With the advancement of economic globalization, investors have become interested in dealing with numerous international securities. Investment in ETFs is relatively cost-effective and tax-advantaged as compared to buying individual stocks.

International ETFs provide exposure to the international market aside from the United States and diversify investors’ portfolios. Although these ETFs focus on global markets, they can also emphasize a specific region like Asia or Europe

Moreover, international funds are a relatively safe investment as they do not entirely depend on one country’s financial institutions. This assortment of various international companies’ shares in a single ETF has captivated millions of investors.

However, it is vital to learn about relevant economic conditions and investment strategies before diving into the investment domain. In this article, we have unfolded the working of international ETFs and gathered a list of promising international funds for investing in 2022.

International ETFs: how do they work?

They track the stock market indices that contain shares of foreign, non-US companies and institutions. These ETFs provide access to a pool of stocks and financial securities of various companies around the globe. Moreover, there can be numerous investment categories under an international fund, including commodities, bonds, stocks, or a combination of these assets.

They work similarly to individual stocks, and shareholders can trade them as individuals on the exchange market through a brokerage platform. Moreover, these funds are convenient to handle and have flexibility and transparency.

ETFs are passive investment funds that derive their value from the underlying benchmark index. International funds that seek investment results from flourished and advanced companies are potentially more diverse and valuable.

Furthermore, international ETFs are available as various ETF types concerning the targeted nation or sector. They include emerging markets ETFs, developed markets ETFs or frontier markets ETFs, each with a different level of return.

What to check before choosing international ETFs?

Investors should determine the percentage of international funds they need in their portfolio according to investment goals and risk capacity.

Total assets under management signify the investors’ interest in a specific fund. Funds with lower AUM are most likely to be less volatile with high bid-ask spreads. Moreover, investors need to evaluate ETFs’ average trading volume and liquidity to trade it swiftly and efficiently.

In addition, many investors assess the historical performance of funds to estimate future trends. It is also vital to choose a fund issuer that has a good management record.

The expense ratio of ETFs and regulatory charges, account maintenance fees, or commission fees of the broker can add up to a significant amount. New investors with limited investment deposits need to crucially evaluate this factor to prevent profits from slipping on fees or charges.

