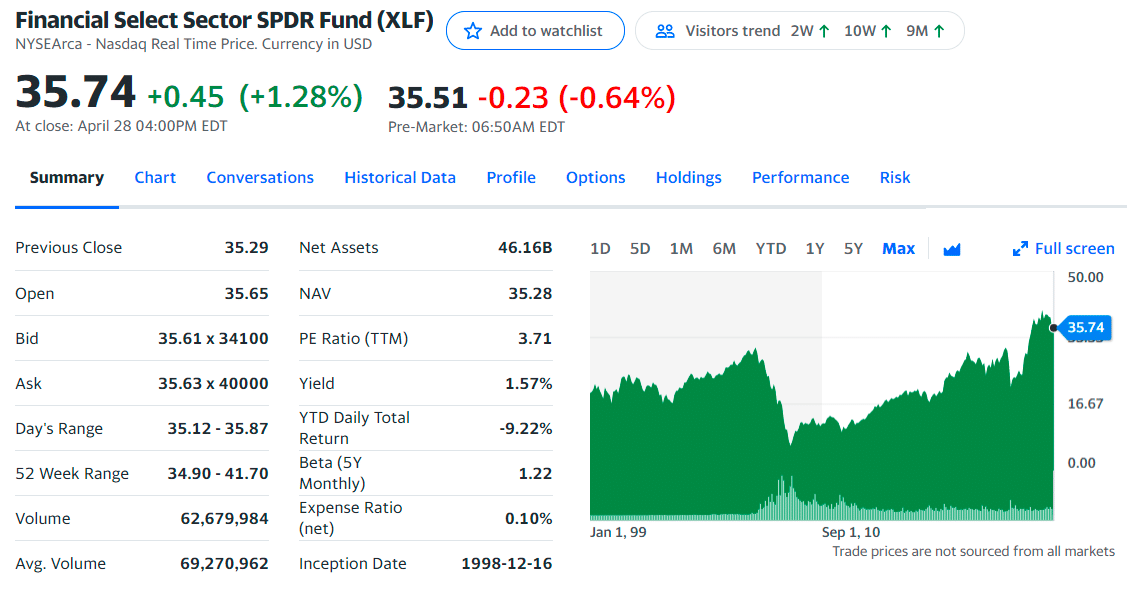

XLF ETF summary

The sector leader in assets under management with a whopping $41 billion, XLF is the go-to financial ETF for investors looking to play the biggest names in the US banking and investment management arena.

The fund is exposed to the major Wall Street firms. And with gains of more than 50% in the last 12 months, it has significantly outperformed the rest of the stock market lately, showing why this sector and this fund are worth a look.

XLF price chart

The first three holdings with their asset percentage are:

