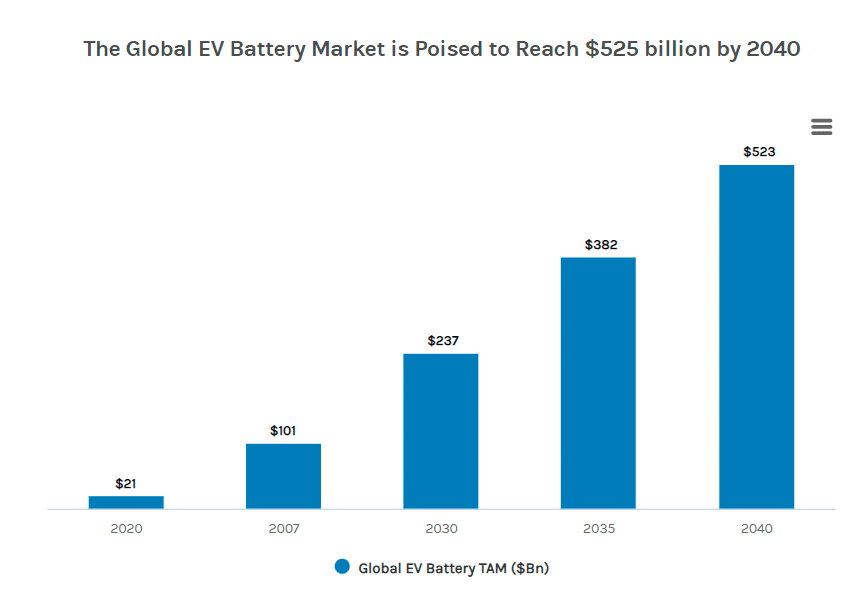

The future of electric batteries (EV) is looking promising. But there is one area many people have overlooked EV battery stocks. Now is an excellent time to invest in the field in an environment where electric vehicles are overgrowing.

GM plans to sell one million EVs by 2025, while Ford expects 40% of its sales to be from EVs by the end of the decade. Volkswagen’s plan is even more ambitious. It targets 70% of EV sales in Europe and 50% of sales in the US and China by 2030.

Mercedes-Benz maker Daimler will invest 40 billion euros in EVs over the next decade, and all of the company’s new vehicle platforms will be purely electric by 2025.

Morgan Stanley research

Companies already major battery producers are investing heavily to meet rising EV battery demand. Meanwhile, start-up battery companies are developing new technologies that could revolutionize the industry. That makes now an exciting time to consider investing in such stocks.

What are EV battery stocks?

In a few words, such stocks are companies that manufacture and sell batteries for EV. With the world looking for ways to transition from a fossil-fuel-based economy, there has been an increasing demand for green approaches.

The popularity of EVs is overgrowing as they become mainstream. Furthermore, the increase in EV sales will result in higher battery sales, thus benefiting the manufacturers of these batteries.

Investing in EV battery stocks could be a good move for investors looking to capitalize on the clean energy revolution. Moreover, the EV industry presents a massive, long-term growth opportunity. Due to this, EV IPOs and early market leaders are being snapped up by investors.

How to buy EV battery stocks?

Nonetheless, some of the best EV battery stocks you will find below. You need to have an account with an online brokerage platform to buy these stocks. When choosing the best stocks to invest in, you should conduct detailed research while considering the volatility found in this marketplace.

Top 3 EV battery stocks to buy in 2022

Which battery stocks stand out among the rest? Well, that’s what we’re here to find out. Here are the three best EV battery stocks to invest in now.

