Tax collecting has been part of human history for many centuries and dates back to 3300 BC in Mesopotamia. The Egyptian pharaohs were the first to collect taxes on goods like oil and gold. Just like now, the head of state used taxes to fund their spending habits.

However, tax collecting was a controversial and unwelcome practice back then. Nowadays, taxation is a formalized legal system that is not for the government’s benefit but for the upkeep of a country and its inhabitants.

Most people accept that it is a legal obligation, and due to this, they are not aware that they might be paying too many taxes. In addition to monthly contributions, no one wants surprises at the end of the tax year learning that they owe the government more money. Therefore, we have put together ten pro tips to help you cut down on taxes while still complying with the law.

Overview of taxes

Taxes are mandatory levies that the government collects from individuals. Taxes are payable on what you earn, what you own, and what you buy — the government uses taxes to fund services like education, health, defense, and infrastructure like roads.

However controversial it might be, taxes are essential for the government to execute these services.

Types of taxes

As we mentioned, there are three types of tax levies, and we will cover an example in each category. Let’s go over the different types in detail.

Tax on what you earn

This type of tax is payable on your salary, wages, and earnings from investments or any other form of household income. The tax also increases as your income increases. Usually, there is a tax bracket that your earnings fall in, and you have to pay your tax accordingly.

Therefore, if you earn a large salary or if your returns on investments are significant, your tax portion will be high as well. In addition, a single person pays more taxes than a married couple with or without dependents. The law favors people with a joint income vs. a single person.

Taxes on what you buy

Manufactured goods are liable for tax as their value increases along the supply chain, and this tax is known as value-added tax or VAT. This type of tax has been very controversial, and some view it as a way for governments to raise revenue. Over 160 countries enforce the value-added tax law.

Taxes on what you own

Property taxes are payable on buildings and land. The US government relies heavily on these taxes as it makes up over 30% of total state and local tax collections. The provincial government uses this revenue to build schools, infrastructure, fire and police departments, and health services.

How to cut down on your tax bill

We have explained the types of taxes that you could be liable to pay, and although taxation is mandatory by law, there are legal ways to reduce taxes by following our pro tips in this segment.

-

Boost your 401k plan

If you pay tax on your income, you can have your retirement plan deducted from your salary. This way, you have less taxable income, and you invest in your retirement simultaneously. If you already have this scenario, you can increase your monthly contributions, giving you a little tax break.

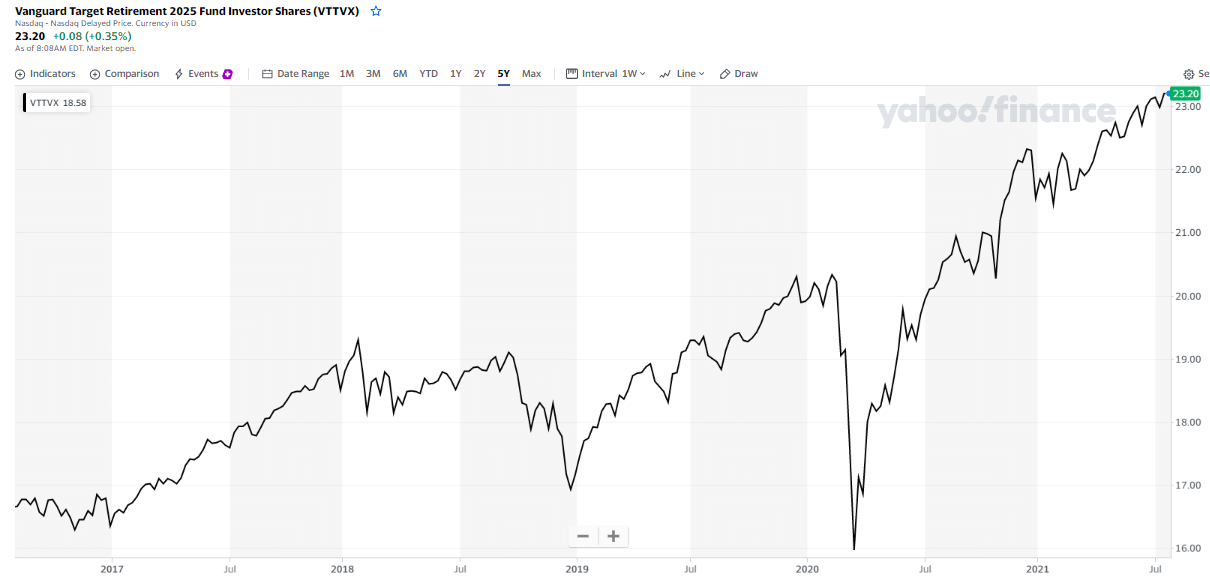

An example of a retirement plan is the Vanguard Target Retirement 2025 Fund.