Best International ETFs to buy in 2022

1. Vanguard Total International Stock ETF (VXUS)

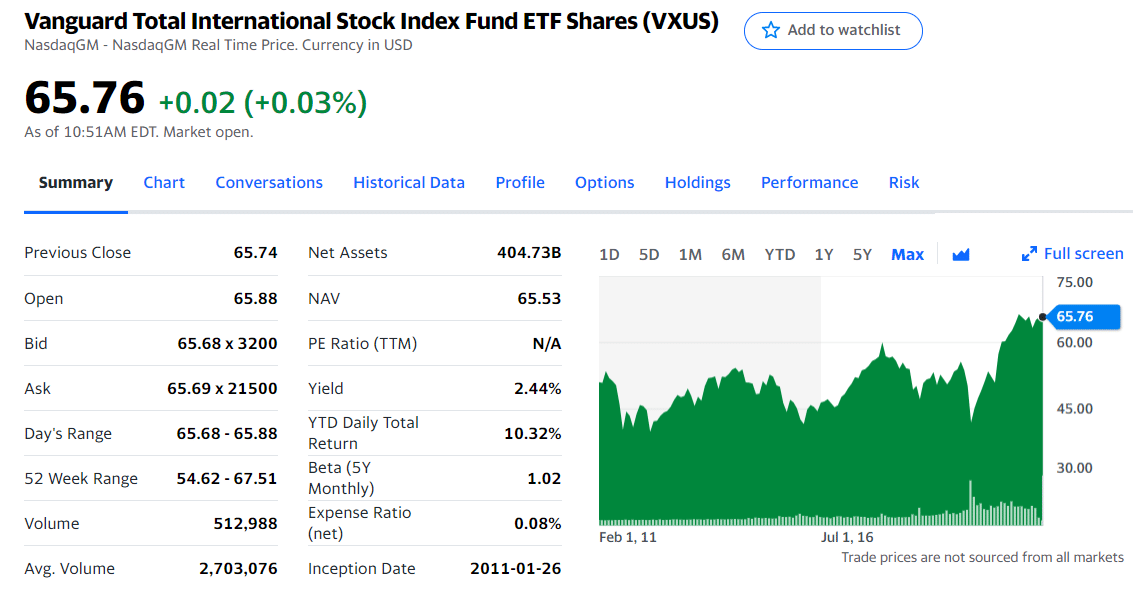

Price: $65.76

Expense ratio: 0.08%

Vanguard Total International Stock ETF tracks the benchmark index of VXUS-US – FTSE Global All Cap ex US Index, which offers exposure to stock markets of developed and emerging markets outside the US. This fund is a good option for investors who want ex-US equity with large-cap companies in their portfolios.