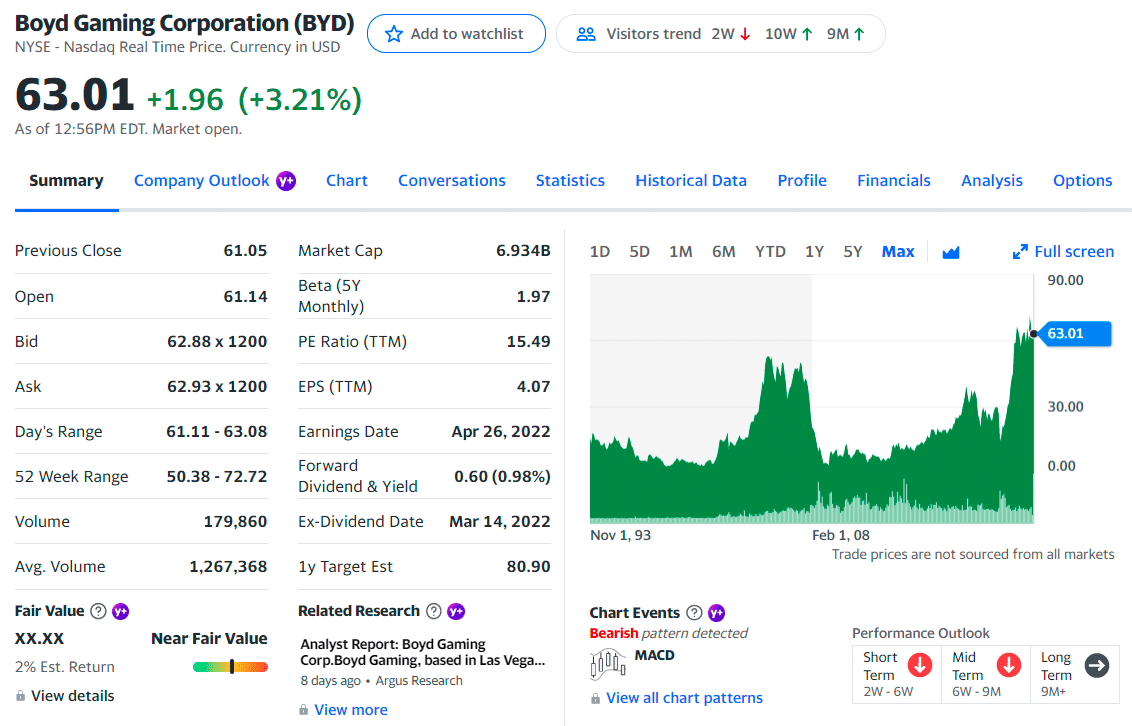

No. 1. Boyd Gaming Corporation (BYD)

Price: $63.01

EPS: $4.07

Market cap: $6.93B

BYD summary

BYD is an integrated EV company based in China. A first bought shares of the battery and EV company in 2008. It manufactures and sells hybrid and battery cars, buses, trucks, and monorails. In addition, it builds the batteries and semiconductors used in its EVs.

One factor that makes BYD stand out in the EV industry is that Warren Buffett is a major shareholder. As of late 2021, Buffett’s company held an 8.2% stake in BYD worth more than $8.5 billion.