- Berkshire Hathaway Inc. — 15.17%

- JPMorgan Chase & Co. — 9.45%

- Bank of America Corp. — 6.88%

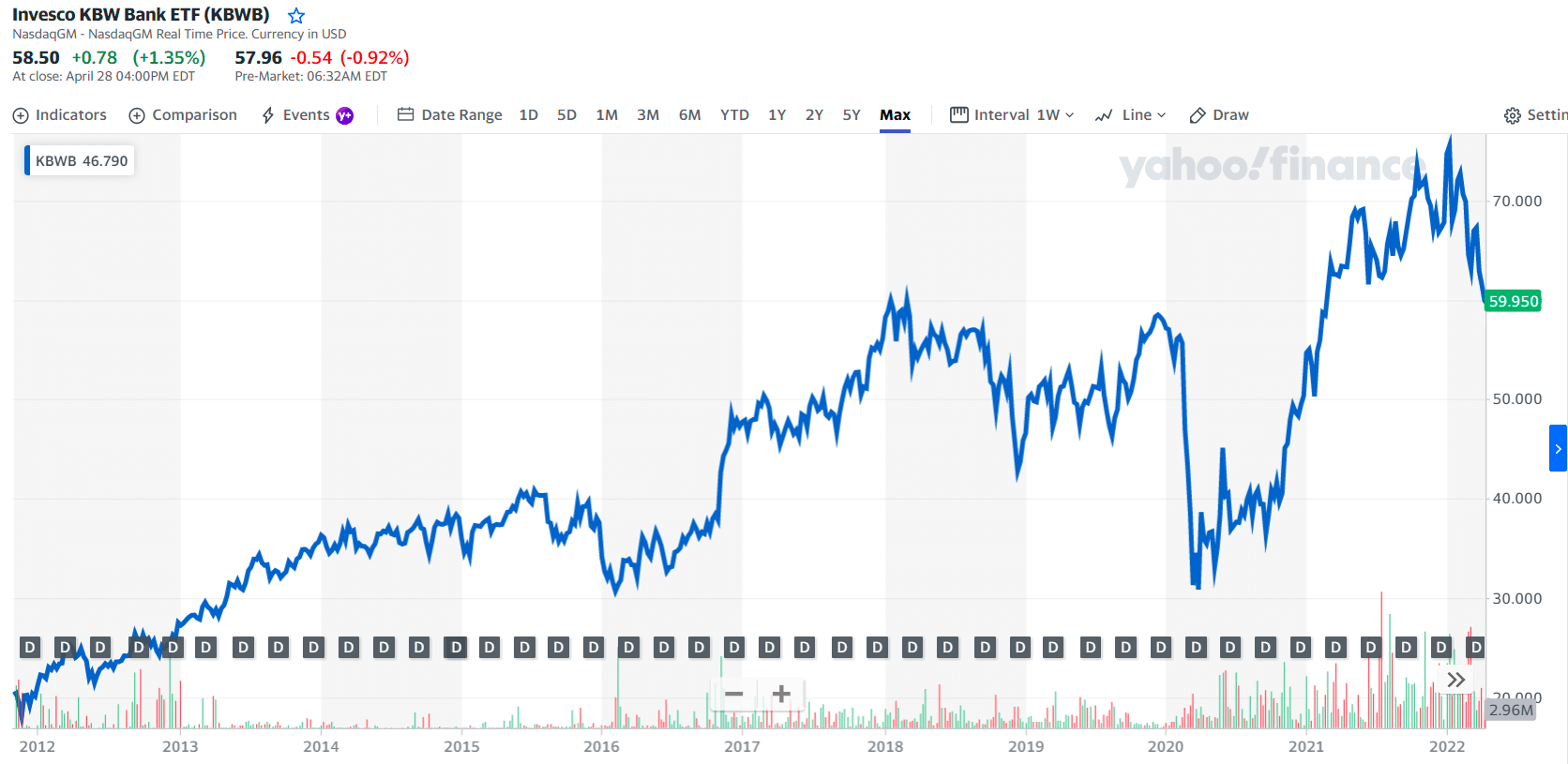

№ 4. Invesco KBW Bank ETF (KBWB)

KBWB ETF summary

Founded in 1935, the fund management firm has a long history of providing quality services to the investing community. It was designed to closely track the KBW Nasdaq Bank Index, including a long list of primarily US banking companies. Because the fund tracks this particular index, investors can

expect highly diversified exposure to the US banking and financial services sector.

Over the past year, investors have realized 72.66% growth, with 3-year and 5-year returns coming in at 9.41% and 16.78%, respectively. The dividend yield on the fund sits at 1.86%, making it another strong income generator and giving you the option to consistently cash in on your investment or reinvest your dividends for more significant long-run returns.

KBWB price chart

It is known for its history of generating compelling returns. Like others on this list, investors enjoy lower-than-average expenses with better-than-average gains. The fund comes with annual costs of 0.35% of your investment, making this another option below the industry average cost.

The first three holdings with their asset percentage are:

