Technological advancements over the last few decades have made the lives of many people more comfortable. The use of applications that are accessible via smartphones is a welcome feature.

Even more convenient is having a money-saving app that you can access on your phone at any time. Money management apps are popular, and their technology has a secure infrastructure. These apps also automate your transactions. Therefore, you don’t have to update transactions manually.

As someone who strictly manages their budget, wouldn’t you like to know more about these apps?

Read further to discover more about YNAB, which has been around for a while and offers more than just a budgeting tool.

What is worth knowing before starting to use YNAB?

- YNAB prompts users to budget proactively.

- The app can link your bank and credit card accounts to one central interface.

- The YNAB has a monthly subscription of $11.99.

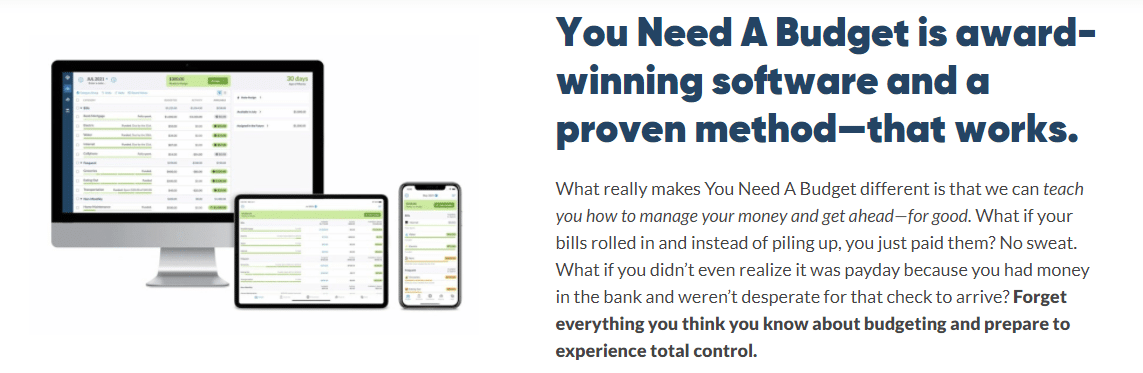

What is the YNAB saving app?

It is an acronym for You Need a Budget, and it is a software application designed to help individuals budget. However, this app is different in that you have to forecast how you will be spending each dollar that you earn. The application launched in September 2004, and the creators had four rules on which they built it:

- They decided how they would spend their money before spending it.

- They broke up more considerable expenses into manageable monthly bills.

- They changed their budget as required.

- They only spent money that was thirty days old.

The app also links your bank accounts to allow you to track your expenditures.

YNAB security

The app uses strict and robust security measures to protect users’ accounts. It uses the same security encryption as banks, and it also allows two-step verification. YNAB suggests strong passwords which are extremely hard to crack, and they require passwords to be eight characters long. Furthermore, they also prevent users from using the top 2,085 most common passwords.

In the event of users deactivating or deleting their accounts, YNAB would erase your data from their database. In terms of data retention, data is retained for a specific period after your account expires. Removal of accounts occurs 120 days after the trial period expires and three years after an expired subscription.

Heroku technology forms the basis for YNAB’s security infrastructure. The Amazon Web Services technology uses Heroku, the same used by government agencies, like the CIA.

YNAB pricing

To join YNAB, you have to pay a subscription of $11.99 per month. However, once you sign up, you can start with a 34-day free trial. Once the trial expires, you can opt to pay the monthly subscription or cancel it altogether. YNAB does not reserve any fees once you activate the trial.

You can also opt for the annual fee, which is $84, and therefore a saving of almost $60 versus the monthly subscription.

The paid subscription allows you to link your accounts and thereby import your transactions into the budgeting tool. You can view your reports and customize accounts and categories as per your spending criteria.

YNAB features

As we mentioned, YNAB’s key feature is linking your YNAB account to your bank accounts. You can link to US bank accounts like American Express, Chase, Wells Fargo, Bank of America, USAA, and many others.

The available money shows on the app’s dashboard once you have linked your bank accounts. The budgeting tool will have default categories that you can edit as you see fit. And it will also indicate what money is unallocated to a category.

Since you have linked your bank accounts, YNAB automatically imports the transactions and updates your budget. However, you can also add transactions manually directly in the app.

Another excellent feature of YNAB is that if you manually enter a transaction and it imports the same data from your bank account, the app will prompt you to delete one of the transactions.

The app also has a cash spending feature, whereby you create a category for cash spending to track your cash flow.

YNAB ratings

YNAB reviews have features on Forbes.com and CNBC.com. Furthermore, YNAB received over 42,500 ratings on the App Store and Google Play. In addition, Forbes listed YNAB on their Best Budgeting Apps for 2021. YNAB’s users also rated the app highly on their website.

The latest ratings from the App Store and Google Play:

- Rating in App Store at time of writing: 4.8 out of 5 (over 29,000 ratings).

- Rating on Google Play at time of writing: 4.1 out of 5 (over 6,800 ratings).

YNAB advantages

This app can be beneficial if one considers the following advantages:

- It encourages users to be proactive about their budget by forecasting what they plan to spend.

- You can link to savings accounts and credit cards.

- YNAB uses excellent security encryption technology and protocols.

- The app is both iOS and Android compatible.

- Students receive a 12-month free subscription.

YNAB alternatives

Just like YNAB, other similar apps offer the same service in terms of money management. We have listed a few here:

-

Albert app

The launch of the Albert app was in 2015. The app automates your budget by helping you bank, save, and invest. The app allows you to invest in stocks directly on their platform, and they charge zero commission on trades. You can also earn cash rewards by using the Albert debit card.

-

Money dashboard

Its features are free to use; the app does not charge any additional fees. Besides, it allows users to link bank accounts and track their budget and expenditure by automatically updating transactions.

-

Moneydance app

It helps you to create your budget, pay your bills, and manage investments. The app allows 100 transactions for free, after which you can pay $49 once off. It is both iOS and Android compatible.

Is the YNAB app worth using?

When it comes to automatic updates and linking bank accounts, there is always a concern that the applications might not work correctly. The YNAB app received rave reviews and ratings from users and prominent online publishers.

However, there have been issues regarding the ease of use, and customers have complained that the app takes longer to set up than others. Furthermore, the fees are a bit steep compared to similar apps, which offer the same features completely free of charge.

The app has been in existence since 2004. Therefore YNAB must be doing something right to grow its clientele. We can conclude that the application does work well even though it might have some glitches, which is typical for this type of technology.

Final thoughts

Personal finance apps are more popular now since many individuals see the value of budgeting correctly. Most of us would like to save extra money where we can, and the YNAB app is perfect for those who follow a strict budget.

The app has excellent security features, which distinguishes it from many similar applications. The top ratings it has received thus far are evidence that YNAB is here to stay for a long while.

Comments