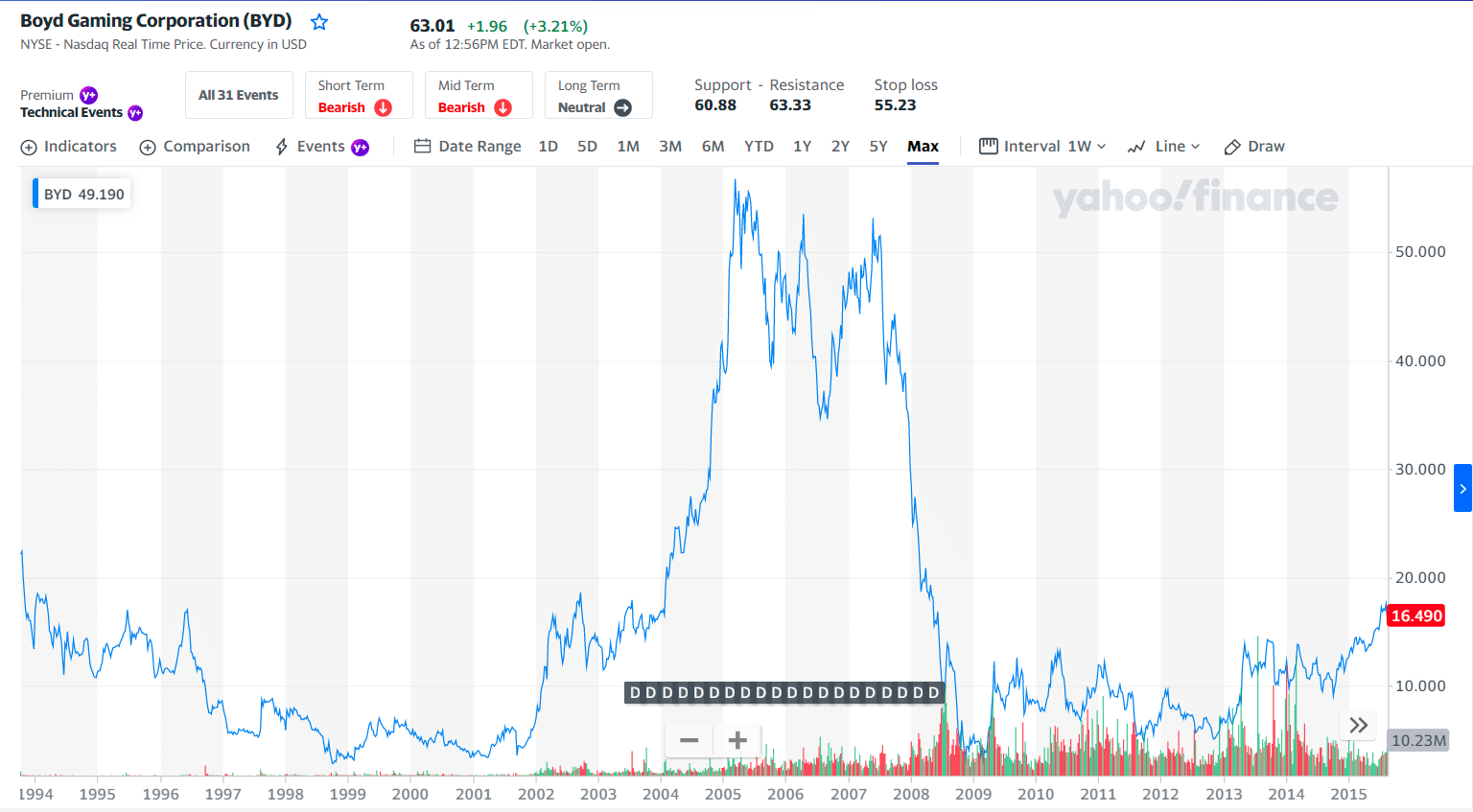

BYD price chart

BYD’s EVs are top sellers in China. The company sells five of the top 15 new energy vehicles in the country, where it ranks as the leading overall brand. Its battery business benefits from the brisk sales pace as a fully integrated EV company.

The analysts offering 12-month price forecasts for BYD Co Ltd have a median target of 8.46, with a high estimate of 12.96 and a low estimate of 8.38. The median estimate represents a -85.18% decrease from the last price of 63.01.

The first three holdings:

- Las Vegas Sands Corp. — 1.88%

- Galaxy Entertainment Group Ltd. — 0.44%

- MGM Resorts International — 1.69%

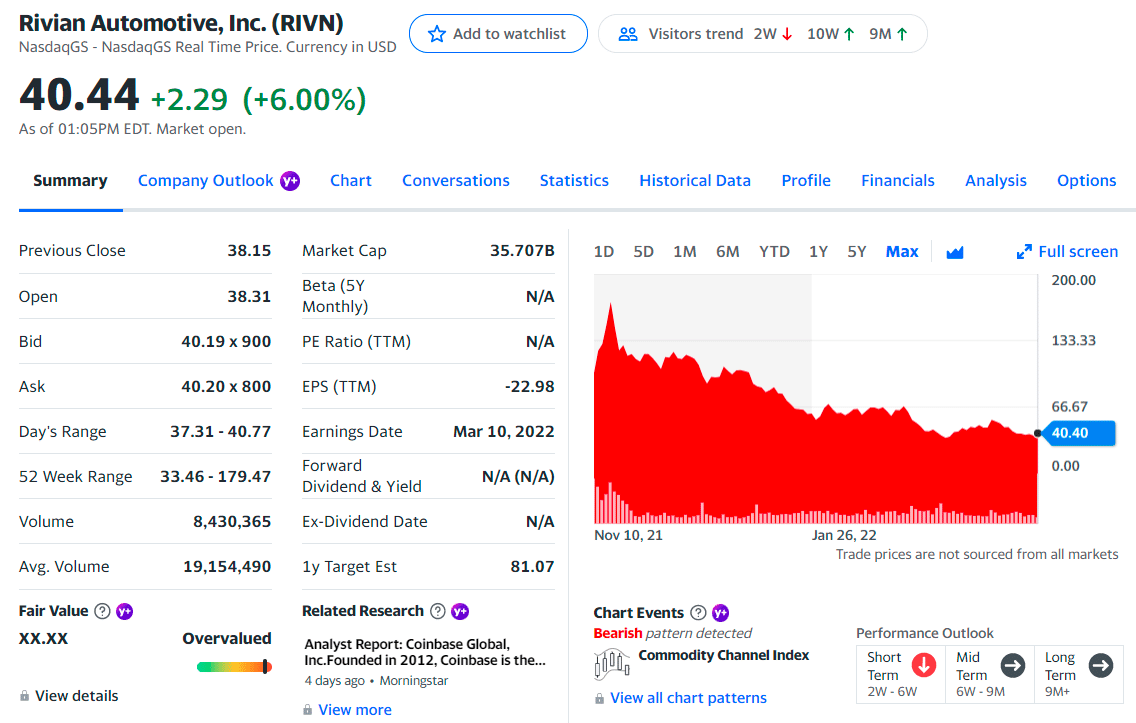

No. 2. Rivian Automotive Inc. (RIVN)