Vanguard Target Retirement 2025 Fund Investor Shares chart

The Vanguard Target Retirement 2025 Fund gives investors automatic portfolio rebalancing to suit their risk appetite, depending on their income and how close they are to their retirement age.

-

Claim for medical expenses

You can claim tax refunds from medical expenses accrued during the year. You need to keep all receipts and submit them once you file your taxes. You can claim back medical expenses in the USA, which are more than 7.5% of your gross income.

-

Sell off poor investments

Investments like stocks, for example, generate taxable returns. These are known as capital gains taxes. If you hold onto assets that are not yielding good returns, you can sell them off since you would be liable to pay capital gains taxes on them anyway. You are, therefore, better off removing those from your portfolio and saving on taxes instead.

-

Invest in a tax-free fund

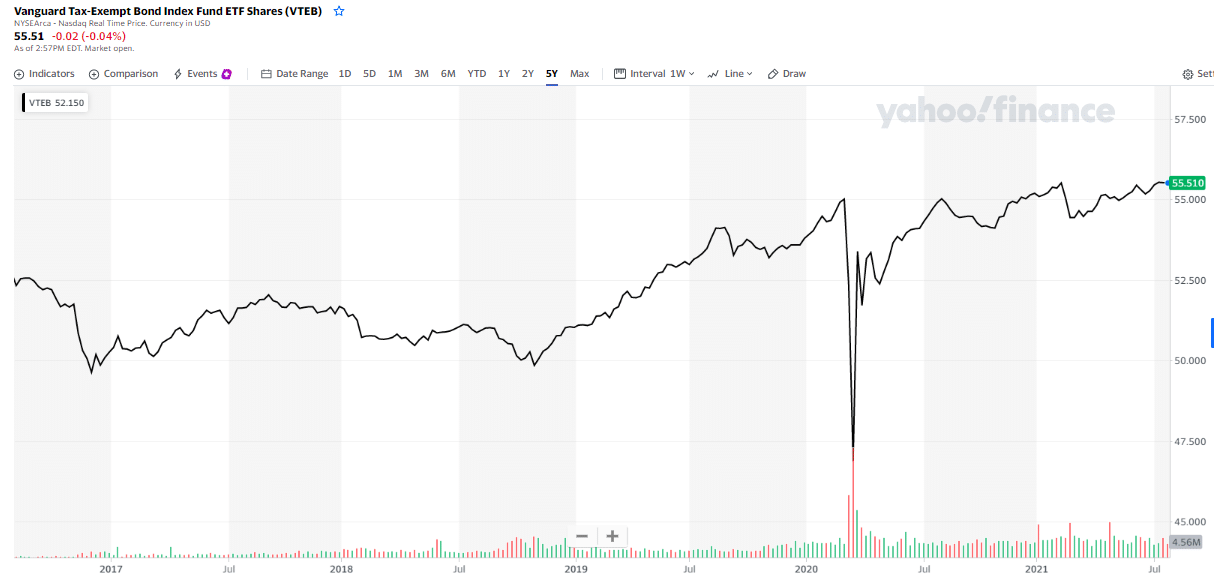

An excellent way to save on taxes is by purchasing a tax-free investment. The gains you earn on these investments are not taxed. And you can enjoy the benefits without having to pay taxes. An example of this is the Vanguard Tax-Exempt Bond Index Fund ETF Shares (VTEB).

Vanguard Tax-Exempt Bond Index Fund ETF shares chart

The Vanguard Tax-Exempt Bond Index Fund tracks the S&P’s National AMT-Free Municipal Bond Index. This includes bond issuers which are state and local government entities and are exempt from US income taxes.