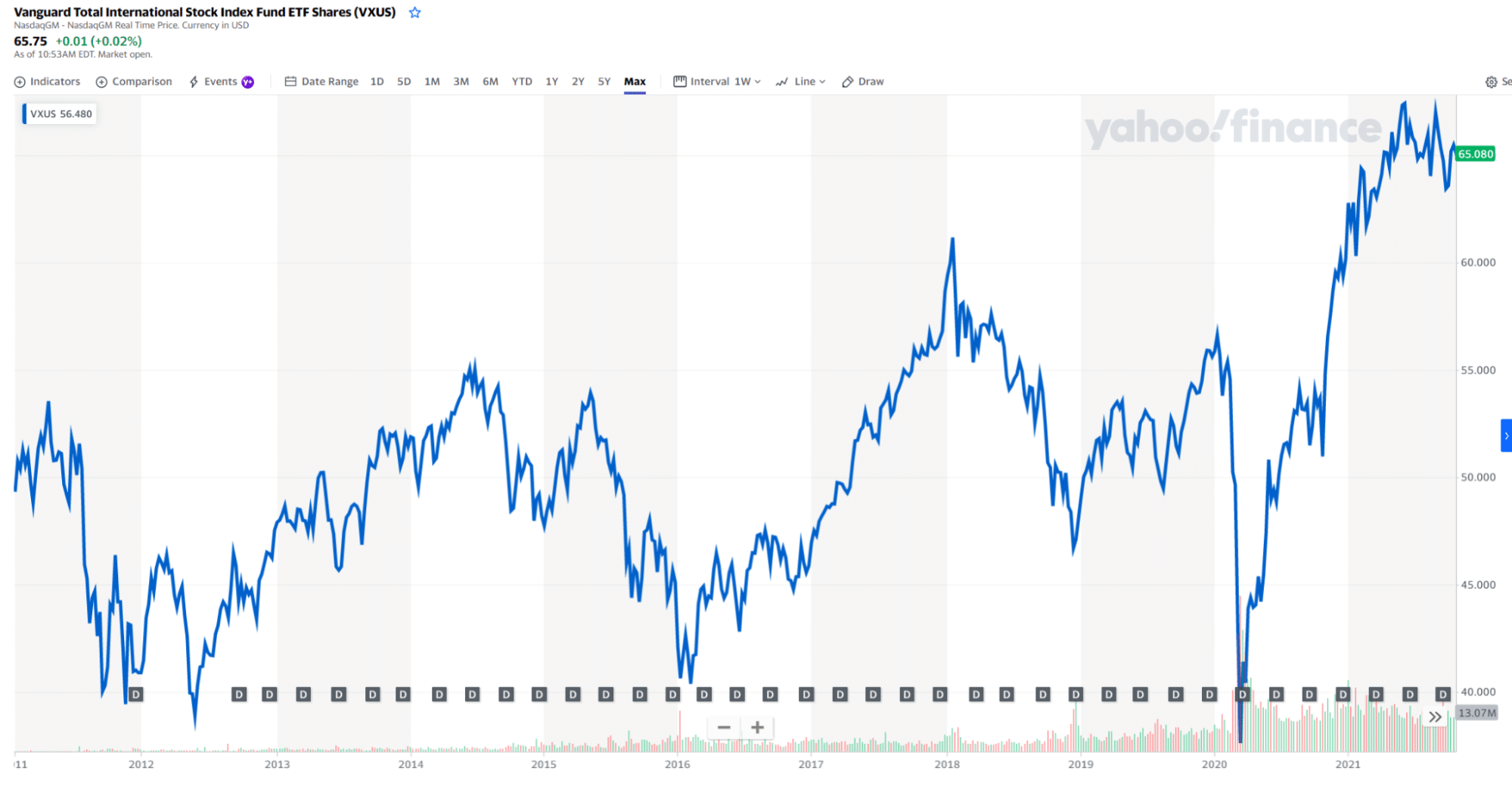

VXUS chart

VXUS has been operational since 2011, with $51.8 billion assets under management and 793 million outstanding shares. The price/earnings ratio and price/book ratio stand at 19.01 and 1.84, respectively. In addition, it offers a promising YTD return of 10.70%.

Moreover, this open-ended fund consists of 100% stocks with financial services, technology, and industrials as the major sectors.

The top three holdings of VXUS from its 7,000 holdings are as follows:

- Taiwan Semiconductor Manufacturing Co Ltd (1.62%)

- Tencent Holdings Ltd (1.41%)

- Alibaba Group Holding Ltd Ordinary Shares (1.26%)

VXUS can be the most beneficial holding of a long-term investment portfolio because it provides access to diverse international equity markets. Furthermore, this fund is cost-efficient and well-balanced regarding its holdings.

2. SPDR Portfolio Developed World ex-US ETF (SPDW)

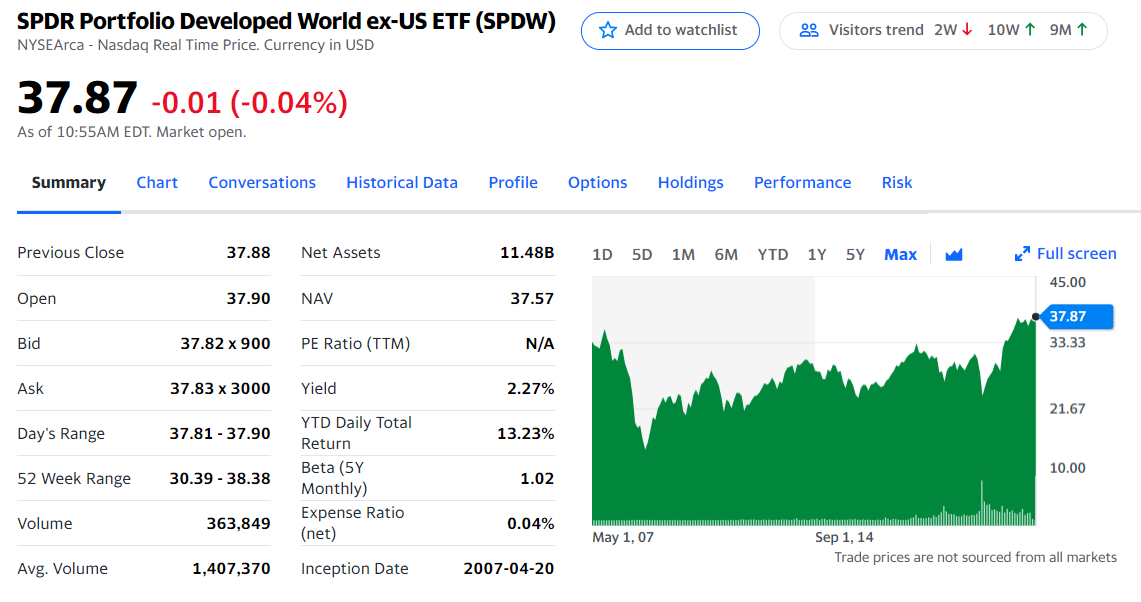

Price: $37.87

Expense ratio: 0.04%

This ETF tracks the performance results of the S&P Developed Ex-US BMI Index, which consists of companies from developed countries outside the US. The fund provides significant diversification to the investors’ portfolio with the collection of thousands of worldwide stocks.