Price: $40.44

EPS: $-22.98

Market cap: 35.707BB

RIVN summary

Rivian went public in November 2021 and began delivering its first R1T electric pickup trucks in December. Rivian’s high-profile investors include Amazon.com Inc., Ford Motor Co., and billionaire George Soros, who recently disclosed holding a 19.8 million-share stake.

Analyst John Murphy says Rivian is one of the most viable competitors within the EV start-up space, thanks to its clearly defined, direct-to-customer sales and service model and attractive vehicles. It has competitive technology, a valuable EV brand, and plenty of financial backing.

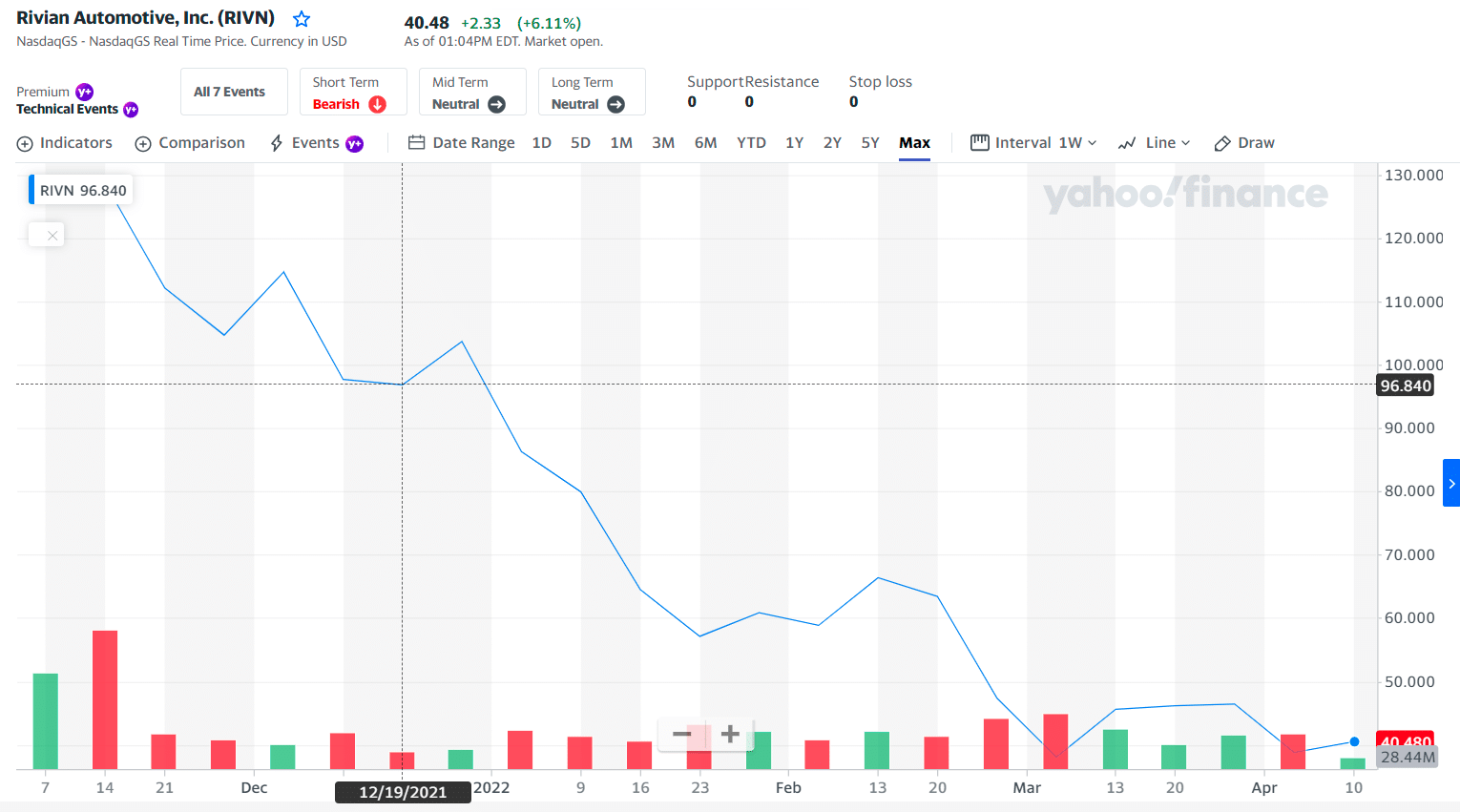

RIVN price chart

The analysts offering 12-month price forecasts for Rivian Automotive Inc have a median target of 81.00, with a high estimate of 130.00 and a low estimate of 35.00. The median estimate represents a +112.26% increase from the last price of 40.44.