-

Give to charity

If you donate to charities in the form of cash, household items, or expenses accrued while volunteering, you can reduce your tax bill. However, the organization should be qualified as a non-profit for you to claim tax relief for the donations.

-

Maximize business expenses

To reduce taxes, you can maximize your business expenses, such as office rentals, inventory, vehicles, equipment, etc. Vehicles, machinery, and office equipment depreciate in value. The taxes on these assets can be written off from the first year of purchase.

-

Start a college fund

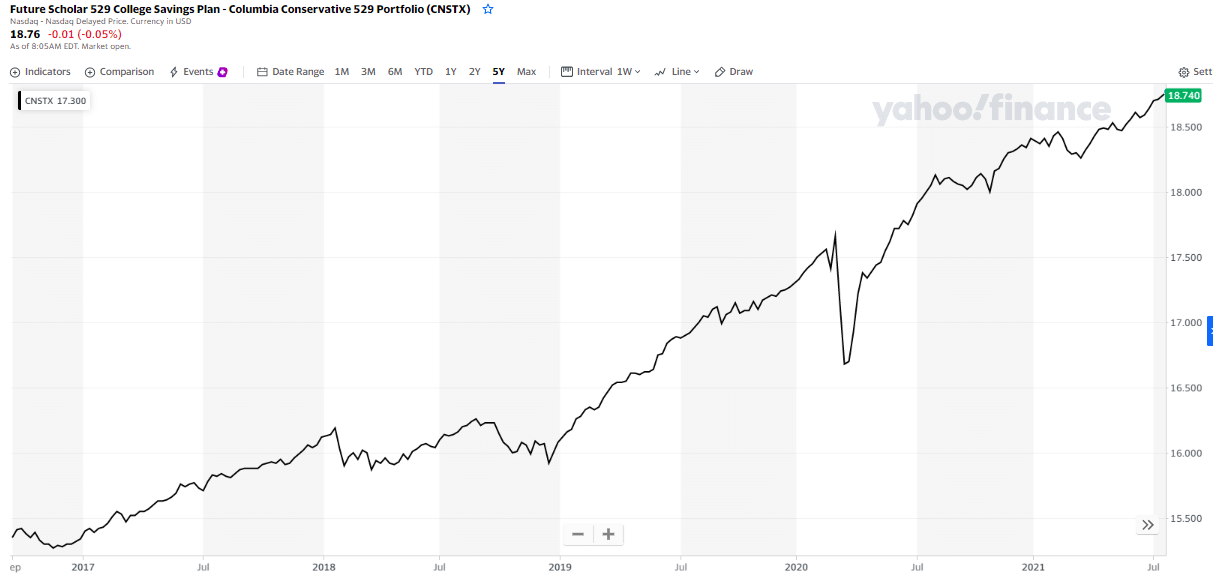

Saving for a college fund will give you a tax benefit. The contributions and earnings are not taxable, but there are certain limitations. In addition, you have to use the money for the educational expenses of the beneficiary. The US government has created 529 plans which are tax-free savings plans to encourage individuals to save for future educational costs.

Future Scholar 529 College savings plan chart

The Future Scholar 529 College savings plan is an example of a college fund available in the USA. This particular fund has an investment limit of $426000, and the earnings are tax-free.

-

Claim against self-employed health insurance

As a self-employed individual, you can claim tax on the health insurance you pay for yourself and your dependents. The higher premium will reduce your taxable income, and therefore the tax deducted will be less.

-

Add health insurance to your salary

You can contribute to your health insurance by having it deducted from your monthly salary. As in the case of the retirement plan, this will reduce your tax-deductible income, resulting in fewer tax deductions.

-

Avoid early withdrawals from your 401k plan

Withdrawals made before your retirement age will result in you having to pay taxes on your retirement plan. In addition, you will be liable for a tax penalty of up to 10% tax if you withdraw earlier.

Final thoughts

Paying taxes is an obligation, but it doesn’t mean you cannot reduce your deductions. As you have read, there are many ways to reduce your contributions, and it’s up to you to determine which is best for your budget and needs.

In addition, some of these tips like investing in retirement and college funds, although the long term, are benefiting you and reducing your taxes at the same time.

Comments