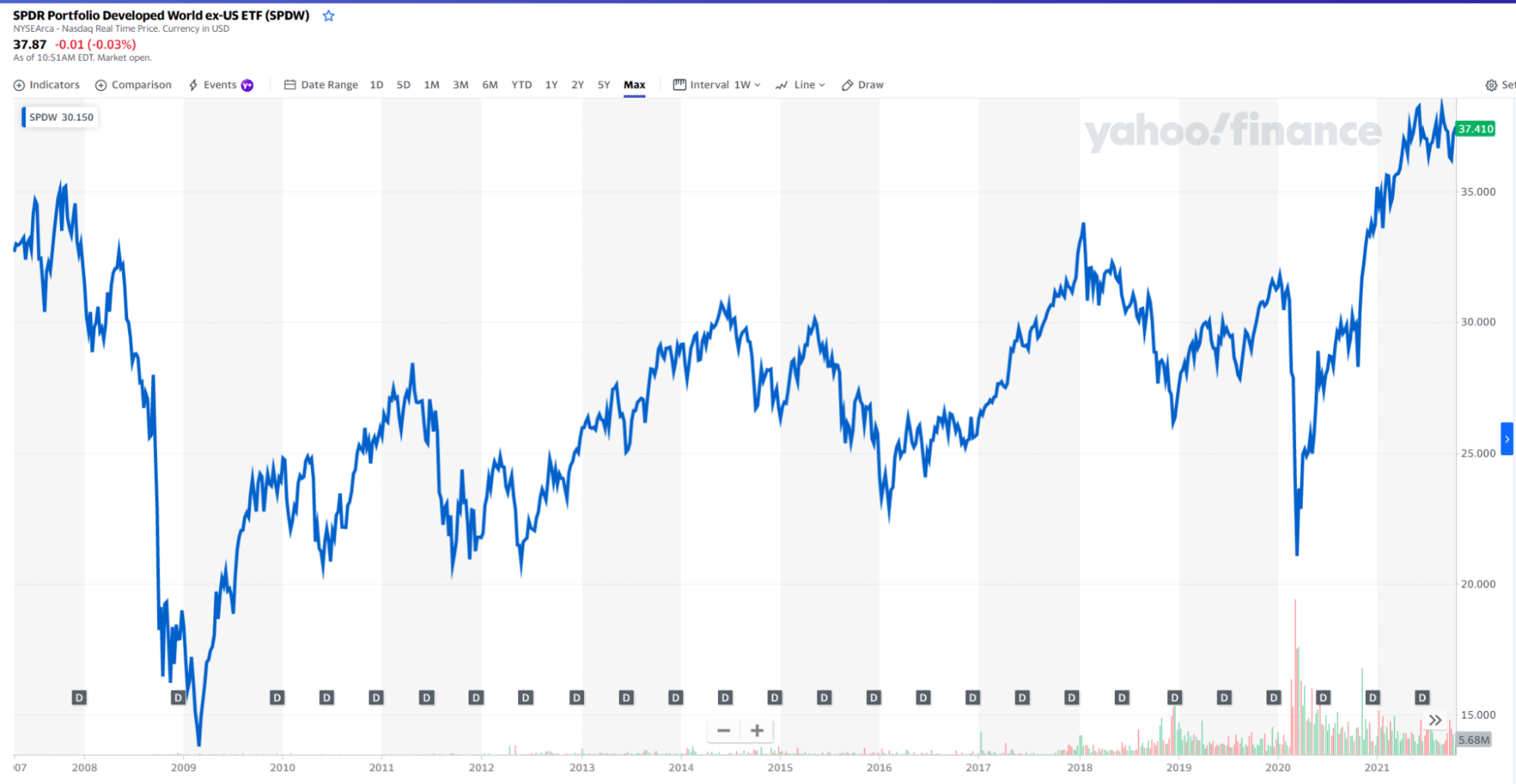

SPDW chart

SPDW has been functional since 2007, with NYSE Arca as its primary exchange and $12,234 million assets under management. Currently, the fund has 327.8 million outstanding shares and offers a good YTD daily return of 12.56%.