The first three holdings:

- T.Rowe Price Associates, Inc. — 18.16%

- Coatue Management LLC — 3.95%

- Fidelity Management & Research Company — 2.95%

No. 3. QuantumScape (QS)

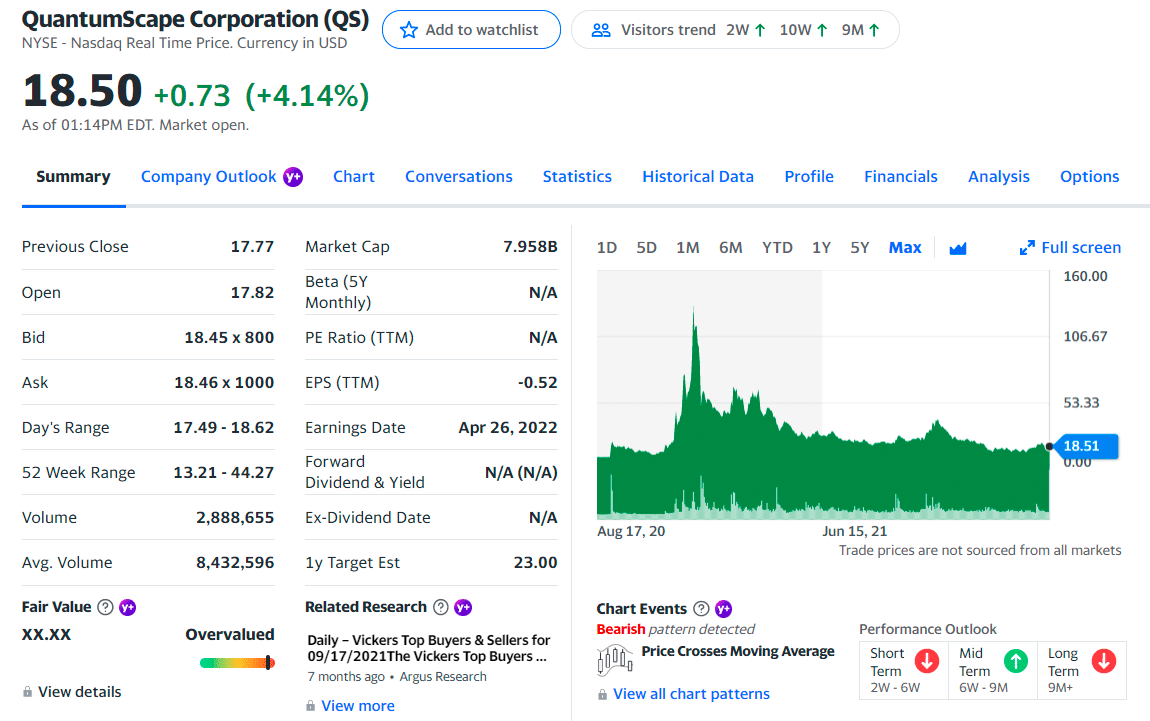

Price: $18.50

EPS: $-0.52

Market cap: 7.95B

QS summary

QS is a Volkswagen AG-backed EV start-up that went public in 2020. The company is an EV firm based in California that creates solid-state lithium-metal batteries and it was founded by Jagdeep Singh, Tim Holme, and Fritz B. Prinz in May 2010 and is headquartered in San Jose.

EV does not use solid-state batteries at the moment. However, they’re regarded as the next significant advancement in EV battery technology. In addition to extending the range of EVs, these batteries will last longer and be safer than today’s batteries.