- US Bancorp — 8.29%

- JPMorgan Chase & Co. — 8.25%

- Citigroup Inc. — 7.96%

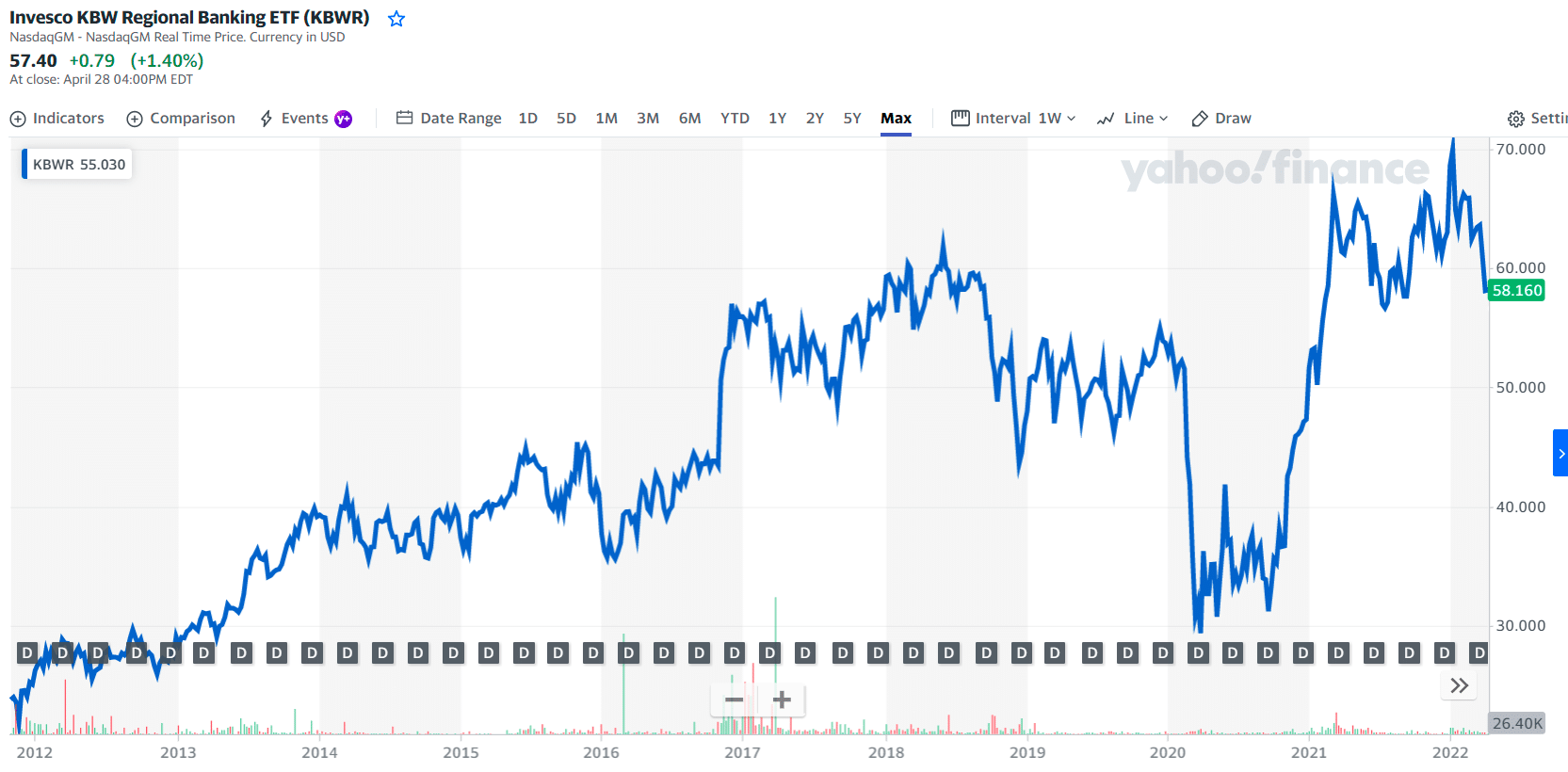

№ 5. Invesco KBW Regional Banking ETF (KBWR)

KBWR chart

The investment seeks to track the investment results of this fund. It generally will invest at least 90% of its total assets in the underlying index securities. The underlying index is a modified-market capitalization-weighted index comprised of companies primarily engaged in US regional banking activities, as determined by the index provider.

The underlying index is designed to track the performance of US regional banking and thrift companies that are publicly traded in the US.

KBWR price chart

The first three holdings with their asset percentage are:

- Commerce Bancshares Inc. — 3.90%

- Cullen/Frost Bankers Inc. — 3.52%

- Synovus Financial Corp. — 3.10%

Final thoughts

These top assets give investors a good range of options for financial investors to choose from. By deciding whether you want the whole sector or just a particular piece of the banking industry, you’ll be able to pick the bank fund that best meets your needs.

Comments