Moreover, the price/earnings and price/book ratios stand at 15.21 and 1.83, respectively. It is a 100% stocks fund with major contribution sectors in financial services, technology, and industrials.

SPDW has 2,421 holdings, and the top three holders are as follows:

- Samsung Electronics Co Ltd GDR (1.46%)

- Nestle SA (1.35%)

- ASML Holding NV(1.22%)

This open-ended fund is an excellent option for maintaining a well-adjusted, long-term portfolio with low management fees.

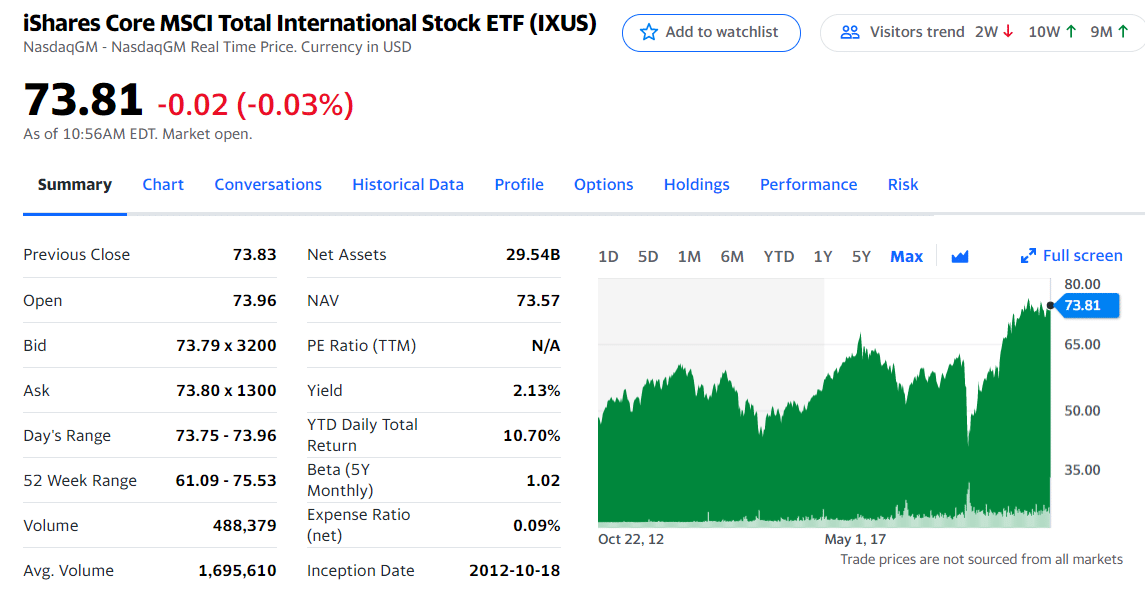

3. iShares Core MSCI Total International Stock ETF (IXUS)

Price: $73.12

Expense ratio: 0.09%

This ETF tracks the investment results of MSCI ACWI ex USA IMI Index, which provides exposure to a wide range of non-US developed and emerging markets. The index is free-float adjusted and includes stock shares of small to large-cap companies.