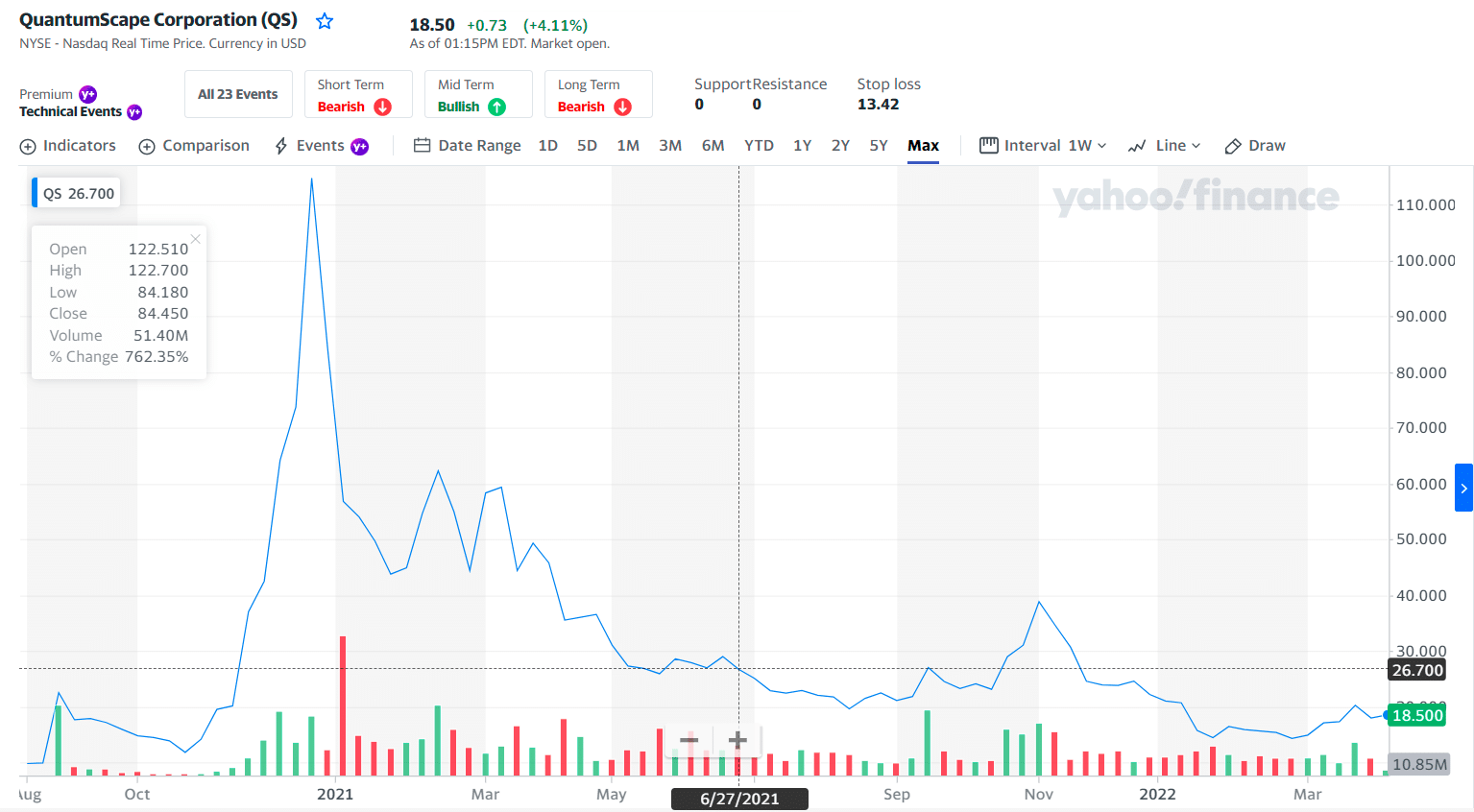

QS price chart

The company is at the forefront of research into solid-state batteries. This makes this stock a bit of a gamble compared to the rest. However, the company behind this EV battery stock is looking promising.

The analysts offering 12-month price forecasts for Quantumscape Corp have a median target of 20.00, with a high estimate of 30.00 and a low estimate of 18.00. The median estimate represents a +9.23% increase from the last price of 18.50.

The first three holdings:

- The Vanguard Group, Inc. — 5.12%

- BlackRock Fund Advisors — 2.47%

- Global X Management Co. LLC — 4.56%

Final thoughts

EV stocks will continue to face chip constraints in the near term, but those are starting to lessen. Battery costs and shortages could be an issue in the mid-term, as supplies of lithium and other raw materials struggle to keep up with demand. More government support is likely headed for electric vehicles in the long term, while more excellent EV production should help bring down vehicle prices.

Comments