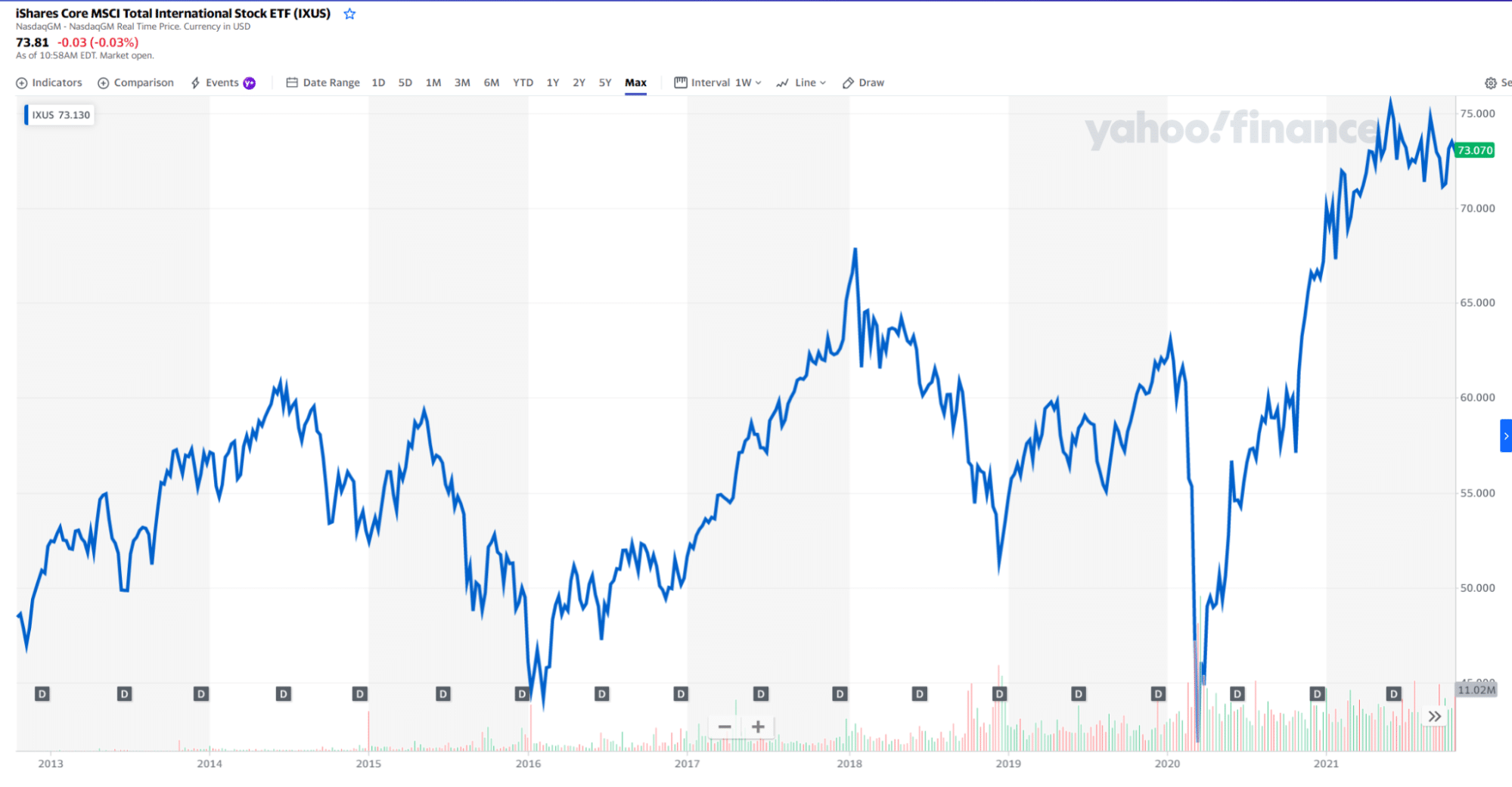

IXUS chart

IXUS has been functional since 2012, with NASDAQ as its central exchange and $31,588 million assets under management. Currently, the fund has 430.1 million outstanding shares with a YTD total daily return of 10.11%. In addition, the P/E ratio and P/B ratio stand at 18.69 and 1.88, respectively.

Moreover, IXUS is a 100% stocks fund with financial services, industrials, and technology as its prime sectors.

Following companies hold the top three holdings:

- Taiwan Semiconductor Manufacturing Co Ltd (1.64%)

- Tencent Holdings Ltd (1.35%)

- Alibaba Group Holding Ltd Ordinary Shares (1.34%)

This exchange-traded fund is all-inclusive, low cost, and suitable for long term investors.

Final thoughts

International ETFs have gained immense importance due to the flourishing world economies. Various countries now play an imperative role in global economics aside from the US. Relatively, investors prefer to add a percentage of international funds in their portfolios for diversification purposes.

VXUS, SPDW, and IXUS are the most promising international funds for buying and holding as they have high growth potential. Investing in these international ETFs provides broad geographical exposure to shareholders with remarkable cost-effectiveness.

Comments